Last Friday was the last trading day of the month, quarter, and half. Stocks rose around 3.6% in June, with the S&P 500 ending within view of the 5,500 month-end target that Fundstrat Head of Research Tom Lee envisioned as a solid possibility in late May. To Lee, these gains have been driven by tanking inflation and an improving global economy – “a positive fundamental combination,” as he put it earlier in the week.

Yet skepticism about the market and about inflation remains. For example, this week Fed Governor Michelle Bowman said she continues to see “a number of upside risks” to inflation, while viewing no rate cuts this year as a distinct possibility. Market sentiment also remains cautious and skeptical. As Lee pointed out, levels of cash on the sidelines remain high ($6 trillion and growing) amid low levels of leverage, as measured by NYSE Margin Debt.

Head of Technical Strategy Mark Newton told us his work gives him a similar view of market sentiment. “For the first half of the year, markets are up more than 14 percent. There’s really no reason to be upset with that, but yet nobody’s happy,” he said during our weekly research huddle. He continued, “Recently, we saw some broader market participation and some great moves out of Financials, and yet it seems like nobody mentioned that.” Newton added, “When I look at Fear and Greed Index and the AAII [Investor Sentiment Survey], I don’t see the type of complacency that would make you think markets have peaked.”

Lee agrees that, given the week’s encouraging numbers, markets continue to have upside potential. This was a big week for macroeconomic data, starting with encouraging April Case-Shiller home price data. Perhaps more importantly, we also saw the latest reading of PCE – the Federal Reserve’s preferred inflation indicator. Core PCE came in at 0.08% MoM – below Street expectations of 0.15%-0.20%. On a YoY basis, Core PCE came in at levels not seen since March 2021. “Inflation is falling like a rock,” Lee reiterated. “You can even see the signs of this if you just look around,” he said, citing recent news stories about Target cutting prices and McDonald’s offering new, lower-priced value-meal options as just two examples of this trend.

A number of market skeptics continue to assert that equities as a whole are not doing so well, and that the apparent gains have largely been driven by just seven big Tech stocks. Lee sees it differently: It’s notable that 8% of the S&P 500 is up by more than 30% YTD. “That’s 40 stocks up more than 30%, hardly a narrow market,” he said. “And with 33% of the S&P 500 up more than 10% YTD, we are arguably in the middle of quite a broad-based rally.”

Chart of the Week

On Tuesday, Case-Shiller home prices for April came in at +0.38 MoM. “The prints from May through August of 2023 were pretty high,” observed Lee, “and that means, in my view, that the YoY for Case-Shiller in the coming months is going to drop. Case-Shiller leads the shelter component of CPI, so that’s set to fall as well,” he reasoned. This is shown in our Chart of the Week above.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

6/24 10:30 AM ET: Jun Dallas Fed Manuf. Activity SurveyTame6/25 8:30 AM ET: May Chicago Fed Nat Activity IndexTame6/25 9:00 AM ET: Apr S&P CoreLogic CS home priceTame6/25 10:00 AM ET: Jun Conference Board Consumer ConfidenceTame6/26 10:00 AM ET: May New Home SalesTame6/27 8:30 AM ET: 1Q T 2024 GDPTame6/27 10:00 AM ET: May P Durable Goods OrdersTame6/28 8:30 AM ET: May PCE DeflatorTame6/28 10:00 AM ET: Jun F U. Mich. Sentiment and Inflation ExpectationTame- 7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMI

- 7/1 10:00 AM ET: Jun ISM Manufacturing PMI

- 7/2 9:30 AM ET: Powell, Lagarde, Campos Neto Speak in Sintra

- 7/2 10:00 AM ET: May JOLTS Job Openings

- 7/3 8:30 AM ET: May Trade Balance

- 7/3 9:45 AM ET: Jun F S&P Global Services PMI

- 7/3 10:00 AM ET: Jun ISM Services PMI

- 7/3 10:00 AM ET: May F Durable Goods Orders

- 7/3 2:00 PM ET: Jun FOMC Meeting Minutes

- 7/5 8:30 AM ET: Jun Jobs Report

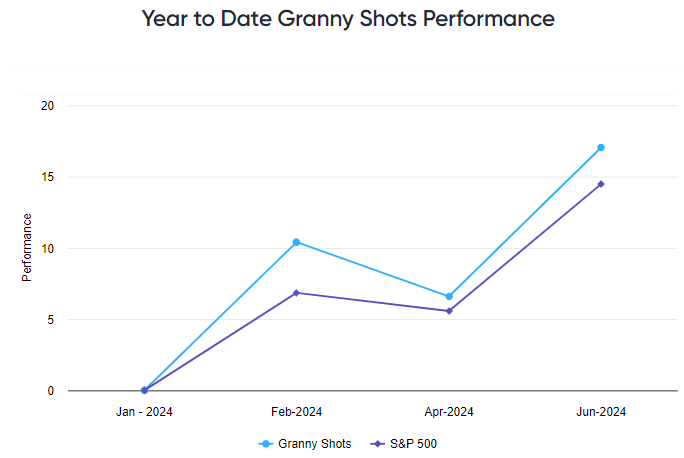

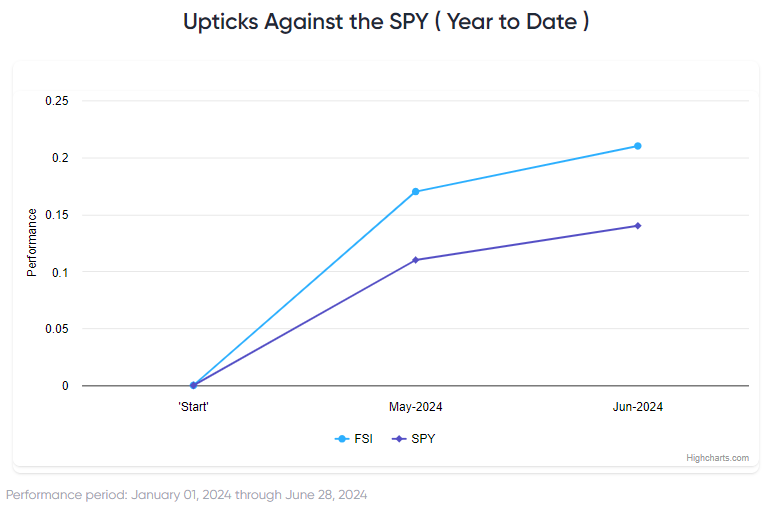

Stock List Performance

In the News

[fsi-in-the-news]