As Fundstrat Head of Research Tom Lee has frequently written, what happens on the first five trading days of the year tends to show how the rest of the year will play out. At the close of trading this Monday, the fifth trading day of 2024, the S&P 500 was down 0.1% over this period. Should we view this as signal, or as a mulligan? To Fundstrat Head of Research Tom Lee, “Our takeaway is that this is a mulligan.”

There have been 20 precedents in which the first five trading days of the year ended “nearly flat,” Lee notes, and only twice in history was this followed by a large down year (1957 and 1974). The country was in a recession during both those occasions. Our takeaway from this is that if we do not have a recession this year (and this is our base case), the odds still favor double-digit gains for the year. However, Lee still continues to expect that the bulk of those gains will occur in the second half of 2024.

Head of Technical Strategy Mark Newton also believes that caution is warranted right now. “The October-December surge has quietly been consolidating in recent weeks,” he said, and his examination of ^SPX and DJIA cycles look “mixed.” Furthermore, Newton sees the likelihood of Treasury yields holding up until March “before turning down sharply into August.” All of this sparks wariness from Newton, as does election year seasonality, which as Newton notes, “argues for a possible choppy period.”

Lee noted, in jest, that even the SEC has had a rough start to 2024, what with the regulator’s X (Twitter) account getting compromised ahead of its approval of spot Bitcoin ETFs. But when the (actual) approval announcement finally arrived on Thursday, Head of Digital Asset Strategy Sean Farrell described it as “a pivotal moment in the evolution of the crypto industry.” Although he refrained from making any snap judgments about how the 11 spot BTC ETF debuts went, Farrell noted that “the BlackRock fund alone reported over $1 billion in volume, one of the highest volume debuts for a single ETF in history.”

Still, he said, “It’s crucial not to overemphasize the significance of a single day’s price action, especially in the context of the recent ETF launch. The initial premarket spike in price seemed to be driven by anticipatory moves, likely a mix of allocators sourcing Bitcoin before the market opened and speculative buying.”

Chart of the Week

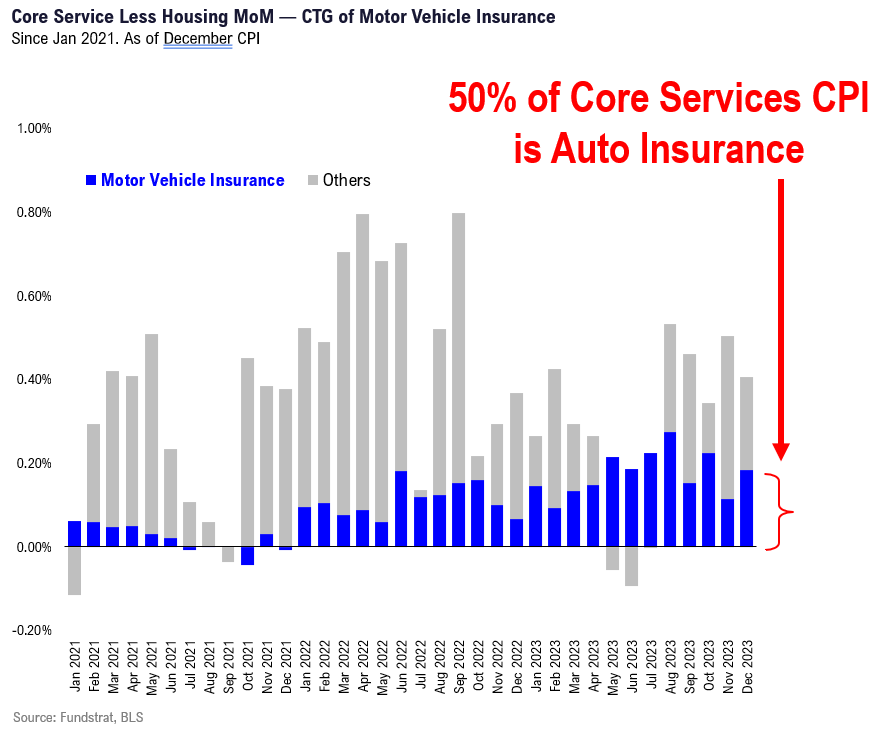

A closer examination of December CPI data released last Thursday showed auto-related components (especially auto insurance) having an outsized impact on the number. Fundstrat’s Tom Lee asserted that auto insurance is not rising because of easy money, easing financial conditions, or Fed funds being too low, so he asked, “Does it seem likely for the Fed to keep rates high because of auto insurance prices?

In his 2023 Outlook, FS Insight Head of Crypto Strategy Sean Farrell correctly called the BTC bottom and forecast BTC would reach $35,000-$44,000 range by 2024. It hit $44,000 on January 1, 2024. This week, with all eyes on cryptocurrency given this week’s approval and launch of 11 spot Bitcoin ETFs, Farrell had this to say: “The past week has been a testament to the remarkable journey of an asset class that emerged just 15 years ago.” This week, we are celebrating this important milestone, making FS Insight’s industry-leading Crypto research more accessible to our community for anyone who registers before Sean’s 2024 Outlook webinar on Tuesday:

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

1/08 9am ET Manheim Used Vehicle Index December FinalTame1/11 8:30am ET December CPIDetails Suggest Tame1/12 8:30am ET December PPITame- 1/16 8:30am ET January Empire Manufacturing Survey

- 1/17 8:30am ET January New York Fed Business Activity Survey

- 1/17 8:30am ET December Retail Sales Data

- 1/17 9am ET Manheim Used Vehicle Index January Mid-Month

- 1/17 10am EST January NAHB Housing Market Index

- 1/19 8:30am ET January Philly Fed Business Outlook Survey

- 1/19 10am ET U. Mich. Sentiment and Inflation Expectation January Prelim

Stock List Performance

In the News

[fsi-in-the-news]