This week illustrated the extent to which large-cap Technology stocks affect broader indices such as the S&P 500 and the Nasdaq. Tech stocks – particularly semiconductor stocks – retreated this week after both sides of the political aisle made remarks seen as negative for the sector.

Still, we saw promising moves from non-Tech sectors, prompting Fundstrat Head of Technology Mark Newton to tell us during our weekly research huddle that “my thinking is that the ‘Great Rotation’ has begun.” Despite the declines in the broader indices, Newton said, “I’m finding it difficult to get all that negative on the market just because breadth has actually gotten so good in recent weeks. I think it’s actually a very encouraging sign that we’ve seen such strength out of many of the lagging sectors, for example in Biotech, regional banks, and Small-caps.”

Fundstrat Head of Research Tom Lee also noticed the move in Small-caps – something he had been anticipating. To Lee, this was largely the result of the astonishingly low June CPI data released during the previous week. This prompted Federal Reserve officials to hint at more dovish outlooks in various public appearances last week. This helped drive the probability of a Fed rate cut in a near-term FOMC meeting (as implied by Fed Funds futures trading) to 98% as of Friday, a significant increase from the 70% we saw before the release of June CPI. As Lee pointed out, “this is the first time since 2019 in which the probability of a rate cut at a near-term future FOMC meeting has risen above the 80% level,” and it is part of why he sees the current Small-caps rally likely continuing. “This rally, we believe, could reach 40% over the next 10 weeks,” he told us.

Crowdstrike

Shares of CrowdStrike (CRWD -1.83% ), a Granny Shot stock, sank more than 11% on Friday in response to news that what appears to have been a routine – but clearly problematic – update from the cybersecurity firm caused millions of machines running Microsoft software to crash. Major companies and institutions in virtually every industry, sector, and geography were affected. The extent of the impact of what many are calling the worst IT outage in history is unclear. In addition to the obvious criticisms already being leveled at Crowdstrike, others have pointed out potential consequences for Microsoft (MSFT 0.37% ) – despite the company not being directly at fault; for the global supply chain, including air- and ocean-cargo shipping; and in banking, with disruptions in the next payroll cycle a distinct possibility. The S&P 500, Nasdaq, and Dow all declined on Friday.

Chart of the Week

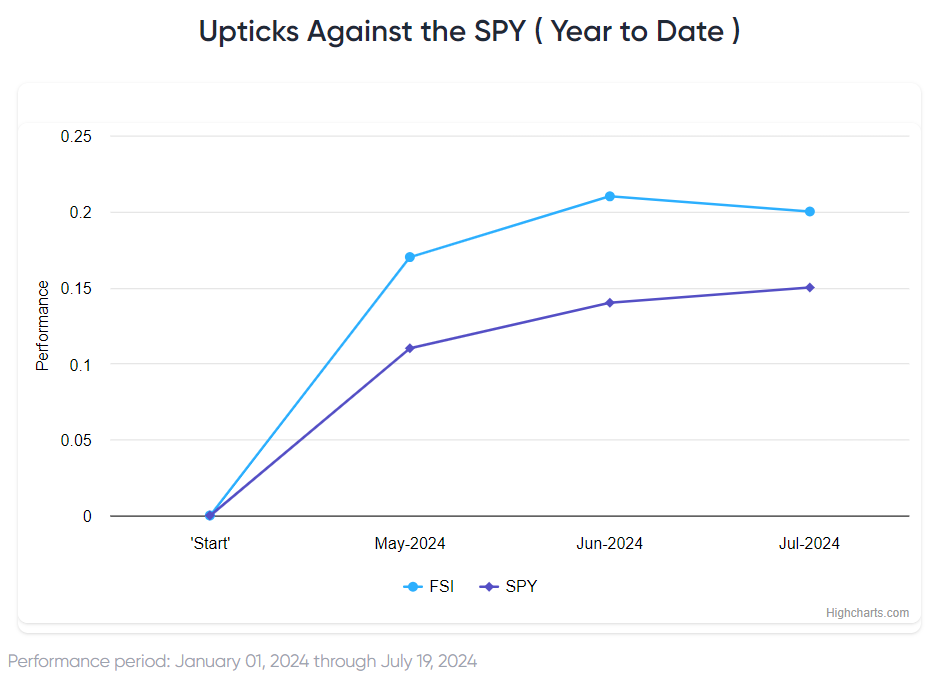

Fundstrat’s Tom Lee sees the likelihood of a “Summer of Small-caps” (as he calls it) emerging. “We are only one week into this rally, but it is tracking very closely to the October to December 2023 small-cap rally,” he pointed out. Both rallies began with an initial surge, followed by a slight decline. In both rallies, this correction was marked by similar valuation (as measured by small cap P/E relative to the S&P 500). In late 2023, the correction was followed by a larger advance. Lee believes recent history could repeat itself. The comparison of Small-cap performance between late 2023 and now is shown in our Chart of the Week.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/15 12:00 PM ET: Fed’s Powell Interviewed by David RubensteinTame7/16 8:30 AM ET: Jun Retail Sales DataTame7/16 10:00 AM ET: Jul NAHB Housing Market IndexTame7/17 9:00 AM ET: Jul M Manheim Used vehicle indexMixed7/17 2:00 PM ET: Jul Fed Releases Beige BookTame7/18 8:30 AM ET: Jul Philly Fed Business OutlookTame7/18 4:00 PM ET: May Net TIC FlowsTame- 7/22 8:30 AM ET: Jun Chicago Fed Nat Activity Index

- 7/23 10:00 AM ET: Jun Existing Home Sales

- 7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMI

- 7/24 9:45 AM ET: Jul P S&P Global Services PMI

- 7/24 10:00 AM ET: Jun New Home Sales

- 7/25 8:30 AM ET: 2QA 2024 GDP

- 7/25 10:00 AM ET: Jun P Durable Goods Orders

- 7/26 8:30 AM ET: Jun PCE Deflator

- 7/26 10:00 AM ET: Jul F U. Mich. Sentiment and Inflation Expectation

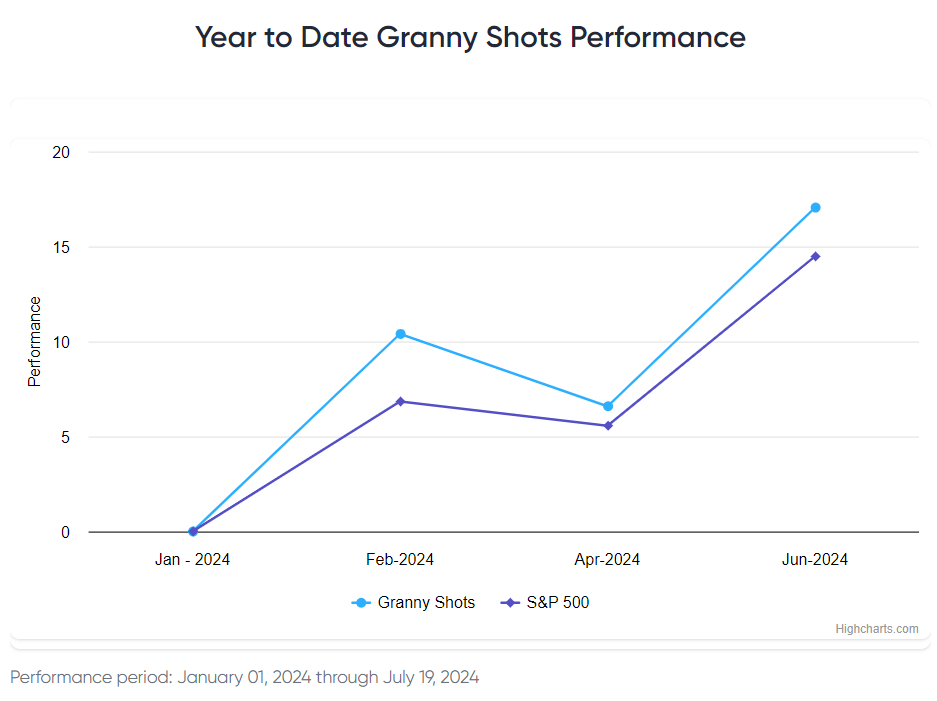

Stock List Performance

In the News

[fsi-in-the-news]