VIDEO: Wednesday was an important day because it signaled a turn in the White House and a turn of economic trajectory (duration: 05:44).

Today marked an obvious meaningful turn as the 90-day delay in the reciprocal tariffs firmly puts the U.S. back on a positive path. There are multiple positive developments and these are coming at a time when I was frankly becoming quite nervous about the risk of a recession.

- Confirms return of the “Trump put”

- KEY: Recession risk drops below 50%, thus going from Defcon 3 to Defcon 4

- “Navarro call” exercised: Less of Navarro and more of Bessent

- Technicals improved at a time of markets stretched to downside

- CONCLUSION: Roadmap “forked” to positive case

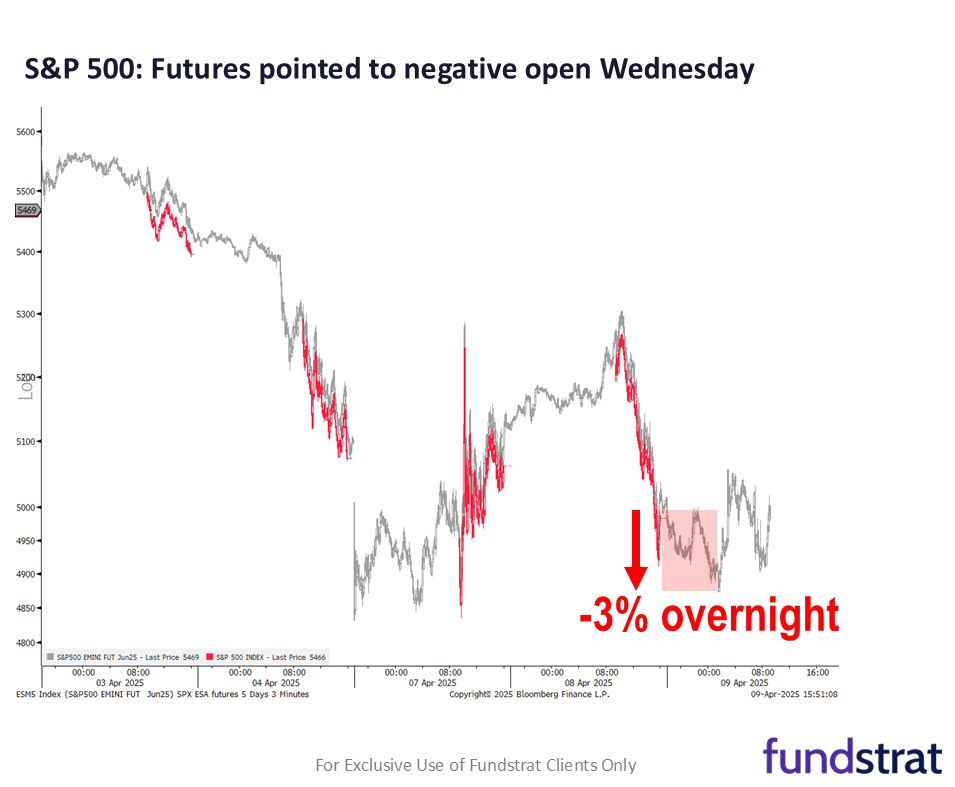

- While stocks ultimately finished sharply higher, the day began with ominous signals.

– Overnight futures were down more than 3%, and headlines early in the day included JPMorgan CEO Jamie Dimon warning of a likely recession.

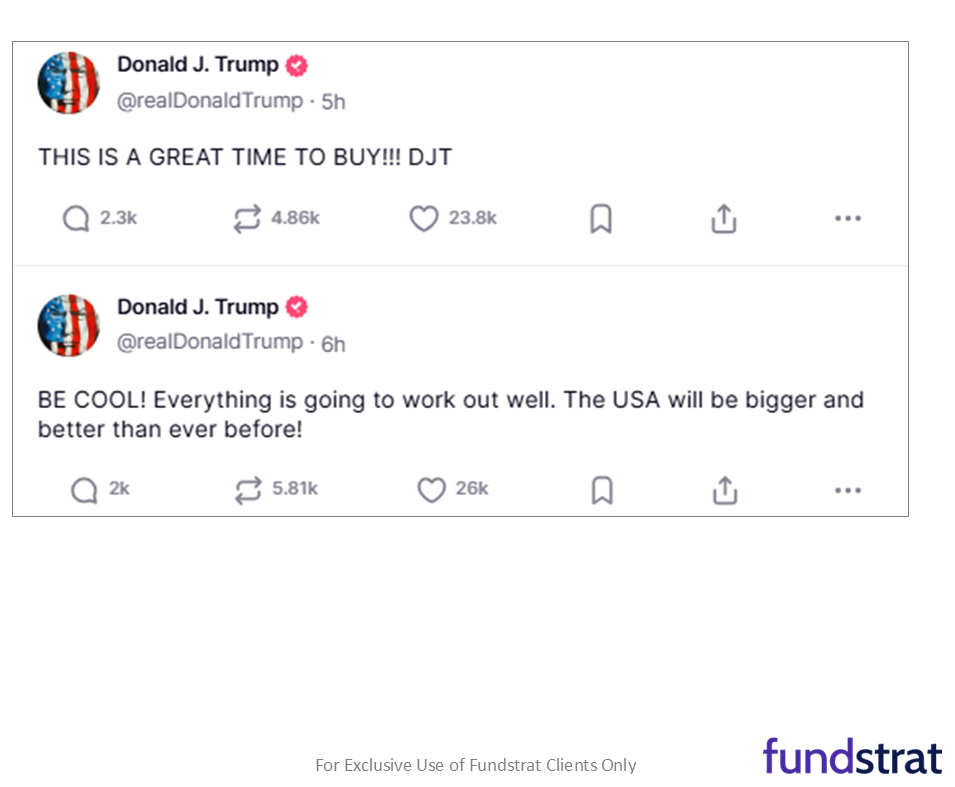

– President Trump, however, countered the growing pessimism by calling for calm and optimism, stating, “This is a great time to buy,” and later announcing a 90-day pause on reciprocal tariffs at 1pm.

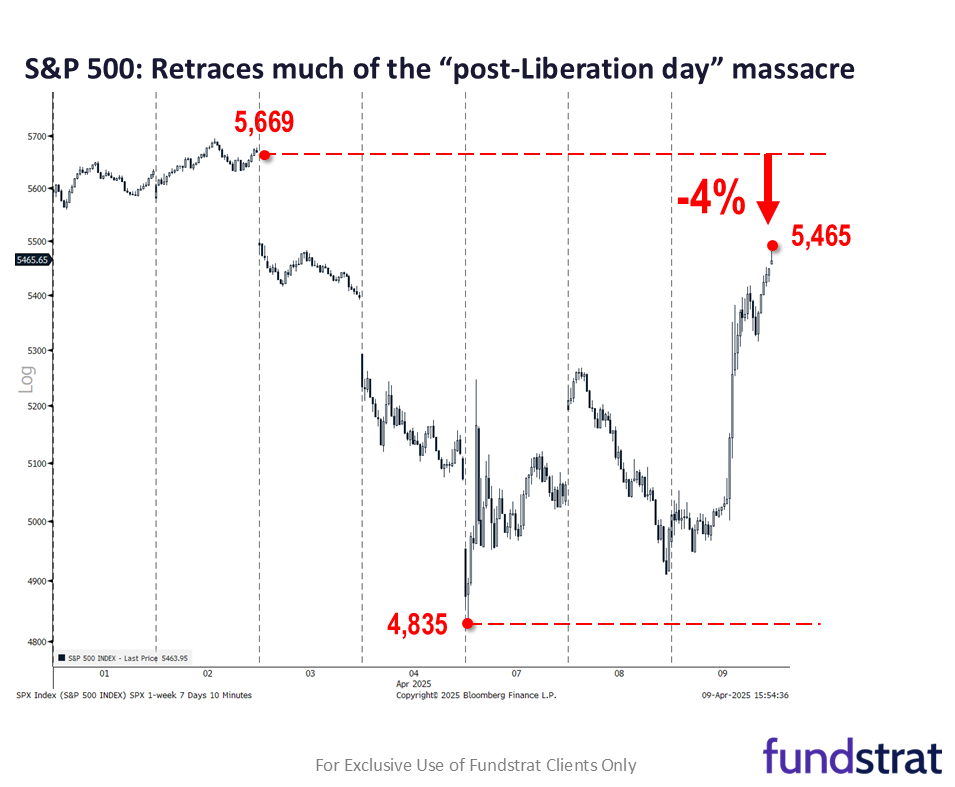

– This surprise policy pivot catalyzed a sharp intraday reversal and helped stocks close not only higher on the day, but above Thursday’s levels, nearly erasing losses since the tariff escalation began. - This development reinforces the idea of a “Trump put,” a belief that the White House is sensitive to equity market declines and will intervene if downside pressure threatens broader sentiment.

– While administration officials often draw a distinction between Main Street and Wall Street, today’s action demonstrates that the stock market still matters to policymakers.

– The ability and willingness of the President to step in provides investors with a backstop—key in maintaining confidence during periods of macro uncertainty. - In addition to restoring market confidence, today’s events reduced the perceived risk of recession.

– Betting markets like Polymarket showed the odds of a U.S. recession were above 60% just yesterday—a level we called “DEFCON 3.”

– But following the risk-on rally, those odds declined to 50%, suggesting markets are once again pricing in a more benign economic outcome.

– If recession odds had crossed above 80%, we argued, it would have effectively confirmed a downturn. - Another encouraging signal is what we call the “Navarro call.”

– With Peter Navarro notably absent from the White House briefing on the tariff pause, it suggests his influence on trade policy may be waning (a “Navarro call”).

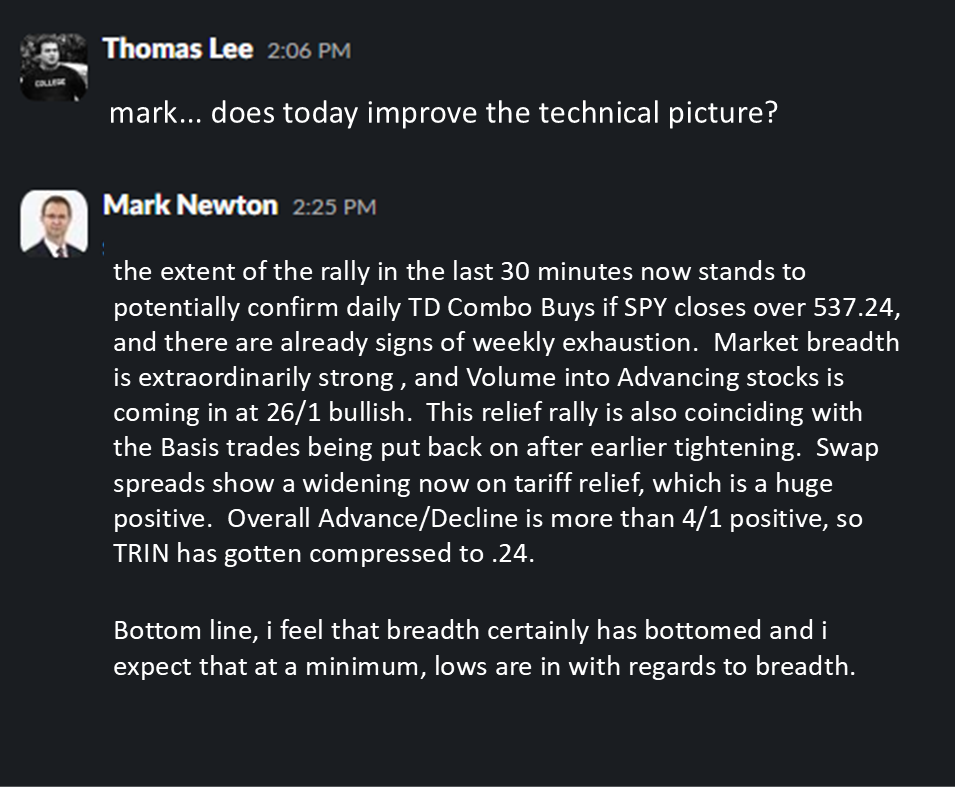

– Navarro is seen by markets as a hawkish voice on tariffs, so his absence indicates a possible shift back toward more market-friendly advisors like Larry Kudlow or Steve Bannon, whose presence tends to reassure investors. - From a technical perspective, Mark Newton notes that today’s sharp reversal adds confirmation to recent TD Combo buy signals, particularly for the SPY and broader S&P 500.

– Newton highlighted the significance of the 5,370 level, which was decisively breached to the upside with today’s close near 5,400.

– This lends further support to the idea that markets may now be shifting decisively back toward the “positive fork” scenario—a bullish roadmap that we laid out earlier this week. - This restoration of bullish momentum has broader implications.

– First, it affirms that the market remains in a bull trend and reestablishes the credibility of the “White House put.” This adds confidence for investors, who otherwise might fear a bidless tape if both the Fed and the White House were sidelined. - Second, it provides companies with a new narrative to guide expectations.

– As one client noted, firms now have a credible excuse to cut guidance without triggering panic.

– For instance, DAL rallied today despite lowering forward guidance, an example of how investor expectations may be recalibrated more constructively. - Third, the temporary tariff pause introduces the possibility of a longer-term shift.

– If this period allows for de-escalation, the administration may argue that tariffs can work as a negotiation tool—especially when combined with tax cuts and deregulation.

– The shift in tone opens the door for renewed optimism around corporate earnings and economic growth. - The rally also marks a substantial reversal of recent technical damage. While a further move to 5,500 by the S&P 500 would be even more constructive, the recovery to current levels already restores much of the lost footing.

– Reclaiming 5,756 would be an even stronger signal of strength—and now appears within reach. - Ultimately, today’s action helped improve market psychology at a time when investor confidence was at risk of breaking.

– With stocks deeply stretched to the downside and recession fears swirling, many wondered whether the earnings picture had any anchors left.

– But today’s developments suggest those fears may have peaked.

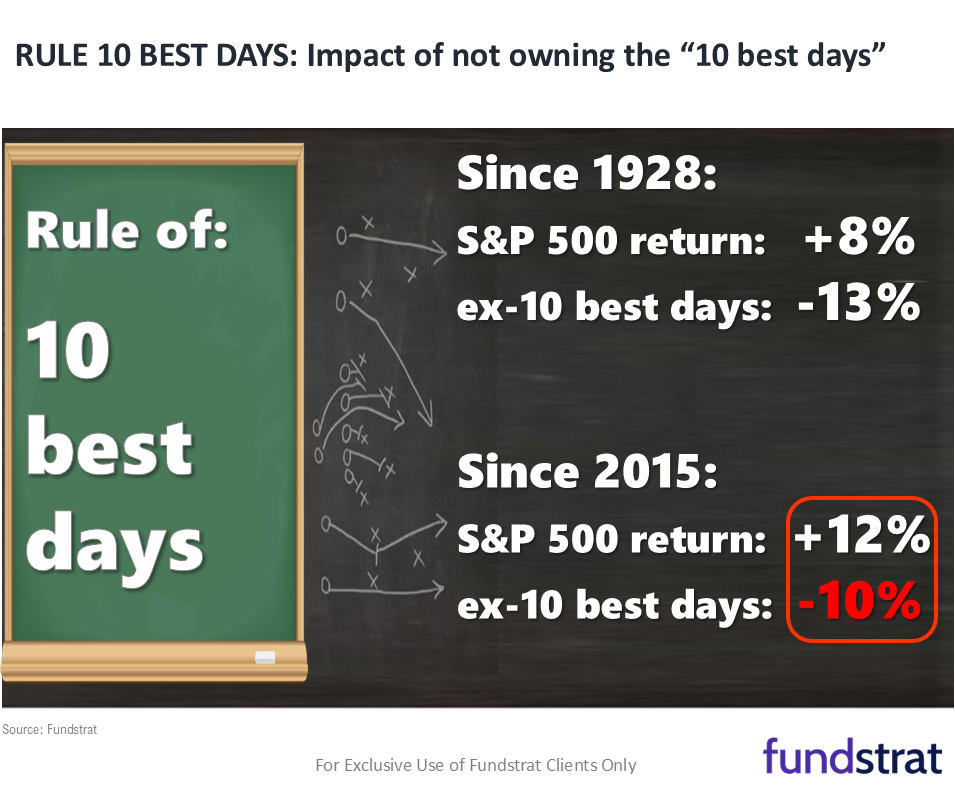

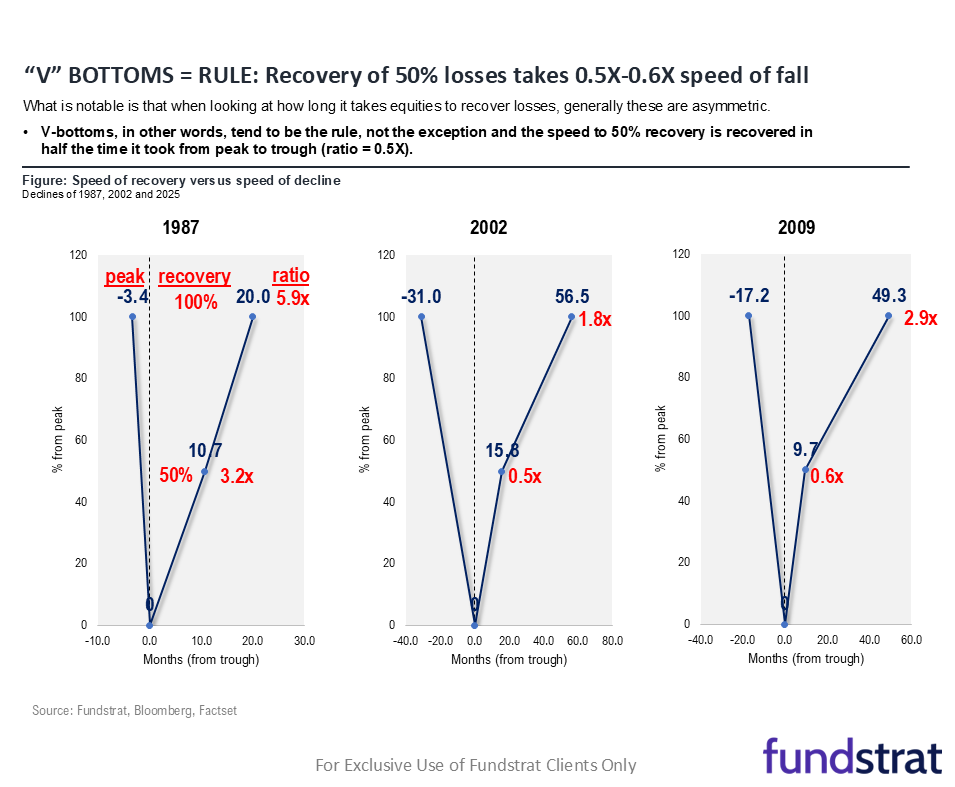

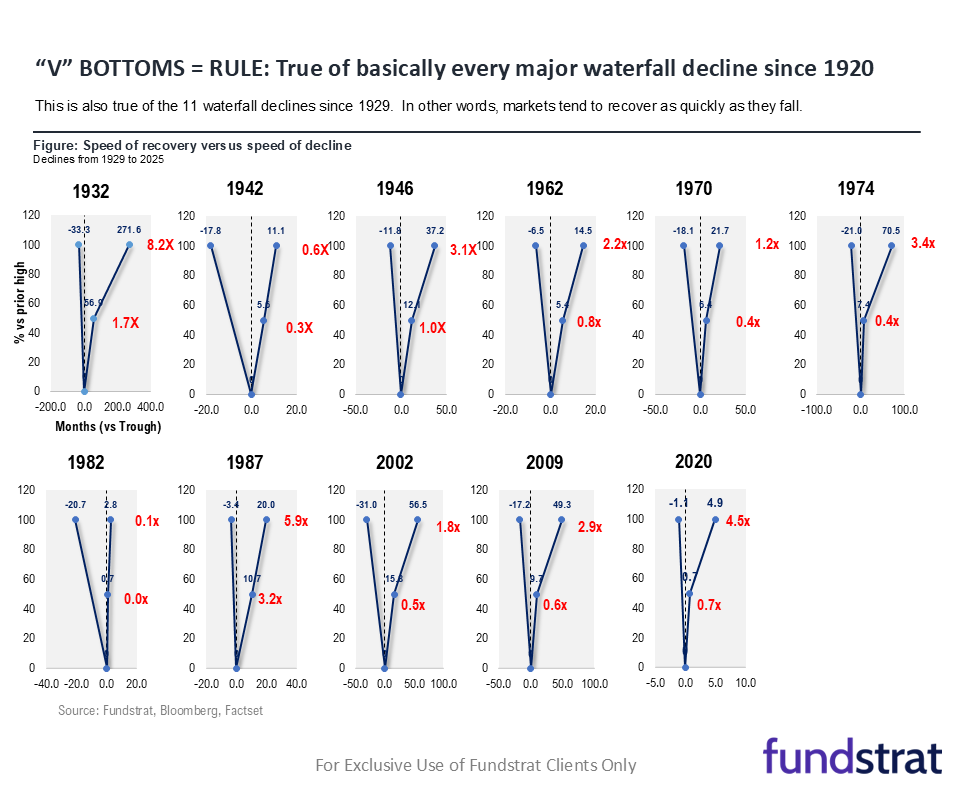

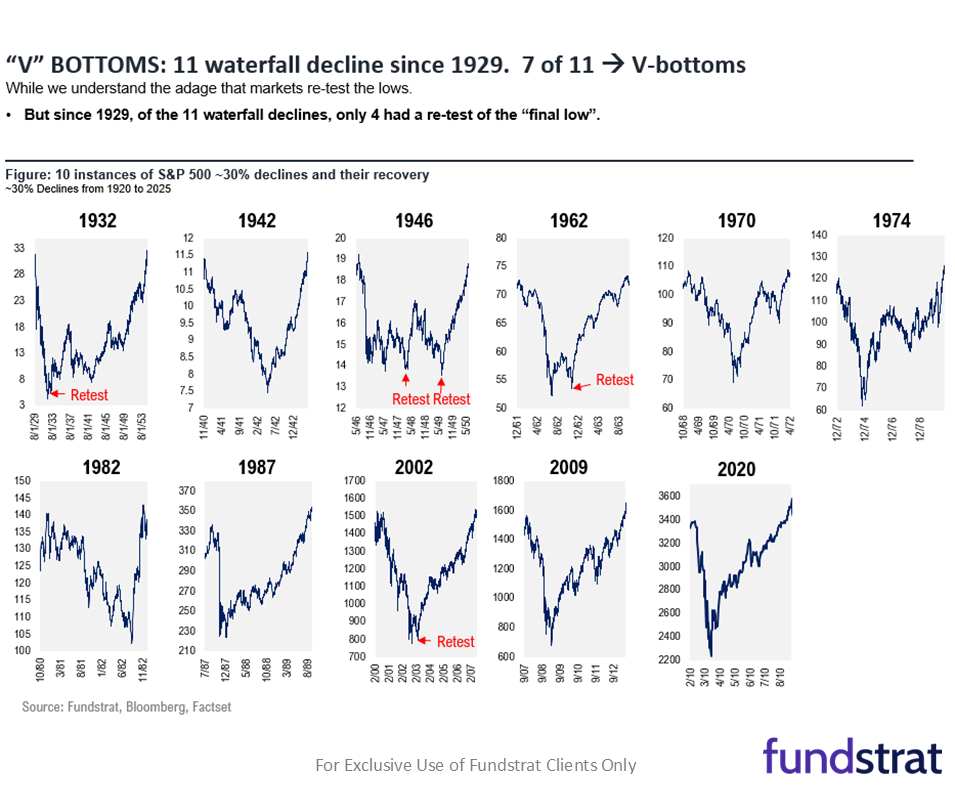

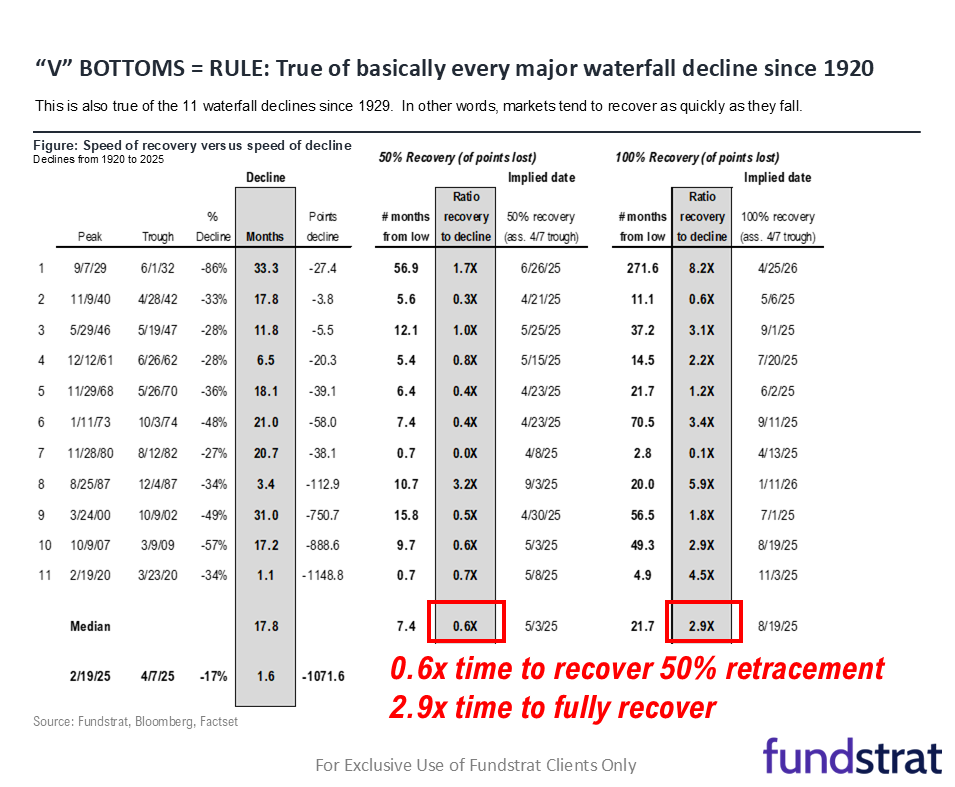

Bottom Line: This rally has the potential to morph into a V-shaped recovery, affirming that we remain in a bull market.

_____________________________

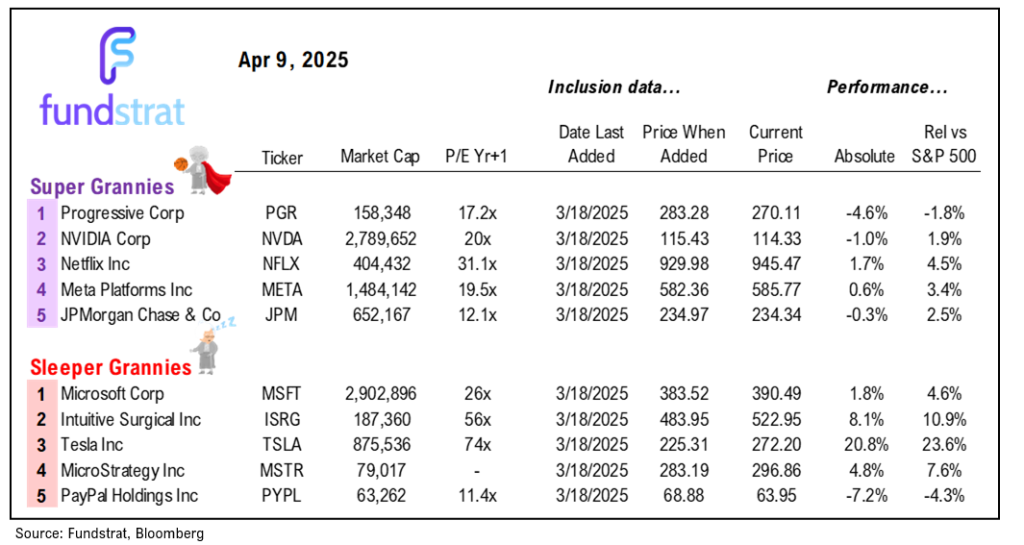

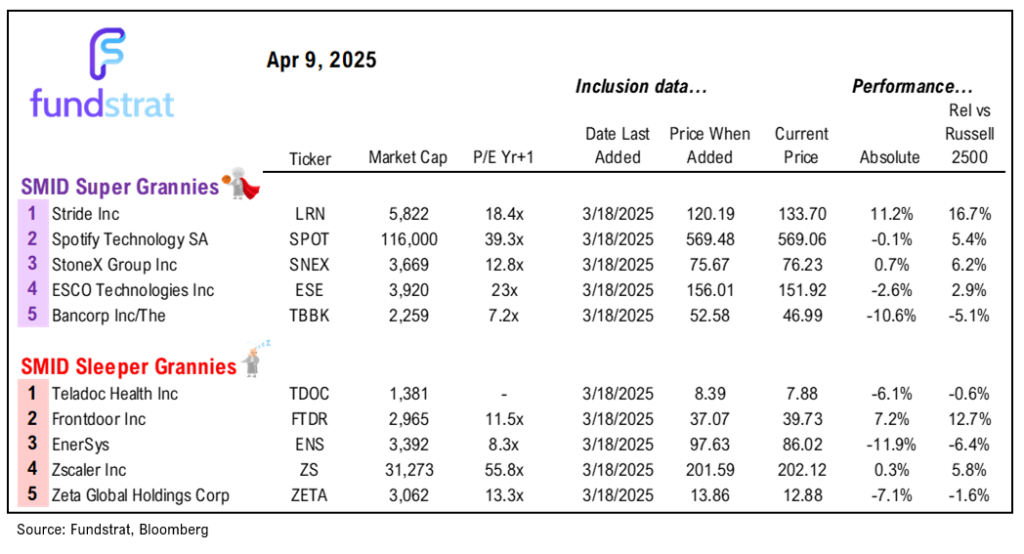

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 2/18. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

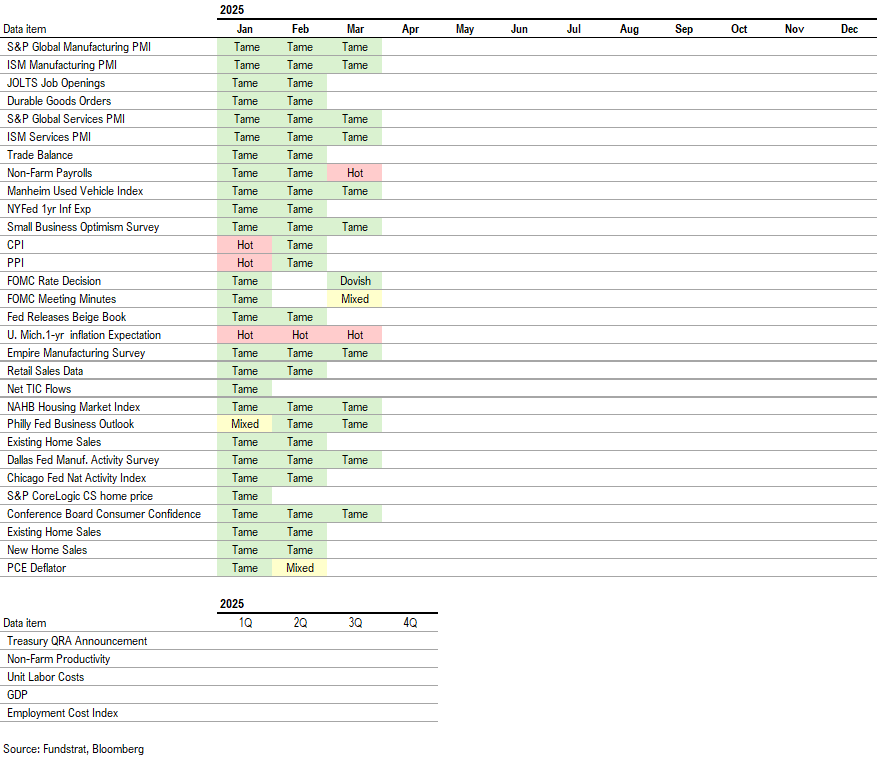

Key incoming data April:

4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMITame4/1 10:00 AM ET: Mar ISM Manufacturing PMITame4/1 10:00 AM ET: Feb JOLTS Job OpeningsTame4/2 10:00 AM ET: Feb F Durable Goods Orders MoMTame4/3 8:30 AM ET: Feb Trade BalanceTame4/3 9:45 AM ET: Mar F S&P Global Services PMITame4/3 10:00 AM ET: Mar ISM Services PMITame4/4 8:30 AM ET: Mar Non-farm PayrollsHot4/7 9:00 AM ET: Mar F Manheim Used Vehicle IndexTame4/8 6:00 AM ET: Mar Small Business Optimism SurveyTame4/9 2:00 PM ET: Mar FOMC Meeting MinutesMixed- 4/10 8:30 AM ET: Mar Core CPI MoM

- 4/11 8:30 AM ET: Mar Core PPI MoM

- 4/11 10:00 AM ET: Apr P U. Mich. 1yr Inf Exp

- 4/14 11:00 AM ET: Mar NYFed 1yr Inf Exp

- 4/15 8:30 AM ET: Apr Empire Manufacturing Survey

- 4/16 8:30 AM ET: Mar Retail Sales

- 4/16 10:00 AM ET: Apr NAHB Housing Market Index

- 4/16 4:00 PM ET: Feb Net TIC Flows

- 4/17 8:30 AM ET: Apr Philly Fed Business Outlook

- 4/17 9:00 AM ET: Apr M Manheim Used Vehicle Index

- 4/23 9:45 AM ET: Apr P S&P Global Services PMI

- 4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMI

- 4/23 10:00 AM ET: Mar New Home Sales

- 4/23 2:00 PM ET: Apr Fed Releases Beige Book

- 4/24 8:30 AM ET: Mar P Durable Goods Orders MoM

- 4/24 8:30 AM ET: Mar Chicago Fed Nat Activity Index

- 4/24 10:00 AM ET: Mar Existing Home Sales

- 4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

Economic Data Performance Tracker 2025:

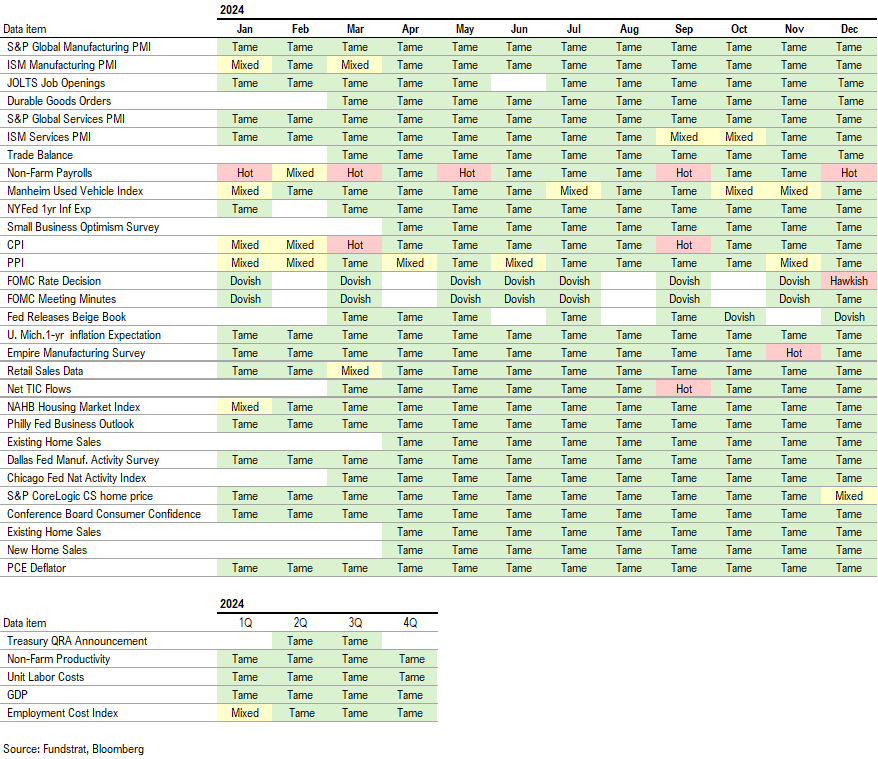

Economic Data Performance Tracker 2024:

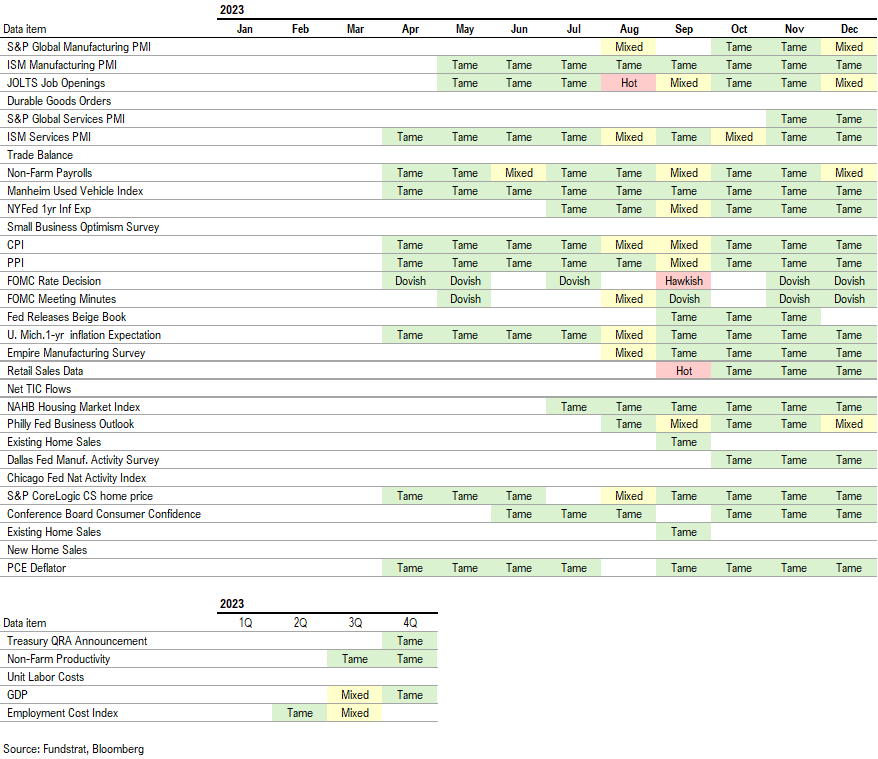

Economic Data Performance Tracker 2023: