Last week’s market movements strengthened Fundstrat Head of Research Tom Lee’s conviction that markets made their bottom on August 5. In fact, the S&P 500 has recovered all of the ground it lost during the recent selloff. Head of Technical Strategy Mark Newton was on a well-earned break this week, but he nevertheless managed to reach out from parts unknown to comment on the recent rally. “The broader rally from early August is quite constructive and, as such, I do not expect any August drawdown to breach early August lows,” he wrote.

Lee agrees, but he warns that despite the S&P 500 having just recorded its best weekly gain of the year, “this does not mean bottoms go straight up. Recovering from bottoms is a process.” Nevertheless, the VIX (volatility index) having fallen back under 20 after its selloff surge to 67 is a “sign of relief,” in his view. (The VIX was at 14.80 as of Friday’s close.)

This week, we saw key data showing that inflation continues to decline. On Tuesday, wholesale inflation – core PPI – came in at -0.05% MoM, below Street expectations of +0.19%. The next day, Headline CPI YoY came in below 3% for the first time since March 2021, continuing a downward trend. July Core CPI came in at +0.17% MoM, better than consensus expectations of +0.19%.

As Lee told us, “This is now the fourth consecutive ‘soft’ inflation report and, to me, it solidifies the case for the Fed to start a rate-cutting cycle starting in September.” Indeed, Fed Funds Futures trading implies unanimous market expectations for a Fed cut in September, with the uncertainty focused on whether we will see a cut of 25 bp or 50 bp. Markets will be looking for clues about this when Fed Chair Jerome Powell speaks at the annual Jackson Hole Economic Symposium next week (August 22-24).

Personally, Lee advocates bigger cuts. However, he concedes, “this is not the market’s stance, nor is it the Fed’s stance.” For markets to anticipate a 50 bp cut, we would arguably need to see an unexpected level of economic softness. However, last week’s retail sales data points to the economy’s continued resilience. The headline consumer spending number for July beat expectations, up 1% MoM (versus 0.3% expected). When excluding purchases of gas and cars, consumer spending again beat expectations, up 0.4% MoM (0.2% expected).

As Head of Crypto Strategy Sean Farrell put it, “In just a few days, the narrative has shifted. Likely thanks to a combination of non-recessionary yet disinflationary data, the market is now leaning back toward a soft-landing scenario rather than one driven by recession fears.”

Chart of the Week

The latest Core CPI reading last week provided good news for the Federal Reserve, and so did its internals. Shelter and auto-insurance components continued to account for the bulk of inflation, but, as we have noted previously, both these components are lagging relative to current, real-world conditions and will eventually become disinflationary when they catch up. As our Chart of the Week shows below, core CPI excluding these two components came in at -0.04 MoM.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

8/12 11:00 AM ET: Jul NY Fed 1yr Inf ExpTame8/13 6:00 AM ET: Jul Small Business Optimism SurveyTame8/13 8:30 AM ET: Jul PPITame8/14 8:30 AM ET: Jul CPITame8/15 8:30 AM ET: Jul Retail Sales DataTame8/15 8:30 AM ET: Aug Empire Manufacturing SurveyTame8/15 8:30 AM ET: Aug Philly Fed Business OutlookTame8/15 10:00 AM ET: Aug NAHB Housing Market IndexTame8/15 4:00 PM ET: Jun Net TIC FlowsTame8/16 10:00 AM ET: Aug P U. Mich. Sentiment and Inflation ExpectationTame- 8/19 9:00 AM ET: Aug M Manheim Used vehicle index

- 8/21 2:00 PM ET: Jul FOMC Meeting Minutes

- 8/22 8:30 AM ET: Jul Chicago Fed Nat Activity Index

- 8/22 9:45 AM ET: Aug P S&P Global Manufacturing PMI

- 8/22 9:45 AM ET: Aug P S&P Global Services PMI

- 8/22 10:00 AM ET: Jul Existing Home Sales

- 8/23 10:00 AM ET: Jul New Home Sales

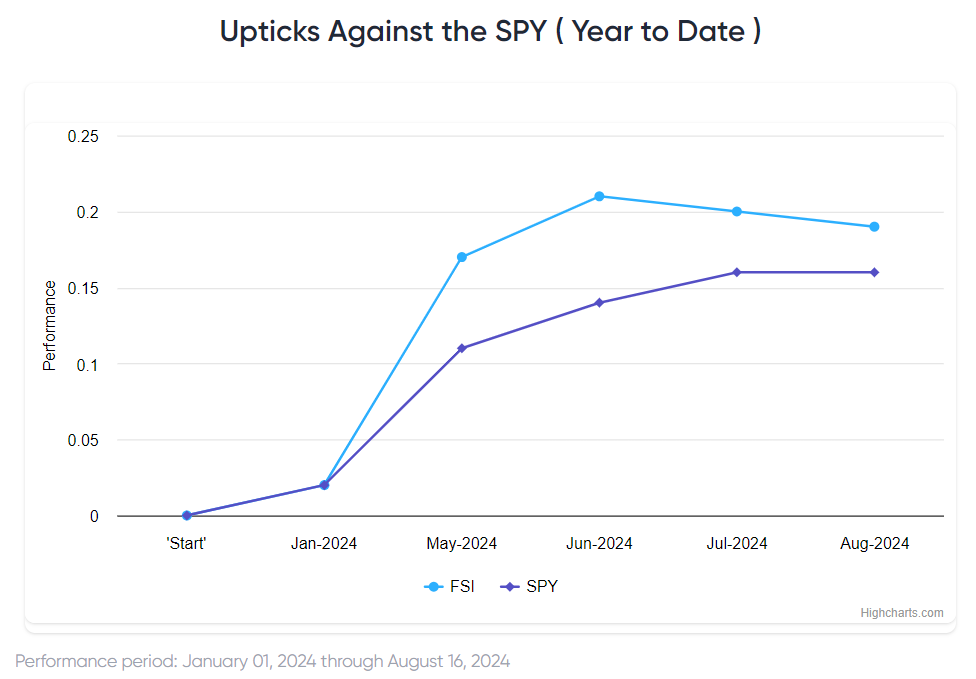

Stock List Performance

In the News

[fsi-in-the-news]