“Inflation is falling like a rock.” Fundstrat Head of Research Tom Lee has been pointing this out for quite some time, and the truth of that repeated assertion was even more evident last week. May Core CPI came in at +0.16% MoM, significantly lower than consensus expectations of +0.28%, and half of what we saw for this figure in April. On Thursday, May Core PPI came in at zero, versus Street forecasts of +0.26%. “This week’s data shows that inflation’s trajectory in May cooled at a faster pace than the stepdown seen in April,” Lee wrote.

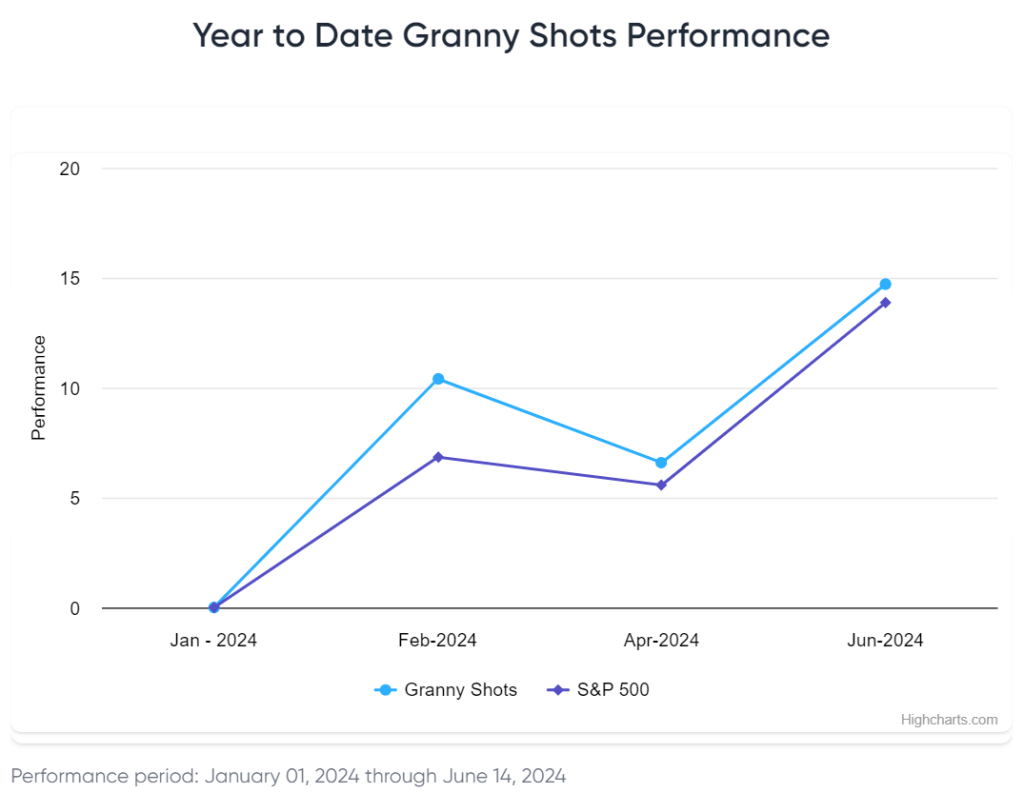

These downside inflation reads helped boost the markets this week, with the S&P 500 setting all-time record-high closes on Monday, Tuesday, Wednesday, and Thursday, before settling slightly on Friday. (The Nasdaq set new all-time record-high closes every day this week.) Yet, as Head of Technical Strategy Mark Newton observed, “Everybody looks at the broader indices ripping every day and thinks everything’s great. That’s true if you are over-concentrated in Technology. Very few investors are truly diversified and invested across all these different sectors, but if you are, right now you’re failing to keep pace with the little grandma who just owns QQQ -0.17% .”

That was not surprising to Lee, who noted that “both markets and the Fed are expressing some level of skepticism that this drop in inflationary pressures in May is genuine.” Wednesday’s Federal Open Markets Committee (FOMC) meeting was somewhat hawkish. “It seems the Fed largely ignored the May CPI report,” said Lee, which is curious given the Fed’s repeated avowals of data dependence. (When asked whether FOMC participants had changed their projections after the May CPI release, Fed Chair Jerome Powell responded, “Some people do, some people don’t. Most people don’t.”)

Regardless, Lee remains constructive. In fact, the FOMC’s somewhat hawkish stance this week “sets up for a very positive surprise for equities heading into May PCE [released at the end of June] and June CPI [mid-July],” he asserted. When also considering June seasonality and historical trends, Lee sees the possibility of the S&P 500 hitting 5,500 by the end of the month.

Chart of the Week

The internals of this week’s CPI data show that the percentage of CPI components below their respective long-term (pre-pandemic) averages jumped to 55% – well above the long-term average of 50%, and the highest since 2019. What’s more, the percentage of CPI components in outright deflation increased to 43% in May, the most since 2019 and well above the long-term average of 30% – as shown in our Chart of the Week. In other words, most of the CPI basket is back to pre-pandemic levels, and this looks repeatable. Thus, we expect increasing dovishness from the Fed in coming months.

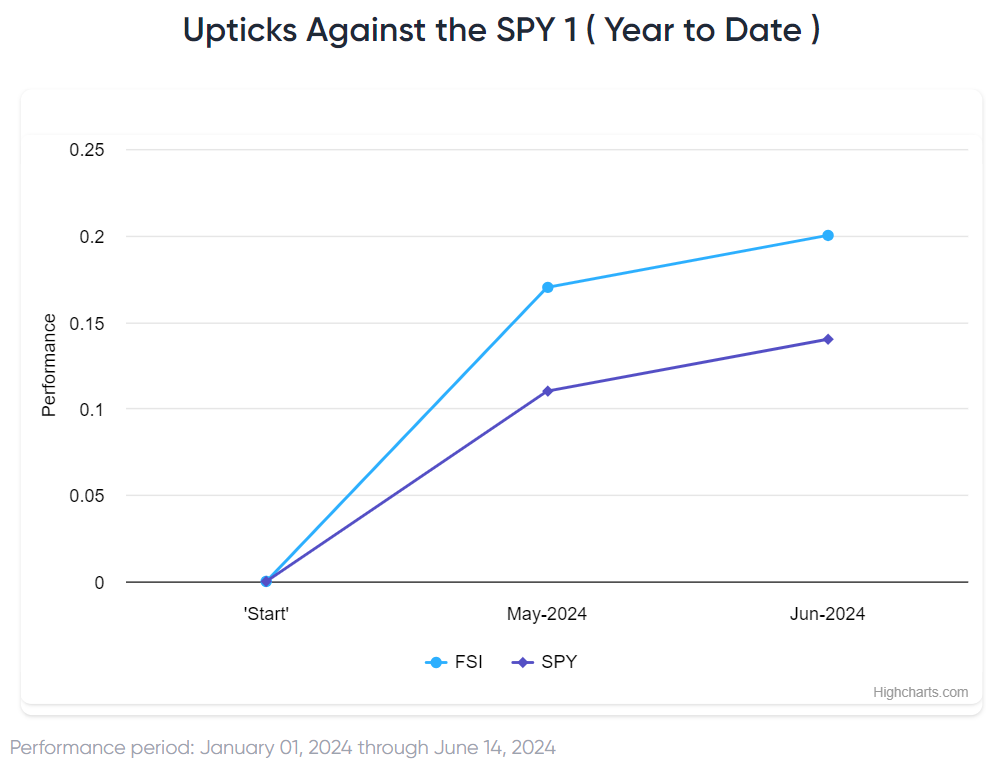

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

6/10 11:00 AM ET: May NYFed 1yr Inf ExpTame6/11 6:00 AM ET: May Small Business Optimism SurveyTame6/12 8:30 AM ET: May CPITame6/12 2:00 PM ET: Jun FOMC DecisionTame6/13 8:30 AM ET: May PPITame6/14 10:00 AM ET: Jun P U. Mich. Sentiment and Inflation ExpectationTame- 6/17 8:30 AM ET: Jun Empire Manufacturing Survey

- 6/18 8:30 AM ET: May Retail Sales Data

- 6/18 9:00 AM ET: Jun M Manheim Used vehicle index

- 6/18 4:00 PM ET: Apr Net TIC Flows

- 6/19 10:00 AM ET: Jun NAHB Housing Market Index

- 6/20 8:30 AM ET: Jun Philly Fed Business Outlook

- 6/21 9:45 AM ET: Jun P S&P Global Manufacturing PMI

- 6/21 9:45 AM ET: Jun P S&P Global Services PMI

- 6/21 10:00 AM ET: May Existing Home Sales

Stock List Performance

In the News

[fsi-in-the-news]