The S&P 500 closed at all-time highs three out of five days last week, as the impact of the Federal Reserve’s September 18 rate-cut decision spread to China. The Chinese government, along with the People’s Bank of China (PBOC), took what Fundstrat Head of Research Tom Lee described as “drastic positive action.” This included, among other things, an CNY 800 billion (USD $114 billion) lending facility to help fund stock buybacks and institutional stock purchases; mortgage-rate cuts; and a cut in the reserve requirement ratio.

This stimulatory blitz helped buoy stock indices around the world – not just in the U.S. Unsurprisingly, Chinese stocks had a banner week, with the CSI 300 index up 15.7%, its best weekly gain since 2008. Hong Kong’s Hang Seng index rose 13% this week. In the wake of Beijing’s stimulus measures, “the regional bet on China might make sense for those who remain hesitant about investing in U.S. due to the uncertainty around the coming Presidential election,” Lee suggested. Among the industries the Fundstrat team has found to be positively correlated to China are those in the Commodities, Industrials, and Consumer sectors.

Head of Technical Strategy Mark Newton has similar constructivism on China. “We’ve seen a lot of false starts in Chinese stocks in the past,” Newton noted, including a failed rally attempt this spring. In contrast, “China’s surge this week has huge technical importance when you look at a larger area. We saw a pretty major breakout on an intermediate-term basis that makes the prospects of a rally a little bit more likely, in my view.”

Regarding U.S. markets, Newton said, “we have managed to yet again climb back above all these prior highs in the last few days. To me, that signals that markets can push ever higher. A lot of that gels with some of the cycle-based forecasts that say that markets probably rise into mid-October.”

For U.S. investors, Lee and Newton both urge caution in the immediate runup to the election on November 5. Yet despite election-related uncertainty from a still-tight race, Lee remains constructive when looking out until the end of the year. He reminds us that the S&P 500 is on track to close up for the month of September despite having fallen 4% in the first week of the month. “To me, that is a sign of a strong market,” he said, particularly when considering that if September does turn out to be positive for stocks, that would mean that the S&P 500 has been up for eight of nine months so far in 2024.

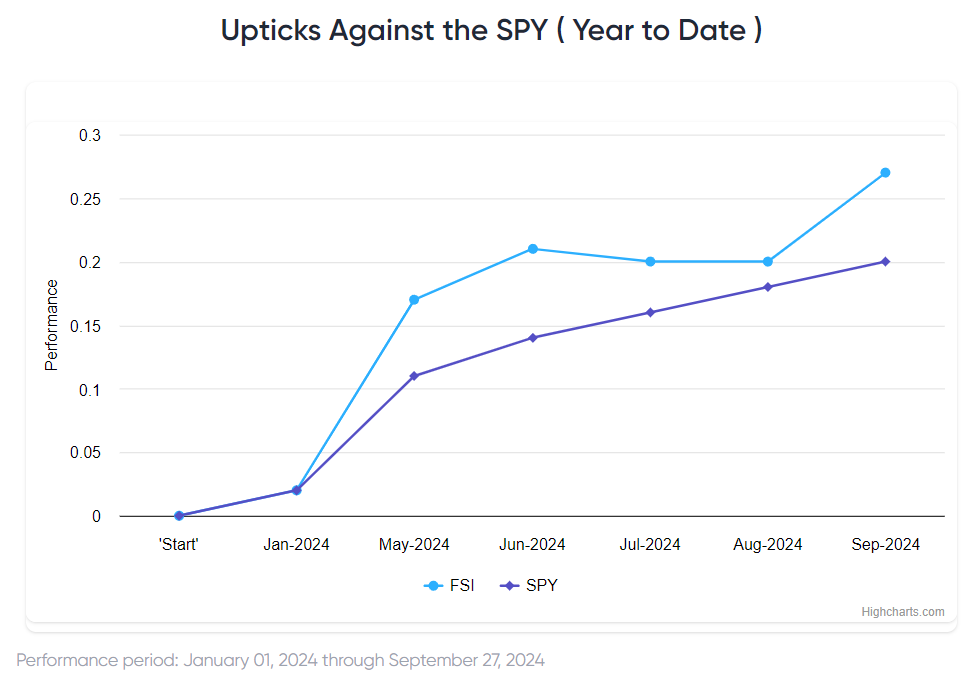

Chart of the Week

The Federal Reserve’s decision to cut rates on September 18 had the side effect of easing pressures on China’s currency, giving Chinese authorities enough room to enact fiscal stimulus measures. Thus, the Fed’s cuts also helped ease some of the pressures that had been weighing on Chinese equities for the past two and a half years. Fundstrat’s Head of Research Tom Lee points out that “China’s market was hardest hit by the Fed’s recent war on inflation,” with China’s stock market underperforming the S&P 50 by 66% during this period. We see this in our Chart of the Week. This is one reason why Lee suggests taking advantage of this upside breakout in broader Chinese equities (FXI).

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

9/23 8:30 AM ET: Aug Chicago Fed Nat Activity IndexTame9/23 9:45 AM ET: Sep P S&P Global Manufacturing PMITame9/23 9:45 AM ET: Sep P S&P Global Services PMITame9/24 9:00 AM ET: Jul S&P CoreLogic CS home priceTame9/24 10:00 AM ET: Sep Conference Board Consumer ConfidenceTame9/25 10:00 AM ET: Aug New Home SalesTame9/26 8:30 AM ET: 2Q T 2024 GDPTame9/26 10:00 AM ET: Aug P Durable Goods OrdersTame9/27 8:30 AM ET: Aug PCE DeflatorTame9/27 10:00 AM ET: Sep F U. Mich. Sentiment and Inflation ExpectationTame- 9/30 10:30 AM ET: Sep Dallas Fed Manuf. Activity Survey

- 10/1 9:45 AM ET: Sep F S&P Global Manufacturing PMI

- 10/1 10:00 AM ET: Sep ISM Manufacturing PMI

- 10/1 10:00 AM ET: Aug JOLTS Job Openings

- 10/3 9:45 AM ET: Sep F S&P Global Services PMI

- 10/3 10:00 AM ET: Sep ISM Services PMI

- 10/3 10:00 AM ET: Aug F Durable Goods Orders

- 10/4 8:30 AM ET: Sep Non-Farm Payrolls

Stock List Performance

In the News

[fsi-in-the-news]