A daily market update from Fundstrat — what you need to know ahead of opening bell.

“Everyone likes flattery; and when you come to royalty you should lay it on with a trowel.” – Benjamin Disraeli

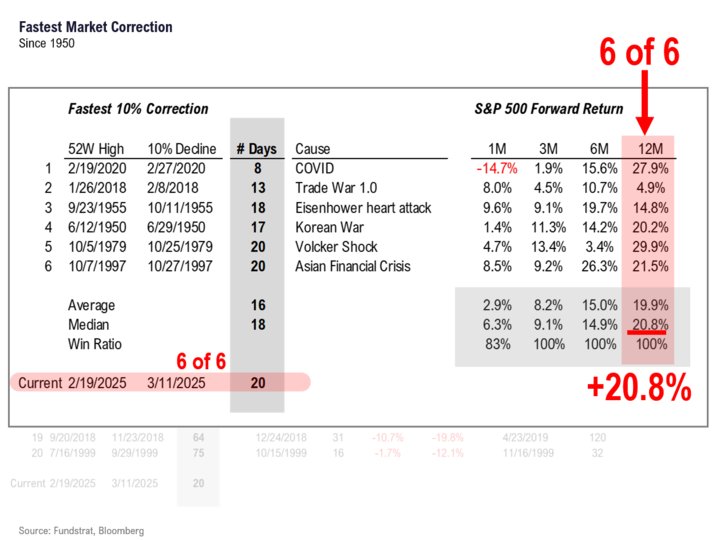

Chart of the Day

Good morning!

The recent decline in stocks has many talking about the “Trump put” – the idea that the President Donald Trump and the White House will not tolerate too steep of a retreat in the stock market before they adjust their policies to at least halt, if not reverse, the slide. Recent price action has some beginning to doubt this, but in our view, they shouldn’t. Here’s why:

After Trump took office in 2017, it quickly became clear that flattery could be used to help get his attention and favor. Some foreign leaders apparently understand this. That’s why during his Feb. 7 visit to the Oval Office, Japanese Prime Minster Shigeru Ishiba told Trump he was “so excited to see such a celebrity on television,” describing him as “very sincere and very powerful, and with strong will for the United States” before denying that he was trying to “suck up” to his American counterpart. The results of the meeting speak for themselves: U.S. support for Japan’s contested claim to the Senkaku Islands, an agreement to increase exports of much-needed liquefied natural gas to Japan, a renewal of the U.S.-Japan security alliance, and – at least as of this writing – no new tariffs on Japanese imports.

Corporate America also knows the importance of flattery with this President. Take Apple as an example. Along with many Big Tech companies, Apple (or at least its Chief Executive, Tim Cook) donated lavishly to Trump’s inaugural celebrations. Then last month, Cook gave Trump what he wanted to hear, allowing him to claim credit for a $500 billion server-manufacturing investment by Apple in the U.S. that would create a projected 20,000 jobs.

Here’s the catch though — as the Wall Street Journal noted, the announcement was not as noteworthy as it might have initially seemed. “The company has added an average of about 19,000 U.S. workers every four years since 2013,” the WSJ noted, and “the spending pledge is roughly on track with its recent investments.” The Journal also noted that Apple made similar pledges in 2021 at the beginning of Joe Biden’s presidency and in 2018 during Trump’s first term, yet didn’t see any noteworthy increases to the size of its U.S. workforce.) Apple is not alone in taking such an approach with the current administration.

“Every company caters to the administration’s needs,” Daniel Keum, a professor at Columbia Business School, told the Journal. “They sugarcoat and repurpose existing investments,” he said, estimating that 80% of the announced investments were likely already in the works before Trump won re-election.

What Apple – and other corporations get in exchange for this flattery is being largely left alone to manage their own businesses as they see fit, and hopefully a President who is willing to listen to their requests and concerns when they arise. Apple is hoping for tariff exemptions on its iPhones and other devices (made in China), while Big Tech is arguably banking on the Trump administration to push back against European regulations on their behalf. Other sectors and industries are also returning to this familiar playbook.

Here’s where the Trump put re-enters the picture. Because the interests of corporate America do not align with a recession, a trade war, or a sustained stock-market slump, they will do what they have to, accruing and using their goodwill with the White House to access Trump’s ear if the economy begins to slide too much. This could arguably help provide a floor to investors’ portfolios.

Catch Up With Fundstrat

Equity markets fell 10% in the past 20 trading days, on the heels of escalating tariff war fears and DOGE fallout leading to a slowing economy. This decline is the 5th fastest in 75 years, and the precedent instances all proved to be “rage selling” panic declines that saw reversals one month later.

TECHNICAL

Markets arguably are growing closer to tradable lows in this orderly and concentrated decline. At present, trends are down, and it will take time to be able to form attractive setups and achieve some base-building following this recent damage. Yesterday’s breach of January lows by equal-weighted S&P 500 and DJIA likely postpones an immediate bottom until Friday, or early next week.

CRYPTO

We suspect MicroStrategy’s buying might have been a key catalyst behind yesterday rally, but speaking generally, we have concerns about the unsettling move in high-yield credit markets.

News We’re Following

Breaking News

- Inflation rate hits 2.8% in February, less than expected CNBC

- EU hits back as U.S. steel and aluminum tariffs take effect WSJ

- Swedish battery maker Northvolt files for bankruptcy SEM

Markets and economy

- Trump walks back latest tariff threat, plays down recession talk BBG

- Nasdaq halts high-speed trading service after regulatory pressure FT

- Airlines cut forecasts, raising an early alarm about consumer spending NYT

- CEOs are ‘suddenly’ the gloomiest they’ve been in over a decade QZ

Business

- Nissan replaces CEO after failed Honda merger WSJ

- Europe’s banks, unlike U.S. rivals, play with DeepSeek INF

- Amazon, Google and Meta support tripling nuclear power by 2050 CNBC

Politics

- Education Department fires 1,300 workers, gutting its staff NYT

- Chaos will delay unemployment for federal workers, states say AX

Overseas

- U.S. to restore military support to Ukraine after it agrees to cease-fire WSJ

- The global importance of Rodrigo Duterte’s arrest ECON

- Portugal’s government collapses after losing parliament vote BBG

Of Interest

- Maradona medical team on trial for football icon’s death BBC

- A new generation is here. Its name is already an insult WSJ

| Overnight |

| S&P Futures +37

point(s) (+0.7%

) Overnight range: -3 to +39 point(s) |

| APAC |

| Nikkei +0.07%

Topix +0.91% China SHCOMP -0.23% Hang Seng -0.76% Korea +1.47% Singapore +0.19% Australia -1.32% India -0.1% Taiwan +0.94% |

| Europe |

| Stoxx 50 +1.2%

Stoxx 600 +0.87% FTSE 100 +0.6% DAX +1.58% CAC 40 +1.17% Italy +1.36% IBEX -0.14% |

| FX |

| Dollar Index (DXY) +0.05%

to 103.47 EUR/USD -0.01% to 1.0918 GBP/USD -0.1% to 1.2938 USD/JPY +0.56% to 148.61 USD/CNY +0.19% to 7.244 USD/CNH +0.27% to 7.2461 USD/CHF +0.1% to 0.8836 USD/CAD +0.04% to 1.4441 AUD/USD -0.13% to 0.629 |

| Crypto |

| BTC -0.2%

to 82619.92 ETH -1.91% to 1899.47 XRP +0.58% to 2.2055 Cardano +1.3% to 0.7351 Solana -1.92% to 124.14 Avalanche +2.09% to 17.86 Dogecoin +0.48% to 0.1672 Chainlink -1.73% to 13.12 |

| Commodities and Others |

| VIX -3.31%

to 26.03 WTI Crude +0.6% to 66.65 Brent Crude +0.53% to 69.93 Nat Gas -2.58% to 4.34 RBOB Gas +0.84% to 2.123 Heating Oil +1.1% to 2.221 Gold -0.01% to 2915.48 Silver +0.25% to 33.02 Copper +1.02% to 4.788 |

| US Treasuries |

| 1M -0.8bps

to 4.2891% 3M -0.0bps to 4.2807% 6M -0.8bps to 4.2132% 12M -2.2bps to 4.0037% 2Y +0.2bps to 3.9449% 5Y -0.5bps to 4.0295% 7Y -0.5bps to 4.1561% 10Y -0.6bps to 4.274% 20Y -0.8bps to 4.6217% 30Y -0.5bps to 4.59% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 1.3bps to -36.4

bps 10Y-2 Y Spread narrowed 0.6bps to 32.7 bps 30Y-10 Y Spread widened 0.1bps to 31.4 bps |

| Yesterday's Recap |

| SPX -0.76%

SPX Eq Wt -1.33% NASDAQ 100 -0.28% NASDAQ Comp -0.18% Russell Midcap -0.78% R2k +0.22% R1k Value -1.17% R1k Growth -0.21% R2k Value -0.05% R2k Growth +0.49% FANG+ +1.59% Semis -0.14% Software +0.97% Biotech -0.08% Regional Banks -0.54% SPX GICS1 Sorted: Cons Disc -0.26% Tech -0.38% Comm Srvcs -0.71% SPX -0.76% Materials -0.81% Fin -0.86% Utes -0.91% Energy -0.96% REITs -1.03% Healthcare -1.12% Cons Staples -1.18% Indu -1.54% |

| USD HY OaS |

| All Sectors -0.2bp

to 358bp All Sectors ex-Energy -1.1bp to 324bp Cons Disc +1.8bp to 339bp Indu -1.9bp to 270bp Tech -0.4bp to 365bp Comm Srvcs -1.2bp to 548bp Materials +0.1bp to 321bp Energy -0.7bp to 362bp Fin Snr +0.2bp to 305bp Fin Sub -3.2bp to 226bp Cons Staples -1.7bp to 237bp Healthcare -0.7bp to 381bp Utes -3.9bp to 253bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 3/12 | 8:30AM | Feb CPI m/m | 0.3 | 0.5 |

| 3/12 | 8:30AM | Feb Core CPI m/m | 0.3 | 0.4 |

| 3/12 | 8:30AM | Feb CPI y/y | 2.9 | 3.0 |

| 3/12 | 8:30AM | Feb Core CPI y/y | 3.2 | 3.3 |

| 3/13 | 8:30AM | Feb PPI m/m | 0.3 | 0.4 |

| 3/13 | 8:30AM | Feb Core PPI m/m | 0.3 | 0.3 |

| 3/14 | 10AM | Mar P UMich 1yr Inf Exp | 4.2 | 4.3 |

| 3/14 | 10AM | Mar P UMich Sentiment | 63.1 | 64.7 |

| 3/17 | 8:30AM | Feb Retail Sales m/m | 0.8 | -0.9 |

| 3/17 | 10AM | Mar Homebuilder Sentiment | 42.0 | 42.0 |

| 3/18 | 8:30AM | Feb Import Price m/m | -0.1 | 0.3 |