Last week provided what Fundstrat Head of Research Tom Lee described as “whipsaw” action, consistent with his expectations for an “iffy” period for equities investors leading up to the election. Early on, investors worried over the possibility of escalating hostilities in the Middle East, as well as the path and potential impact of Hurricane Milton. As the week continued, some also eyed the impending release of inflation data warily.

The September CPI print showed inflation falling on a YoY basis, but it nevertheless came in higher than expected. In Lee’s view, “We think this report will have little effect on the Fed’s thinking on future cuts, and thus, we expect this to be not meaningful for stocks in the near term.”

“The CPI print didn’t really structurally change the outlook for inflation risk,” Head of Data Science Ken Xuan said during our weekly researcj huddle. “And from what I can see in the minutes for the September 18 FOMC meeting [which were released Wednesday], largely all of the participants saw inflation risk as diminishing, so the Fed has shifted back to its dual mandate.”

Lee agreed. “The reality is that the Fed is focused more on the employment numbers, and the Fed is now dovish largely to support the economy,” he told us.

This week gave Head of Technical Strategy Mark Newton reasons to maintain a near-term constructive view. “One of the main short-term positives is that structure continues to be very bullish,” he told us. “We just saw the S&P 500 break out back to new all-time highs, as did the Dow. To me, this is very constructive in the short run, by which I mean the next one or two weeks, and I think it’s possible that next week we could see a pretty good push [for the S&P 500] up to near 5,835, or maybe even the area around 5,850.”

That’s consistent with Lee’s intermediate-term view. “We think investors should expect turbulence into Election Day, but the dips are buyable because there is too much cash on the sidelines,” he said.

Chart of the Week

For Fundstrat’s Tom Lee, the important thing to note about the latest CPI data is that the internals show inflation continuing to cool. Specifically – and as shown in our Chart of the Week, the percentage of CPI components in outright deflation continues to rise, coming in at a new high for this cycle of 44%.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

10/7 9:00 AM ET: Aug F Manheim Used Vehicle IndexTame10/8 6:00 AM ET: Sep Small Business Optimism SurveyTame10/8 8:30 AM ET: Aug Trade BalanceTame10/9 2:00 PM ET: Sep 18 FOMC Meeting MinutesDovish10/10 8:30 AM ET: Sep CPITame10/11 8:30 AM ET: Sep PPITame- 10/11 10:00 AM ET: Oct P U. Mich. Sentiment and Inflation Expectation

- 10/14 11:00 AM ET: Sep NY Fed 1yr Inf Exp

- 10/15 8:30 AM ET: Oct Empire Manufacturing Survey

- 10/17 8:30 AM ET: Sep Retail Sales Data

- 10/17 8:30 AM ET: Oct Philly Fed Business Outlook

- 10/17 9:00 AM ET: Sep M Manheim Used Vehicle Index

- 10/17 10:00 AM ET: Oct NAHB Housing Market Index

- 10/17 4:00 PM ET: Aug Net TIC Flows

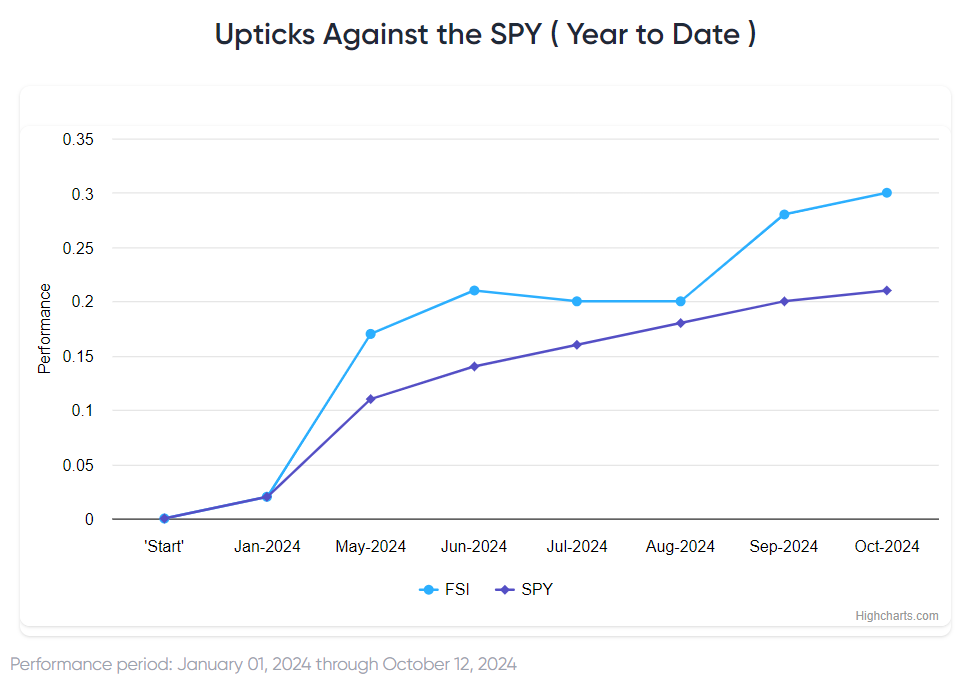

Stock List Performance

In the News

[fsi-in-the-news]