After the Federal Open Market Committee meeting on Wednesday, July 31, we had expected markets to rally. Instead, they got bludgeoned over the next three trading days. As followers of our work will recall, the selloff was largely triggered by a soft jobs report released on August 2 that sparked fears of a recession. Fundstrat Head of Research Tom Lee had immediately voiced suspicions that the numbers were a “fluke” caused by Hurricane Beryl, which hit in Texas in July shortly before the state’s jobless claims surged in July. Lee’s theory was arguably strengthened this week when Texas weekly jobless claims plummeted almost 20% to 20,264 from 25,078.

Last week’s national jobless numbers were also reassuring : 233,000 initial claims for unemployment benefits, versus Street expectations of 240,000, and compared to 250,000 initial claims the prior week. Markets rallied back after this news – evidence to Lee that the three days of equity carnage we saw on August 1, 2, and 5 were indicative of a growth scare rather than the beginning of a recession or bear market, and strongly supporting his contention that “worst of the selling is behind us.”

As Head of Technical Strategy Mark Newton pointed out, the market remains fearful. “We saw a huge overbalance in declining versus advancing issues, as well as volume to the downside. We now technically have hit ‘extreme fear’ based on the Fear and Greed Index. Historically, these are the types of signals that are seen near when the market tends to bottom out.”

Newton was not as worried about the selloff as many others in the market. “The equal-weighted S&P 500 barely fell at all, and we’ve seen recent all-time highs in Financials and Industrials. The broader indices might make some think the market’s selling off,” he said, “but look at what non-Technology sectors have done since the market peak on July 16. We’ve seen REITs, Utilities, Healthcare, Financials, and Industrials all up more than 5%. That’s actually a very good sign for the market despite Tech’s declines. So I think a lot of this fear is unfounded.”

That is not to say that Newton is near-term optimistic. “I still think we’re in a tough spot between now and the election. I don’t think it’s going to be a straight shot to the downside or the upside. I sense it’s going to be a tough, choppy couple of months,” he warned.

Fundstrat Head of Research Tom Lee acknowledges agrees that the technical damage done by the selloff will take time to repair, particularly in light of seasonality factors at play (historically, August has tended to be a difficult month for investors to make money). However, he remains constructive in the long-term. “In fact, the selloff arguably left the market in better shape than before,” he asserted.

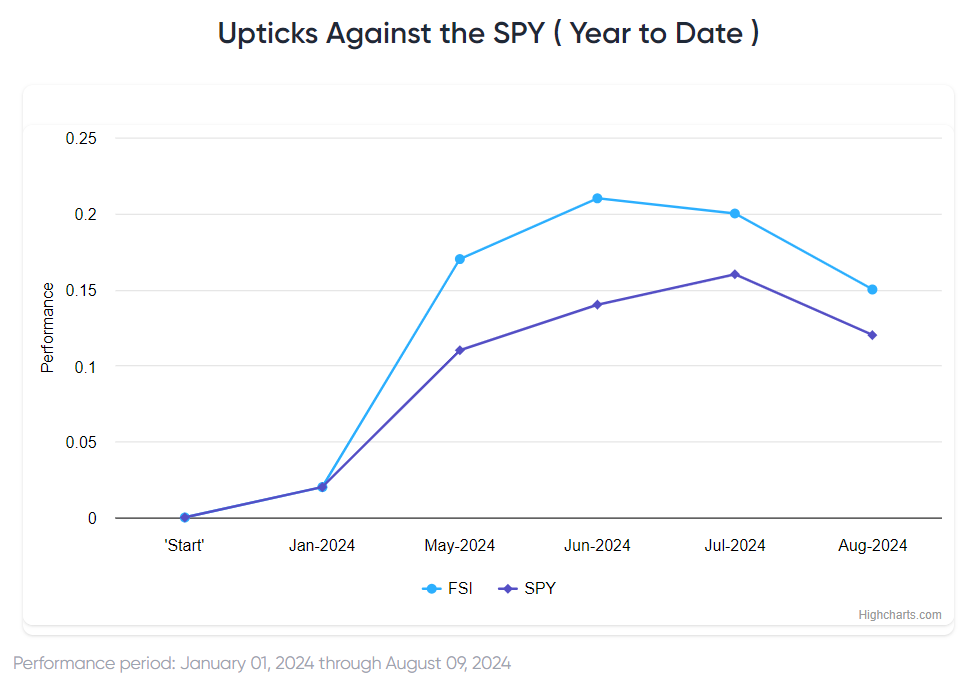

Chart of the Week

One reason for Fundstrat Head of Research Tom Lee’s long-term constructiveness post-selloff is is the change in expectations for the Federal Reserve. As implied by Fed Funds Futures trading, markets now anticipate as many as five rate cuts from the Fed before the end of the year – a huge step up from three months ago, when the market was resigned to just one cut before the end of December. We can see this in our Chart of the Week. Such cuts would arguably provide major tailwinds for stocks.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

8/2 8:30 AM ET: Jul Jobs ReportTame8/2 10:00 AM ET: Jun F Durable Goods OrdersTame8/5 9:45 AM ET: Jul F S&P Global Services PMITame8/5 10:00 AM ET: Jul ISM Services PMITame8/6 8:30 AM ET: Jun Trade BalanceTame8/7 9:00 AM ET: Jul F Manheim Used vehicle IndexMixed- 8/12 11:00 AM ET: Jul NY Fed 1yr Inf Exp

- 8/13 6:00 AM ET: Jul Small Business Optimism Survey

- 8/13 8:30 AM ET: Jul PPI

- 8/14 8:30 AM ET: Jul CPI

- 8/15 8:30 AM ET: Jul Retail Sales Data

- 8/15 8:30 AM ET: Aug Empire Manufacturing Survey

- 8/15 8:30 AM ET: Aug Philly Fed Business Outlook

- 8/15 10:00 AM ET: Aug NAHB Housing Market Index

- 8/15 4:00 PM ET: Jun Net TIC Flows

- 8/16 10:00 AM ET: Aug P U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

[fsi-in-the-news]