“I think social media has taken over for our generation. It’s a big part of our lives, and it’s kind of sad.” – Kendall Jenner

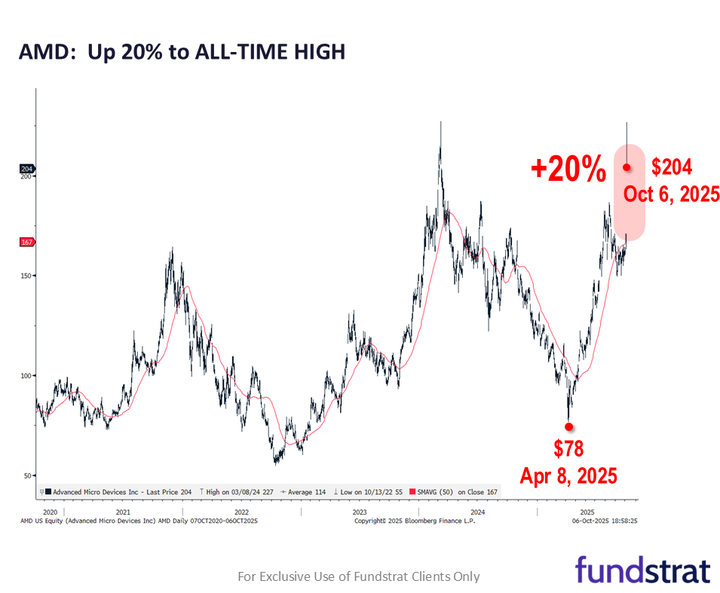

Chart of the Day

Good morning!

There’s been a well-documented trend in recent months of younger people becoming fascinated with older, retro technologies. Witness pop stars like Taylor Swift and Bad Bunny increasingly releasing new albums not just on streaming and digital formats, but also CD and vinyl. (Swift, for reasons that escape us entirely, also opted to release her album on cassette tape.) Zoomers are also increasingly seeking out “dumb phones”, paper books, and purpose-built digital cameras (or even film cameras) in an effort to “detox” from their smartphones and screens, at least some of the time.

This disenchantment with “new” technology might be spreading to the usage of social media.

As reported by the Financial Times, “time spent on social media peaked in 2022 and has since gone into steady decline, according to an analysis of the online habits of 250,000 adults in more than 50 countries.” The data also suggests that of those still active on social media, the share of those who use it to be “social” – to stay in touch with friends or make new friends – has fallen as well. (The U.S. is bucking the trend for now, but given the aforementioned effort to detox from screens and smartphones, it’s unlikely to continue doing so.)

That has implications for several industries. Obviously, social media companies make money by selling ads, so if users start spending less time on social media, then ads on such platforms will start to be worth less to advertisers, and businesses will look for other ways to reach prospective customers. This might be positive for streamers’ and traditional media outlets’ ad revenues, however. Hey, someone’s got to fill the gap.

Furthermore, if human beings stop getting their social “fix” through social media, they’re going to need to fulfill their innate need for social interaction elsewhere – maybe old-school, in-person ways like meeting up in person (how retro!) – at concerts, movie theaters, malls, and restaurants/bars. Companies in those industries might be positioned to benefit, if so.

Perhaps less obviously, the financial sector could be impacted if social-media usage declines significantly – and not just due to the movements of stocks in the industries mentioned above.

We’re talking about meme stocks.

Consider that meme stocks are only possible because retail traders like to hype up shares of the most random companies and amplify their bets via the social media medium. So if social media use declines sufficiently, this could plausibly result in less-intense fervor for any meme stocks that emerge in the future.

It’s true that historically, even highly volatile moves in meme-stocks have not had a significant or lasting impact on the stock market in general – despite the headlines. However, those headlines have arguably driven greater interest in investing in general, leading to a boom in retail investing that we’re still seeing to this day. Many credit the initial wave of meme-stock mania for a surge in new brokerage accounts being opened and dramatic revenue increases for trading platforms like Robinhood and the firms to which Robinhood turned for trade execution. (Robinhood apparently views social media and meme stocks as important enough for its business model to warrant the creation of its own social media platform.)

As much as people might gripe about “those darn kids” staring at their social media feeds, it’s reasonable to ask what might happen if they stop and look up.

Share your thoughts

What are your thoughts about the (possible) slowdown in social-media usage? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Do you think the trend toward smaller homes is being driven by financial considerations, or shifting personal preferences?

A: The millennials seem to value experiences over possessions. With all of the current pressures on costs, I think the trend for smaller homes on smaller lots continues.

Catch up with FS Insight

Prediction markets are showing a 96% probability that the shutdown lasts beyond 9 days. While at first glance, this might sound like bad news, we know government shutdowns do not tend to have lasting equity market impacts. But the reaction from the Fed would be different — and in our view, this would likely be dovish.

Technical

Near-term and intermediate-term technical trends remain bullish for U.S. equities, but a few sectors have started to weaken lately, making it right to be more vigilant.

Crypto

We view recent crypto weakness as part of a broader risk-off driven by AI margin concerns, rather than crypto-specific factors or changes in Fed expectations. Bitcoin miners such as WULF, CIFR, IREN, HIVE, BITF, and GLXY outperformed, highlighting power-cost sensitivity in AI infrastructure and the leverage of energy-efficient compute providers.

News We’re Following

Breaking News

- Gaza ceasefire and hostage releases ‘within days’ after Israel and Hamas agree first phase of deal BBC

- László Krasznahorkai wins Nobel Prize in Literature WSJ

Markets and economy

- Fed officials were cautious about inflation as they agreed rate cuts FT

- China expands rare earth export restrictions ahead of possible Trump-Xi meeting CNBC

- Global economy performing ‘better than feared,’ IMF chief says SEM

- Strikes worsen shipping congestion at Europe’s two biggest ports BBG

Business

- Regulators are investigating MassMutual’s accounting practices WSJ

- First Brands creditor claims as much as $2.3bn has ‘simply vanished’ FT

- Ferrari reveals Elettrica but dials down 2030 electrification goals REU

Politics

- Ex-FBI director James Comey pleads not guilty to federal charges BBC

- Senate fails for the sixth time to pass a government funding bill POL

- Trump calls to jail Illinois Governor Pritzker, Chicago Mayor Johnson WSJ

Overseas

- Macron will nominate new French prime minister in 48 hours BBC

- China’s Golden Week’ travel boom masks a bruising price war CNBC

Of Interest

- Florida man charged with intentionally setting Pacific Palisades fire in LA CNBC

- 30 Bob Ross original paintings will be auctioned off QZ

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crypto | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodities and Others | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Treasuries | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/10 | 10AM | Oct P UMich 1yr Inf Exp | 4.7 | 4.7 |

| 10/10 | 10AM | Oct P UMich Sentiment | 54.0 | 55.1 |

| 10/14 | 6AM | Sep Small Biz Optimisum | n/a | 100.8 |

| 10/15 | 8:30AM | Sep CPI m/m | 0.4 | 0.4 |

| 10/15 | 8:30AM | Sep Core CPI m/m | 0.3 | 0.3 |

| 10/15 | 8:30AM | Sep CPI y/y | 3.1 | 2.9 |

| 10/15 | 8:30AM | Sep Core CPI y/y | 3.1 | 3.1 |