“I’m never going to be good enough for you, am I?” — Elle Woods, Legally Blonde

Chart of the Day

Good morning!

When everything everywhere all at once is ripping higher, guess what’s missing? The answer is simply really: Financial vehicles that aim to win even bigger in this current rally. Very greedy.

The latest example for that came mid-October, when Volatility Shares, famous for its 2x leveraged corn, ether, solana, and more, filed paperwork to launch 27 highly leveraged ETFs. It also includes the first-ever proposal for a 5x leveraged ETF, which as the name suggests would seek to 5x the daily return of the underlying single stock.

The 5x proposal was made for crypto like bitcoin and solana and also volatile stocks like MicroStrategy, Tesla, Alphabet, AMD, Circle, and others.

It’s not clear if the filing will be approved by the SEC, especially as the shutdown continues to impact operations there. The most the agency has allowed for is 2x single-stock leverage. Logical thinking suggests that there might need to be a 3x approval, then 4x, before we jump to 5x. But sometimes logic is too slow, right?

Here’s the notable part for me: Even if the SEC comes down hard on these applications, the mere fact that they were filed for a market that has ballooned to become over $128 billion in size is a prime example of the animal spirits that are underpinning this year’s bull run.

As it stands, the number of leveraged equity ETFs are at a record high, hitting over 700 in October, according to Bank of America research. Consider also that about a third of the ETFs launched this year were leveraged, according to Bloomberg News.

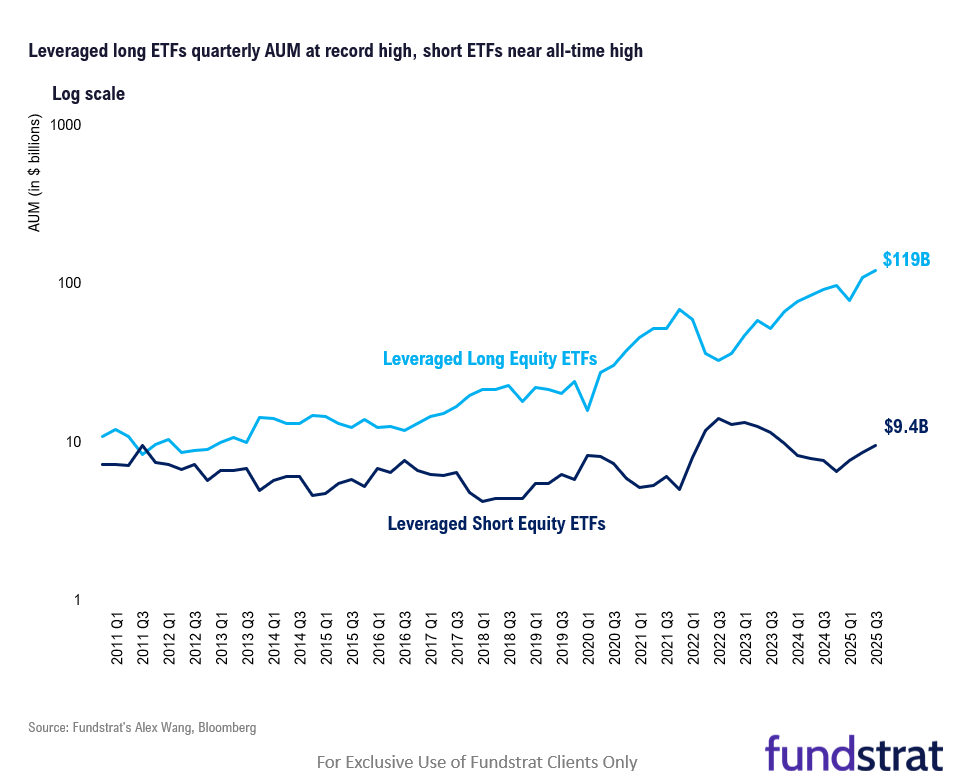

Our data team’s Alex Wang also pulled together some quarterly data on their assets under management, which for leveraged long ETFs are at records, as well. Leveraged short equity ETFs’ AUM is near all-time highs.

The increase in size and popularity shows just how fast this complex corner of the market has grown. The first leveraged single-stock ETF was only approved as recently as 2022, even though leveraged bets on broader indexes had existed for years prior.

Leveraged ETFs increase returns by using swaps or options strategy to meet their respective targets. “Degenerate” retail investors (no offense intended) love the prospect of greater returns, especially day traders. They know if they play their cards right, they could create generational wealth. So it goes without saying that 5x leveraged ETFs would be playing jump rope with that fine line between trading and gambling.

The only problem is that when the tide reverses, oh boy, can it pull you into the ocean. You don’t have to look deep to find all the examples where things went wrong. The resurgence of trade fears earlier in October sparked losses in the stock market. According to a report published by JPMorgan’s Americas equities derivatives strategy team, the sell-off was likely worsened by leveraged ETFs.

Right before that, a 3x leveraged fund bet against AMD (allowed in Europe) and went to zero. The investors were left with nothing after a massive rally in AMD shares due to its deal with OpenAI. Catastrophic.

Late last year, at least two 2x funds long MSTR posted “daily losses greater than three times the underlying stock, while posting gains of less than double,” according to a WSJ story.

And let’s not forget that time during the Covid-19 crash that the ProShares UltraPro QQQ lost over 70% in mere weeks.

If markets note volatility, cute products like leveraged ETFs are among the first ones to show signs of trouble. And then suddenly their iffy price performance is no longer worth the stomach pain.

But, hey, that doesn’t mean you can’t still use them in your market analysis. Flows or AUMs for these 5x products can serve as a contrarian signal of sorts, especially because the moves for volatile stocks are based on sentiment.

Share your thoughts

Do you think the SEC should approve these products? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: What do you make of the recent credit worries?

A: I wonder about the “real” cost of capital prior to adjusting for inflation, time, and risk, is the underlying real cost of money being misread. The demand for AI capital with the expected follow on of increased productively for expanding margins and growth, imply a step up in demand with a very long tail. As we build the discount rate for equities or the required interest rate on debt are we systemically underestimating the real required cost of capital. This issue feeds into how lose/restrictive fed policy really is, and the knock-on effect that implies.

Catch up with FS Insight

Sept Core CPI is reported this Friday. The first govt “macro report” since the shutdown started, which means investors will put a lot of weight on this. Polymarket sees 50% chance of headline CPI MoM of +0.4% and 39% of +0.3%. The +0.3% would be softer than consensus and those odds are rising.

Technical

Despite some minor warnings regarding breadth, high yield spread widening, and/or lack of broad-based participation, it looks like breakouts in AAPL GOOGL should help Technology show sufficient leadership to carry US stock indices over the next few weeks.

Crypto

Galaxy Digital reported a standout quarter with adjusted EPS of $1.12 vs. $0.30 expected, driven by record trading volumes, strong M&A activity, and treasury mandates from Digital Asset Treasury companies. GLXY continues to build a “two-headed monster” with both its scaling crypto business and expanding AI data center operation.

News We’re Following

Breaking News

- Vehicle Crashes Into Security Gate Outside the White House NYT

- Netflix misses big on profit, but remains firm that its growth will continue unabated MW

Markets and economy

- Beyond Meat shares surge for a third day in a row as meme traders jump on board CNBC

- Gold and related stocks are falling for a second day. The metal is off 8% from high CNBC

- One theory on why gold suffered its biggest one-day fall in more than ten years MW

- The fallout from the AI-fuelled dash for gas FT

- The Average Cost of a Family Health Insurance Plan Is Now $27,000 WSJ

Business

- Activist Robby Starbuck Sues Google Over Claims of False AI Info WSJ

- Crypto Trading Firm FalconX to Acquire ETF Manager 21shares WSJ

- Inside Oklo: the $20bn nuclear start-up without any revenue FT

Politics

- The U.S. Is Trying to Drive a Wedge Between Argentina and China WSJ

- Trump Nominee for Watchdog Role Is Out After Report of Racist Texts NYT

- Mamdani Is Promising a Cheaper New York. But Can He Afford to Pay for It? WSJ

- Trump Administration to Release Farm Aid Frozen by Shutdown WSJ

Overseas

- India to cut Russian oil purchases, U.S. to slash tariffs as they near trade deal: Indian media report CNBC

Of Interest

- Travis Kelce Teams Up With Investor for Activist Campaign at Six Flags WSJ

- Bird Flu Is Back NYT

- Steve Bannon and Meghan Markle among 800 public figures calling for AI ‘superintelligence’ ban FT

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/23 | 10:00 AM | Sep Existing Home Sales | 4.06 | 4 |

| 10/23 | 10:00 AM | Sep Existing Home Sales m/m | 1.5 | -0.25 |

| 10/24 | 8:30 AM | Sep CPI m/m | 0.4 | 0.4 |

| 10/24 | 8:30 AM | Sep Core CPI m/m | 0.3 | 0.3 |

| 10/24 | 8:30 AM | Sep CPI y/y | 3.1 | 2.9 |

| 10/24 | 8:30 AM | Sep Core CPI y/y | 3.1 | 3.1 |

| 10/24 | 9:45 AM | Oct P Sep F S&P Srvcs PMI | 53.5 | 54.2 |

| 10/24 | 9:45 AM | Oct P Oct S&P Manu PMI | 51.9 | 52 |

| 10/24 | 10:00 AM | Oct F Oct P UMich 1yr Inf Exp | 4.6 | 4.6 |

| 10/24 | 10:00 AM | Oct F Oct P UMich Sentiment | 54.6 | 55 |

| 10/24 | 10:00 AM | Sep New Home Sales | 708.5 | 800 |

| 10/24 | 10:00 AM | Sep New Home Sales m/m | -11.4 | 20.5 |

| 10/27 | 8:30 AM | Sep P Durable Gds Orders | -0.1 | 2.9 |

| 10/28 | 9:00 AM | Aug Case Shiller 20-City m/m | n/a | -0.07 |

| 10/28 | 10:00 AM | Oct Conf Board Sentiment | 93.75 | 94.2 |