Good morning!

It’s not easy to usher in a so-called golden age of American manufacturing. But fickle policy is surely not the way.

President Donald Trump has repeatedly said that tariffs are a way to force American companies’ supply chains back home, signaling that the global economy may be headed toward deglobalization. Maybe he hopes that this, in turn, would boost American wages and revive the long dormant manufacturing economy.

He wants that even if it means that (1) U.S.-made iPhones could cost $3,500 (by one analyst’s estimate), (2) tariffs push the highly awaited Nintendo Switch 2 prices to $605, up from $450, or (3) increase the average monthly auto loan payment to about $603 from $552.

Companies’ reaction to that? Most of them say that bringing back supply chains could as much as double their costs and they would instead search for a low-tariffs country, according to a new CNBC Supply Chain Survey.

And even Big Tech isn’t spared from this turmoil. Smartphones and other consumer electronics imported to the U.S. from China may still face tariffs, a reversal from what Trump signaled Friday.

Of course, it makes sense to on-shore America’s chip manufacturing capabilities because it’s important to our national security and helps us maintain an edge in this artificial intelligence global race. And over the past three decades (since smartphones became ubiquitous), the U.S. has only tumbled down the leaderboard. Early on, the U.S. represented 100% of the manufacturing capacity of semiconductors, but now it’s at about 8%. And though we’re increasing our share of the global fab capacity, who knows how much more we may need.

In order for Big Tech to move more aggressively into manufacturing, they need to be able to rely on stable policy, however, last weekend’s potential policy reversal further indicates that they can’t. So for now, most of them are keeping their head down and trudging along the same goals they pursued before the whole tariffs debacle started.

Alphabet last week reaffirmed its $75 billion spending plan for the year. Microsoft, too, in recent days has reiterated that it’s staying the course. Meta hasn’t changed its plans to spend $65 billion in AI this year. Nvidia though is an outlier, saying Monday that it has commissioned more than a million square feet of manufacturing space to “build and test AI chips in Arizona and Texas as part of an effort to move a portion of its production to the U.S,” according to a TechCrunch article.

One could say the fact that they haven’t boldly changed their plans signals they don’t believe tariffs are here to stay—making it even more unlikely that they move to on-shoring chips manufacturing in a big way. We know tech companies are capable of ramping up spending and growing in an industry at a moment’s notice, especially when they can identify that it’s a multiyear supercycle. We saw it when it seemed like the AI-revolution was here, thanks to ChatGPT’s release in late 2022, which gave FOMO to tech titans and bolstered them to ramp-up capex.

Maybe a potential unveiling of semiconductors-specific tariffs will finally force Big Tech’s Hand. Earnings later this month will shed more light. But for now, they’re mostly unfazed.

Share your thoughts

How can we on-shore our chips manufacturing capabilities? Click here to send us your response.

Catch up with FS Insight

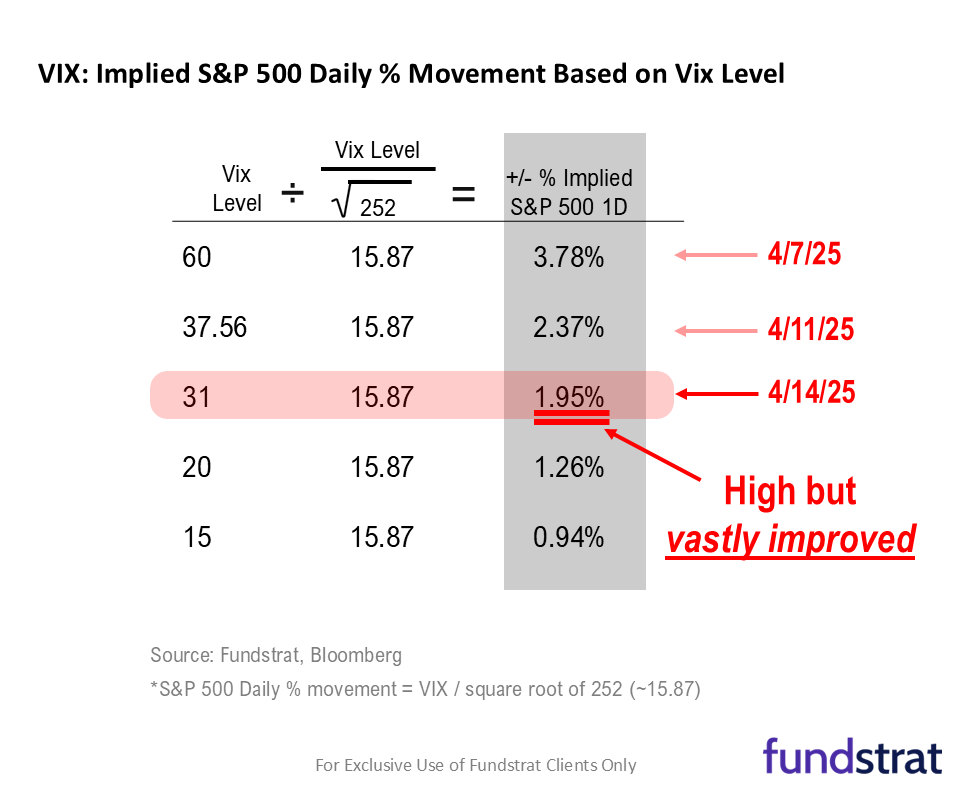

The VIX dropping below 50 after previously breaching that level is historically a tactical “buy” signal, and recent price action reinforces this setup for equities.

Technical

Despite the ongoing volatility, last week’s volume and price action suggested a good likelihood of a short-term low in place for U.S. stocks, which might now be followed by a push higher in a “two-steps forward, one-step back” type process into May.

Crypto

We discuss Bitcoin’s breakout, dovish signals from the Fed on tariffs, and why rising liquidity and soft positioning could set the stage for further upside.

News We’re Following

Breaking News

- U.S. Freezes Billions in Funding After Harvard Says It Will Fight Trump’s Demands WSJ

Markets and economy

- Fund managers have never turned so pessimistic this quickly on U.S. stocks, a survey finds MW

- How Wall Street got Donald Trump wrong FT

- Trump tariffs drove a Treasury sell-off — who sold the safe-haven asset? CNBC

- Zero-day options are fueling the unprecedented volatility on Wall Street amid tariff chaos CNBC

Business

- Citigroup results exceed analysts’ estimates on gains in fixed income and equities trading CNBC

- Bank of America’s Profit Climbs With Consumer Spending Resilient WSJ

- Hermès overtakes LVMH for luxury’s top spot after weak sales spark sell-off FT

- Netflix Aims to Join the $1 Trillion Club WSJ

- American Airlines to make Wi-Fi free on most of its fleet in 2026 CNBC

Politics

- Trump Gave Automakers a Tariff Break. It’s Causing More Confusion. WSJ

- Despite a court order, White House bars AP from Oval Office event AP

Overseas

- Trump’s Trade War With China Could Be Good for India. But Is It Ready? NYT

Of Interest

- How ‘A Minecraft Movie’ Won With Memes and Deliberate Stupidity WSJ

- Novo Remade Denmark. Then Came the Stock Selloff. BR

| Overnight |

| S&P Futures +1

point(s) (+0.0%

) overnight range: -28 to +23 point(s) |

| APAC |

| Nikkei +0.84%

Topix +1.00% China SHCOMP +0.15% Hang Seng +0.23% Korea +0.88% Singapore +2.14% Australia +0.17% India +2.19% Taiwan +1.77% |

| Europe |

| Stoxx 50 +0.61%

Stoxx 600 +1.00% FTSE 100 +0.77% DAX +0.95% CAC 40 +0.21% Italy +1.65% IBEX +1.21% |

| FX |

| Dollar Index (DXY) +0.22%

to 99.86 EUR/USD -0.26% to 1.1322 GBP/USD +0.24% to 1.3222 USD/JPY +0.09% to 142.93 USD/CNY -0.09% to 7.3159 USD/CNH -0.12% to 7.3207 USD/CHF -0.06% to 0.8154 USD/CAD -0.03% to 1.3878 AUD/USD +0.40% to 0.6353 |

| UST Term Structure |

| 2Y-3

M Spread narrowed -1.5bps

to -49.2bps

10Y-2 Y Spread widened 1.0bps to 53.5bps 30Y-10 Y Spread widened 1.2bps to 44.3bps |

| Yesterday's Recap |

| SPX +0.79%

SPX Eq Wt +1.28% NASDAQ 100 +0.57% NASDAQ Comp +0.64% Russell Midcap +1.27% R2k +1.11% R1k Value +1.17% R1k Growth +0.50% R2k Value +1.09% R2k Growth +1.13% FANG+ +0.08% Semis +0.15% Software +0.89% Biotech +2.97% Regional Banks +1.75% SPX GICS1 Sorted: Cons Disc -0.10% Energy +0.25% Comm Srvcs +0.25% Tech +0.63% SPX +0.79% Fin +1.03% Indu +1.04% Materials +1.09% Healthcare +1.18% Cons Staples +1.64% Utes +1.75% REITs +2.15% |

| USD HY OaS |

| All Sectors -5.7bps

to 453bps All Sectors ex-Energy -5.5bps 416bps Cons Disc -4.9bps 448bps Indu -5.3bps 339bps Tech -8.5bps 449bps Comm Srvcs -7.3bps 631bps Materials -5.2bps 434bps Energy -3.2bps 519bps Fin Snr -6.4bps 386bps Fin Sub -2.1bps 305bps Cons Staples -6.4bps 302bps Healthcare -6.3bps 452bps Utes -5.2bps 314bps * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 4/15 | 8:30 AM | Mar Import Price m/m | 0 | 0.4 |

| 4/16 | 8:30 AM | Mar Retail Sales m/m | 1.3 | 0.2 |

| 4/16 | 10:00 AM | Apr Homebuilder Sentiment | 38 | 39 |

| 4/16 | 4:00 PM | Feb Net TIC Flows | n/a | -48.82 |