The past week was a challenging one for markets. Still, the overall message to us, says Fundstrat Head of Research Tom Lee, is that “companies are delivering strong earnings and investors are still wary that inflation might be accelerating.” We will look forward to a better answer with April CPI, in a few weeks.

Looking back, the first three inflation reports of 2024 show inflation has been higher than in the last 3 months of 2023. The broader question is whether inflation is actually accelerating. In our view, inflation has been tracking better than the CPI/PCE reports imply, as U Mich 1-yr inflation expectations are muted at 3.1% and below 20-year avg at 3.2% or 40-year average of 3.6%. 1Q24 conference calls see the lowest number of references to “inflation is a problem” since 1Q21. Median Core CPI component inflation is 1.76% YoY, below the long-term average of 2.4%.

As we’ve noted in our research, the higher inflation of Core CPI is primarily due to shelter remaining high (but statistically lagging) and the soaring of auto insurance premiums. Still, stresses Lee, this does not neutralize the fact that equity markets have become a “two step forward, one step back” phenomenon. In a way, this is expected. That is the technical pattern Mark Newton, Fundstrat’s Head of Technical Strategy, expected coming into this week. He believes the market had established the internal low last week, but this means it will take time for markets to regain a sustained positive footing.

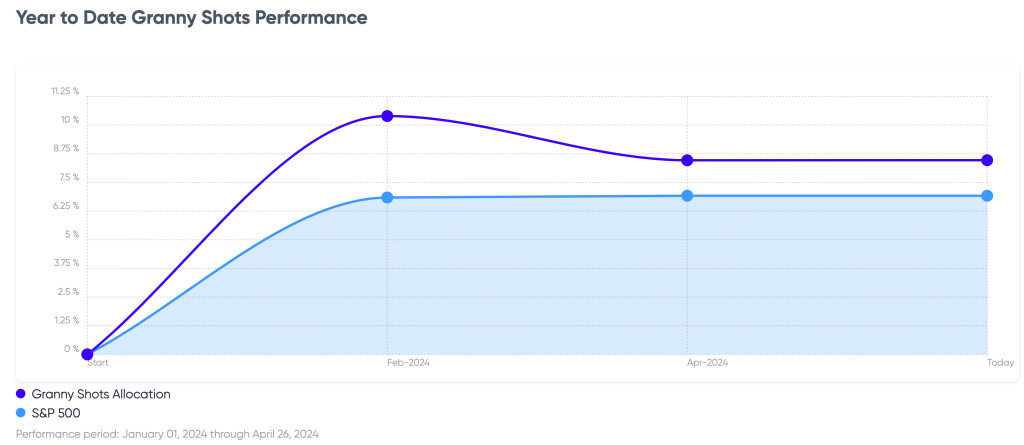

Lee is fully cognizant of the fact that the turmoil of the past few weeks has emboldened the skeptics, enabling a bearish views of equities. At the same time, he stresses that this need not mean that the path for equities into year-end has changed. Thus, Lee remains constructive and sees S&P 500 exceeding 5,200 by year-end on the back of, among other factors, incoming macro data that should be supportive of a softening of inflation, which, in turn, is supportive of equities.

Newton’s work backs Lee’s views. “The rally which started Monday likely should carry SPX back to 5400” says Newton. Delving into specifics, he explains that a five-wave advance higher represented the first real positive structural effort off the lows, as both U.S. Dollar and Treasury yields are looking close to turning back lower, and now very well could help to facilitate upside follow-through in the days to come. “Movement back over SPX-5090 would confirm that a rally back to 5200, and ultimately 5400, should be underway” says Newton, echoing Lee’s expectations.

Head of Digital Asset Strategy Sean Farrell sees the market as being in wait-and-see mode for next week, when the Fed meets and announces its latest thoughts on monetary policy, and the Treasury releases its quarterly refunding announcement, which details the amount and composition of funding sources for the rest of this quarter and next.

Says Farrell, “Over the intermediate and long term, recent weakness will prove to be a great buying opportunity. We think it is right for investors to view the QRA and FOMC meeting at the end of the month as a potential turning point for crypto markets.” Farrell’s base case for next week is that the actions taken by the Fed and Treasury will smooth out bond and equity market volatility, which should create positive downstream effects for crypto.

Commenting on Speaker Mike Johnson’s dramatic shift in position on the foreign aid bill, our Head of U.S. Policy Tom Block points out that Johnson’s effort to get the package passed received important support from both the White House and Democratic House Leader Jeffries, while in the House the Speaker failed to get a ‘majority of the majority’, with 112 Republicans voting against the Ukraine-specific part of the Supplemental package.

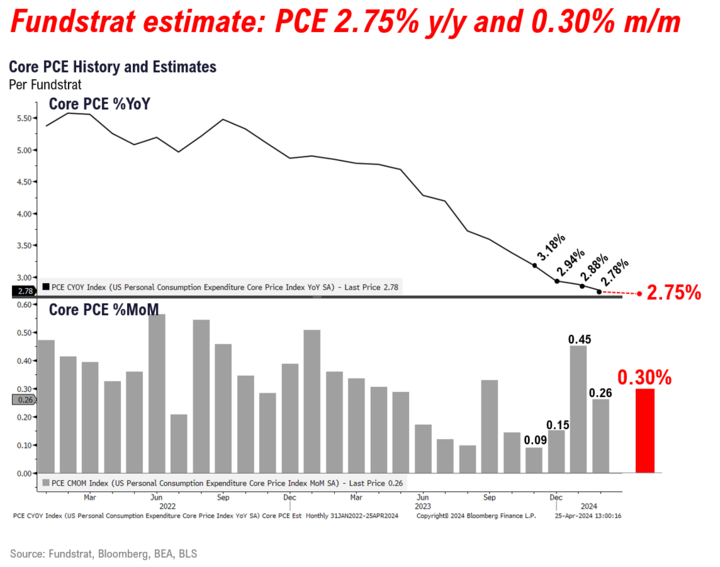

Chart of the Week

Fundstrat Head of Research Tom Lee points out that 1Q24 Core PCE Price Index YoY came in at +2.9%, higher than expected for March YoY +2.7%, while pointing to the key question: how much is due to Jan/Feb revisions? As we have noted multiple times, the higher inflation of Core CPI is primarily due to shelter remaining high (but statistically lagging) and the soaring of auto insurance premiums.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

4/22 8:30 am ET: Mar Chicago Fed Nat Activity SurveyTame4/23 9:45 am ET: Apr P S&P Global PMITame4/25 8:30 am ET: 1QA 2024 GDPTame4/26 8:30 am ET: Mar PCETame- 4/29 10:30 am ET: Apr Dallas Fed Manufacturing Activity Survey

- 4/30 9:00 am ET: Feb S&P CoreLogic CS home price

- 4/30 10:00 am ET: Apr Conference Board Consumer Confidence

- 4/30 10:00 am ET: Apr F U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

[fsi-in-the-news]