“A lack of transparency results in distrust and a deep sense of insecurity.” – Dalai Lama

Chart of the Day

Good morning!

The bankruptcy of privately held First Brands, an Ohio-based supplier of after-market automotive parts, adds to troubling concerns about the auto industry and health of the U.S. consumer raised by the Sept. 11 collapse of Tricolor. In a corporate crisis that emerged relatively quickly, First Brands on Sunday disclosed upwards of $10 billion in liabilities, far more than the $5.9 billion it disclosed in March before questions emerged about its use of off-balance-sheet accounting.

Currently, much of First Brands problems are believed to have stemmed from its spate of highly leveraged acquisitions, coupled with its extensive and aggressive use of factoring and other forms of supply chain financing. Such practices can improve cash flow but mask a company’s financial liabilities. For now, the company remains in operation, thanks to $1.1 billion in debtor-in-possession financing from its first-lien lenders.

The emerging scandal around First Brands follows the crumbling of Tricolor last month, a car dealer and point-of-purchase originator of sub-prime auto loans. The company had boasted of using an innovative AI model to mitigate the heightened risks associated with lending to its target market of recent immigrants (many undocumented) with little or no credit history and sometimes not even a Social Security number, but it filed for bankruptcy amidst allegations of fraudulent practices such as the purported double-pledging of collateral in auto-loan securities.

The two events might seem similar solely by coincidence and to the casual observer, perhaps merely isolated events. Both spark suspicions of accounting irregularities, and major financial firms are among those that reportedly have exposure to both events: Jefferies and UBS to First Brands, and JPMorgan, Fifth Third, and Barclays to Tricolor.

The two might cancel each other out when looking solely at prices for both used cars and auto parts (which as followers of our work know, have been some of the stickier components of inflation helping to keep the metric higher than the 2% target desired by the Federal Reserve). On the one hand, a decline in available financing could place downward pressure on used-car prices (though industry experts anticipate used-car price volatility in the near term). Yet, if the supply chain for auto parts is disrupted, prices for parts could drive up the cost of used-car ownership, as such vehicles tend to require more repairs and maintenance.

Importantly, both Tricolor and First Brands also highlight the risks associated with private credit, and private markets, which proponents – including the White House – have been moving to offer to everyday investors through retirement accounts. Nick Moakes, who oversaw an endowment of roughly $34.8 billion as then-chief investment officer for the Wellcome Trust, warned readers of the Financial Times at the beginning of 2025 that the private credit world likely had a number of “accidents waiting to happen” this year.

As we have previously highlighted, many critics note that due diligence for such investments remains simultaneously difficult and relatively more important. As the IMF noted, “Valuation is infrequent, credit quality isn’t always clear or easy to assess, and it’s hard to understand how systemic risks may be building given the less than clear interconnections between private credit funds, private equity firms, commercial banks, and investors.” Yet right up until the two companies collapsed, major financial institutions, even with their sophisticated due-diligence and operational risk controls, viewed both as presenting acceptable risk-reward

To us, First Brands and Tricolor present troubling signals about what might happen if private-market investments become widely integrated into Americans’ retirement accounts.

Share your thoughts

Do the First Brands and Tricolor collapses make you more wary about private-market investments? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: What are some other indicators you’re noticing that suggest the economy is on solid footing?

A: I look at truck traffic on the main interstate highways that run through Illinois. Just about everything from the east headed west and vice versa goes through the state. North and south too. The giant retailers from the south and Amazon warehouses ship through the state. They are everywhere. And I still see people eating out like normal. So I think it’s pretty solid.

Catch up with FS Insight

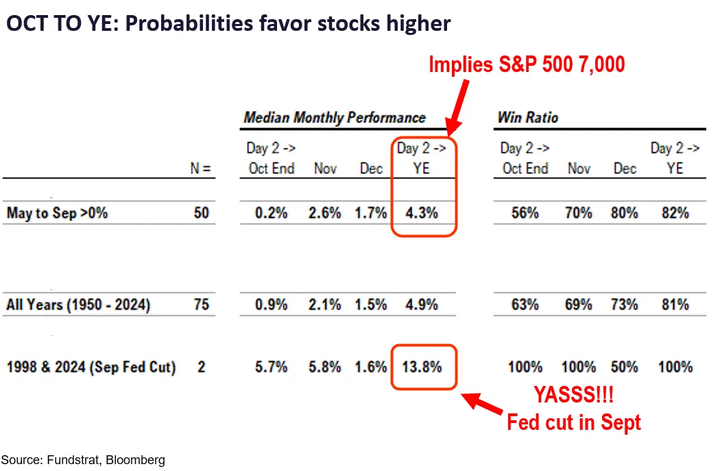

The government shutdown started at Wed 12:01am ET and this means that we will not be getting data from BLS or any agency until the shutdown is over. But we think this is a “sidebar” issue and probabilities heavily favor stocks strong from October to December this year.

Technical

SPX has now pushed back to new all-time high territory this week, which sets up for a push up to 6749 in the short run, and potentially near 6800 into mid-October before some consolidation starts to get underway. While there appears to be resistance heading into mid-October, it’s likely not for another 30-80 points higher in SPX.

Crypto

MSTR’s rebound is encouraging, Bitcoin ETFs have seen multiple strong inflow days, and trading volumes are climbing across BTC and ETH, signaling renewed investor participation.

News We’re Following

Breaking News

- Private equity is hunting for a quicker path to tap 401(k) money BBG

Markets and economy

- It’s jobs Friday without a jobs number: here’s where to look for alternatives WSJ

- US bank reserves decline further below key $3 trillion mark BBG

- Trump explores bailout of at least $10 billion for U.S. farmers WSJ

- Christine Lagarde calls for tougher rules on ‘darker corners’ of finance FT

Business

- Oracle investigating hacks of its customers’ E-Business Suite BBG

- Perplexity AI rolls out Comet browser for free worldwide CNBC

- Tesla sales hit record as US buyers rush to beat end of tax credits FT

- FICO provider is shaking up its credit score business. Its stock is surging CNBC

Politics

- Trump hits independent agencies, spares the big stuff – for now POL

- Lawmakers from both sides pressed Pentagon on legal basis for drug boat strikes WSJ

Overseas

- Trump’s drone deal with Ukraine to give U.S. access to battlefield tech WSJ

- Japan’s next leader may be its first woman or youngest in modern era REU

- Munich airport closed after drone sightings FT

Of Interest

- UK man pleading guilty to $100 million wine fraud in New York BBG

- Church of England names female leader in historic first SEM

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/3 | 9:45 AM | Sep F S&P Srvcs PMI | 53.9 | 53.9 |

| 10/3 | 10:00 AM | Sep ISM Srvcs PMI | 51.7 | 52 |

| 10/7 | 8:30 AM | Aug Trade Balance | -61.4 | -78.311 |

| 10/7 | 11:00 AM | Sep NYFed 1yr Inf Exp | n/a | 3.2 |

| 10/8 | 2:00 PM | Sep 17 FOMC Minutes | n/a | 0 |

| 10/8 | 2:00 PM | Sep 17 FOMC Minutes | n/a | 0 |