After a 2023 in which the S&P 500 rose more than 24%, the rough markets in the first four trading days of the year proved somewhat jarring. Fundstrat Head of Research Tom Lee had already warned that the first half of the year would likely be bumpy, as investors get “itchy” while waiting for anticipated rate cuts from the Federal Reserve. On Friday, he added, “This turmoil in the first week of trading is telling us to brace for a challenging year,” referencing his previous research showing that the first five trading days of January tend to foreshadow how the rest of the year plays out.

However, Lee’s outlook for 2024 as a whole remains constructive and largely unchanged. “We expect stocks to ultimately rally strongly in the second half of the year,” he said, with his year-end S&P 500 target at 5,200. The tailwinds he sees driving his 2024 forecast remain in place. They include:

- Declining inflation

- A dovish Fed shifting to managing the business cycle, rather than fighting an inflation war

- Falling interest rates, benefiting consumers, corporates, and valuations

- An upward inflection in PMI boosting earnings growth

- Positive flows as sidelined investors allocate funds back into equities

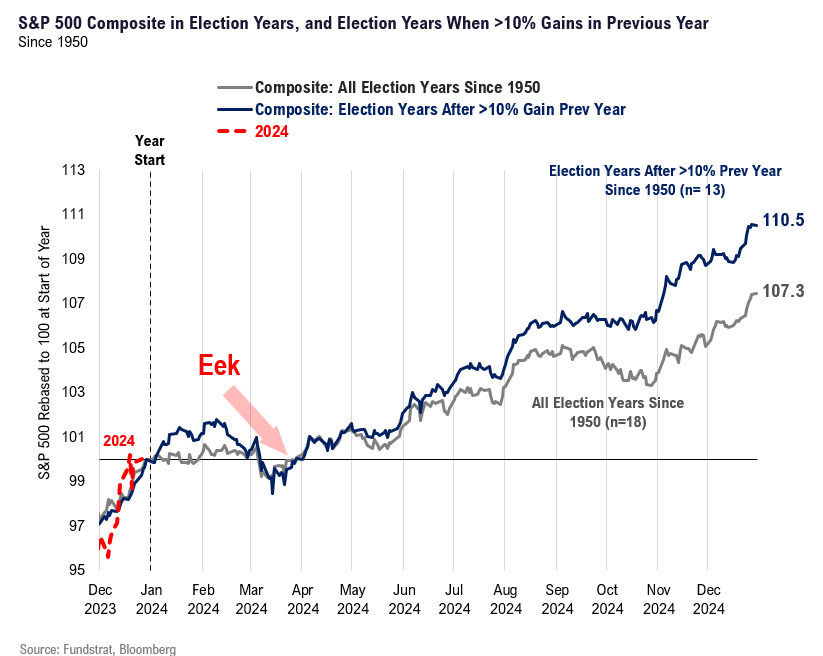

In the near term, Lee points out that the strong gains of December are likely to extend into January and February: “When December is positive, markets tend to do well in January and February,” especially if December was up more than 4% (which it was). This coincides with election-year seasonality, discussed in our Chart of the Week below.

Head of Technical Strategy Mark Newton has a constructive near-term reaction to the first trading week of the year. Technically, “four days of equity weakness haven’t really done much technical damage at all,” he said on Friday. Although rising bond yields pressured equities this week, “momentum on yields is still very negative. I suspect that yields should start to roll over again soon, and that means that equities should start to rally, at least in the short term.”

Chart of the Week

A look at market history shows that in election years, markets tend to peak in February and consolidate into April, so investors should be alert to the possibility of this trend repeating in 2024.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

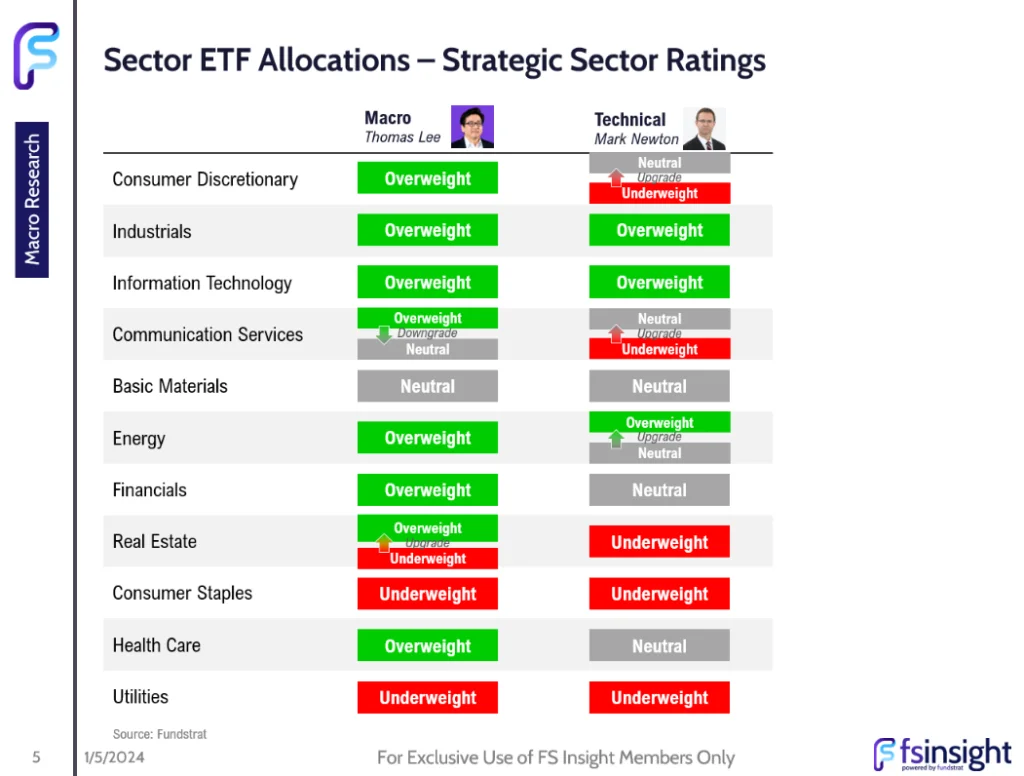

Sector Allocation Update

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton, part of the January 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Key incoming data

1/02 9:45am ET S&P Global Manufacturing PMI December FinalTame1/03 10am ET December ISM ManufacturingTame1/03 10am ET JOLTS Job Openings NovemberTame1/03 2pm ET December FOMC Meeting MinutesMixed1/04 9:45am ET S&P Global Services & Composite PMI December FinalMixed1/05 8:30am ET December Jobs ReportHot1/05 10am ET December ISM ServicesTame- 1/08 9am ET Manheim Used Vehicle Index December Final

- 1/11 8:30am ET December CPI

- 1/12 8:30am ET December PPI

Stock List Performance

In the News

[fsi-in-the-news]