“Reality is merely an illusion, albeit a very persistent one.” – Albert Einstein

Chart of the Day

Good morning!

Technologies often have a democratizing effect. On Oct. 16, Federal Reserve Gov. Christopher Waller discussed this, comparing the impact of the Gutenberg printing press and the personal computer to AI. AI, Waller said, “will take power from ‘experts’ and shift it to ‘nonexperts.’ […] Tools that once required specialized training are already becoming accessible to a much wider range of people.”

In fact, this seems to be on the verge of happening already in creative industries such as music and movies. Streaming apps had started to change how artists were discovered. They made it possible for musicians like Chance the Rapper to build a following on Spotify, or video personalities like Awkwafina to become famous on Youtube. But that was just technology starting to weaken the monopoly on distribution that record labels and movie studios had.

Along came AI to accelerate this trend – rapidly. In 2023, a collaborative track purportedly featuring Drake and the Weeknd was released on Spotify, quickly going viral. Many fans happily but incorrectly believed that the artists in question had actually collaborated in real life before they were informed otherwise. Generative AI soon proved itself just as adept at generating video content – whether it was B-roll footage or deep fakes of known personalities. Youtube is already full of AI-generated fan-made films (or film trailers) featuring iconic characters – some of surprisingly high quality. And that was before OpenAI introduced Sora 2, its generative AI for video.

To be clear, we are not talking about using AI to enhance an artistic work, as the award-winning director of 2024’s The Brutalist employed it (AI was used to improve the accents in the Hungarian-language dialogue spoken by non-Hungiarian leads Adrian Brody and Felicity Jones). Instead, we are talking about using AI right from the start to make music and movies.

For a long time, ordinary people like you and me didn’t make music – we had people like Itzhak Perlman or Mariah Carey for that. But Perlman spent years honing his astounding violin technique, and few people are born with “Mimi’s” transcendent pipes.

Similarly, the first Toy Story film required 27 animators and a production team of around 110 people, working for almost three years (not including story development and scriptwriting). OpenAI is betting that AI can drastically improve on those stats. Partly to prove the usefulness of its technology, OpenAI will provide computing tools and resources to former employee Chad Nelson in hopes that he will need just nine months and 30 people to bring his story, Critterz, to screen. (And not just any screen – the current plan is to premiere the film at the Cannes Film Festival in spring 2026.) (A short proof-of-concept preview of the film is already available.)

Netflix is also about to go all in on AI. A Bloomberg story from July reported that Netflix would begin incorporating Runway AI software to generate video. Runway AI has signed a deal with Lionsgate (John Wick, Sicario, The Hunger Games, etc.) to use the latter’s content to train its model.

At first glance, it would seem that AI has the potential to dramatically lower costs for major entertainment companies, enabling them to produce more content with fewer employees and smaller investments, and in less time to boot. That would arguably be a tailwind for investors in companies like Disney (which is said to be experimenting with generative AI but denied plans to integrate it widely into its production process.)

But the longer trend might give entertainment conglomerates cause to worry. Back in the days before mass media, before the invention of television, radio, and the phonograph, middle-class families would gather around the living-room piano and make their own music. Or they would tell each other stories they had either made up from scratch or embellished. (That’s how iconic works of fiction like The Hobbit, Alice’s Adventures in Wonderland, and Little House on the Prairie came to be.)

Harvey Mason Jr., chief executive of the Recording Academy (the organization that presents the Grammy Awards) predicted that AI “will totally upend the creative process: everything from creating a drum loop or chord progression to making the entire track with lyrics and vocals.”

Why spend hours a day practicing scales or learning how to properly light a scene when all that truly matters is what your mind can conceive? As AI technology becomes increasingly more capable and more accessible to the masses, anyone will be able to create their own entertainments at the same level as the professionals currently do – in fact, that might be part of the fun.

That should worry the conglomerates that sell passively consumed entertainment.

Share your thoughts

Will AI someday negate the need for record labels and movie studios? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: What do you make of dabbling in meme stocks?

A: Playing devil’s advocate, meme stocks do present an intriguing opportunity. They appear to move in unpredictable patterns relative to the market, often surging when short sellers are most active.

Catch up with FS Insight

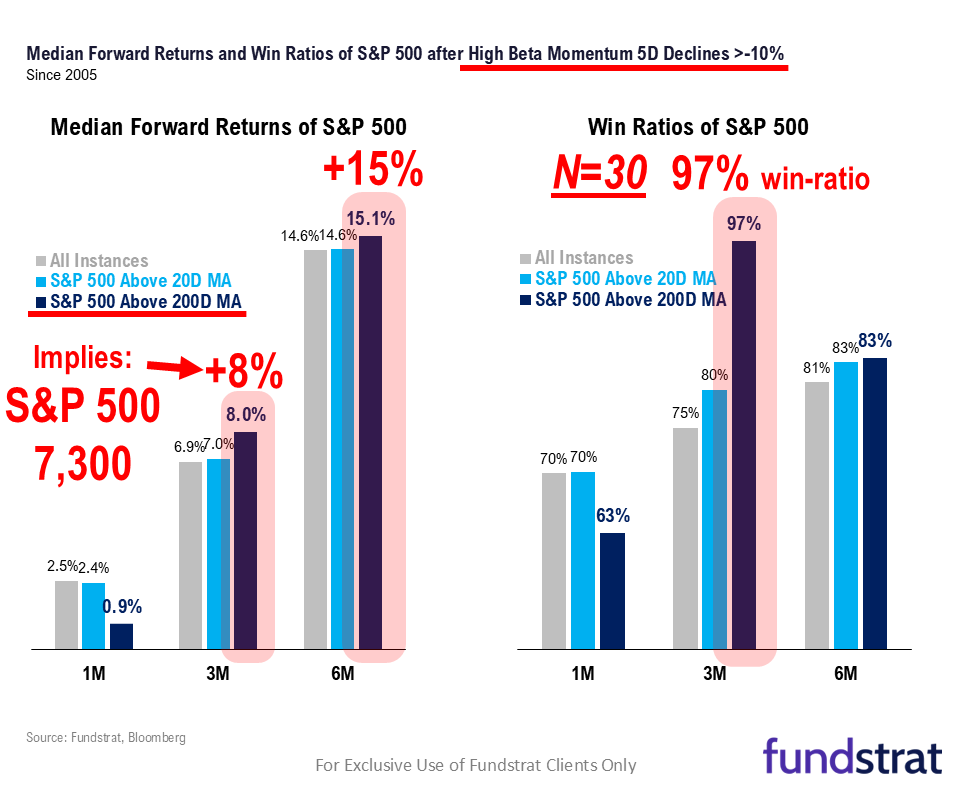

The collapse of high beta momentum in the past week is often a sign of a local low. Since 2005, a decline of more than -10% points to a 97% probability of gains into YE, particularly when S&P 500 is above the 200d moving avg.

Technical

Technology, Healthcare, Consumer Discretionary, and Utilities could be the sectors that lead in the weeks ahead. While the lack of relative strength from Financials is a temporary concern, I expect this to return in November.

Crypto

A bounce in yields alongside strong equity and crude performance signals a growth-positive environment supportive of a rotation into crypto.

News We’re Following

Breaking News

- U.S. Inflation Picked Up to 3% in September WSJ

- Trump Says He Is Terminating Trade Negotiations With Canada WSJ

Markets and economy

- Companies Have Shielded Buyers From Tariffs. But Not for Long. NYT

- Why everyone is trying to sell you private assets right now FT

- Social Security Administration announces 2026 COLA benefit increase of 2.8% — what it means for you CNBC

- The race to launch ever-riskier leveraged ETFs in the U.S. is heating up MW

Business

- Investors Love Intel Again. That Still Doesn’t Solve Its Problems. WSJ

- Google’s Quantum Computer Makes a Big Technical Leap NYT

- Target cuts 1,800 corporate jobs in its first major layoffs in a decade CNBC

- Microsoft Stock Has Barely Budged Since July. Earnings Are About to Change That. BR

Politics

- The Trump Supremacy FT

- Trump says tech bosses persuaded him not to deploy federal forces to San Francisco FT

Overseas

- A Tiny NATO Nation Is Cashing In on the Threat Next Door NYT

- India’s Most Valuable Export: Tens of Millions of Workers NYT

Of Interest

- Was a Sports Betting Scandal Inevitable? NYT

- Once seen as ‘inflation-proof,’ banana prices are up 5.4% since Trump announced tariffs in April CNBC

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/24 | 9:45 AM | Oct P S&P Manu PMI | 52 | 52 |

| 10/24 | 9:45 AM | Oct P S&P Srvcs PMI | 53.5 | 54.2 |

| 10/24 | 10:00 AM | Oct F UMich 1yr Inf Exp | 4.6 | 4.6 |

| 10/24 | 10:00 AM | Oct F UMich Sentiment | 54.5 | 55 |

| 10/27 | 8:30 AM | Sep P Durable Gds Orders | 0.3 | 2.9 |

| 10/28 | 9:00 AM | Aug Case Shiller 20-City m/m | n/a | -0.07 |

| 10/28 | 10:00 AM | Oct Conf Board Sentiment | 93.75 | 94.2 |

| 10/29 | 2:00 PM | Oct 29 FOMC Decision | 4 | 4.25 |

| 10/30 | 8:30 AM | 3Q A GDP QoQ | 3 | 3.8 |