“Contemplation seems to be about the only luxury that costs nothing.” ― Dodie Smith

Chart of the Day

Good morning!

For a long time, the bullish case for luxury goods relied largely on surging demand from a growing Chinese middle class eager to enjoy the finer things in life.

That’s not what we have seen lately.

China took a long time to emerge from its pandemic lockdown, and when it did, the Chinese economy didn’t blossom as expected. Instead it limped along, with consumer sentiment sinking amidst a real-estate crash and elevated levels of youth unemployment. President Trump starting a trade war with China this spring added even more weight on not just the Chinese economy, but also the financial worries of the average Chinese household.

For those looking for reasons to be constructive on luxury and travel companies, this week provided two significant arguments.

The first and most visible was the trade deal – a truce, at least – reached between Trump and Xi Jinping. While the U.S. got a pause on Chinese export controls on rare earths and an agreement to resume buying American soybeans, China will likely benefit from a reduction in certain tariffs and fees related to fentanyl-related products, cargo ships, and perhaps most importantly, a reprieve from Trump’s previous threat of far more onerous tariffs. The dispute is far from resolved, to be clear, but at least for now, it seems like everyone has some breathing room.

Less mentioned, but arguably just as important in this context, was a domestic policy change in China: an explicit goal of encouraging consumerism. On Tuesday, China’s Communist Party pledged to “significantly raise the household consumption rate” and make it a larger part of its economy over the next five years.

No further details were provided about how this objective would be measured or what concrete steps would be taken. As Larry Hu, chief China economist at Macquarie, told Bloomberg News, “It doesn’t mean that China will immediately launch meaningful consumption stimulus, but it shows that consumption’s status is rising in the longer term.”

This is hardly a new objective, of course. China has long known that the time was coming to exit its industrialization phase and transition to a more consumer-driven economy. (It didn’t help – at least not very much.)

Earlier in the year, it tried stimulating spending by subsidizing purchases of home appliances and consumer electronics. Economists have long viewed a consumer-driven economy as having a positive effect on living standards, incentives to innovate, and economic resilience, but in China, household consumption accounts for just 40% of Chinese GDP. (For reference, that figure is 67.9% for the U.S. and 51.9% for the EU as a whole.)

This would obviously lessen China’s reliance on exports and hence, its vulnerability to actual or threatened tariffs by the U.S. or anyone else perhaps makes China’s government more motivated to achieve this. After all, China’s goal of self reliance also includes relying less on export partners.

But is this necessarily good news for global luxury companies? They surely hope so, and likely do some on Wall Street. After all, the S&P Global Luxury Index (SPGLGUP) has notched rather lackluster performance of late, averaging 8.5% annually over the past five years and climbing 11% YTD, significantly below the S&P 500 benchmark in both timeframes.

But in the years since the Chinese lockdown ended, attitudes toward luxury have changed, and so too have tastes. In the highly coveted younger demographic, Chinese consumers have followed their U.S. and European counterparts in turning away from conspicuous consumption and status-seeking purchases, favoring experiences. Many of the global luxury brands have responded, revamping their stores to better integrate experiences such as special events, private lounges, and fine dining. At the very high end, this might be enough, given the continued appeal of the heritage and historical legacies of brands like Hermes and Louis Vuitton.

A more problematic change (from the point of view of European and American companies) has occurred at the so-called mass luxury level. Brands at this level cannot lean on heritage, and global brands such as those of Tapestry (Coach, Kate Spade, etc.) now find themselves contending with homegrown luxury brands like Songmont and Uma Wang. The Chinese brands are widely seen by the Chinese affluent as understanding Chinese tastes better, and they also benefit from guochao (国潮), a kind of trending/rising national pride in Chinese culture and aesthetics. Even in terms of everyday “nice things” and lifestyle brands, names like Nike and Starbucks no longer hold the same cache, with young adults visibly leaning toward Chinese chains like Anta Sports and Luckin, respectively.

For luxury companies, China’s importance as a market is unlikely to change. But while the window of opportunity might be re-opening, the extent to which it opens might not be as wide as it was before.

Share your thoughts

What are your thoughts on the prospects for global luxury companies? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Is 6G development a good use of Nvidia’s resources?

A: Yes, the success of 6G build out using NVDA chips and software solidifies AI applications and widen NVDA’s moat. NVDA is not just a semiconductor company, it is an AI revolutionary leader, enabler and a powerful venture capitalist. NVDA has gotten here today because of its strategic partnerships with OpenAI in 2016, Audi in 2010, Google in 2016, Mercedes Benz in 2017 and Microsoft in 2018, just to name a few.

Catch up with FS Insight

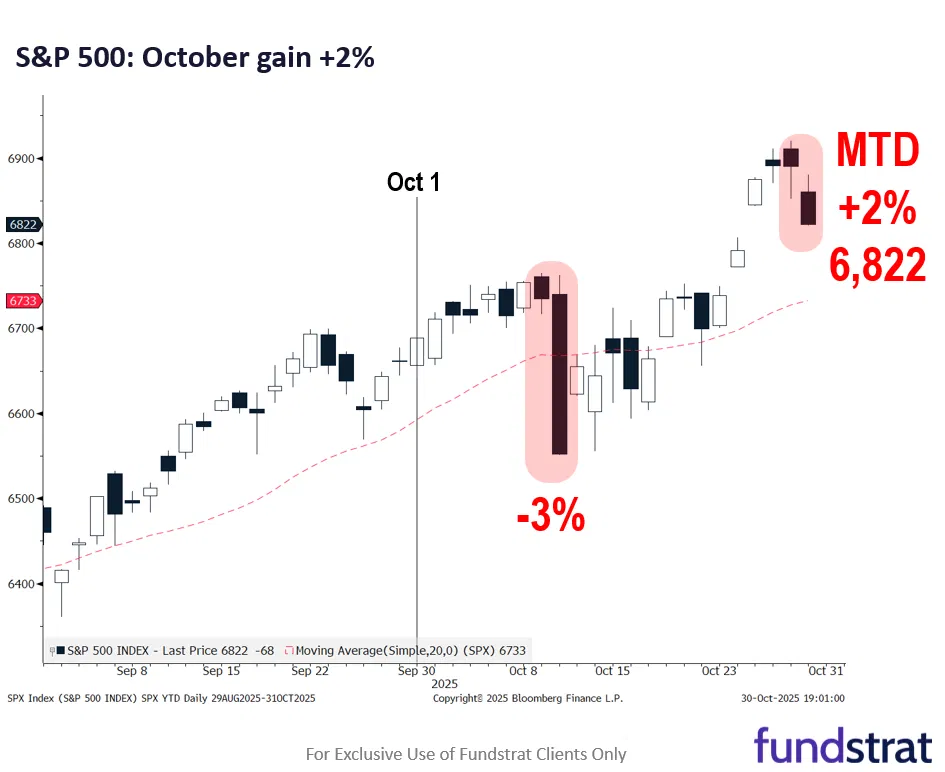

The S&P 500 is on track to close up 2% for October, so some understandable “chop” to digest those gains might be ahead. But we see multiple reasons for S&P 500 to gain in November.

Technical

Despite Thursday’s minor setback, I don’t think much can be made of yesterday’s selling pressure technically. My thinking is that AMZN’s strong results, along with a possible strong result out of AAPL, might help this market show further gains into early to mid-November before additional consolidation plays out.

Crypto

Crypto and equities both sold off yesterday, with digital assets showing an outsized reaction. However, the VIX, high-yield credit, and bond markets painted a more measured picture.

News We’re Following

Breaking News

- S&P 500 futures rise, bolstered by Apple, Amazon rally WSJ

Markets and economy

- JPMorgan tokenizes private-equity fund on its own blockchain WSJ

- ECB holds interest rates at 2% FT

- Federal Reserve to reduce bank supervision staff by 30% WSJ

- Mortgage rates jump 20 basis points following Fed cut CNBC

Business

- BlackRock stung by loans to business accused of ‘breathtaking’ fraud WSJ

- Amazon reports cloud computing unit grew faster than expected BBG

- Netflix announces a 10-for-1 stock split CNBC

- Coinbase stock rises after revenue climbs more than estimates BBG

Politics

- US judge skeptical Trump administration can legally suspend food benefits REU

- Surgeon General nominee Casey Means’ confirmation hearing delayed as she goes into labor POL

- Trump sets refugee ceiling at record-low 7,500 with focus on white South Africans REU

Overseas

- UN leaders condemn ‘horrifying’ mass killings in Sudan GUA

Of Interest

- Four feet higher and rising: Barcelona’s Sagrada Familia becomes world’s tallest church GUA

- Prince Andrew to be stripped of his royal title NYT

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/31 | 8:30 AM | Sep PCE m/m | 0.3 | 0.3 |

| 10/31 | 8:30 AM | Sep Core PCE m/m | 0.21 | 0.23 |

| 10/31 | 8:30 AM | Sep PCE y/y | 2.8 | 2.7 |

| 10/31 | 8:30 AM | Sep Core PCE y/y | 2.9 | 2.90511 |

| 10/31 | 8:30 AM | 3Q ECI QoQ | 0.9 | 0.9 |

| 11/3 | 9:45 AM | Oct F Oct S&P Manu PMI | n/a | 52.2 |

| 11/4 | 8:30 AM | Sep Aug Trade Balance | n/a | -78.311 |

| 11/4 | 10:00 AM | Sep JOLTS | n/a | 7227 |

| 11/4 | 10:00 AM | Sep F Sep P Durable Gds Orders | n/a | 2.9 |

| 11/5 | 9:45 AM | Oct F Sep F S&P Srvcs PMI | n/a | 55.2 |

| 11/5 | 10:00 AM | Oct Sep ISM Srvcs PMI | 51 | 50 |

| 11/6 | 8:30 AM | 3Q P Nonfarm Productivity | n/a | 3.3 |

| 11/6 | 8:30 AM | 3Q P Unit Labor Costs | n/a | 1 |