“All who gain power are afraid to lose it.” — Emperor Palpatine, Star Wars

Chart of the Day

Good morning!

Small caps are somewhat like gold. Those who care for them are called whackos until they go on a tear. Then suddenly everyone is regretting not buying in earlier when the headlines on CNBC flash “Russell 2000 At All-Time Highs.”

I reckon that’s precisely the macro environment we’re in right now. Few sang praises of the unloved Russell 2000’s persistent climb since the Liberation Day market low. It has gained 40% since then and has outperformed the S&P 500’s 33% advance over the same duration.

But it wasn’t until recently that small caps gangbuster’s performance started garnering some respect. Freaking finally.

This week, in particular, the Russell 2000 has gained 3%, on course for the largest percentage gain in about a year. The index has hit all-time highs four times in October, the highest number since January 2021.

The rally has been led by stocks in the technology, industrials, and utilities sectors, propelled higher by the same artificial-intelligence wave that has carried tech behemoths like Nvidia, AMD, and Oracle.

Credo Technology shares have jumped 287% since April 8, with the maker of electric cables benefiting from the current data center buildout. Bloom Energy shares have rallied 576% over the same period. Its fuel cells can turn natural gas or hydrogen into electricity, which is in high demand right now to help power AI data centers. Nuclear play Oklo’s shares have climbed 700%, lifted higher by the same enthusiasm.

As you can see, the AI enthusiasm is bursting out of the large-cap legacy stocks and pouring into even the smaller companies, indicating that the third year of the bull market remains strong.

What’s driving the furious gains for small caps this week? Well, it helps that Federal Reserve Chair Jerome Powell signaled in a speech earlier this week that the board could cut interest rates at the end of the month. But it’s not that simple.

I think the gains might have more to do with Powell signaling that the economy’s still holding up and hasn’t tumbled yet, which means whatever rate cuts we do end up getting will come in an economy that hasn’t weakened to a concerning point yet. That gave investors confidence, which is good news for riskier areas of the market like small caps.

I bet I know what you’re thinking: Who’s to say that small caps don’t revert back to their typical pattern of ripping and then limping?

Our Head of Technical Strategy Mark Newton said during our weekly huddle that small caps are in the midst of a “very nice longer-term break out” from a four-year long downtrend.

“It’s right to be long small caps,” he said. “It’s right to be overweight small caps versus large caps.”

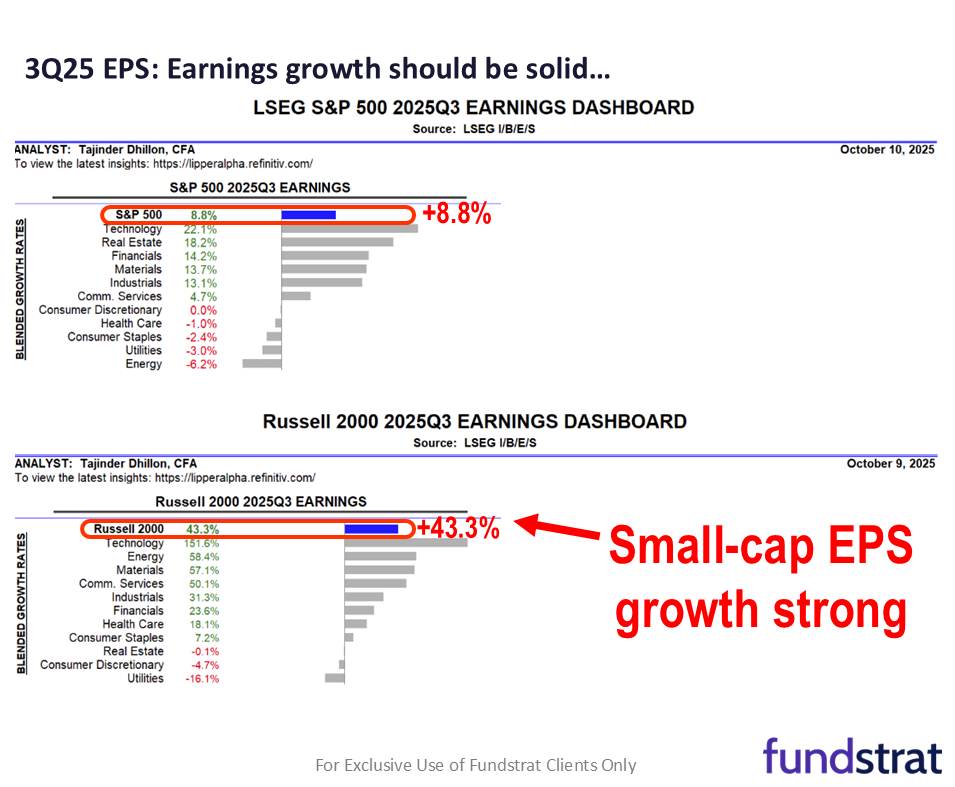

Earnings for small caps in the third quarter are also supposed to come in way stronger than that for the S&P 500. Every investor likes to see robust earnings back up all-time highs for stocks or indexes.

As a fun fact, IPO additions to the Russell 2000 in the third quarter hit the highest level since 2022.

Share your thoughts

Do you think this is finally a small-cap rally we can trust? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Is the circular nature of cross-company stakeholding and partnerships in Silicon Valley making you reassess your portfolio weightings?

A: Yes, most definitely. I have owned the Mag 7 for years. Same for crypto (Bitcoin, Ether, Solana, Avalanche and HYPD). In addition, I’m a director of a publicly traded AI company. I have options at $3 and the stock is in the mid 80s. I wish I could just freeze everything at today’s values. Selling would create massive capital gains.

Catch up with FS Insight

The S&P 500 is up 1.17% so far this week and down 0.9% for the month. Not bad. But the level of “apprehension” for equities has risen as the VIX now sits at 25, the highest levels since the tariff days of April to May 2025. So markets are worried.

Technical

The weakness in the US Dollar index directly coincided with Treasury yields also breaking down on Thursday, which proved to be far more consequential than anything that happened in Equity indices.

Crypto

These pressures are likely temporary, as the “volatility controllers,” namely the Fed and Treasury, have the tools and incentive to intervene if credit or liquidity conditions deteriorate further.

News We’re Following

Breaking News

- Trump Treasury Sec. Bessent to speak with Chinese trade counterpart on Friday CNBC

- Exclusive: Micron to exit server chips business in China after ban, sources say RT

Markets and economy

- The Auto Industry Is Panicking About Another Potential Chip Shortage WSJ

- Small businesses are being crushed by Trump’s tariffs and economists say it’s a warning for the economy CNBC

- Official data dramatically underestimates hedge funds’ involvement in the Treasury market, Fed paper finds MW

- Zions’ $50 Million Loan Loss Sent the Market Spiraling. The Stock’s Selloff Was ‘Overdone.’ BR

Business

- Walmart, Once a Byword for Low Pay, Becomes a Case Study in How to Treat Workers WSJ

- Oracle Isn’t Answering the Hardest Questions About Its AI Plans WSJ

- Apple, Caught Between U.S. and China, Pledges Investment in Both NYT

Politics

- 7 Takeaways From the First N.Y.C. Mayoral Debate NYT

- Trump Says He Will Meet With Putin in Budapest to Discuss End to Ukraine War WSJ

- Donald Trump’s former national security adviser John Bolton indicted FT

Overseas

- Venezuela Mobilizes Troops and Militias as U.S. Military Looms Offshore WSJ

- Trump Organization Expands in India, Where Many of Its Partners Face Accusations WSJ

Of Interest

- New Yorkers Are Losing Their Favorite Bathroom: REI WSJ

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/17 | 8:30 AM | Sep Import Price m/m | 0.1 | 0.3 |

| 10/17 | 4:00 PM | Aug Net TIC Flows | n/a | 2.078 |

| 10/23 | 10:00 AM | Sep Existing Home Sales | 4.06 | 4 |

| 10/23 | 10:00 AM | Sep Existing Home Sales m/m | 1.5 | -0.25 |