The S&P 500 once again set a new all-time high close last Tuesday, and both the S&P 500 and the Nasdaq notched substantial weekly gains to open the first half of the year. On the macroeconomic front, arguably the most significant data of the holiday-shortened trading week was released on Friday, with the U.S jobs report. Perhaps more important than the June numbers, however, were revisions to May and April numbers that translate into 111,000 fewer new jobs in the last two months than previously calculated. “That is a big number,” said Fundstrat Head of Research Tom Lee, “and to us it shows that the labor market is slowing.”

In the view of Head of Technical Strategy Mark Newton, we remain in a “bad news is good news” regime for investors. In that light, evidence of a softening labor market could be a positive for stocks. In addition to Friday’s jobs report, this week we saw continuing unemployment claims hit multi-year highs.

“The rally to SPX-5650-5750 seems to be underway, as large-cap Technology continues to press higher,” Newton told us this week, and his cycle composite suggests further gains are possible heading into mid-July. So does seasonality: The first two weeks of July are typically strong, and a look at past election years suggests that a long bias could be appropriate until August.

The minutes from the June 12, 2024 meeting of the Federal Open Markets Committee were also released last week. They show that although FOMC members continue require still more evidence of tanking inflation, a number of officials also appear concerned that years of elevated rates could be taking its toll on the economy, stressing that the Fed needs to be ready to respond quickly to any “unexpected economic weakness.” Such sentiments are consistent with remarks made by Fed Chair Jerome Powell last week at the annual forum hosted by the European Central Bank. Powell noted that the respective risks of cutting too early (risking a resurgence of inflation) or cutting too late (thus weakening the economy) had become more balanced.

Newton pointed out that “we seem to be seeing a sector rotation into Industrials, Materials and Consumer Discretionary.” From a technical standpoint, he noted that “interestingly, momentum has been positively diverging on weekly Summation index charts [a widely used gauge of market breadth]. McClellan’s Summation index has fallen to new lows for the year, but momentum gauges like MACD have held up in much better shape and are on the verge of making a bullish crossover of the signal line.” Although uncertainty remains on this matter, Newton suggested that “this very well might coincide with the start of a bounce in market breadth.”

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the July 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

The U.S. jobs report for June (released Friday) was in line with expectations, with slightly higher unemployment balancing out a headline beat on jobs added (206,000 jobs versus consensus expectations of 190,000). However, the government sector accounted for most of the upside in jobs this month. In the private sector, the numbers came in far short, at 136,000 versus consensus expectations of 160,000 – as our Chart of the Week shows. Fundstrat’s Tom Lee expects that investors will ultimately view the latter as the more important number. “After all,” Lee asked rhetorically, “will the Fed view the government adding more jobs as a reason to stay hawkish?” He concluded, “Probably not. Previously, the Fed was reluctant to reduce interest rates, despite softening inflation, because of the perceived strong labor market,” he observed. “This is arguably less and less the case.”

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/2 9:30 AM ET: Powell, Lagarde, Campos Neto Speak in SintraTame7/2 10:00 AM ET: May JOLTS Job OpeningsTame7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMIMixed7/3 10:00 AM ET: Jun ISM Services PMITame7/3 10:00 AM ET: May F Durable Goods OrdersMixed7/3 2:00 PM ET: Jun FOMC Meeting MinutesTame7/5 8:30 AM ET: Jun Jobs ReportTame- 7/9 6:00 AM ET: Jun Small Business Optimism Survey

- 7/9 9:00 AM ET: Jun F Manheim Used vehicle index

- 7/9 10:00 AM ET: Fed’s Powell Testifies to Senate Banking

- 7/11 8:30 AM ET: Jun CPI

- 7/12 8:30 AM ET: Jun PPI

- 7/12 10:00 AM ET: Jul P U. Mich. Sentiment and Inflation Expectation

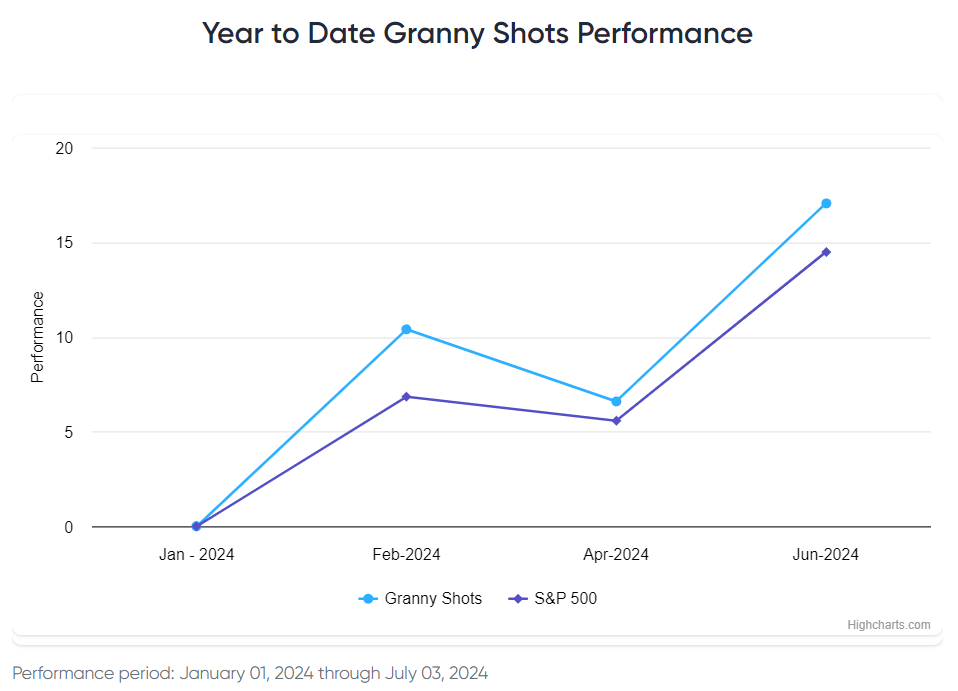

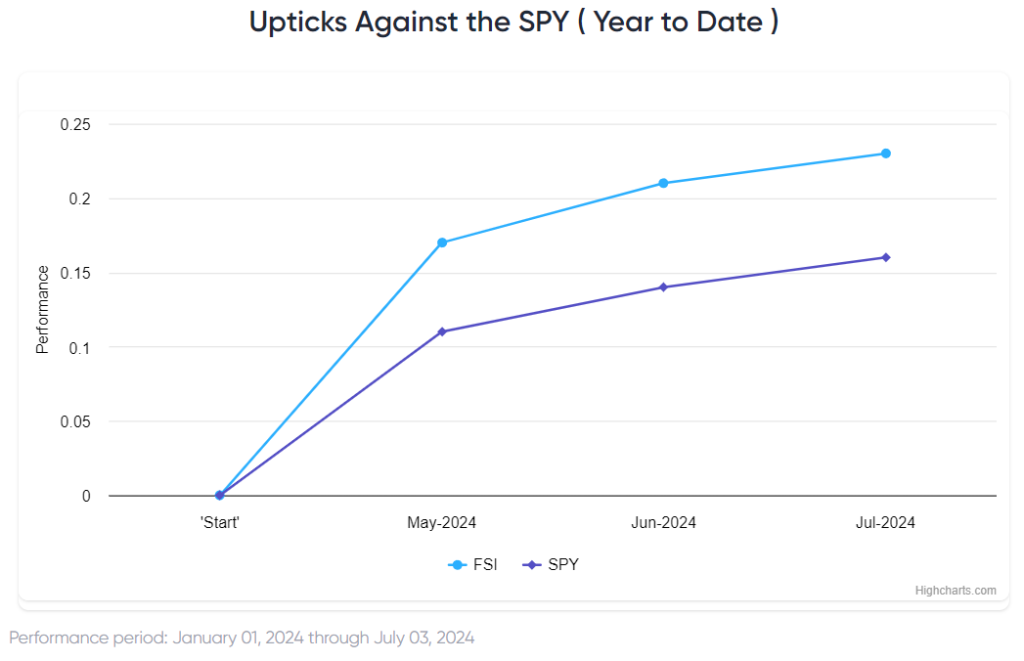

Stock List Performance

In the News

[fsi-in-the-news]