Most investors had one main focus last week: December 13, when the Federal Reserve announced that it would leave the Fed funds rate at the same levels they have occupied since July 26, 2023. Before the announcement, the likelihood of the FOMC leaving rates unchanged was seen as a foregone conclusion, and hence priced into the markets. Because of that, the catalyst was expected to be the Fed’s views on the path forward. This includes not just the FOMC’s Summary Economic Projections (SEP) and dot plot, but also Fed Chair Jerome Powell’s statement and remarks during the press conference.

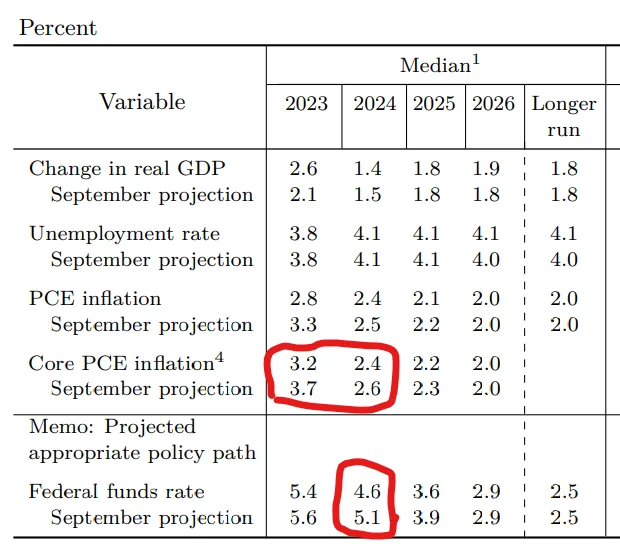

For weeks before the meeting, Tom Lee, Fundstrat’s Head of Research, had argued that not only could the Fed make a dovish move, but that it needed to do so, asserting that Committee members had been ignoring data that showed inflation cooling. On Wednesday, that is what happened, with the Fed capitulating on inflation and on its “higher for longer” stance: The latest SEP showed significantly lowered median expectations for both inflation and rates in 2023 and 2024. Assuming that the Fed continues its pattern of shifting rates in increments of 0.25%, it suggested three rate cuts in 2024. This sparked a surge in equities, and it sent U.S. 10-year yields plummeting.

For FS Insight members, another important event last week was Head of Technical Strategy Mark Newton's 2024 Outlook. Newton opened by pointing out that while this year’s rally was arguably dominated by Technology in the first part of 2023, the rally has broadened recently, with strengthening in Financials, Consumer Discretionary, and Healthcare. “That’s a very big positive as we look into 2024," he said as he forecast that while it might not be a straight shot, stocks should climb next year and hit new highs. His year-end 2024 target for the S&P 500 is 5,175.

Chart of the Week

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.