VIDEO: Equity markets continue to suffer from uncertainty and the risk of ending Fed independence would be adverse. (09:05).

Stocks fell under pressure Monday, hurt by China warning of reprisals if nations appease the U.S. and also by the White House’s louder calls to remove Fed Chair Jerome Powell. Thankfully, Polymarket only sees a 20% chance of Powell removal in 2025. And we wait for the first meaningful trade agreement, which may be India.

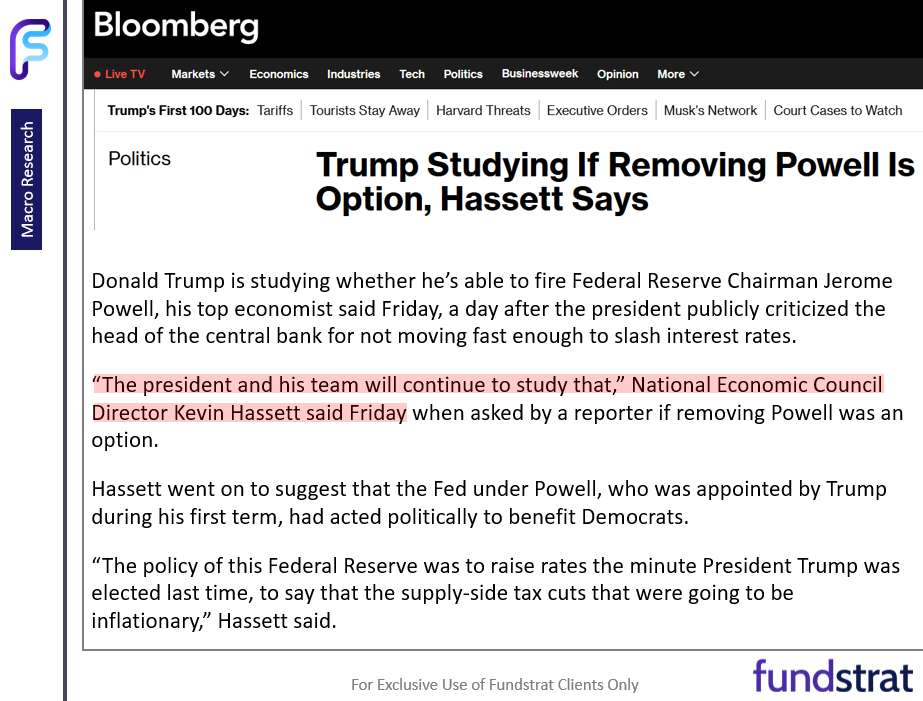

Trump’s calls for the termination of Fed Chair Powell getting louder and in our view constitute further negative policy action.

- Firing Fed Chair would deal severe blow to investor confidence in US financial system.

The “covenant of capitalism” has already undermined by absurd tariff “Liberation Day” execution.

- The turmoil stemming from Tariff Liberation Day continues to impact investor and business confidence significantly, breaching what many see as a critical covenant of capitalism—predictable regulatory frameworks.

- This uncertainty has driven some economists to prematurely declare that a recession has already begun.

- Contrastingly, the high-yield market, an accurate historical recession predictor, has rallied approximately 50 basis points from recent wides

- This remains far from the critical 1,000-point threshold typically associated with recessions.

- Moreover, betting markets peg recession odds at 57%, high but not definitive, leaving room for economic stabilization if positive policy shifts occur.

We see equity markets as vulnerable to “positive policy shock” such as a credible trade deal.

- Notably, recent policy dynamics offer potential optimism.

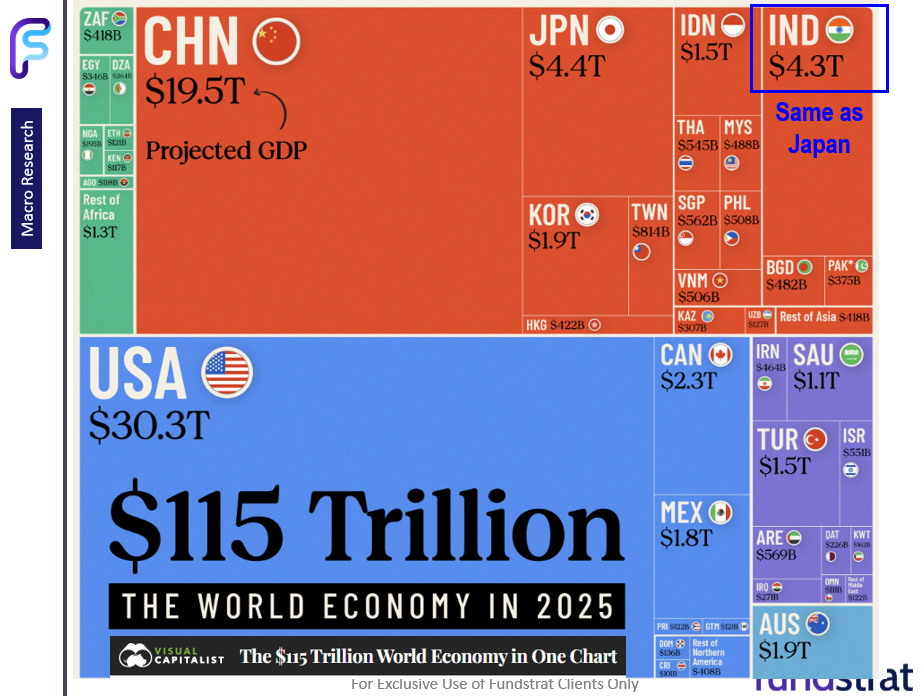

- Although no immediate trade deal materialized with Japan, India’s agreement on a clear roadmap with Vice President Vance and Prime Minister Modi marks a positive and strategic realignment favoring U.S. interests over China.

- This bilateral agreement, which explicitly outlines trade negotiation frameworks, helped markets close stronger, underscoring India’s growing economic prominence.

- India’s economy roughly matches Japan’s and surpasses those of many European nations.

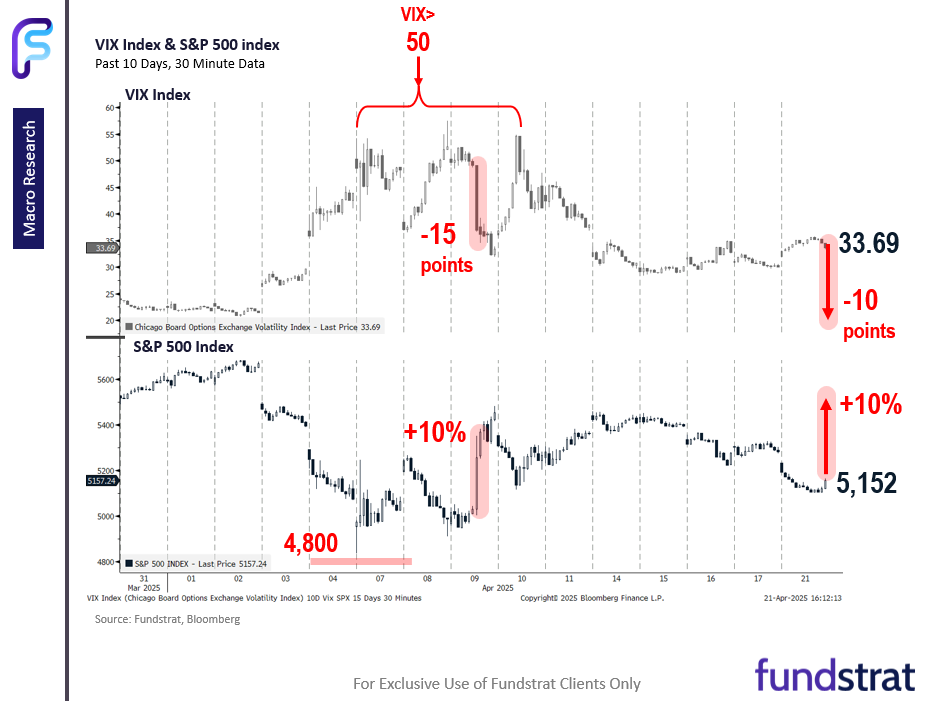

- Historical precedent provides further encouragement: previous episodes of market pressure around April 7-8 saw positive interventions, notably a 90-day tariff pause initiated by the White House, triggering substantial market rallies and reduced volatility.

- Current conditions could similarly catalyze market gains if credible trade deals are established.

- Investor sentiment, however, remains cautious, exacerbated by fears of escalation to a full-blown economic cold war, inflation spikes, or earnings deterioration.

This week, market participants will largely shift their focus to earnings reports, with key insights expected from major players such as Tesla, which historically tends to rise post-earnings but currently faces bearish expectations.

- Additionally, Microstrategy appears technically oversold, potentially setting the stage for a rebound amid investor short positioning levels reminiscent of the Covid crisis lows.

- A recent report by Renaissance Macro highlights last week’s heightened selling activity as indicative of past market turning points, suggesting opportunities for investors willing to maintain a strategic investment perspective despite tactical uncertainties.

Bottom Line: Investors should remain strategically positioned, as markets are vulnerable to positive policy surprises.

- OUR TAKE: Patience needed. Still a bull market: Not clear if “V” (2020) or if we will be stuck in a “range” (2011).

- Many fears remain, including:

- Tariff war turns into “Cold War.”

- Economic ripples from “shock” lead to global recession.

- Financial crisis ensues from rapid financial de-leveraging.

- Inflation expectations surge leading to “greed-flation” and Fed is forced to hike rates.

- S&P 500 EPS estimates fall >20% from here.

- As for macro, this is not a heavy week:

– 4/23 Wed 9:45 AM ET: Apr P S&P Global Manufacturing PMI 49.3e

– 4/23 Wed 9:45 AM ET: Apr P S&P Global Services PMI 53.0e

– 4/23 Wed 10:00 AM ET: Mar New Home Sales 680ke

– 4/23 Wed 2:00 PM ET: Apr Fed Releases Beige Book

– 4/24 Thu 8:30 AM ET: Mar P Durable Goods Orders MoM 1.5%e

– 4/24 Thu 8:30 AM ET: Mar Chicago Fed Nat Activity Index

– 4/24 Thu 10:00 AM ET: Mar Existing Home Sales 4me

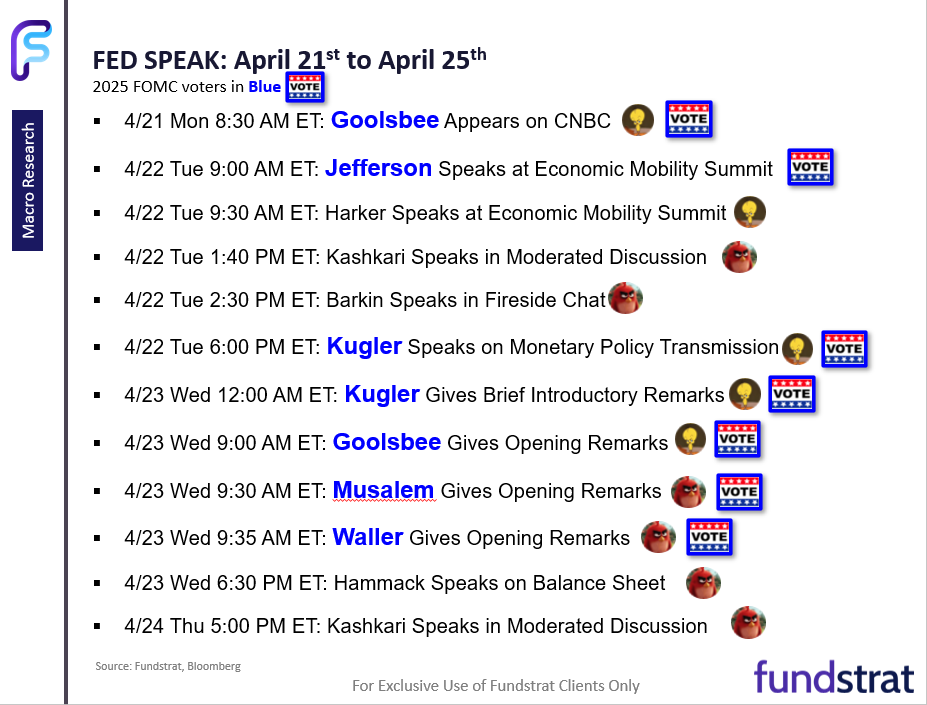

– 4/25 Fri 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp - There is a lot of Fed speak this week (see below) and we think comments from here likely have asymmetry. Hawkish comments will be “expected” and less hawkish will be seen as “dovish”:

– 4/21 Mon 8:30 AM ET: Goolsbee Appears on CNBC

– 4/22 Tue 9:00 AM ET: Jefferson Speaks at Economic Mobility Summit

– 4/22 Tue 9:30 AM ET: Harker Speaks at Economic Mobility Summit

– 4/22 Tue 1:40 PM ET: Kashkari Speaks in Moderated Discussion

– 4/22 Tue 2:30 PM ET: Barkin Speaks in Fireside Chat

– 4/22 Tue 6:00 PM ET: Kugler Speaks on Monetary Policy Transmission

– 4/23 Wed 12:00 AM ET: Kugler Gives Brief Introductory Remarks

– 4/23 Wed 9:00 AM ET: Goolsbee Gives Opening Remarks

– 4/23 Wed 9:30 AM ET: Musalem Gives Opening Remarks

– 4/23 Wed 9:35 AM ET: Waller Gives Opening Remarks

– 4/23 Wed 6:30 PM ET: Hammack Speaks on Balance Sheet

– 4/24 Thu 5:00 PM ET: Kashkari Speaks in Moderated Discussion

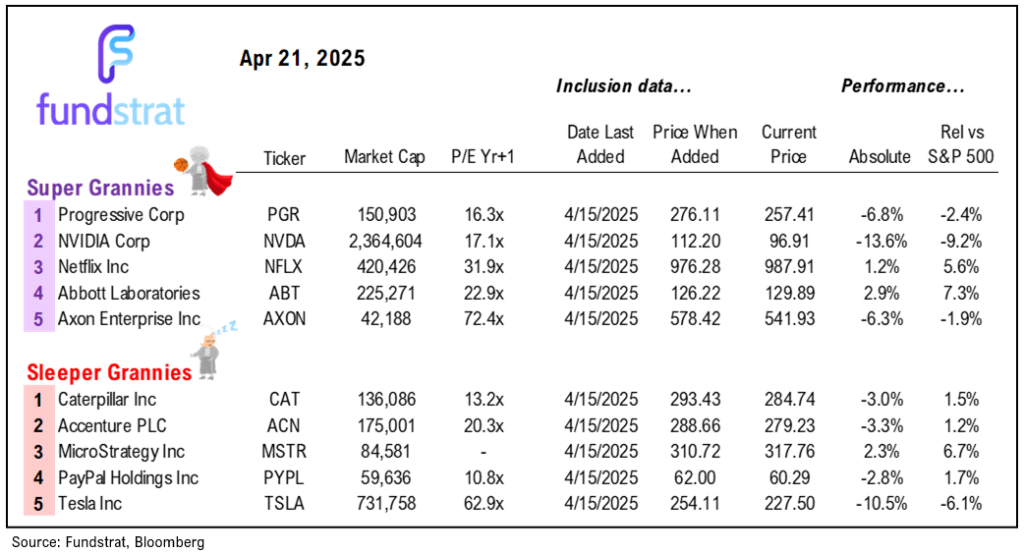

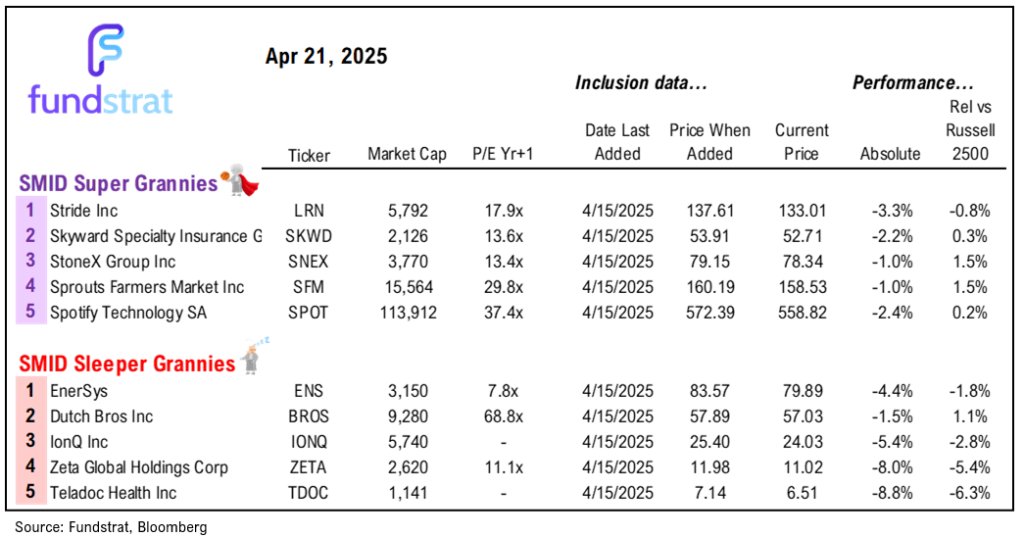

45 SMID GRANNIES: Updated list is below

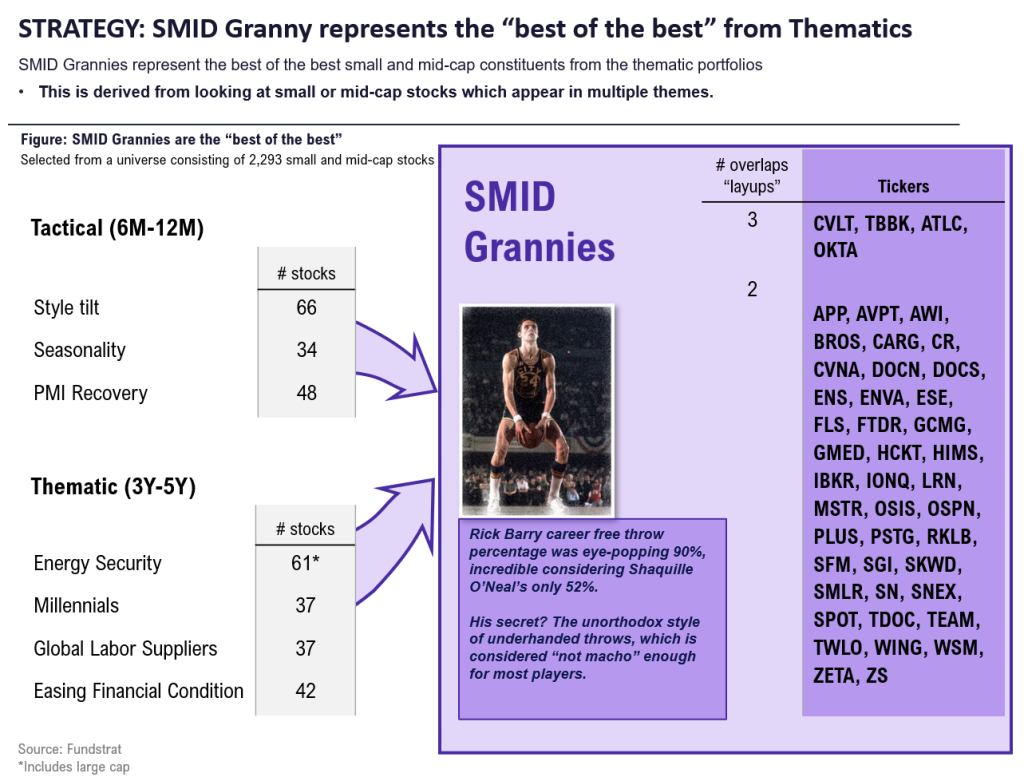

SMID grannies are small and mid-cap stocks that appear in at least 2 of our 7 investment strategies.

- We believe SMID Grannies could benefit from the multiple themes and secular tailwinds.

The Current Portfolio as of 2/18/2025 is as follows (new additions in Bold):

Comm. Services: CARG, SPOT

Discretionary: BROS, CVNA, FTDR, LRN, SGI, SN, WING, WSM

Staples: SFM

Financials: ATLC, ENVA, GCMG, IBKR, SKWD, SNEX, TBBK

Healthcare: DOCS, GMED, HIMS, SMLR, TDOC

Industrials: AWI, CR, ENS, ESE, FLS, RKLB

Technology: APP, AV

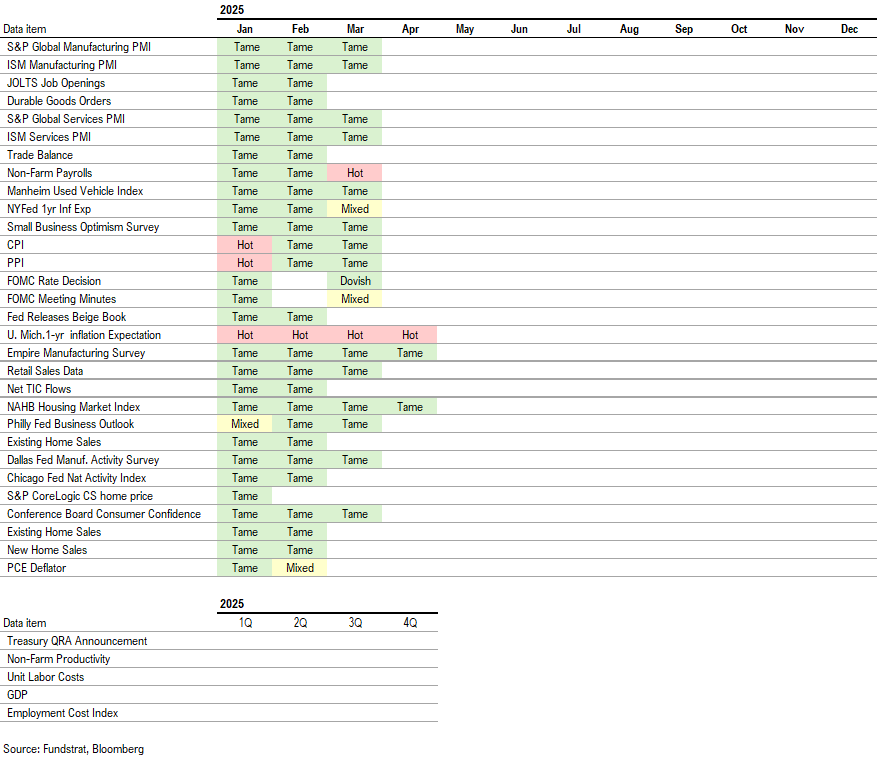

Key incoming data April:

4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMITame4/1 10:00 AM ET: Mar ISM Manufacturing PMITame4/1 10:00 AM ET: Feb JOLTS Job OpeningsTame4/2 10:00 AM ET: Feb F Durable Goods Orders MoMTame4/3 8:30 AM ET: Feb Trade BalanceTame4/3 9:45 AM ET: Mar F S&P Global Services PMITame4/3 10:00 AM ET: Mar ISM Services PMITame4/4 8:30 AM ET: Mar Non-farm PayrollsHot4/7 9:00 AM ET: Mar F Manheim Used Vehicle IndexTame4/8 6:00 AM ET: Mar Small Business Optimism SurveyTame4/9 2:00 PM ET: Mar FOMC Meeting MinutesMixed4/10 8:30 AM ET: Mar Core CPI MoMTame4/11 8:30 AM ET: Mar Core PPI MoMTame4/11 10:00 AM ET: Apr P U. Mich. 1yr Inf ExpHot4/14 11:00 AM ET: Mar NYFed 1yr Inf ExpMixed4/15 8:30 AM ET: Apr Empire Manufacturing SurveyTame4/16 8:30 AM ET: Mar Retail SalesTame4/16 10:00 AM ET: Apr NAHB Housing Market IndexTame4/16 4:00 PM ET: Feb Net TIC FlowsTame4/17 8:30 AM ET: Apr Philly Fed Business OutlookTame4/17 9:00 AM ET: Apr M Manheim Used Vehicle IndexMixed- 4/23 9:45 AM ET: Apr P S&P Global Services PMI

- 4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMI

- 4/23 10:00 AM ET: Mar New Home Sales

- 4/23 2:00 PM ET: Apr Fed Releases Beige Book

- 4/24 8:30 AM ET: Mar P Durable Goods Orders MoM

- 4/24 8:30 AM ET: Mar Chicago Fed Nat Activity Index

- 4/24 10:00 AM ET: Mar Existing Home Sales

- 4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

Economic Data Performance Tracker 2025:

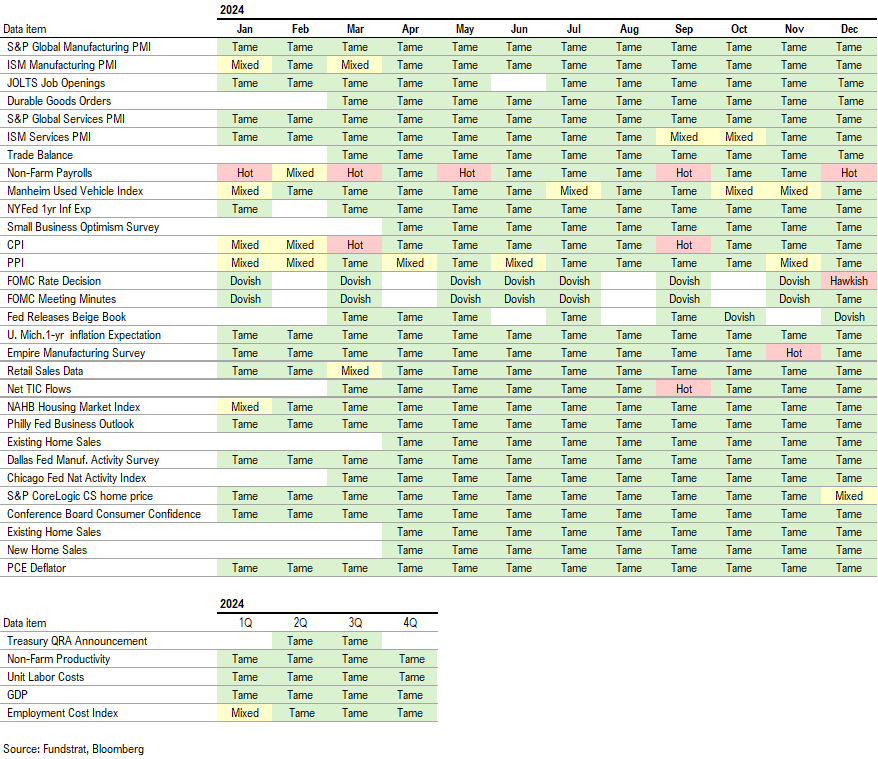

Economic Data Performance Tracker 2024:

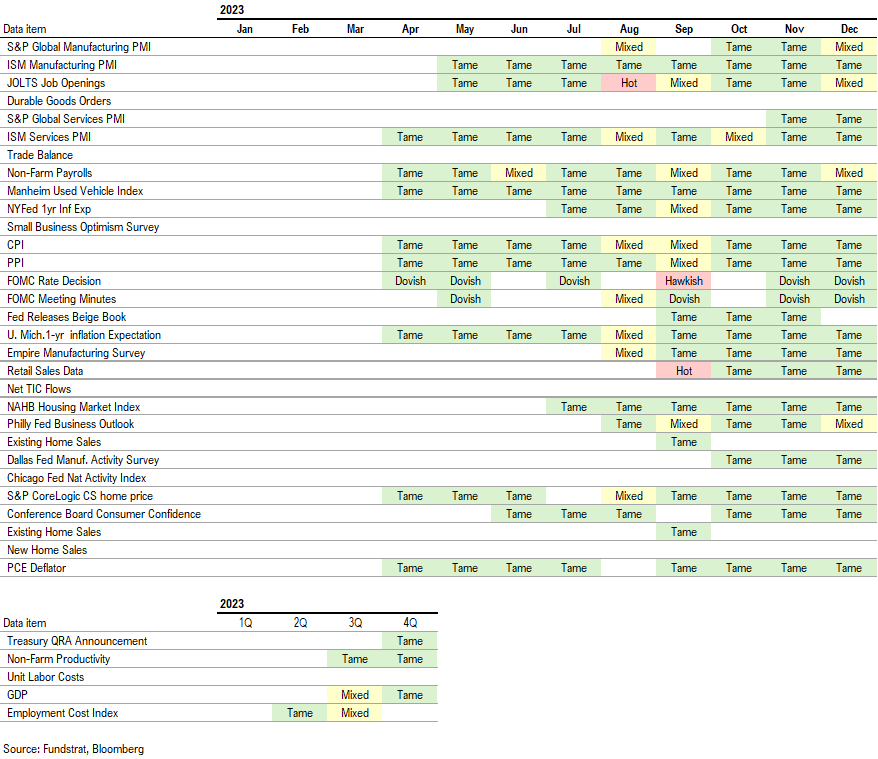

Economic Data Performance Tracker 2023: