“Financial forecasters are a humble lot, with a lot to be humble about.” — Federal Reserve Chair Jerome Powell reiterating a saying.

Chart of the Day

Good morning!

I don’t believe that a recession is most investors’ base case, and it’s possible that all the warnings about an upcoming recession are from a handful of those who are drowning out the more reasonable voices.

That’s because the biggest sign of economic optimism has been right in front of us this whole time.

The consumer-staples sector, which holds companies that make all kinds of household goods items like detergent, “fridge cigarettes,” and mayonnaise, is the only one of the S&P 500’s 11 segments that finished the third quarter in the red. It lost 2.9%.

The S&P 500 has added 7.8% in comparison. Most of that was led by a gangbusters rally in information-technology and communication-services sectors, which rose 13% and 12% this quarter.

I know shares of companies tied to the health of the consumer being good for the economy is a bit counterintuitive, so let me explain.

When investors are panicking about a recession, defensive sectors like staples tend to benefit because the expectation is that even if consumers aren’t buying a Tesla, they will continue to buy toilet paper. That’s what drove their outperformance over fancier tech stocks in the first quarter when tariffs’ effects on corporate margins dictated where money was flowing.

Of course, tariffs have hardly been the bazooka many had feared. And it’s hard not to be captivated by building out of AI infrastructure.

Just yesterday, CoreWeave signed an over $14 billion contract with Meta to provide it with AI cloud infrastructure, sending its shares 12% higher. It’s not only one either, with Nvidia investing $100 billion in OpenAI and $5 billion in rival Intel. Oracle, too, expects to collect $300 billion over the coming years.

Here’s their respective share-price performance this quarter:

- CoreWeave: down 16%

- Nvidia: up 18%

- Intel: up 50%

- Oracle: up 29%

In comparison, staples like Coca-Cola have declined 6.3% this quarter, Costco has lost 6.5%, and Colgate-Palmolive has slid 12%.

Consumer stocks wouldn’t be down and tech stocks wouldn’t be up on these unimaginable levels of investment, the benefits of which aren’t even expected to reaped until years later, if the economy didn’t look like it was humming along.

Share your thoughts

What are some other indicators you’re noticing that suggest the economy is on solid footing? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: What are your tips for buying a home in this market?

A: When I was in my 20’s, early 30’s the idea or philosophy was to buy a home ASAP and start building equity. This strategy while it helped you accumulate wealth over time is slow. Today, the strategy is to buy Bitcoin ASAP, instead of the house and hopefully you start in your teens and let it build equity for you, this is much quicker.

Catch up with FS Insight

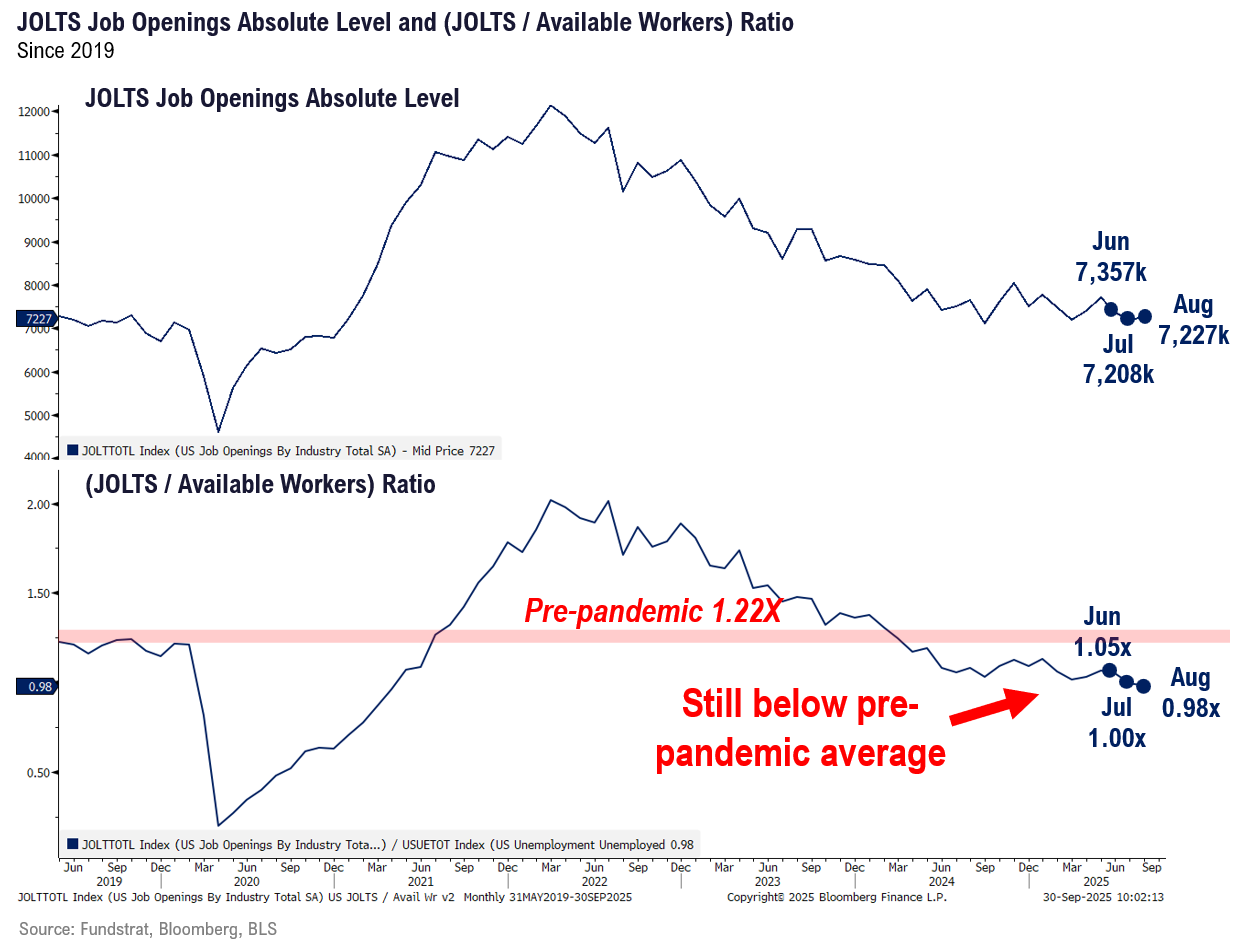

This week is a data heavy week, and we expect leans Fed dovish given the risk of economic disruption from a shutdown, and less inflation risk as well. But the bigger news might be this warning from AI researcher, who believes AI could be human-replacement jobs by next year. This would show AI is not a bubble, but the vast impacts are underestimated.

Technical

I do view an eventual breakdown in DXY and TNX in October to be likely, so a prolonged shutdown could be a possible catalyst to watch for in the weeks to come.

Crypto

HOOD has surged on prediction market traction (>$2B Q3 volume), underscoring its ability to execute and monetize Gen Z through a full financial product suite.

News We’re Following

Breaking News

- White House Pulls Pick to Lead Labor Data Agency NYT

Markets and economy

- How Do Markets Respond to Government Shutdowns? WSJ

- Student-Loan Debt Is Strangling Gen X WSJ

- Private payrolls declined in September by 32,000 in key ADP report coming amid shutdown data blackout CNBC

- Stablecoins could help shift financial system from commercial lending, BoE governor says FT

- Treasury yields dive, probability of 2 more 2025 rate cuts rises after negative ADP private-sector jobs reading MW

Business

- Walmart Ditching Dyes, Other Artificial Ingredients in Its Food Brands WSJ

- FTC claims Zillow paid Redfin $100 million to dominate online rental listings CNN

- Alphabet’s stock just had its best quarter in two decades thanks to AI MW

- How the Warehouse Store Won Retail—and How Sam’s Club Is Winning the Warehouse BR

Politics

- Trump Gave the Military’s Brass a Rehashed Speech. Until Minute 44. NYT

- Shutdown Grinds Many Government Services to a Halt NYT

Overseas

- Taiwan becomes largest importer of Russian naphtha FT

Of Interest

- The Company Founders Who Think They Need Not One but Two Successors WSJ

- Warren Buffett is reportedly eyeing Berkshire Hathaway’s biggest deal in three years CNBC

- Is a bad economy good for art? FT

| Overnight | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 10/1 | 9:45 AM | Sep F S&P Manu PMI | 52 | 52 |

| 10/1 | 10:00 AM | Sep ISM Manu PMI | 49 | 48.7 |

| 10/2 | 10:00 AM | Aug F Durable Gds Orders | 2.9 | 2.9 |

| 10/3 | 8:30 AM | Sep AHE m/m | 0.3 | 0.3 |

| 10/3 | 8:30 AM | Sep Unemployment Rate | 4.3 | 4.3 |

| 10/3 | 8:30 AM | Sep Non-farm Payrolls | 52 | 22 |

| 10/3 | 9:45 AM | Sep F S&P Srvcs PMI | 53.9 | 53.9 |

| 10/3 | 10:00 AM | Sep ISM Srvcs PMI | 51.7 | 52 |

| 10/7 | 8:30 AM | Aug Trade Balance | -61.4 | -78.311 |

| 10/7 | 11:00 AM | Sep NYFed 1yr Inf Exp | n/a | 3.2 |