“The biggest risk is not taking any risk.” — AMD Chief Executive Lisa Su

Chart of the Day

Good morning!

If you look at the share-price performance of Advanced Micro Devices lately, it suggests that Nvidia is losing its status as the golden child. That’s not necessarily a bad thing.

AMD shares rose 9% Wednesday, a day after its analyst day. Nvidia’s, in comparison, fell 0.3%.

As far as I understand, there was not that much new, good stuff discovered during the AMD analyst day that justifies a meteoric rise like yesterday’s. All focus is on its Helios rack and upcoming MI400 series, but it didn’t offer additional insight into either. What may be responsible for the move could be the company’s ambition and confidence. It said it expects AI chip sales to grow at a crazy 80% annual pace over the upcoming years.

But no matter. The gap between Goliath and David has narrowed ever since AMD signed a deal with OpenAI on Oct. 6, sending shares skyrocketing 57% over that period, while Nvidia has inched up 3.3%. The latter has also been affected this week by SoftBank cashing out its position in it — worth around $5.8 trillion — to invest in OpenAI instead.

Investors will find out how Nvidia’s faring when it reports earnings on Nov. 19. Since its valuation climbed over $5 trillion last month, smaller moves have become its hallmark. AMD has had seven 5% moves in either direction since the OpenAI news, while Nvidia has logged one.

Enthusiasm tied to the AI trade has helped further carry the shares of memory manufacturers like Micron and South Korea’s SK Hynix shares up 46% and 77%, respectively, in the fourth quarter.

Contrary to what conventional market wisdom may suggest, Nvidia being outshined might actually be better for the market rally’s longevity. The most obvious reason is that it reduces investors’ overreliance on a single company that has now grown to be worth more than the GDP of every country on earth, except for the United States and China.

Right now, we’re seeing extraordinary fundraising efforts from AI players in the public markets. Meta’s Mark Zuckerberg recently formed a joint venture with Blue Owl in a wonky deal worth $27 billion to finance the build-out of a data center in rural Louisiana.

While bonds for it were priced at par initially, they’re now trading at 107.6 cents on the dollar. In simpler terms, the yield offered on the bond actually went down after it started trading in the secondary markets, signaling just how hot demand is for AI investments. FT Alphaville wrote a deep dive on its cutesy engineered bonds.

If AI is indeed a multiyear secular bull cycle, which I believe it to be, then it’s healthy to see other chip stocks rotate to the top from time to time.

It only makes sense that other hot AI trades will garner investors’ attention from time to time, but that doesn’t mean that Nvidia is beginning a slide into obscurity. Its moat as it relates to AI research remains far too deep for that, but it’s always nice to see all stocks get a reality check.

And to be sure, the recent fervor with AMD has made its shares look much more expensive than Nvidia’s. The former is trading at 45.95 times forward earnings, while Nvidia’s at 33.15. For comparison, Intel’s at 82.89 times multiple and Oracle’s at 31.98.

Share your thoughts

Do you prefer AMD here or Nvidia? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: What impacts your view of the economy the most?

A: I think that jobs lost due to AI have no clear path of whether they will come back in another form. I don’t think the CEOs building this out have a clear idea of what shape it will take. And they are going by past technology changes that helps create new types of jobs. Only a couple of them like Musk have talked about what future society will look like. The leaders in Washington aren’t going to know either. I guess we will all wait and find out where all this leads to in coming years.

Catch up with FS Insight

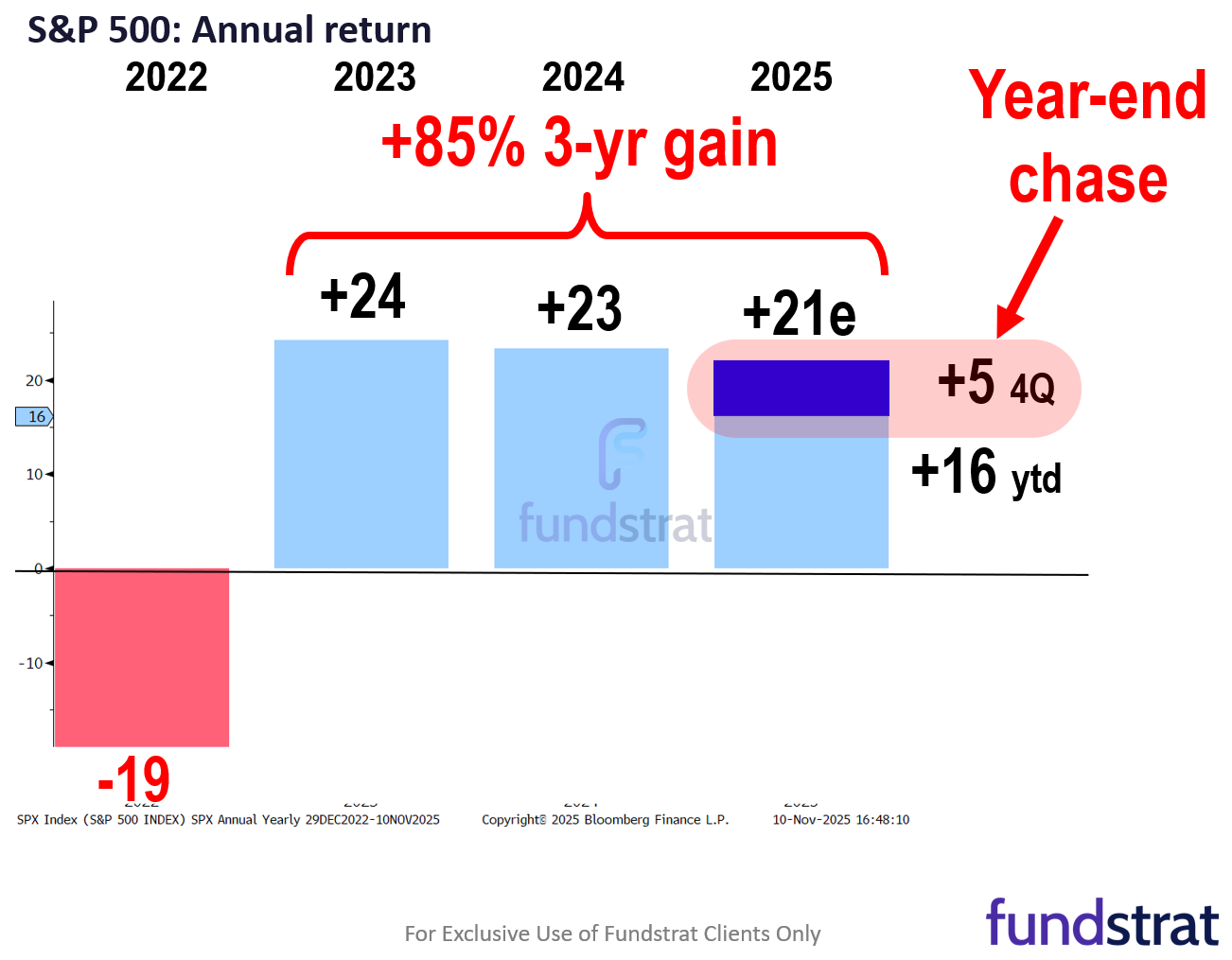

We were at a conference earlier this week, and we met with many investors. The skepticism into year-end is rising due to the recent weakness and now concerns about AI stocks. But we discuss why many of these concerns for AI are overstated.

Technical

While I believe that last week’s lows should represent the probable lows for November, I’m unwilling to think that an immediate push back to highs is imminent.

Crypto

BTC is currently below both its 50-day and 200-day moving averages, thresholds under which it has historically experienced significant bouts of downside volatility. If momentum continues to deteriorate, this could compound downside pressure, particularly in altcoins.

News We’re Following

Breaking News

- Dow, S&P 500, Nasdaq futures struggle as Wall Street eyes fallout from US shutdown YF

Markets and economy

- Atlanta Fed president Bostic to retire in February, opening seat on key committee AP

- China’s Singles’ Day stumbles as frugal shoppers shrink the world’s biggest sale CNBC

- Proxy advisers ISS and Glass Lewis are facing antitrust probes WSJ

Business

- AMD stock soars 9% on strong growth projections as CEO Su calls AI spending ‘the right gamble’ CNBC

- Cisco stock climbs as earnings and revenue beat expectations BAR

- Starbucks workers union launches strike in at least 40 cities on chain’s key holiday sales day CNBC

- Disney boosts dividend and buyback, parks and streaming drive profit beat REU

- Firefly Aerospace shares jump 15% on strong revenues, boosted guidance CNBC

Politics

- Record US government shutdown ends as Trump signs spending bill BBG

- Petition forcing Epstein vote succeeds over White House objections WSJ

Overseas

- US withdrew $900mn from IMF account as Argentina debt payment loomed FT

- Major corruption scandal engulfs top Zelensky allies BBC

- US allies cut intelligence sharing with US over Caribbean strikes SEM

Of Interest

- U.S. Mint presses final Penny after more than 200 years NYT

- Sotheby’s says a diamond brooch lost by Napoleon as his forces fled Waterloo sells for $4.4 million AP

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/13 | 8:30 AM | Oct Sep CPI m/m | 0.2 | 0.3 |

| 11/13 | 8:30 AM | Oct Sep Core CPI m/m | 0.3 | 0.2 |

| 11/13 | 8:30 AM | Oct Sep CPI y/y | 3 | 3 |

| 11/13 | 8:30 AM | Oct Sep Core CPI y/y | 3 | 3 |

| 11/14 | 8:30 AM | Oct Sep PPI m/m | 0.2 | -0.1 |

| 11/14 | 8:30 AM | Oct Sep Core PPI m/m | 0.3 | -0.1 |

| 11/18 | 8:30 AM | Oct Sep Import Price m/m | n/a | 0.3 |

| 11/18 | 10:00 AM | Nov Oct Homebuilder Sentiment | n/a | 37 |

| 11/18 | 4:00 PM | Sep Aug Net TIC Flows | n/a | 2.078 |

| 11/19 | 2:00 PM | Oct 29 Sep 17 FOMC Minutes | n/a | 0 |