’Tis the season for holiday parties, and last week Fundstrat Head of Research Tom Lee related his anecdotal experience at the parties this season: “In my conversations, I’ve found that most institutional investors remain cautious,” he observed. He suggested that “those with a bearish take are retaining an anchoring bias” – this despite many data points showing that inflation has fallen “like a rock” this year. Friday gave us yet more evidence of this, with Nov. Core PCE Deflator released and coming in at +0.06% MoM. This was in line with the forecast of our Head of Data Science, “Tireless” Ken Xuan, and well below Street consensus expectations of +0.20%. Housing accounted for +0.09% of the MoM increase, so if we exclude housing, Core inflation is actually negative. To put it another way, there is so much goods deflation that overall core inflation ex-housing is falling below 0%.

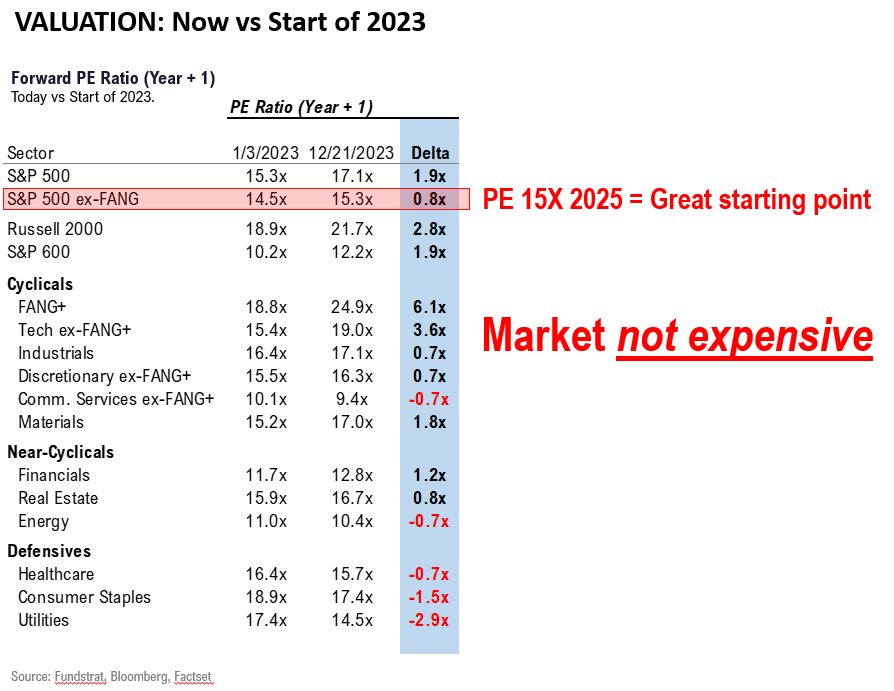

Some bears are citing valuation as a concern, but Lee discounts this. Although equities are indeed up by about 25% YTD, he points out that PE for the S&P 500 ex-FAANG is now around 15.3x, compared to 14.5x at the beginning of the year, as shown by our Chart of the Week (below). In Lee’s opinion, “that’s barely any increase.” The PE for the S&P 500 is also significantly lower now (17.1x) than it was at the beginning of 2022 (21.7x). So to our Head of Research, “we are at a great launching point for stocks heading into 2024.”

As we enter the Santa Claus rally period, Lee said, “We are buyers of dips into year-end,” and that’s a view with which Mark Newton, Head of Technical Strategy, agrees. Last week, Newton said, “Pullbacks into Friday of this week and/or next Tuesday (December 26) likely should prove buyable for an S&P 500 move back to exceed 4,818.” On a more cautious note, however, Newton’s technical work tells him that “if a pullback fails to materialize until January, then a larger-than-normal correction likely will occur heading into February 2024.”

Chart of the Week

Though some assume that stocks are expensive because they are up 25% year to date, the price-equity ratio for the S&P 500, ex-FAANG, has barely risen this year to 15.3x. To us, this means equities have ample room to expand in 2024.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

12/18 8:30am ET December New York Fed Business Activity SurveyTame12/18 10am ET December NAHB Housing Market IndexTame12/19 9am ET Manheim Used Vehicle Index December Mid-MonthTame12/20 10am ET December Conference Board Consumer ConfidenceTame12/21 8:30am ET 3QT 2023 GDPMixed12/21 8:30am ET December Philly Fed Business Outlook SurveyMixed12/22 8:30am ET November PCETame12/22 10am ET: U. Mich. Sentiment and Inflation Expectation December FinalTame- 12/26 9am ET December S&P CoreLogic CS home price

- 12/26 10:30am ET Dallas Fed December Manufacturing Activity Survey

Stock List Performance

In the News

[fsi-in-the-news]