VIDEO: Equities fell -4.4% after rising 9.5% Wednesday. This is not entirely surprising and not necessarily adverse. We think it makes sense to look at washed out stocks.

Please click below to view our Macro Minute (duration: 8:32).

Markets took a step back on Thursday following Wednesday’s rally, in what can be described as a “two steps forward, one step back” session. Investors had initially responded positively to the apparent softening of tariff terms announced on Liberation Day. However, after digesting the full details of the executive order, it became clear that tariff rates are expected to settle closer to 18%—higher than the 10% initially hoped. This triggered a reassessment across markets, including in the rates space, where SOFR swap spreads reversed some of their prior improvement.

- Despite this reversal, not all developments were negative, particularly on the geopolitical front.

– President Trump signaled a willingness to re-engage with China, stating in a press conference that he expects to speak with President Xi and expressed confidence that a deal beneficial to both countries could be reached.

– These comments, paired with Trump’s openness to further extending the 90-day tariff pause, support the view that de-escalation is possible.

– European officials also weighed in after the close, signaling they would not accept China re-routing dumped goods into Europe to circumvent U.S. tariffs.

– This alignment adds to the sense that global cooperation is strengthening. - In Washington, the personnel shuffle—replacing Scott Bessent with Lutnick and Navarro—was viewed as a sign that the administration is shifting toward a more tactical posture.

– As noted yesterday, the so-called “Navarro call” appears to have been exercised, signaling a potential turn in strategy toward a more conciliatory stance.

– Meanwhile, Fed officials reiterated a now-familiar message: they are not willing to take risks with credibility on inflation.

– This aligns with recent comments from Chair Powell and suggests the “Fed put” remains on hold for now.

– Until the impact of the tariffs is better understood, the Fed is likely to remain cautious, which nudged recession risk marginally higher Thursday. - Looking ahead, tomorrow’s earnings from major financials—including JPM, BLK, WFC, BK, MS, and FAST—will provide important signals.

– While companies are likely to receive some leeway due to tariff-related uncertainty, the commentary around credit and loan growth will still matter. - The broader pattern of “two steps forward, one step back” is not uncommon in emerging bull markets or during late-stage bear market consolidations.

– Drawing a parallel to 2011, an internal low was seen in early August, well before the market made its actual bottom in October.

-Although the S&P only declined another two percentage points post-August, credit spreads continued to widen, marking the true low two months later.

– This historical analog suggests that monitoring credit remains crucial. - From a technical standpoint, sectors and stocks that bottomed earlier than the broader market may represent “sold out” conditions.

– Walter Deemer’s distinction between “oversold” and “sold out” is useful here—sold out markets have exhausted sellers and begin to rise on bad news.

– For example, the Mag 7 made a relative low on March 28 and posted a higher low on April 9, despite broader weakness.

– Similarly, high-beta stocks bottomed on April 4, which could also signal sold out conditions.

Finally, we have compiled a list of 32 stocks that we believe are “sold out,” but not “oversold” using the following criteria:

- Current Market Cap >$10 Billion

- Down >30% at least a week before April 8th

- Didn’t make new 52-week low on April 8th

- Daily volume April 8th less than daily volume at 52-week low

- Short interest Day to Cover Ratio >2

Below is the full list of 32 stocks:

SOLD OUT NOT OVERSOLD: 32 stocks potentially washed out

- Comm. Services: EA, RBLX, WBD

- Discretionary: RIVN, DUOL, ULTA, CAVA

- Staples: HSY

- Financials: ARES, NU, LPLA, KNSL

- Healthcare: DXCM, EW, PEN, UHS, CVS, SOLV, HUM

- Industrials: AXON, PWR, UBER, BAH, LDOS

- Technology: DT, NTNX, ANET, CRWD, PSTG, SMCI, WDC

- Utilities: CEG

Bottom Line: 2 steps forward, one step back for stocks Thursday doesn’t necessarily show deterioration, but rather healthy consolidation.

_____________________________

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 2/18. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

Technology: APP, AV

Key incoming data April:

4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMITame4/1 10:00 AM ET: Mar ISM Manufacturing PMITame4/1 10:00 AM ET: Feb JOLTS Job OpeningsTame4/2 10:00 AM ET: Feb F Durable Goods Orders MoMTame4/3 8:30 AM ET: Feb Trade BalanceTame4/3 9:45 AM ET: Mar F S&P Global Services PMITame4/3 10:00 AM ET: Mar ISM Services PMITame4/4 8:30 AM ET: Mar Non-farm PayrollsHot4/7 9:00 AM ET: Mar F Manheim Used Vehicle IndexTame4/8 6:00 AM ET: Mar Small Business Optimism SurveyTame4/9 2:00 PM ET: Mar FOMC Meeting MinutesMixed4/10 8:30 AM ET: Mar Core CPI MoMTame- 4/11 8:30 AM ET: Mar Core PPI MoM

- 4/11 10:00 AM ET: Apr P U. Mich. 1yr Inf Exp

- 4/14 11:00 AM ET: Mar NYFed 1yr Inf Exp

- 4/15 8:30 AM ET: Apr Empire Manufacturing Survey

- 4/16 8:30 AM ET: Mar Retail Sales

- 4/16 10:00 AM ET: Apr NAHB Housing Market Index

- 4/16 4:00 PM ET: Feb Net TIC Flows

- 4/17 8:30 AM ET: Apr Philly Fed Business Outlook

- 4/17 9:00 AM ET: Apr M Manheim Used Vehicle Index

- 4/23 9:45 AM ET: Apr P S&P Global Services PMI

- 4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMI

- 4/23 10:00 AM ET: Mar New Home Sales

- 4/23 2:00 PM ET: Apr Fed Releases Beige Book

- 4/24 8:30 AM ET: Mar P Durable Goods Orders MoM

- 4/24 8:30 AM ET: Mar Chicago Fed Nat Activity Index

- 4/24 10:00 AM ET: Mar Existing Home Sales

- 4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

Economic Data Performance Tracker 2025:

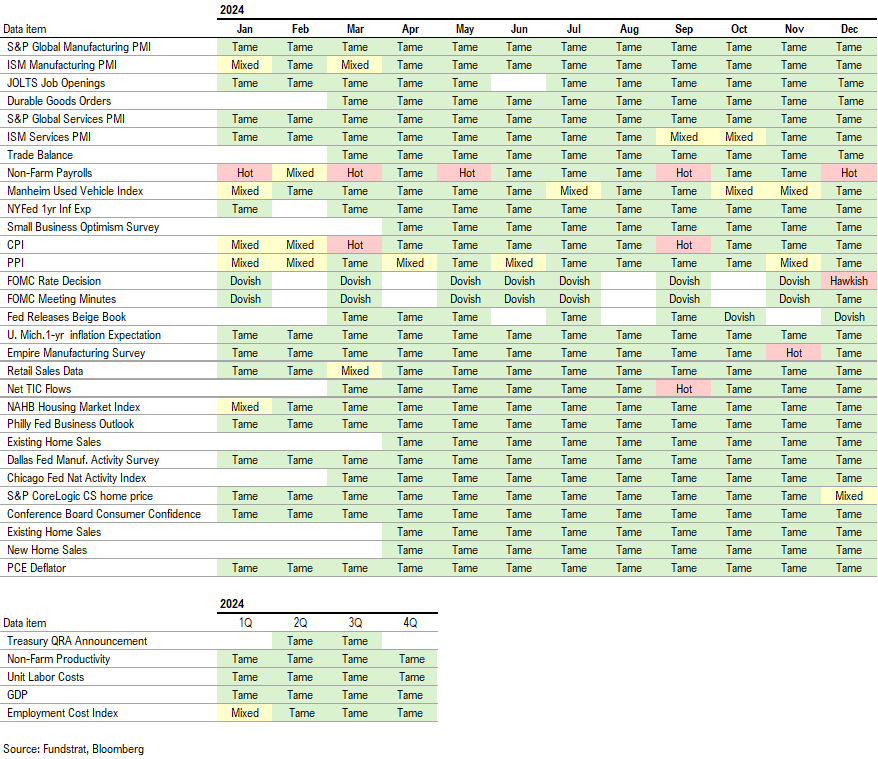

Economic Data Performance Tracker 2024:

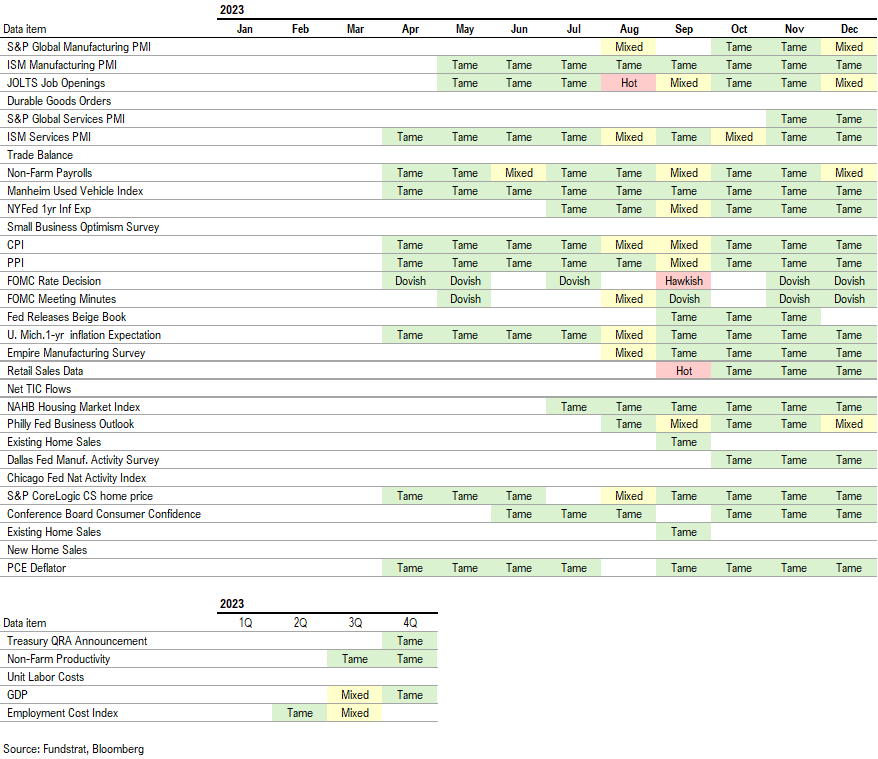

Economic Data Performance Tracker 2023: