‘Tis skill, not strength, that governs a ship.” – Thomas Fuller

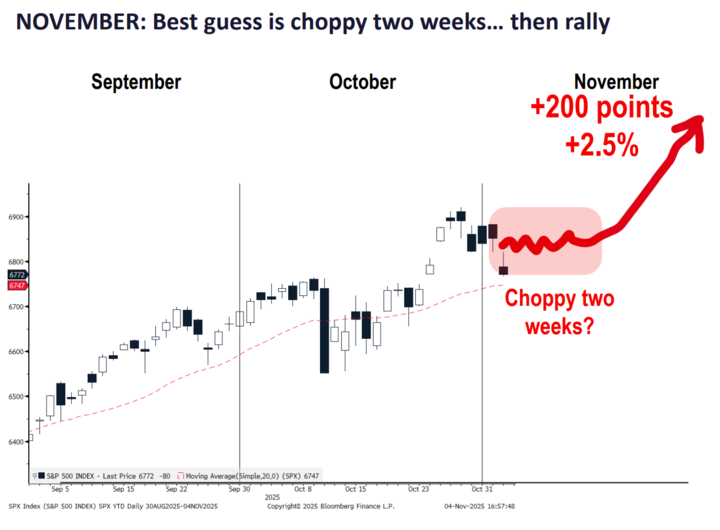

Chart of the Day

Good morning!

Centuries ago, Britain built a global empire on the strength of its naval supremacy. Today, despite the advent of jet planes and rockets and satellites, the U.S. and China are taking steps that reflect their growing awareness that the sea remains incredibly important, both for economic and geopolitical reasons.

Within President Trump’s multifaceted agenda, shipbuilding has become something of a priority. Trump is fond of noting – correctly – that the Chinese government’s support of its own shipbuilding and maritime industry has led to a massive expansion of its cargo-shipping and naval power in the last decade.

However, any suggestion that this has come at the expense of U.S. shipbuilding would be incorrect.

The last time the U.S. had a shipbuilding industry worth emulating was when clipper ships were regarded as cutting-edge technology. Even during World War II, the last time that U.S. shipbuilding was worth writing home about, the impressiveness of Liberty ship production speed masked U.S. inefficiency: although, the U.S. was able to throw far more warm bodies into wartime shipbuilding than the British, it still took Americans far more man-hours (and thus, more money) to build a cargo ship than the United Kingdom.

U.S. shipbuilding is in currently a sorry state (there is, alas, no gentler way to put it). Even by the most wildly charitable measures, its capacity is 1/20th that of China’s. Not only can we not build ships in any meaningful way, even the U.S. Navy struggles to keep its warships maintained and in operable condition, due to a dearth of skilled labor and inadequate shipyards that are too small and too obsolete.

It’s the latter that might be more problematic, arguably limiting U.S. shipbuilders to making smaller ships suitable only for transporting smaller cargo loads from one U.S. port to another.

The two largest shipyards in the U.S. (Huntington Ingalls Industries’ shipyard in Newport News, Va., and General Dynamics shipyard in Groton, Conn.) are reserved for large military vessels, and they are currently the only ones equipped to handle nuclear-submarine manufacturing. This bottleneck has caused a massive backlog in the U.S. Navy’s orders for Virginia-class and Columbia-class submarines, which puts a constraint on companies involved, such as Curtiss Wright and BWX Technologies.

That’s why Trump’s recent shipbuilding agreements with South Korea are so important.

Last December, South Korea’s Hanwha bought the Philly Shipyard. In August, the company announced that 10 cargo tankers out of a recent 12-ship order would be built there. Yet the two largest ships in the order would still need to be built in South Korea, because the Philadelphia facility and U.S. workers are not capable of such complex projects – at least not yet, even though Hanwha has pledged billions in investments to improve capabilities at the Philly Shipyard.

Change comes at a slow pace, we suppose.

On Oct. 29, Trump announced a preliminary agreement that could further facilitate those efforts: Trump agreed to let South Korea build nuclear-powered submarines for itself in Philadelphia. As nuclear submarines have never been built in the Philly Shipyard, this project is likely to add impetus and significantly facilitate the improvement of its facilities.

This is a win for South Korea, which has long desired to augment its diesel-powered subs with superior nuclear variants. Trump’s predecessors had hesitated to approve the sharing of the required nuclear technology with other countries, with few exceptions.

But it is also a win for the U.S.

Manufacturers of cargo ships and military vessels will benefit, and so too will manufacturers of the steel and components that go into both.

That’s not to say that the problem will then be solved. Ships are still likely to cost far more to build in the U.S. than elsewhere. But surely it’s better to regain the ability to engage in major shipbuilding in the U.S., even if more expensively, than to have it unavailable at any price.

Share your thoughts

Are you optimistic about the future of U.S. shipbuilding? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Can you recall a time when a sector grew without adding jobs?

A: How about agriculture for the last 100 years or so? All you have to do is drive through the mid-west and look at the remnants of whole communities that once were vibrant. The single family farmer had to invest in automation and pesticides to compete. Most had to sell out to the industrial food chain. What can be done now? The Prime Act could be a driver to restore small scale regenerative farming practices as well as restore the quality of the food produced on a more local level. The point is the loss of jobs from AI will only happen if we let it.

Catch up with FS Insight

Supercycles remain intact. With the wall of worries growing, risk/reward is still positive.

Technical

Despite yesterday’s U.S. equity index lows not holding, the undercut of this support does not turn the trend bearish. Technology has weakened this week, but has not broken down, and Technology ETFs like XLK and RSPT both are trending near the uptrend line support.

Crypto

Supply-adjusted coin days destroyed continues to trend higher, indicating distribution from older holders to newer investors. While this can pressure price action in the short term, it often precedes stronger bases for subsequent advances once selling pressure subsides.

News We’re Following

Breaking News

- Air traffic cut at some airports as government shutdown drags on CNN

Markets and economy

- Retailers’ holiday hiring to hit lowest level since the Great Recession, says major industry trade group CNBC

- Trump expands critical minerals list to copper, met coal, uranium REU

- China’s exports fall for first time since ‘liberation day’ trade tariffs FT

Business

- Tesla shareholders approve Elon Musk’s $1 trillion pay package WSJ

- Judge dismisses Boeing criminal case over 737 Max crashes at DOJ request despite skepticism CNBC

- UBS to liquidate funds with substantial First Brands exposure FT

- Meta is earning a fortune on a deluge of fraudulent ads, documents show REU

- Sam Altman says OpenAI will top $20 billion in annualized revenue this year, hundreds of billions by 2030 CNBC

Politics

- Senators closing in on key piece of shutdown deal POL

- Nancy Pelosi to retire from politics FT

- SNAP benefits must be fully paid by Trump administration by Friday, judge orders CNBC

Overseas

- China launches new aircraft carrier in naval race with the US BBC

- EU set to water down landmark AI act after Big Tech pressure FT

Of Interest

- The Florentine Diamond resurfaces after 100 years in hiding NYT

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/7 | 8:30 AM | Oct AHE m/m | 0.3 | 0.3 |

| 11/7 | 8:30 AM | Oct Unemployment Rate | 4.4 | 4.3 |

| 11/7 | 8:30 AM | Oct Non-farm Payrolls | -23 | 22 |

| 11/7 | 10:00 AM | Nov P Oct P UMich 1yr Inf Exp | 4.6 | 4.6 |

| 11/7 | 10:00 AM | Nov P Oct P UMich Sentiment | 53 | 53.6 |

| 11/7 | 11:00 AM | Oct Sep NYFed 1yr Inf Exp | n/a | 3.38 |

| 11/11 | 6:00 AM | Oct Sep Small Biz Optimisum | 98.2 | 98.8 |

| 11/13 | 8:30 AM | Oct Sep CPI m/m | 0.2 | 0.3 |

| 11/13 | 8:30 AM | Oct Sep Core CPI m/m | 0.3 | 0.2 |

| 11/13 | 8:30 AM | Oct Sep CPI y/y | 3.1 | 3 |

| 11/13 | 8:30 AM | Oct Sep Core CPI y/y | 3 | 3 |