“There are people who drive luxury cars, but have only second- or third-rate sofas in their homes. I put little trust in such people.” — Haruki Murakami

Chart of the Day

Good morning!

Back in the day, MTV’s long-running show “Cribs” featured celebrities taking viewers on tours of their ginormous, amenity-laden, resort-like mansions. For regular folks who viewed the show as aspirational, we have some bad news: homes for normal people are getting smaller. For economists, the more important implication is that they are probably not going to spend as much on stuff to fill their homes.

Smaller homes are not exactly a new trend. Over the past decade, the median size of newly built single-family homes has declined roughly 12% (2,467 square feet down to 2,150). It’s not just the houses that have gotten smaller — so have the yards on which they’re built – two thirds of new homes are now built on lots smaller than 1/5 of an acre. Both trends are partly a function of a declining amount of land available for development. With many cities and communities implementing strict zoning laws about where new homes can be built, land and space are becoming more expensive.

These trends are also a function of changing preferences. It might have looked amazing when Snoop Dogg showed off his private full-sized basketball court or Wayne Newton showed us the swimming pool he’d had built for his horses, but more and more purchasers of even modestly large homes are finding that they do not need or want as much space as they’d expected, leading to an increasing number of bedrooms going unused, for instance.

Maybe that’s not so great for the economy, even if it does seem like building smaller homes on smaller lots will mean more affordable housing at a time when it’s very much needed. For decades, U.S. policymakers have encouraged home ownership in part because this stimulates consumer spending. As those readers who own their homes are surely well aware, even excluding mortgages, property taxes, utilities, and maintenance, owning a home is associated with many other expenditures, from furniture and home appliances to fixtures and fittings.

To put it simply, a June 2025 Federal Reserve study found that “home purchases lead to sizable increases in home-related spending.” Recent home purchasers can expect to boost the economy through purchases of appliances, furniture, and other durable goods. That’s particularly true for first-time home buyers: the well-loved IKEA couch that seemed so comfy in one’s rental apartment tends to start looking a bit shabby when one finally achieves the “American Dream.”

More importantly, that same study found that home ownership, even long after closing, is associated with increased spending in general as well. Even after adjusting for household income, existing/staying homeowners continue to spend more than renters – not just on home-related spending, but overall. Regardless of whether that’s because home ownership helps build wealth or for some other reason, the effect seems clear. So in other words, boosting the rate of homeownership can help boost the economy – and not just immediately after the purchase.

Here’s the thing: Owners of smaller homes naturally tend to buy less stuff than owners of more spacious ones. A smaller lot means you might decide not to buy that fancy riding mower and push the stupid thing yourself (sorry). Fewer bedrooms means you need to buy fewer beds. Owning a more modest home without a man-cave means you don’t need that extra TV or sofa.

The expected boost to consumer spending from home purchases might shrink even more as the White House’s tariffs on lumber, steel, and furniture take effect in the coming months. The National Association of Home Builders claimed that “these new tariffs will create additional headwinds for an already challenged housing market by further raising construction and renovation costs,” as the import duties force Americans to pay more for home-related items like kitchen cabinets, dishwashers, hardwood floors, and bathroom vanities.

Making affordable housing more widely available still seems like good policy. But for multiple reasons, the resulting boost to the economy might be on the decline.

Share your thoughts

Do you think the trend toward smaller homes is being driven by financial considerations, or shifting personal preferences? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Are you suffering from [government]-data withdrawal symptoms?

A: Absolutely not because I don’t trust the numbers anymore. President Trump wants the numbers to reflect a situation that will force lower interest rates on the Fed. It’s like going to the doctor and having him tell you your blood pressure is perfect, when it’s really very high. You feel great but the silent killer continues until something bad happens and then you end up a patient again.

Catch up with FS Insight

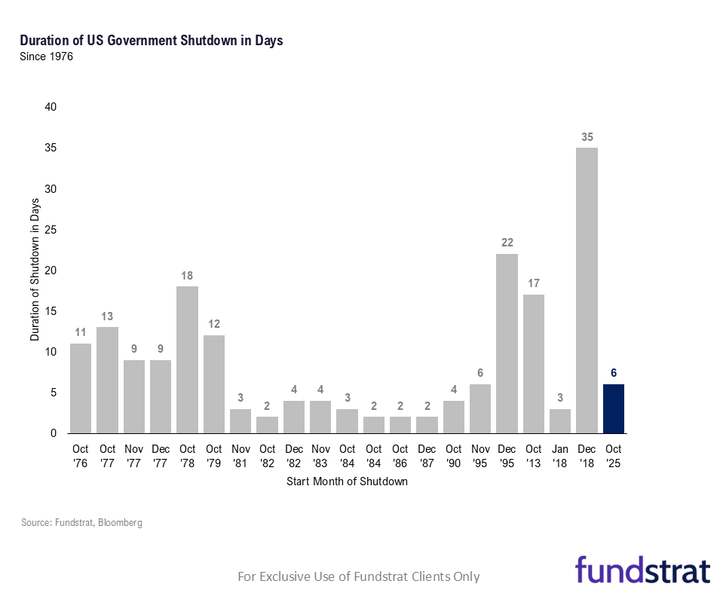

Prediction markets are showing a 96% probability that the shutdown lasts beyond 9 days. While at first glance, this might sound like bad news, we know government shutdowns do not tend to have lasting equity market impacts. But the reaction from the Fed would be different — and in our view, this would likely be dovish.

Technical

Overall, I do not make much of yesterday’s decline, as weekly lows along with the ongoing uptrend from both late September and the intermediate-term uptrend from April were not violated. For now, I still view trends as having a good likelihood of pushing higher this week.

Crypto

We view yesterday’s crypto weakness as part of a broader risk-off driven by AI margin concerns, rather than crypto-specific factors or changes in Fed expectations. Bitcoin miners such as WULF, CIFR, IREN, HIVE, BITF, and GLXY outperformed, highlighting power-cost sensitivity in AI infrastructure and the leverage of energy-efficient compute providers.

News We’re Following

Breaking News

- Chemistry Nobel Prize awarded for advances tackling carbon and ‘forever chemicals’ FT

Markets and economy

- Gold prices top $4,000 for first time WSJ

- Consumers are more worried about the labor market and inflation: NY Fed BAR

- WTO hikes global trade forecast for 2025 — but next year doesn’t look so good CNBC

- Recession warning seen in demand for cardboard boxes QZ

Business

- Tesla offers cheaper versions of 2 electric vehicles in bid to win back market share in tough year AP

- US may revoke $1.1 billion in auto plant funding for Stellantis, GM REU

- Verizon signs deal with AST SpaceMobile to provide cellular service from space CNBC

- Airbus A320 flies past Boeing 737 as most-delivered jet in history REU

Politics

- AG Bondi stonewalls question about Trump mentions in Epstein files at Senate hearing CNBC

- Staffing shortages cause more US flight delays as government shutdown reaches seventh day AP

- Congress erupts over Trump’s shutdown back-pay threat AX

- Trump’s wind energy assault stings red states WSJ

Overseas

- Myanmar military paraglider bombs Buddhist festival, killing dozens NYT

- Donald Trump and Brazil’s Lula appear to mend fences after call SEM

- Protesters attack car carrying Ecuador president SEM

Of Interest

- Renewables overtake coal as world’s primary source of electricity SEM

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/8 | 2:00 PM | Sep 17 FOMC Minutes | n/a | 1 |

| 10/10 | 10:00 AM | Oct P UMich 1yr Inf Exp | 4.7 | 4.7 |

| 10/10 | 10:00 AM | Oct P UMich Sentiment | 54 | 55.1 |

| 10/14 | 6:00 AM | Sep Small Biz Optimisum | n/a | 100.8 |