“In God we trust. All others must bring data.” — W. Edwards Deming

Chart of the Day

Good morning!

Can you really make reliable takes about the economy if you don’t have much fresh data to go off?

My guess is not — and that’s concerning. We strategists, investors, and economists are literally flying by the seat of our pants. Like that one scene from Mission Impossible where Tom Cruise is holding onto a flying jet with his bare hands.

Thanks to the shutdown, we didn’t get our typical nonfarm payrolls report last Friday. No problem, said some investors, because it’s just for a little while (one hopes) and that there are some other alternative sources we can use to form a mosaic.

Well, as it turns out, even that mosaic will be hard to create in the shutdown. The latest reason for why I believe that is because the Conference Board had to delay its Monday release of the September employment trends index report.

The not-for-profit research organization, which releases data on everything from employment to confidence, plans to resume publication once updated U.S. federal government data is released.

Timely and reliable reporting from the Bureau of Labor Statistics influences and supports many alternative reports, which in turn moves trillions of dollars all over the world. That’s why I believe private data will never be a substitute for public data. Just last week ADP’s private-sector employment report showed a huge decline in jobs because it is benchmarked against the government data set.

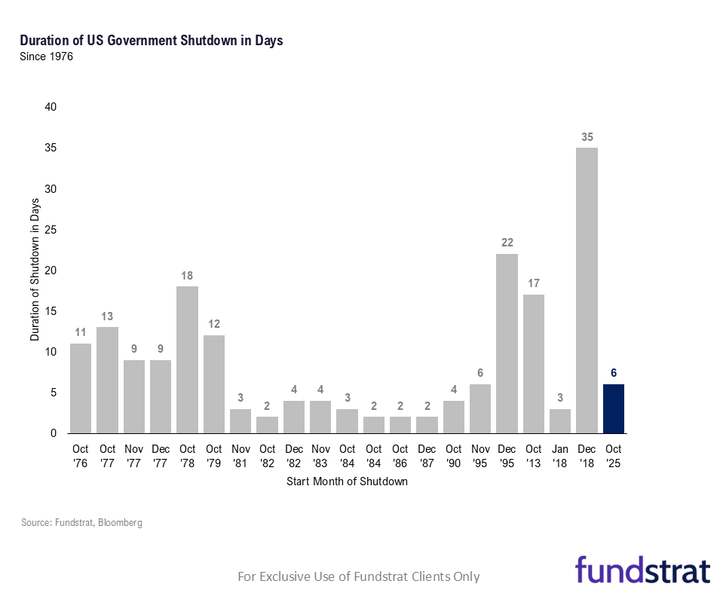

I’ve argued in recent days that though shutdowns are typically not a cause of concern for markets, this time it could be different.

The economy is in a precarious position. And we didn’t know that for sure until the BLS in early September reported that the economy added 911,000 fewer jobs than expected over the 12-month long period ending in March. That completely changed the way I and many other strategists were looking at the economy, so now we’re all desperate to know how it’s faring.

Stocks eked out a gain Friday and rallied Monday like it’s no big deal. I suppose that when reports of doom and gloom are out of sight, they’re out of mind. Plus — and to be clear, a big plus — it helps when OpenAI announces a stake in AMD. Shares of AMD finished up 23% on Monday.

As an example of an outlier labor markets-focused report that did come out last week, data compiled by the Chicago Federal Reserve showed that new hirings in 2025 are on pace for the lowest level since 2009. That’s again going to add pressure on the Fed to cut interest rates during their late October meeting.

Share your thoughts

Are you suffering from data-withdrawal symptoms? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Do the First Brands and Tricolor collapses make you more wary about private-market investments?

A: One should be cautious in the first place about private equity as part of an investment strategy. A major reason for staying private as opposed to going public is avoidance of the rigorous financial scrutiny and responsibility that comes with being a public company.

Catch up with FS Insight

The fact that AMD surged 20% is a good sign and shows the AI trade remains intact. The fundamental story of AI remains a U.S.-centric tailwind and offsets the uncertainty associated with the U.S. government shutdown.

Technical

Yesterday’s AMD news certainly took the spotlight, helping both SPX and QQQ push higher while the broader market was fractionally weaker on Monday. I still view trends as having a good likelihood of pushing higher this week, but expect that should find resistance near 6790.

Crypto

Bitcoin ETFs saw $2.5B in trailing 7-day inflows, ETH added $800M, and stablecoin market cap grew by $5B, underscoring sustained spot demand and capital rotation into crypto.

News We’re Following

Breaking News

- Nobel Prize in physics awarded to three scientists for work on quantum mechanics GUA

Markets and economy

- NYSE-owner Intercontinental Exchange rises on report of $2 billion Polymarket stake NYSE

- Amazon’s Prime event is a test of holiday shopping demand BAR

- U.S. to take 10% stake in Trilogy Metals (TMQ), approves Alaska Road BBG

- Donald Trump and Canadian Prime Minister Mark Carney to meet for trade talks SEM

Business

- AppLovin stock tanks on report SEC is investigating company over data-collection practices CNBC

- US Supreme Court allows order forcing Google to make app store reforms REU

- BNY explores tokenized deposits as blockchain payments catch on BBG

- A devastating fire at a major Ford supplier will disrupt business for months WSJ

Politics

- Donald Trump threatens to invoke the Insurrection Act to deploy troops FT

- Judges appointed by Trump keep ruling against him. He’s not happy about it POL

- Trump open to healthcare talks with Democrats amid shutdown WSJ

- Supreme Court rejects appeal from Ghislaine Maxwell, longtime Epstein associate NYT

Overseas

- International Criminal Court convicts Sudanese militia leader of war crimes WSJ

- Turkey’s Halkbank faces criminal charges after US Supreme Court rejects appeal FT

- New Zealand central bank creates board to manage financial stability issues WSJ

Of Interest

- Europe’s new biometric border checks: what do non-EU travellers need to know? | European Union holidays GUA

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/7 | 8:30 AM | Aug Trade Balance | -61 | -78.311 |

| 10/7 | 11:00 AM | Sep NYFed 1yr Inf Exp | n/a | 3.2 |

| 10/8 | 2:00 PM | Sep 17 FOMC Minutes | n/a | 0 |

| 10/10 | 10:00 AM | Oct P UMich 1yr Inf Exp | 4.7 | 4.7 |

| 10/10 | 10:00 AM | Oct P UMich Sentiment | 54 | 55.1 |