“When I choose to see the good side of things, I’m not being naive. It is strategic and necessary. It’s how I’ve learned to survive through everything.” — CEO Waymond, Everything Everywhere All At Once

Chart of the Day

Good morning!

All I wanted for Christmas was for Nvidia’s third quarter earnings to reaffirm the AI bull run. It seems like Santa came early this year.

Shares of the chips juggernaut rallied as much as 6.5% after the bell yesterday, and this morning, they’re up about 5% before open.

It reported record third quarter sales of $57 billion, up 62% from a year ago, which beat expectations. It also upped its guidance for fourth quarter revenue, expecting it to hit $65 billion.

“AI is going everywhere, doing everything, all at once,” Chief Executive Jensen Huang said during the earnings call.

Let me just say I and countless other investors are breathing a huge sigh of relief that Nvidia’s earnings came in better than expected because it makes it significantly harder for the broader market to rally without the biggest weight in the S&P 500 leading the charge.

The next big test for the market now is whether Nvidia’s earnings can help revive the broader tech trade, which seems to be showing signs of unraveling this month. Many are questioning if an AI bubble has already popped.

Its strong earnings last night should help quell a lot of the AI naysayers, and hopefully help the Nasdaq Composite recover from its 4.9% decline this month. If we’re lucky, it might even be enough for investors to overlook a late September jobs report and make up for the dashed hopes of a December interest-rate cut.

The positive reception is particularly welcome because a handful of prominent investors have become bearish on the stock, which when it’s 7% of the S&P 500 also has the tendency to make one bearish about other AI stocks. The latest example came Monday when billionaire tech investor Peter Thiel’s fund entirely cut its Nvidia position in the third quarter. SoftBank completely emptied out its position recently, too. Prominent investors like Michael Burry have outrightly taken a bearish bet against Nvidia.

While that’s never good to see, I think their outflows will ultimately matter little because of all the deals that Nvidia keeps signing. Just yesterday, Huang announced he is working with Saudi Arabia to “build supercomputers that will control quantum computers and power their compute-heavy error correction systems.” Elon Musk’s xAI will also work with the kingdom’s HUMAIN on a new data center that will be powered by Nvidia chips.

I’m hopeful the stock can sustainably break out of its rut. It’s been rangebound for the past five months, and while it was not that long ago that it hit $5 trillion in market value, it no longer has those bragging rights. Rival AMD’s recent deals and excitement surrounding its upcoming MI450 chips signal that it’s shaping up to be a formidable opponent in the chips race.

The most interesting bit about the recent market sell-off to me is that Nvidia’s stock looks very attractive from the perspective of valuations. It’s trading at 29.3 times forward valuations, while Broadcom’s trading at 37.4 and Walmart’s at 35.0 multiples. JFYI: Walmart had its earnings this morning, and I’ll share my thoughts on that later.

Share your thoughts

Do you think we’re saved because of Nvidia? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Do you think Google’s the tortoise and ChatGPT’s the hare?

A: I am switching to Gemini. ChatGPT could not import the chart CSV data accurately this morning and after about 5 times trying I gave up. Not sure what happened, it used to be very accurate. I tried Gemini and received accurate results on the first try. I don’t know how many billions or trillions ChatGPT is planning on spending, but if they can’t successfully import a simple .csv file with a handful of rows it will be a lot of wasted money.

Catch up with FS Insight

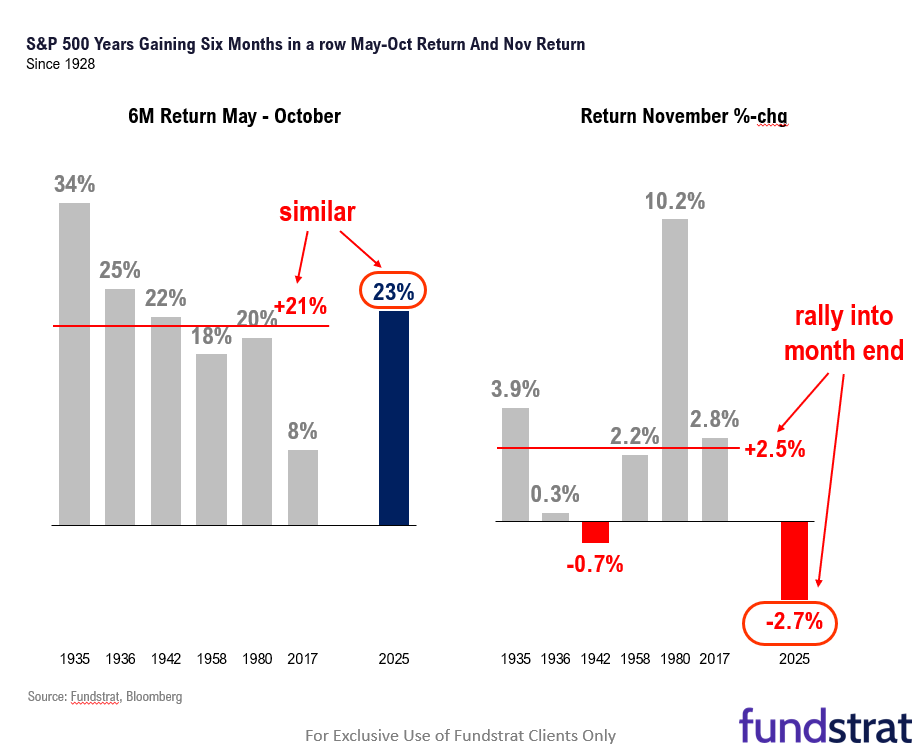

We had expected equities would rally post-NVDA, partially due to relief and partially reflecting that the stock was down into earnings. We still expect November to end up being a positive month.

Technical

Failure to mount a strong rally in December that helps to lift market breadth into year-end would likely prove to be a 1st Half 2026 problem. For now, I like positioning long and feel that NVDA’s results likely help the market recover.

Crypto

BTC was selling off during U.S. hours even as equities rose, pointing to structural (possibly forced) sellers. With equities near perceived upside targets, investors were less willing to rotate into a non-trending asset.

News We’re Following

Breaking News

- Hiring Defied Expectations in September, With 119,000 New Jobs WSJ

- Nvidia’s Strong Results Show AI Fears Are Premature WSJ

Markets and economy

- Holiday Hiring Slows, Frustrating Job Seekers NYT

- Saudi Arabia’s Prince Has Big Plans, but His Giant Fund Is Low on Cash NYT

- Federal Reserve officials ‘strongly’ divided on December interest rate cut FT

- Bitcoin Fails to Rally After Nvidia Boosts Markets. Why That’s a Big Worry for Crypto. BR

Business

- Walmart Reports Strong Sales Growth, Raises Outlook WSJ

- Oracle Was an AI Darling on Wall Street. Then Reality Set In. WSJ

- Palo Alto tops earnings expectations, announces Chronosphere acquisition CNBC

- Block’s stock has suffered in a ‘dismal’ fintech market. But these new forecasts are drawing cheers. MW

Politics

- Trump and Mamdani Will Meet at White House on Friday NYT

- Trump Approves the Release of the Epstein Files, but Loopholes Remain NYT

Overseas

- Trump’s total boycott of G20 casts shadow over its future FT

- China’s shadow navy trains to take Taiwan RT

Of Interest

- Walmart to shift listing to Nasdaq as retailer raises sales forecasts FT

- Self-storage real estate has ‘close to zero’ correlation to the broader economy. That’s a good thing CNBC

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/20 | 8:30 AM | Sep Oct AHE m/m | 0.3 | 0.3 |

| 11/20 | 8:30 AM | Sep Oct Unemployment Rate | 4.3 | 4.3 |

| 11/20 | 8:30 AM | Sep Oct Non-farm Payrolls | 51 | 22 |

| 11/20 | 10:00 AM | Oct Sep Existing Home Sales | 4.08 | 4.06 |

| 11/20 | 10:00 AM | Oct Sep Existing Home Sales m/m | 0.49 | 1.5 |

| 11/21 | 9:45 AM | Nov P Sep F S&P Srvcs PMI | 54.6 | 54.8 |

| 11/21 | 9:45 AM | Nov P Oct S&P Manu PMI | 52 | 52.5 |

| 11/21 | 10:00 AM | Nov F Oct P UMich 1yr Inf Exp | n/a | 4.7 |

| 11/21 | 10:00 AM | Nov F Oct P UMich Sentiment | 50.6 | 50.3 |

| 11/25 | 8:30 AM | Sep PPI m/m | n/a | -0.1 |

| 11/25 | 8:30 AM | Sep Core PPI m/m | n/a | -0.1 |

| 11/25 | 9:00 AM | Sep Aug Case Shiller 20-City m/m | n/a | 0.19 |

| 11/25 | 10:00 AM | Nov Oct Conf Board Sentiment | 93.3 | 94.6 |

| 11/26 | 8:30 AM | 3Q P 3Q A GDP QoQ | n/a | 3.8 |

| 11/26 | 8:30 AM | Sep P Durable Gds Orders | n/a | 2.9 |

| 11/26 | 10:00 AM | Oct Sep PCE m/m | n/a | 0.3 |

| 11/26 | 10:00 AM | Oct Sep Core PCE m/m | n/a | 0.23 |

| 11/26 | 10:00 AM | Oct Sep PCE y/y | n/a | 2.7 |

| 11/26 | 10:00 AM | Oct Sep Core PCE y/y | n/a | 2.90511 |