Stocks continue to advance, and a number of Wall Street equity strategists have responded by revising their year-end targets for the S&P 500 upwards. As Fundstrat Head of Research Tom Lee observed wryly last week, the 5,200 target he set in December 2023 has thus gone from being one of the most bullish targets to one of the least bullish. “That doesn’t mean we think the market’s already peaked this year,” he assured us. “We’re probably going to update our target in the middle of the year, which is a little less than two weeks away.”

He also pointed out that despite the rise in the broader indices – nearly a third of the stocks in the S&P 500 are up 10% or more YTD, stocks have not become expensive. “The P/E multiples haven’t even gone up yet,” he pointed out, noting that “the S&P 500, excluding FAANG, is still trading at 16.7 times forward earnings, roughly the same as it was at the start of the year. And to me, 16.7x is quite reasonable.”

The S&P 500 is up around 4% for the month so far, and Lee told us that stocks are rising “for the right reasons.” By this, he meant that stocks are rising in response to inflation continuing to track lower than consensus expectations. In his view, this raises the probability that the Federal Reserve will cut rates more than once this year, a possibility that markets appear to have recently become more willing to consider (based on Fed funds futures trading).

Head of Technical Strategy Mark Newton agreed that “we have reached a point where a lot of the data is just coming in weaker and weaker.” He said, “I don’t have a lot of insight as to why it’s coming in that way, but the key takeaway when you look at what markets are doing from a technical perspective is that we’re starting to see just a tremendous amount of bifurcation between how Technology is doing compared to the rest of the market. Energy, Financials, and Industrial just have not been doing anything, though we are starting to see these other sectors starting to gain traction. I view this as actually a pretty big positive, but we still need to see bigger breakouts of equal-weighted indices.”

Chart of the Week

Recent automobile price data supports the contention by Fundstrat’s Tom Lee that inflation is tracking lower than consensus expectations. “New car inventory has surged back to pre-pandemic levels as auto production has improved and consumer demand has waned,” he said, foreshadowing a decline in new car prices, particularly given an ongoing decline in used car prices (down 10% from their 2023 peak) and a rise in auto insurance prices that is making car purchases less affordable. “The drop in new car and used car prices impacts Core CPI more than many appreciate,” Lee said. As our Chart of the Week illustrates, auto-related components (cars plus insurance, etc) are 17% of the Core CPI basket. And more startlingly, they constitute 31% of all core inflation since 2019.”

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

6/17 8:30 AM ET: Jun Empire Manufacturing SurveyTame6/18 8:30 AM ET: May Retail Sales DataTame6/18 9:00 AM ET: Jun M Manheim Used vehicle indexTame6/18 4:00 PM ET: Apr Net TIC FlowsTame6/19 10:00 AM ET: Jun NAHB Housing Market IndexTame6/20 8:30 AM ET: Jun Philly Fed Business OutlookTame6/21 9:45 AM ET: Jun P S&P Global Manufacturing PMIDovish6/21 9:45 AM ET: Jun P S&P Global Services PMIDovish6/21 10:00 AM ET: May Existing Home SalesMixed- 6/24 10:30 AM ET: Jun Dallas Fed Manuf. Activity Survey

- 6/25 8:30 AM ET: May Chicago Fed Nat Activity Index

- 6/25 9:00 AM ET: Apr S&P CoreLogic CS home price

- 6/25 10:00 AM ET: Jun Conference Board Consumer Confidence

- 6/26 10:00 AM ET: May New Home Sales

- 6/27 8:30 AM ET: 1Q T 2024 GDP

- 6/27 10:00 AM ET: May P Durable Goods Orders

- 6/28 8:30 AM ET: May PCE Deflator

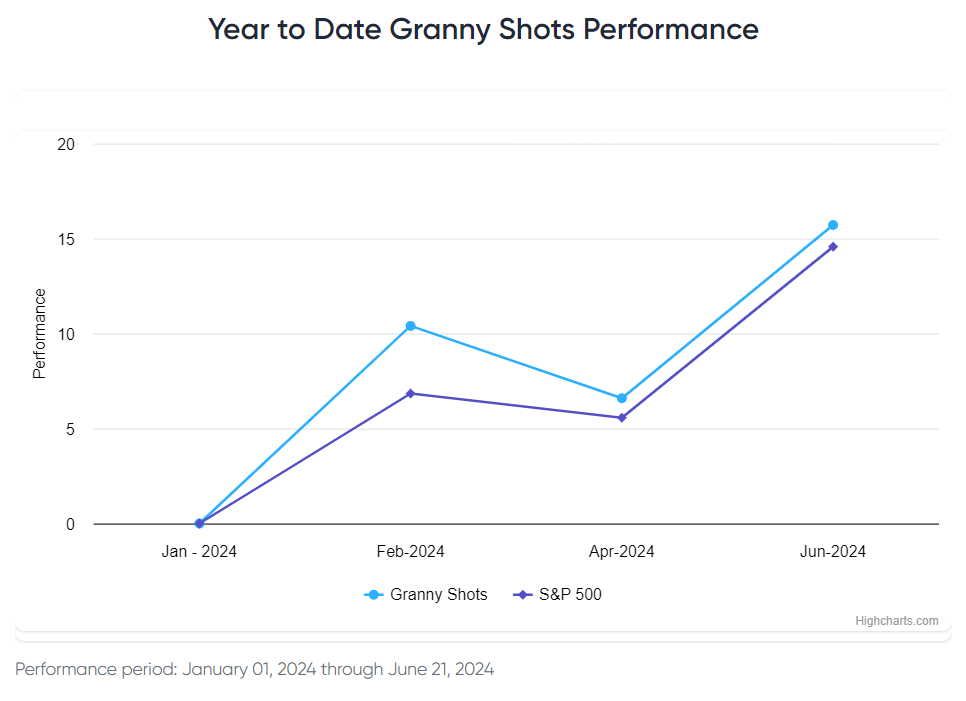

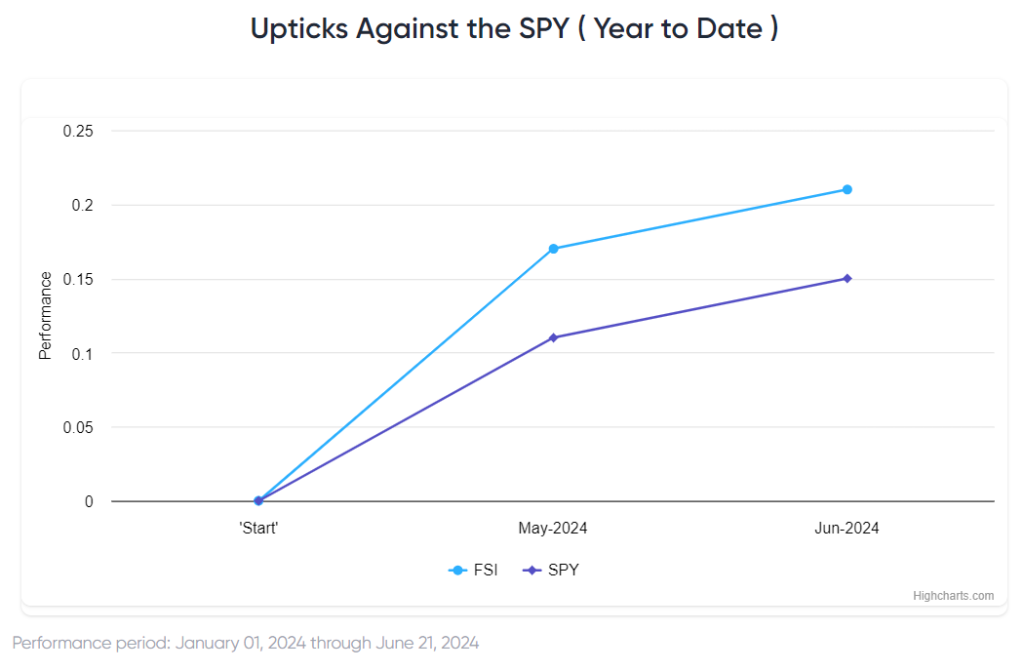

Stock List Performance

In the News

[fsi-in-the-news]