“Remembrance of things past is not necessarily the remembrance of things as they were.” ― Marcel Proust

Chart of the Day

Good morning!

One of the key arguments made by bears lately for why the AI trade can’t keep going is that the party’s simply been going on too long. They’re saying dawn’s about to break and everyone’s got to go home.

That’s partially why the tech-stock focused Nasdaq Composite has notched two straight weekly declines (it’s down 3.9% month-to-date as of Friday’s close), unable to shrug off concerns about sky-high valuations and herculean levels of spending on capital expenditure: many think the time is up. That, to me, is a silly belief.

Yes, it’s fair to say that investors across the globe haven’t really been thrown into the throngs of recession for about 15 years, if you exclude Covid-19, which didn’t last all that long. Yes, it’s somewhat concerning that a third of America’s workforce has never seen a steep economic downturn, according to a recent Economist article. Yes, it’s not good to see that the older generation is way more exposed to stocks than they should be, which leaves them more vulnerable if there is a big pullback.

But at the same time, those who are focused on those traditional beliefs are missing what’s right in front of them. The sheer brilliance of AI and its advancements, even though we’re three years in, is enough to keep me going. Playbooks for investing in all kinds of industries are being reshuffled around, there are signs that productivity is already rising, and hyperscalers are sharing the growing opportunity with many other players.

At the same time, I don’t feel that I’m blindly bullish on AI. I believe in “disaster myopia” — as highlighted by The Economist. It refers to the tendency that people can forget just how bad things were during crunch times, making them bigger risk takers.

Household wealth declined almost $17 trillion in inflation-adjusted terms, or 26 percent, from its peak in mid-2007 to its trough in early 2009, according to the Federal Reserve Bank of St. Louis.

If there’s a pullback of similar levels, this is likely to wipe out even bigger sums from households. That’s because they are so much more exposed to stocks now. They owned $61.1 trillion in stock directly and indirectly in the second quarter of this year, while the most they held in 2007 was $17.9 trillion.

So, I sympathize with those who are scared about any minor dips here marking the start of a decline that destroys wealth.

The best way to get out of that thinking is that you have to remember that central banks and governments across the globe have truly developed their monetary and fiscal policy tools that can aid economies during recessionary times, which will likely help make the bad times short.

Realistically speaking, there’s no way that the bulls can keep partying come dawn, but I don’t see signs so far that signal they’ve drank so much that they need their stomachs pumped. Total business-to-household debt relative to GDP was stable at 20-year lows, according to the Fed’s financial stability report. Household debt mostly sits with those who have strong credit scores. That’s not even the best bit—Most domestic banks have maintained high levels of liquid assets and stable funding, and their reliance on uninsured deposits remained well below recent peaks.

Until we see those basic signs deteriorate, it’s tough to make the case that investors could get scarred for life if they keep partying. To quote Fundstrat Head of Research Tom Lee, “Walls of worries can quickly become tailwinds.”

Share your thoughts

Do you have any memories to share from the past recessions? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Do you prefer AMD here or Nvidia?

A: Nvidia preferred at current levels. I used the strength in AMD yesterday to sell. I plan on adding that position back to my portfolio once its price comes back in. I would not sell my Nvidia stake on strength as I think Nvidia is a must have investment where other chip stocks can be bought and sold as price action warrants.

Catch up with FS Insight

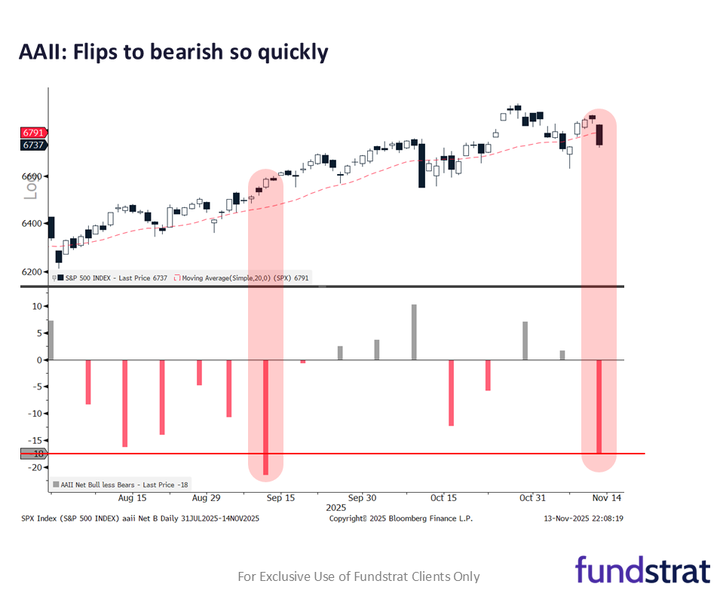

Fed officials are still pushing back against a Dec cut, which is making markets more wary. And markets have a new “wall of worry” as the Supreme Court expresses skepticism about the White House tariffs. All in all, the turbulence is tracking the expected chop in the first half of Nov.

Technical

It’s important now for SPX and QQQ to make a strong rebound off these levels without any further backing and filling. As discussed, the areas at SPX 6631 and QQQ 598.68 look important and should not be violated in order to keep this recent uptrend intact.

Crypto

Overall, while I think the odds of a bounce are rising, I continue to favor a defensive posture toward the crypto market in the immediate-term.

News We’re Following

Breaking News

- S&P 500 and Nasdaq futures rise to start the week CNBC

- Jeff Bezos creates A.I. start-up where he will be co-chief executive NYT

Markets and economy

- Morgan Stanley sees US outperforming global stocks in 2026, raises S&P 500 target REU

- Kugler resignation from Fed board followed disclosures of improper stock trades WSJ

- Jeffrey Gundlach warns of ‘garbage lending’ as private credit booms BBG

Business

- Bankruptcy judge clears $7.4bn Purdue Pharma opioid settlement BBC

- Alphabet shares jump after Berkshire makes rare tech bet with $4.9 bln stake REU

- Peter Thiel’s fund sold off entire Nvidia stake in third quarter BBG

Politics

- Trump does Epstein U-turn as House Republicans prepare to spurn him POL

- Immigration crackdown intensifies in Charlotte, N.C. WSJ

- FAA lifts all remaining flight cuts imposed during shutdown BBG

Overseas

- Chile’s presidential race heads to a runoff between a communist and a pro-Trump conservative AP

- Gen Z-styled protests spread in Mexico, fueled by mayor’s murder REU

- China escalates Japan spat with threats of economic retaliation BBG

- Bangladesh’s ousted leader Sheikh Hasina sentenced to death BBC

Of Interest

- Japan’s Sakurajima volcano erupts, ashfall cancels flights REU

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/18 | 8:30 AM | Oct Sep Import Price m/m | 0.1 | 0.3 |

| 11/18 | 10:00 AM | Nov Oct Homebuilder Sentiment | 36 | 37 |

| 11/18 | 10:00 AM | Aug F Sep P Durable Gds Orders | 2.9 | 2.9 |

| 11/18 | 4:00 PM | Sep Aug Net TIC Flows | n/a | 2.078 |

| 11/19 | 8:30 AM | Aug Trade Balance | -60.3 | -78.311 |

| 11/19 | 2:00 PM | Oct 29 Sep 17 FOMC Minutes | n/a | 0 |

| 11/20 | 8:30 AM | Sep Oct AHE m/m | 0.3 | 0.3 |

| 11/20 | 8:30 AM | Sep Oct Unemployment Rate | 4.3 | 4.3 |

| 11/20 | 8:30 AM | Sep Oct Non-farm Payrolls | 50 | 22 |

| 11/20 | 10:00 AM | Oct Sep Existing Home Sales | 4.1 | 4.06 |

| 11/20 | 10:00 AM | Oct Sep Existing Home Sales m/m | 0.99 | 1.5 |

| 11/21 | 9:45 AM | Nov P Sep F S&P Srvcs PMI | 55 | 54.8 |

| 11/21 | 9:45 AM | Nov P Oct S&P Manu PMI | 52 | 52.5 |

| 11/21 | 10:00 AM | Nov F Oct P UMich 1yr Inf Exp | n/a | 4.7 |

| 11/21 | 10:00 AM | Nov F Oct P UMich Sentiment | 50.8 | 50.3 |