Markets continued to advance on the last trading week of the month and quarter, which ended on the Thursday of a shortened trading week. The S&P 500 again closed at new all-time highs, notching five consecutive months of gains. Fundstrat Head of Research Tom Lee sees more gas in the tank, with fund flows and cash on the sidelines suggesting that we have yet to approach a top in this latest rally.

Mark Newton, Head of Technical Strategy, agreed. In his technicals-based view, “We’ve seen the best start to the year in the past five years, and there’s really no evidence of any technical deterioration whatsoever,” he said during our weekly research huddle.

Lee has described the current rally as “mature,” but Newton suggested that “maturing” might be a more appropriate descriptor. “I see this rally as gradually maturing,” he said. “The waning of Technology over the last month has been encouraging, because it really has not caused any technical damage to the market. We’ve seen the move in Industrials, Financials, and Discretionary all give way to strength in commodity-based sectors. Energy has just broken out to its highest level in 10 years. I wrote more about this move, and about some of my favorite names in that sector, a few days ago,” he reminded us.

On small-caps (IWM 1.29% )

We saw small-caps outperforming this week, and Lee sees the potential for this to continue. In his view, the Fed is currently dovish, and if that continues, market consensus will come to realize this. “A lot of things will come into place [when this happens], and the group that should benefit is small caps,” he asserted.

PCE

Although markets were closed on Friday, March 29, the Bureau of Economic Analysis was open, publishing the PCE deflator numbers for February. As Fundstrat clients know, PCE is the Fed’s preferred inflation indicator. Earlier last week, Fundstrat Head of Data Science Ken Xuan estimated core PCE (MoM) coming in at 0.27, below Street consensus of 0.29. The actual number came in softer than both, at 0.26. In Lee’s view, “This should give [Federal Reserve Chair Jerome] Powell and the Fed more confidence that inflation is not just falling, but falling faster than consensus expects. And that should be good for stocks,” he said.

Chart of the Week

Our Chart of the Week illustrates that while margin debt rose in February, it remains “well below” October 2021 levels. This is one reason why Fundstrat’s Tom Lee believes the current rally can continue. “I think there’s still plenty of dry powder,” he asserted, “and, until margin debt rolls over, I wouldn’t even consider stocks being anywhere near a peak.”.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

3/25 10:30 am ET: Mar Dallas Fed Manufacturing Activity SurveyTame3/26 9:00 am ET: Mar S&P CoreLogic CS home priceTame3/26 10:00 am ET: Mar Conference Board Consumer ConfidenceTame3/28 8:30 am ET: 4QT 2023 GDPTame3/28 10:00 am ET: Mar F U. Mich. Sentiment and Inflation ExpectationTame3/29 8:30 am ET: Feb PCETame- 4/01 9:45 am ET: Mar F S&P Global Manufacturing PMI

- 4/01 10:00 am ET: Mar ISM Manufacturing

- 4/02 10:00 am ET: Feb JOLTS Job Openings

- 4/03 9:45 am ET: Mar F S&P Global Services PMI

- 4/03 10:00 am ET: Mar ISM Services

- 4/05 8:30 am ET: Mar Jobs Report

- 4/05 9:00 am ET: Mar F Manheim Used Vehicle Index

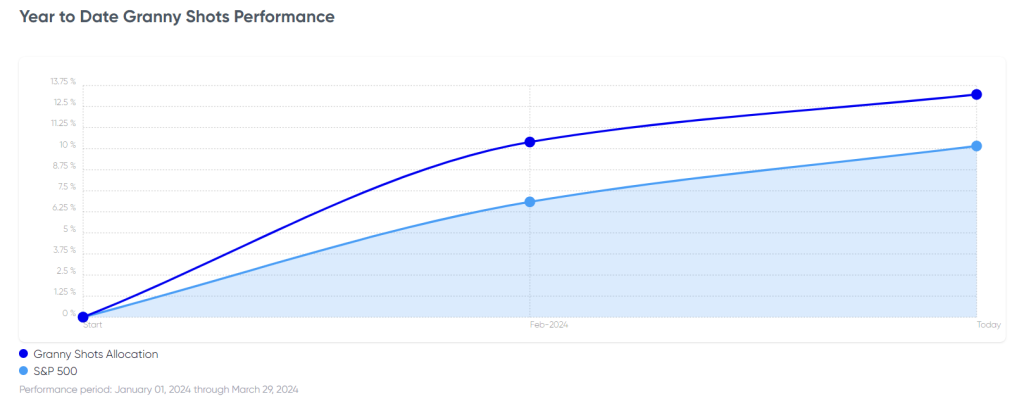

Stock List Performance

In the News

[fsi-in-the-news]