“Use only that which works, and take it from any place you can find it.” ― Bruce Lee

Chart of the Day

Good morning!

The Trump administration’s decision to add a new $100,000 entry fee on H-1B visas took many companies (and foreign employees) by surprise. Among those surprised was JPMorgan’s Jamie Dimon, who explained that “for us, visas matter because we move people around globally — experts who get promoted to new jobs in different markets.” JPMorgan is the eighth-heaviest user of H-1B visas.

Unsurprisingly, much of the news coverage of the new policy focused on the tech industry’s response. After all, the top 10 heaviest users of H-1B visas include Amazon, Microsoft, Meta, Apple, and Google. Also on the list are Cognizant Technology and Tata Consultancy Services, both multinational IT consulting firms.

Yet the decision has ties to another story that made headlines recently: the Sept. 5 detention and deportation of more than 300 South Korean employees working at Hyundai’s planned electric-vehicle battery factory in rural Ellabell, Georgia. It appears that many of the employees had been improperly working under a B-1 visa, which allows foreigners into the U.S. to do business, but not to work.

According to the Financial Times, this is a commonplace, but nods-and-whispers, practice for South Korean companies pressured for decades by the U.S. government to invest in and build manufacturing facilities here – quickly – while denied assistance in bringing in their own experts to facilitate the efforts. The usual response to requests for such assistance has frequently been to simply hire Americans, but all too often, that’s not an option. The president might not want to disagree publicly, but he likely knows that this is the case: After Hyundai employees were detained, Trump reportedly delayed their departure so he could ask them to stay and train Americans. (Reportedly, all but one refused.)

It’s not a matter of companies being reluctant to pay higher wages for American employees. When it comes to the industrial engineers needed to build factories, bring them online, and keep them running, a sufficient number of qualified Americans are often not available at any price. They haven’t been for decades, and the problem’s getting worse.

The Bureau of Labor Statistics projects an 11% aggregate increase in the number of industrial engineers needed over the next decade – one of the fastest growth rates in any occupation, with 23,000 to 27,000 new openings per year. At U.S. colleges and universities, we are producing under 8,000 such engineers per year. Nor are higher wages for such jobs (median salary for an industrial engineer is already at $101,140) likely to help: too many of the high-school grads produced by U.S. public schools lack the math and science skills needed to enter an engineering program in college. Those who do have what it takes tend to eschew unglamorous fields like industrial engineering for more prestigious, Silicon Valley-bound disciplines like electrical engineering.

The U.S. could arguably fix all of this structural problem, but it will take time – more time than Trump has left in his second presidential term. Making it harder for manufacturers to bring in expertise from abroad isn’t going to speed that up, but it is likely to impede the manufacturing resurgence the White House wants.

Share your thoughts

What can be done to ensure we continue to get the foreign expertise we need in certain areas? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: What are your thoughts on rate cuts and the housing issue?

A: Have you seen housing prices on a graph since 2022? If you were to look on Zillow for example, you can see the parabolic graph from 2020-2025. I’m assuming most of homes for sale were purchased with a 3-4 % mortgage rate. I find it difficult to believe there’s enough people ready to pay top of the market prices at a 6% mortgage. The only thing that will bring down home prices to a reasonable level is a recession. Same thing with rentals. There has to be enough vacancies to force owners/landlords to lower prices.

Catch up with FS Insight

NVDA surged today to near all-time highs on an announced deal with OpenAI. To us, the positive reaction shows that good news is “still good news“.

Technical

Finally, the rally in precious and industrial metals has continued, and it still seems early to avoid this area, despite how overbought momentum has become lately.

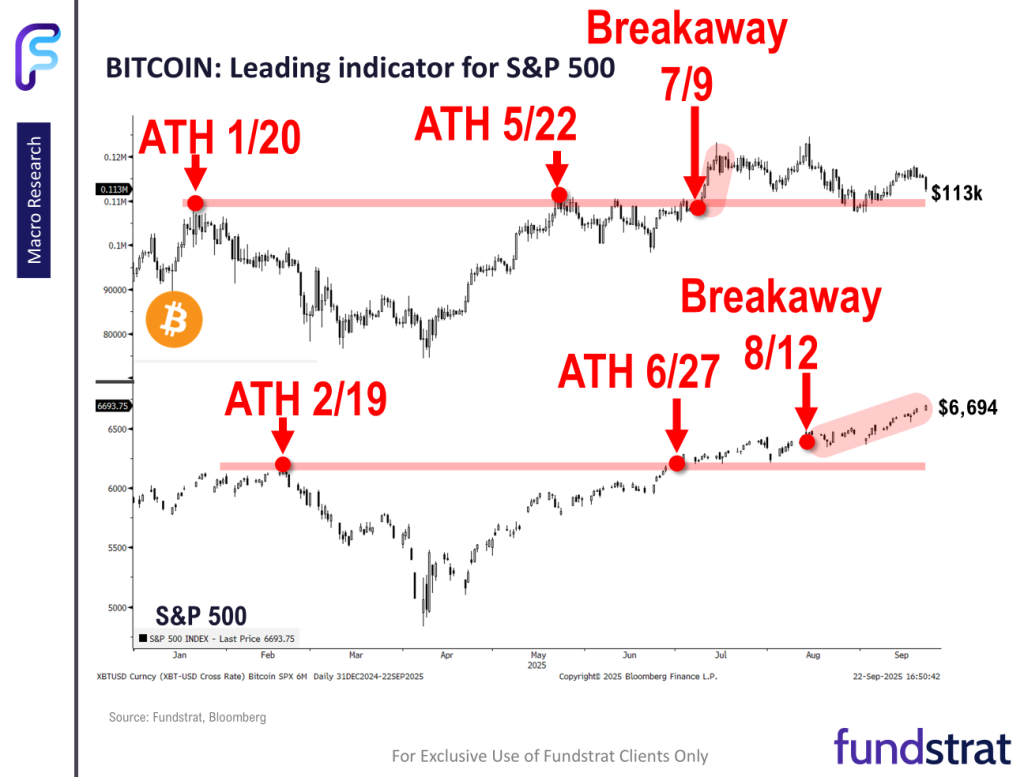

Crypto

Altcoins remain weak, and the Coinbase–Binance BTC spread remains stuck in discount territory since mid-August, reflecting persistent U.S. selling.

News We’re Following

Breaking News

- Kimmel Makes Emotional Return to ABC With Trump Barbs, Comments on Kirk Controversy WSJ

- Shares of Lithium Miner Pop as U.S. Proposes Equity Stake BR

Markets and economy

- Fed Chief Powell says stock prices appear ‘fairly highly valued’ CNBC

- Stephen Miran’s Rate-Cut Arguments Don’t Add Up WSJ

- Get Rich or Get Wiped Out: Bitcoin’s Hottest New Trade WSJ

- Tether targets $500bn valuation with $20bn private funding round FT

- Citadel’s Ken Griffin on Markets, the Fed, and Building His Firm for the Next Century BR

Business

- Micron’s stock gains as the memory-chip maker clears a high bar MW

- Amazon’s stock is now Big Tech’s biggest loser in 2025 as the cloud race heats up MW

- Alibaba shares jump 9% in U.S. premarket after CEO unveils plans to boost AI spending CNBC

Politics

- In a Sudden Shift, Trump Says Ukraine Can Win the War With Russia NYT

- Why Obamacare Bills May Double Next Year NYT

- Trump cancels meeting with top Democrats as government shutdown looms CNBC

Overseas

- Italy weighs freezing its retirement age at 67 FT

Of Interest

- The Race Back to America for a Plane Full of H-1B Workers WSJ

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crypto | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodities and Others | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Treasuries | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 9/24 | 10AM | Aug New Home Sales | 650.0 | 652.0 |

| 9/24 | 10AM | Aug New Home Sales m/m | -0.3 | -0.6 |

| 9/25 | 8:30AM | 2Q F GDP QoQ | 3.3 | 3.3 |

| 9/25 | 8:30AM | Aug P Durable Gds Orders | -0.3 | -2.8 |

| 9/25 | 10AM | Aug Existing Home Sales | 3.96 | 4.01 |

| 9/25 | 10AM | Aug Existing Home Sales m/m | -1.38 | 2.04 |

| 9/26 | 8:30AM | Aug PCE m/m | 0.3 | 0.2 |

| 9/26 | 8:30AM | Aug Core PCE m/m | 0.2 | 0.27 |

| 9/26 | 8:30AM | Aug PCE y/y | 2.7 | 2.6 |

| 9/26 | 8:30AM | Aug Core PCE y/y | 2.9 | 2.87723 |

| 9/26 | 10AM | Sep F UMich 1yr Inf Exp | 4.8 | 4.8 |

| 9/26 | 10AM | Sep F UMich Sentiment | 55.4 | 55.4 |

| 9/30 | 10AM | Sep Conf Board Sentiment | 95.75 | 97.4 |

| 9/30 | 10AM | Aug JOLTS | n/a | 7181.0 |