Nvidia (NVDA -0.36% ) soared last week after once again reporting stellar quarterly results and releasing ebullient guidance. The stock had been consolidating since February before last Wednesday’s earnings release, and Fundstrat Head of Research Tom Lee reminded us that “in the weeks and months after consolidations, NVDA -0.36% tends to make a parabolic rise higher (see late 2022 and late 2023).” This pattern appears to be repeating again.

For those asserting that Nvidia is at or near a peak, Lee pointed out that in the 1990s, Cisco routers played a key role in the rise of the Internet age, just as Nvidia chips are proving to be critical now as the AI era takes off. “Cisco stock ultimately got to 100 P/E,” Lee pointed out, while Nvidia’s P/E is currently around 30. This admittedly imperfect comparison is nevertheless sufficiently similar for Lee to assert that, in his view, “this tells us that there’s still a lot of upside left, both on earnings and multiples.”

Head of Technical Strategy Mark Newton agreed with the logic. “It’s Nvidia’s world, and everybody else can rent,” he quipped at our weekly research huddle, before sounding a more grounded note. “Nvidia’s success and influence on the indices make it easy conclude that everything’s great,” Newton said. “Well, Technology is great. It has recovered, but the rest of the market still has some work to do. Most of the other sectors, when we look at them on an equal-weighted basis, were lower over the last week.”

Lee believes that Nvidia can change this. “Both institutions and retail have been raising cash for the last three weeks,” Lee pointed out. Based on anecdotal data from his conversations with clients and major investors, “we get the sense that investors were cautious on stocks ahead of NVDA results, because of the size and importance of the company to the broader technology thesis,” he told us. If that’s the case, “a strong report from Nvidia could pull money off the sidelines,” in Lee’s view.

Newton suggested an alternative catalyst. “In my view, it will be important to see whether the key data in the weeks to come shows any real softness that would justify all these rate cuts that have been built in, and/or if we get a real growth slowdown. I suspect that the data in the weeks to come is going to allow for a bigger breakdown in yields, which are really starting to tail off and pull back.”

If so, it’s worth remember that recent data shows the two most stubborn components of inflation, auto insurance and shelter, are already cooling. “The data to watch are next week’s April PCE data and May CPI,” Lee said.

Chart of the Week

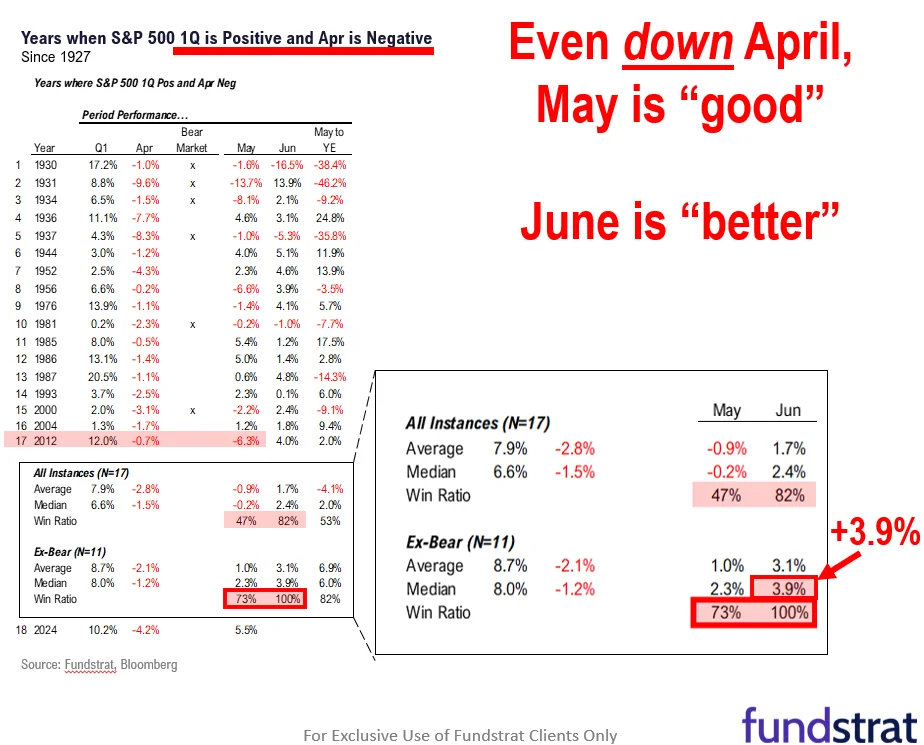

Our Chart of the Week shows that in past bull or flat markets, when the S&P 500 has been positive in the first quarter (as we were this year) and April was down, June has been an up month 100% of the time. Fundstrat’s Tom Lee said, “To me, that’s another reason why stocks are looking pretty good for the next six weeks or so.”

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

5/22 10:00 AM ET: Apr Existing Home SalesTame5/22 2:00 PM ET: May FOMC Meeting MinutesTame5/23 8:30 AM ET: Apr Chicago Fed Nat Activity IndexTame5/23 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/23 9:45 AM ET: Apr F S&P Global Services PMITame5/23 10:00 AM ET: Apr New Home SalesTame5/24 8:30 AM ET: Apr P Durable Goods OrdersHot5/24 10:00 AM ET: May F U. Mich. Sentiment and Inflation ExpectationTame- 5/28 9:00 AM ET: Mar S&P CoreLogic CS home price

- 5/28 10:00 AM ET: May Conference Board Consumer Confidence

- 5/28 10:30 AM ET: May Dallas Fed Manuf. Activity Survey

- 5/29 2:00 PM ET: May Fed Releases Beige Book

- 5/30 8:30 AM ET: 1Q S 2024 GDP

- 5/31 8:30 AM ET: Apr PCE Deflator

Stock List Performance

In the News

[fsi-in-the-news]