The S&P 500 closed last week up 1.32%. The ^SPX and Nasdaq both set new all-time high closes on Wednesday (5,354.03 and 17,187.90, respectively). As Fundstrat Head of Research Tom Lee has previously observed, in similar historical precedents (non-bear markets in which the first quarter is positive for stocks but April is a down month, June has been positive for stocks 11 out of 11 times.

Macroeconomic data also arguably played its part in driving gains earlier in the week. We saw soft data readings in May ISM Manufacturing, May ISM Services, 1Q labor costs, and April JOLTS job openings. Lee’s perspective: “Viewed collectively, the macroeconomic picture to me is showing softening price pressures and a labor market that is not creating upward wage pressures. In my view, that’s what the Fed wants to see.”

Despite a higher-than-expected jobs report from the Bureau of Labor Statistics (BLS) on Friday, Head of Data Science Ken Xuan pointed out in our weekly research huddle that “a lot of other signs suggest to us that the labor market is cooling.”

Head of Technical Strategy Mark Newton agreed with the Fundstrat macro team’s assessment: “The data in the U.S. has slowly been getting worse, or disinflationary – however you want to say it. That’s actually a very positive thing for US markets, because the broader economy is still in good shape. It’s just that on the fringes, you’re seeing things weakening ever so slightly.” He added, “To me, the broader-based stock rally has not really started yet. But I think that from a technical perspective, things are in place now for that to happen. We are seeing rates and the dollar start to plunge and that is a very good sign.”

On Nvidia

Longtime Granny Shot NVDA hit a new all-time high of 12224.40 on Wednesday, briefly sending its market cap above Apple’s to claim #2 spot on Wednesday. We remain long-term constructive on Nvidia, and Newton provided a nearer-term technical perspective on the stock at our weekly research huddle. “My near- to intermediate-term target for Nvidia was 1250 to 1350, and we might be able to hit the higher end of that target. We’re hearing a lot of people saying that Nvidia stock is stretched, that it’s time to sell. But based on the methods that I use, it’s early to think that Nvidia is going to peak out. It’s still very early to sell at least by a week on a daily chart.”

FSI Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the June 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

Fundstrat’s Tom Lee saw hints last week that some institutional investors began re-risking after they de-risked in May. As he observed earlier in the week, “it is notable in three straight trading sessions that stocks rallied into the close,” reminding us of the “old trader’s adage that ‘amateurs open the market, professionals close the market’.” This is illustrated in our Chart of the Week.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

6/3 9:45 AM ET: May F S&P Global Manufacturing PMITame6/3 10:00 AM ET: May ISM Manufacturing PMITame6/4 10:00 AM ET: Apr JOLTS Job OpeningsTame6/4 10:00 AM ET: Apr F Durable Goods OrdersTame6/5 9:45 AM ET: May F S&P Global Services PMITame6/5 10:00 AM ET: May ISM Services PMITame6/6 8:30 AM ET: 1Q F Nonfarm ProductivityTame6/6 8:30 AM ET: Apr Trade BalanceTame6/6 8:30 AM ET: 1Q F Unit Labor CostsTame6/7 8:30 AM ET: May Jobs ReportHot6/7 9:00 AM ET: May F Manheim Used vehicle indexTame- 6/10 11:00 AM ET: May NYFed 1yr Inf Exp

- 6/11 6:00 AM ET: May Small Business Optimism Survey

- 6/12 8:30 AM ET: May CPI

- 6/12 2:00 PM ET: Jun FOMC Decision

- 6/13 8:30 AM ET: May PPI

- 6/14 10:00 AM ET: Jun P U. Mich. Sentiment and Inflation Expectation

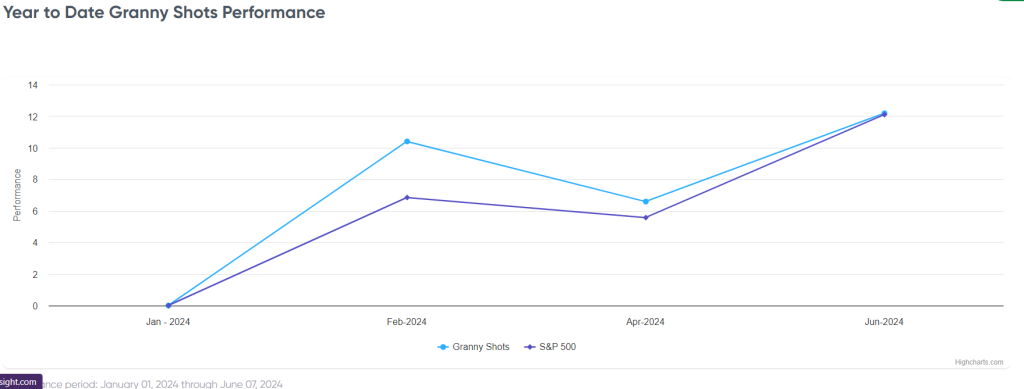

Stock List Performance

In the News

[fsi-in-the-news]