“I think of doing a series as very hard work. But then I’ve talked to coal miners, and that’s really hard work.” – William Shatner

Chart of the Day

Good morning!

Drill, baby, drill? More like mine, baby, mine.

President Donald Trump’s affinity for “beautiful” coal and promise to “bring coal back” might be more than just pandering to U.S. coal country voters and his Republican base.

Coal does seem to be back – though mostly not due to his efforts. Instead, it stems from our surging need for electricity (pun probably not intended). As Fundstrat researchers have written about on multiple occasions, the growth of AI, data centers, and cryptocurrency, along with the increasing popularity of electric vehicles, is projected to quickly boost our need for electricity to such an extent that it has apparently silenced the environmental concerns of those who might ordinarily voice them. After all, many project that even aggressive efforts to expand other power-generation options (both renewable and non-) will likely not be enough to meet our needs (not unless a massive breakthrough in nuclear fusion research emerges, anyway).

Nevertheless, while much of the world was understandably focused on tariffs, Trump signed four pro-coal executive orders on Tuesday. They authorize aging coal power plants scheduled to be shut down to continue operation, loosen environmental regulations associated with coal plants, and boost efforts to expand coal mining in several ways. (It’s worth noting that recently, the United Mine Workers of America suggested that Trump was declaring a “war on coal miners,” so a political motivation on his part is nevertheless possible.)

Increased demand for coal isn’t just limited to the U.S. The same drivers ramping up our need for energy from coal are in play in many other parts of the world as well. Despite also pursuing green energy, China is aggressively ramping up construction of coal-fired power plants. So is India. In fact, even though these two countries are already the two largest producers of coal in the world, they still feel the need to import coal from the U.S. (India, in fact, is the biggest importer of American coal in the world.)

This offers opportunities for U.S. coal miners. And though it wasn’t directly linked to his love for coal, Trump issued an amendment to a previous executive order that should help with that, as well. In late February, he proposed charging steep fees on all Chinese and Chinese-made cargo ships for each port-of-call in the U.S. Someone appears to have told him that if he’s serious about tackling the U.S. trade deficit (a main reason behind imposing the tariffs in the first place), he might want to reconsider targeting the ships that don’t just bring in imports, but also transport U.S. exports – including coal – to the rest of the world. Maybe that’s why on Wednesday, he revised and softened his port-fee proposal.

Share your thoughts

Does coal have a real future, or is this just a fleeting reprieve from the end? Click here to send us your response.

Here’s what a reader commented

Question: Are U.S. Treasuries and the U.S. dollar still the automatic safe havens they have been since Bretton Woods?

Answer: Emotionally, I don’t see Treasury bonds and the U.S. dollar as a safe haven after what Trump and his administration did. [But] objectively, it still is.

Catch up with FS Insight

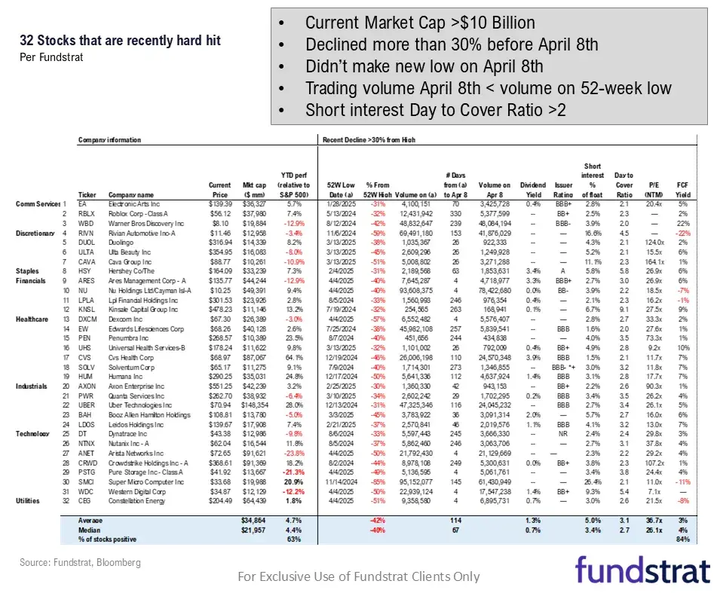

Markets took a step back on Thursday following Wednesday’s rally, in what can be described as a “two steps forward, one step back” session. This is not entirely surprising and not necessarily adverse. We think it makes sense to look at washed out stocks.

Technical

Overall, my technical thought process is that a pushback higher to challenge and potentially briefly exceed 5500 could be possible into next week. However, it should still prove difficult to exceed the ongoing downtrend line.

Crypto

Given this week’s developments, we believe it will be appropriate to increase exposure in our Core Strategy (total long position from 50% to 75% long and increasing our relative altcoin weighting). That said, we think it is prudent to wait for either a retrace or a confirmed breakout before executing.

News We’re Following

Breaking News

- China raises tariffs on US goods to 125% in retaliation BBG

Markets and economy

- Egg inflation remains stubborn on bird flu and tariff risks BBG

- US shale sector in peril as oil price plunge rattles drillers FT

- Global bond funds log biggest weekly outflows in over five years REU

- Trump’s tariffs leave economists fixated on one word: stagflation BBG

Business

- JPMorgan’s profit jumps on dealmaking, trading boost REU

- OpenAI sues Elon Musk claiming ‘bad-faith tactics’ BBC

- Morgan Stanley’s quarterly profit rises as traders shine REU

- Meta vs. the FTC: The blockbuster antitrust trial kicks off CNBC

- State Farm pleads for emergency rate hikes on California homeowners CNBC

Politics

- Supreme Court unanimously orders return of man wrongly deported to Salvadorean prison SEM

- Trump administration wants to install federal oversight of Columbia University WSJ

- How the SAVE Act could impact married women and other voters FRB

- Trump plans to withhold all federal funding from sanctuary cities WSJ

Overseas

- In secret meeting, China acknowledged role in U.S. infrastructure hacks WSJ

- US, Russia swap prisoners as officials meet for diplomatic talks SEM

Of Interest

- George Bell, once named the tallest person in the U.S., dies at 67 WSJ

- Spanish Siemens executive killed alongside family in Hudson River helicopter crash WSJ

- MLB could draw greater private equity interest as uncertainties lie ahead CNBC

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crypto | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodities and Others | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Treasuries | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 4/11 | 8:30AM | Mar PPI m/m | 0.2 | 0.0 |

| 4/11 | 8:30AM | Mar Core PPI m/m | 0.3 | -0.1 |

| 4/11 | 10AM | Apr P UMich 1yr Inf Exp | 5.2 | 5.0 |

| 4/11 | 10AM | Apr P UMich Sentiment | 53.5 | 57.0 |

| 4/14 | 11AM | Mar NYFed 1yr Inf Exp | n/a | 3.13 |

| 4/15 | 8:30AM | Mar Import Price m/m | 0.0 | 0.4 |

| 4/16 | 8:30AM | Mar Retail Sales m/m | 1.4 | 0.2 |

| 4/16 | 10AM | Apr Homebuilder Sentiment | 37.0 | 39.0 |

| 4/16 | 4PM | Feb Net TIC Flows | n/a | -48.82 |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 4/11 | 8:30AM | Mar PPI m/m | 0.2 | 0.0 |

| 4/11 | 8:30AM | Mar Core PPI m/m | 0.3 | -0.1 |

| 4/11 | 10AM | Apr P UMich 1yr Inf Exp | 5.2 | 5.0 |

| 4/11 | 10AM | Apr P UMich Sentiment | 53.5 | 57.0 |

| 4/14 | 11AM | Mar NYFed 1yr Inf Exp | n/a | 3.13 |

| 4/15 | 8:30AM | Mar Import Price m/m | 0.0 | 0.4 |

| 4/16 | 8:30AM | Mar Retail Sales m/m | 1.4 | 0.2 |

| 4/16 | 10AM | Apr Homebuilder Sentiment | 37.0 | 39.0 |

| 4/16 | 4PM | Feb Net TIC Flows | n/a | -48.82 |