VIDEO: Overall, its been a good week, with equities showing resilience. The jobs report matters on Friday.

Please click below to view our Macro Minute (duration: 5:39).

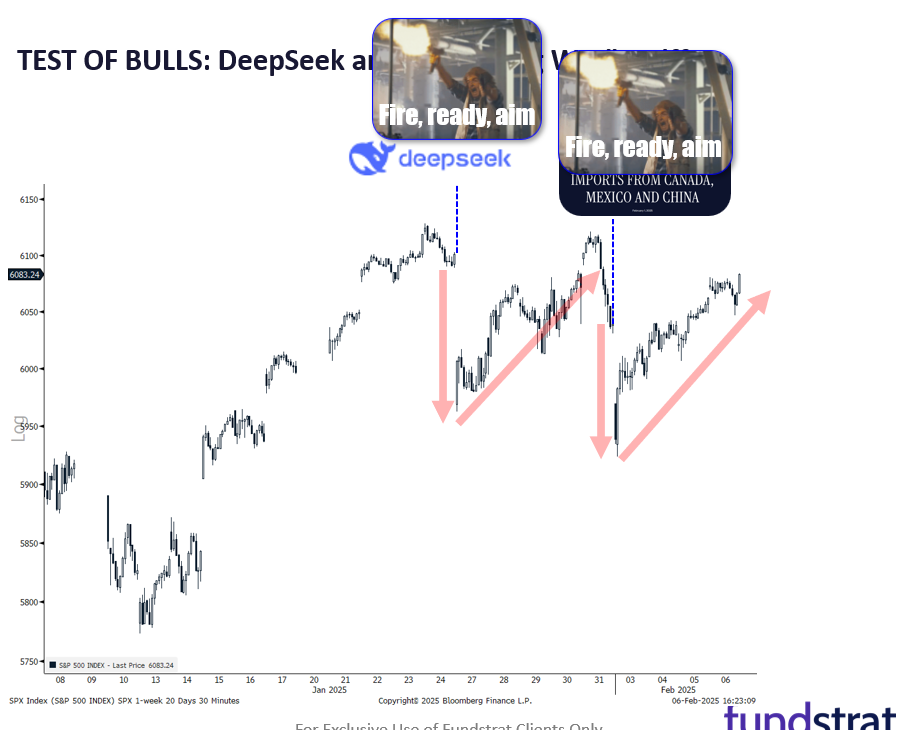

This week has been a positive test for equity markets. After a sizable plunge Monday (“drug tariff” reaction), equity markets are on track for a slight gain as of Thursday’s close. As noted several times recently, this is the second consecutive “Monday surprise” (last week, DeepSeek) and equities managed to shrug off those fears. To me, this is a sign that 2025 likely proves to be better than our base case.

- Our base case for 2025 is the S&P 500 reaches 7,000 by mid-year and probably sees a weaker 2H ending the year at 6,600. But this is just a “base case” and so far, 2025 is tracking better than this.

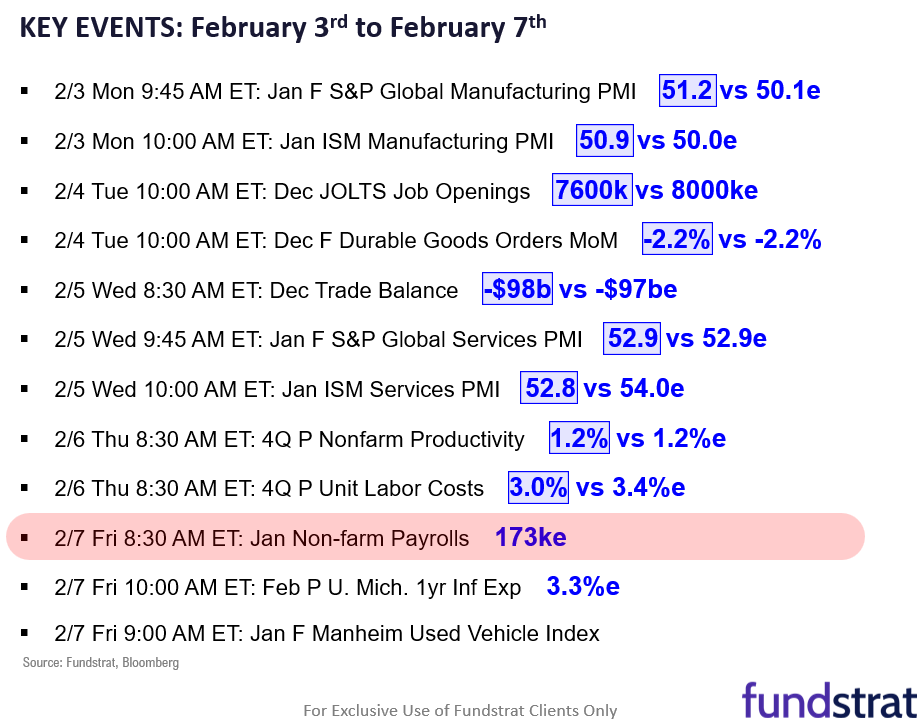

- This has been a good week for data, supporting the view that the US economy is strong but also that inflationary pressures are not necessarily accelerating:

– 2/3 Mon 9:45 AM ET: Jan F S&P Global Manufacturing PMI 51.2 vs 50.1e

– 2/3 Mon 10:00 AM ET: Jan ISM Manufacturing PMI 50.9 vs 50.0e

– 2/4 Tue 10:00 AM ET: Dec JOLTS Job Openings 7600k vs 8000ke

– 2/4 Tue 10:00 AM ET: Dec F Durable Goods Orders MoM -2.2% vs -2.2%

– 2/5 Wed 8:30 AM ET: Dec Trade Balance -$98b vs -$97be

– 2/5 Wed 9:45 AM ET: Jan F S&P Global Services PMI 52.9 vs 52.9e

– 2/5 Wed 10:00 AM ET: Jan ISM Services PMI 52.8 vs 54.0e

– 2/6 Thu 8:30 AM ET: 4Q P Nonfarm Productivity 1.2% vs 1.2%e

– 2/6 Thu 8:30 AM ET: 4Q P Unit Labor Costs 3.0% vs 3.4%e

– 2/7 Fri 8:30 AM ET: Jan Non-farm Payrolls 173ke

– 2/7 Fri 10:00 AM ET: Feb P U. Mich. 1yr Inf Exp 3.3%e

– 2/7 Fri 9:00 AM ET: Jan F Manheim Used Vehicle Index - The standouts for the positive data are:

– Jan ISM above 50 for the first time in 26 months

– this likely signals accelerating EPS growth for small-caps and broader index

– Dec JOLTS job openings came in below consensus at 7.6mm,

– second lowest since pandemic and signals a soft jobs market

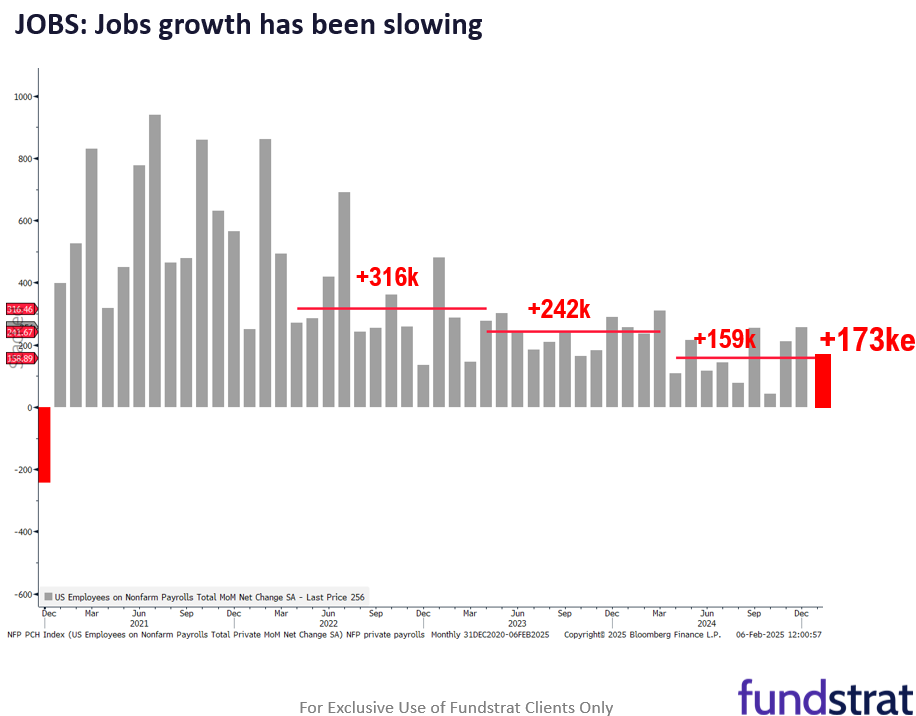

- The Jan jobs report, released on Friday at 8:30am ET is consequential. And a “worse” than consensus reading is better:

– the Street is looking for 173k jobs added

– the average for past 6 months is ~150k

– this is about the level of labor market growth,

– so it is not inflationary

- But a softer reading could pull forward (earlier) a rate cut. As Fed Chair Powell said at the Jan FOMC press conference:

“the labor market is at a sustainable level, it’s not overheated anymore, we don’t think we need it to cool off anymore, we do watch it extremely carefully.” - So the Fed does not want to see much further deterioration in the jobs market.

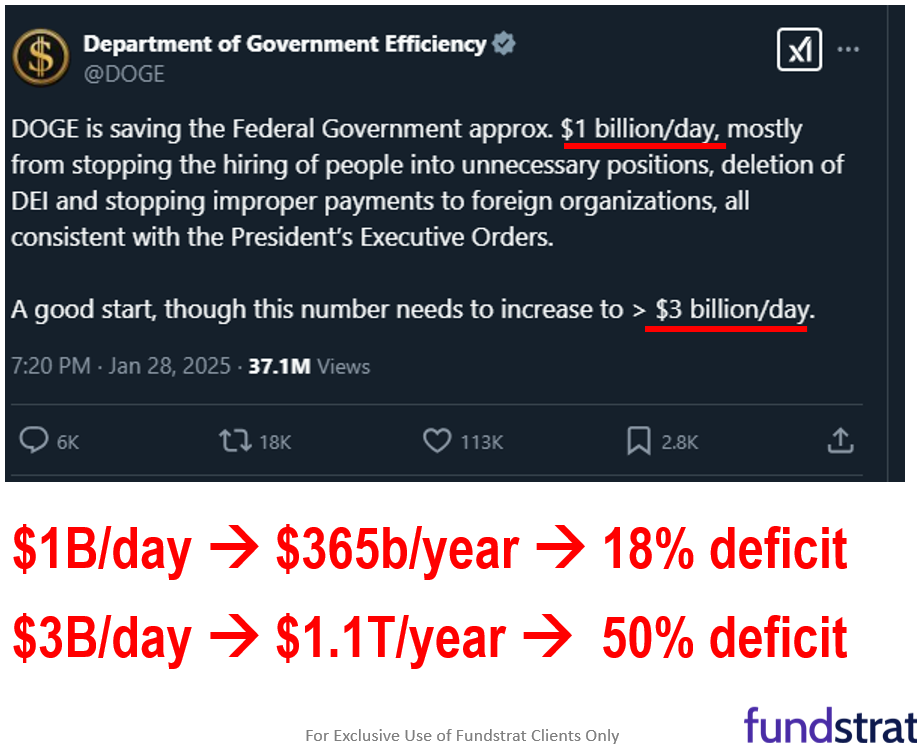

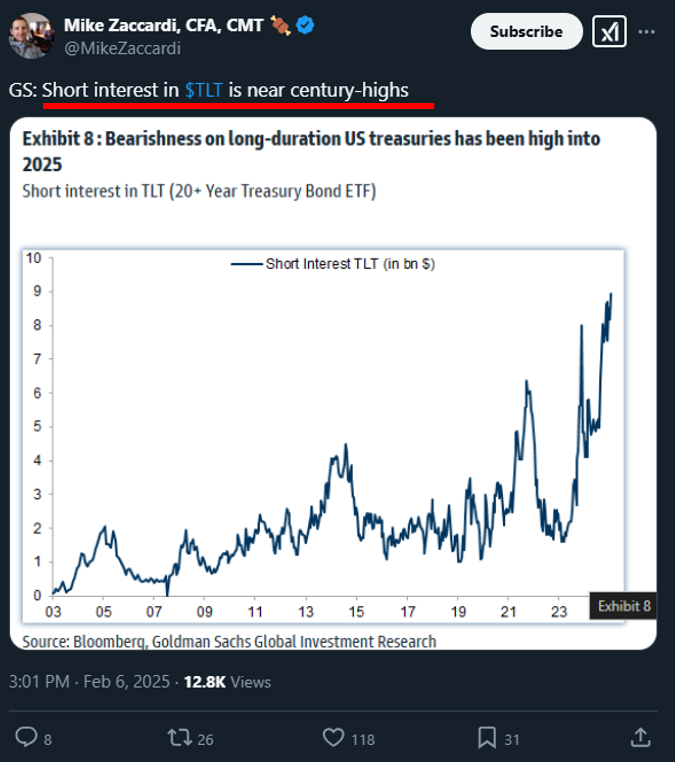

- US yields have softened since reaching 4.80% in mid-Jan. And at 4.42%, are a meaningful pullback in yield. We believe some of this is attributable to DOGE, the agency headed by Elon Musk. In a recent x.com tweet by @DOGE, they stated:

– “DOGE is saving the Federal Government approx. $1 billion/day, mostly from stopping the hiring of people into unnecessary positions, deletion of DEI and stopping improper payments to foreign organizations, all consistent with the President’s Executive Orders. “

– “A good start, though this number needs to increase to > $3 billion/day.” - This is would make a meaningful impact on the US deficit:

– $1b per day -> $365b per year -> 18% deficit

– $3b per day -> $1.1T per year -> 50% deficit - A 50% reduction in the deficit is astounding. Of course, this is only theoretical. But we believe the fact these savings are being found is also possibly putting downside pressure on interest rates.

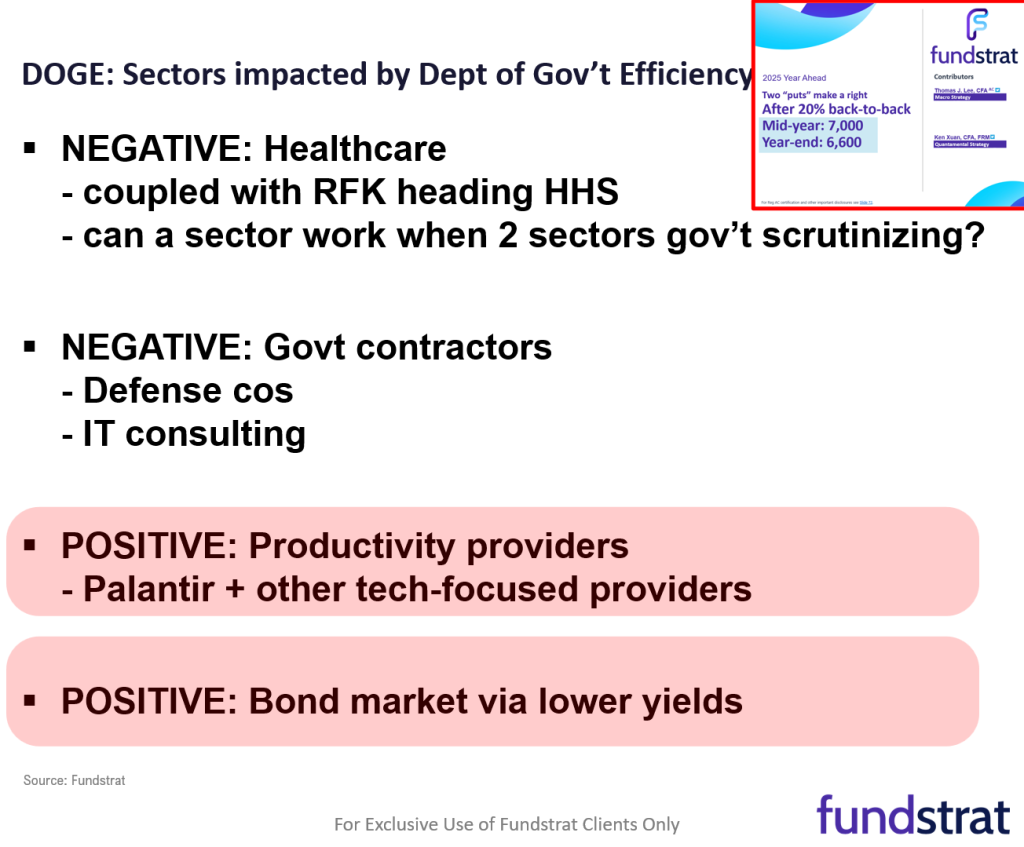

- In our 2025 Year Ahead, we noted that DOGE likely has the following implications:

– NEGATIVE: Healthcare: coupled with RFK heading HHS

– can a sector work when 2 divisions gov’t scrutinizing?

– NEGATIVE: Govt contractors: Defense cos, IT consulting

– POSITIVE: Productivity providers such as PLTR Palantir

– POSITIVE: Bond market via lower yields

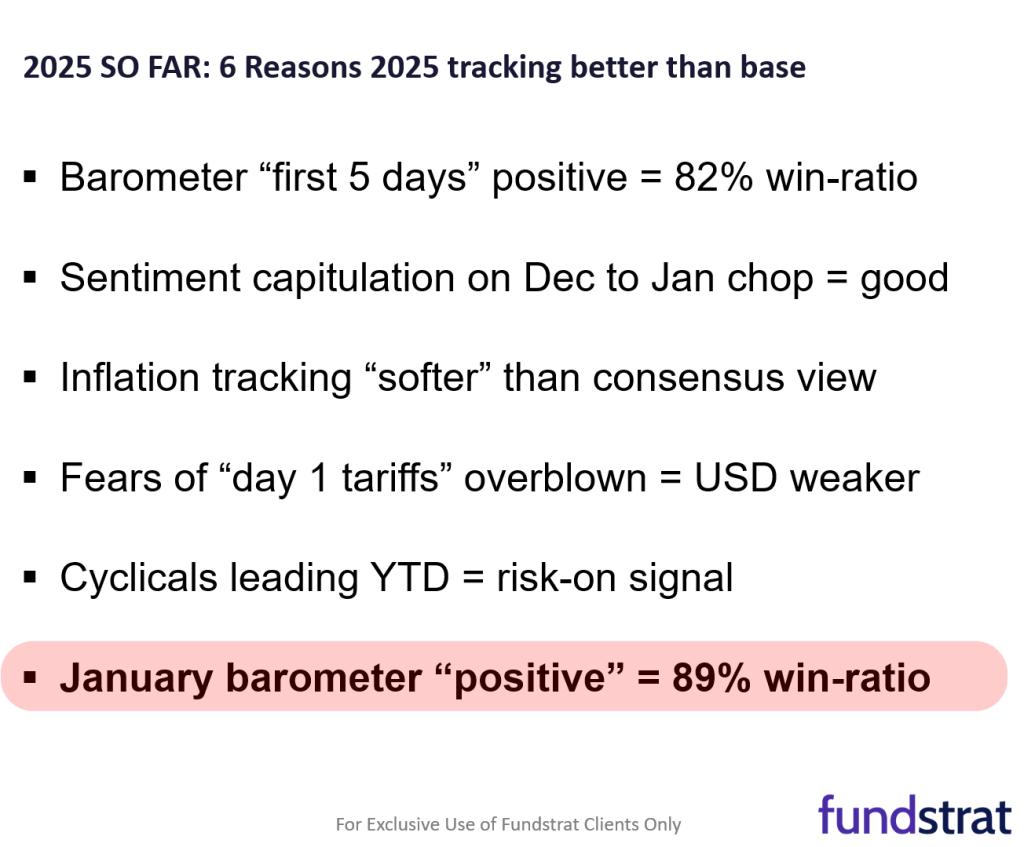

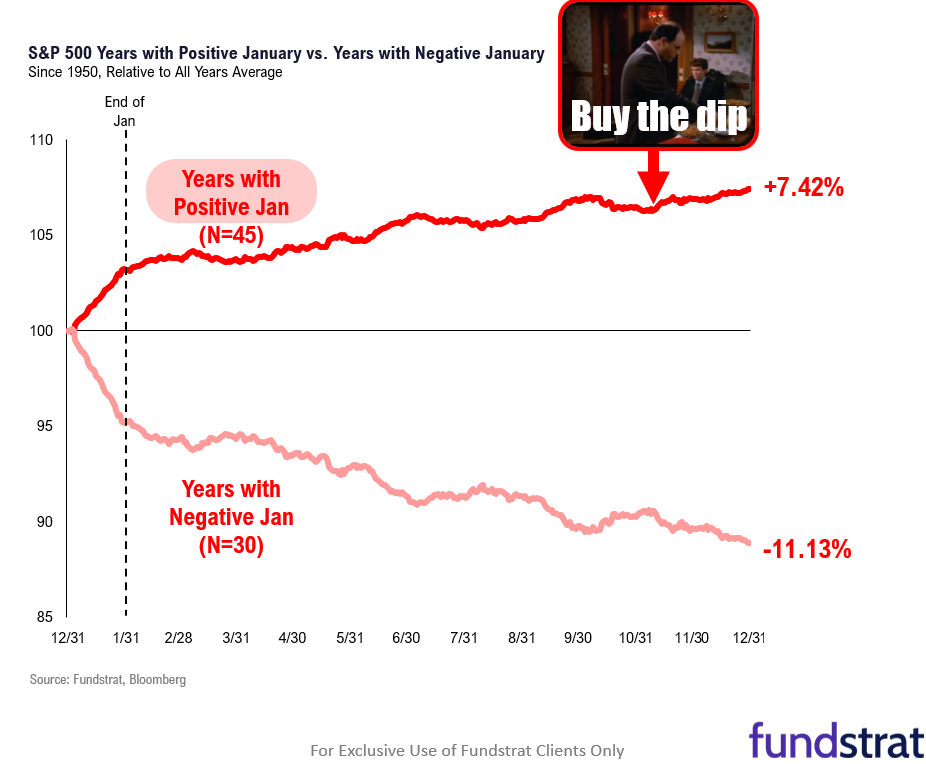

BOTTOM LINE: Investors are “buying the dip” as 2025 is tracking better than expected

Overall, there are six reasons that show 2025 tracking better than our base case:

- Barometer “first 5 days” positive = 82% win-ratio

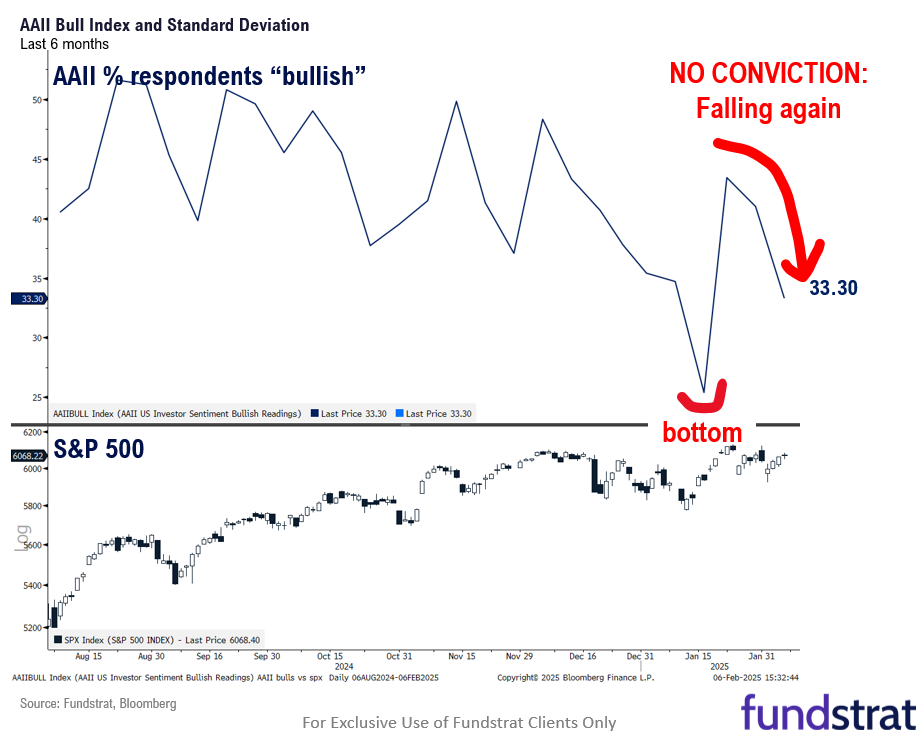

- Sentiment capitulation on Dec to Jan chop = good

- Inflation tracking “softer” than consensus view

- Fears of “day 1 tariffs” overblown = USD weaker

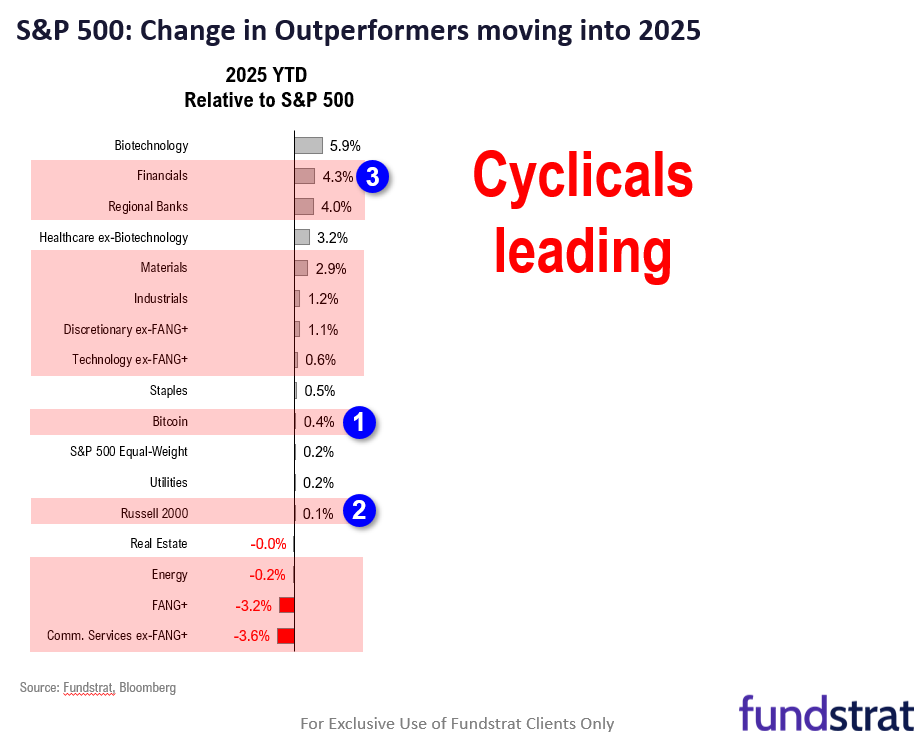

- Cyclicals leading YTD = risk-on signal

- January barometer “positive” = 89% win-ratio

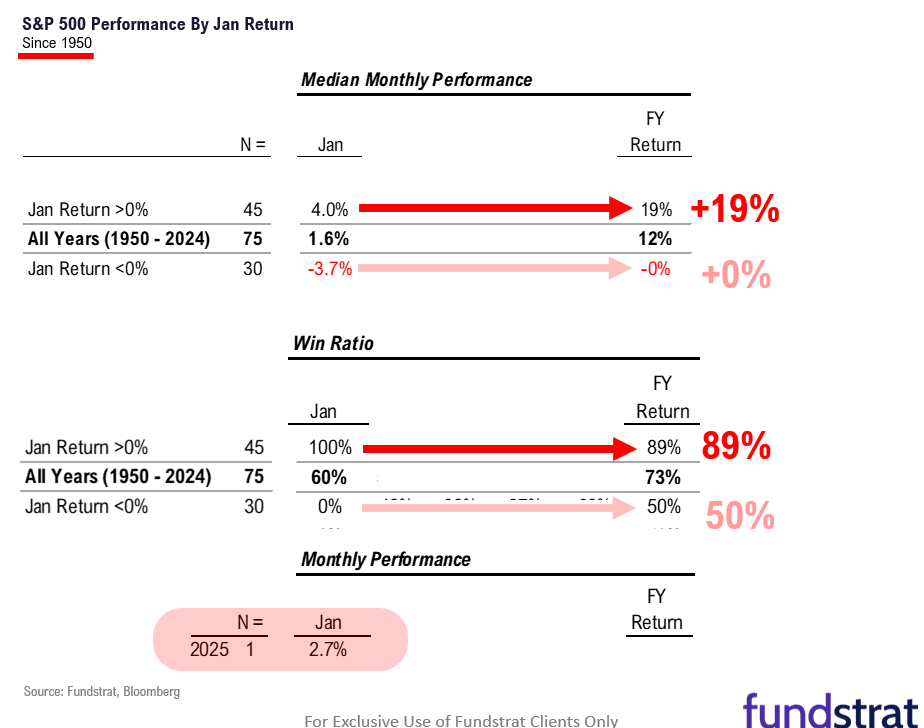

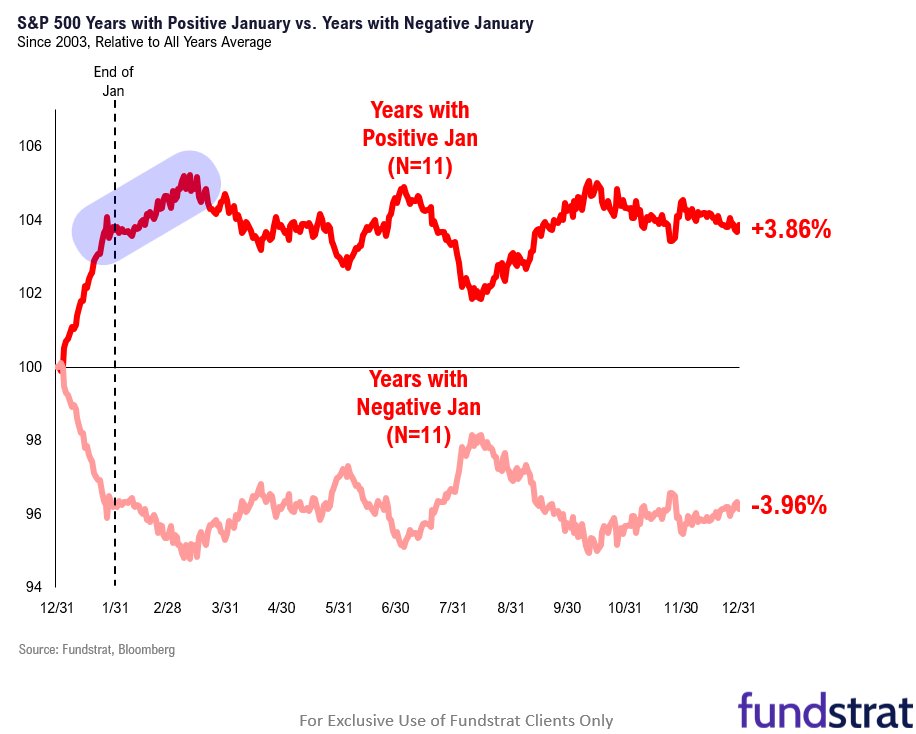

- January 2025 closed +2.7%. This is the January barometer “as January goes, so goes the year”:

– The January barometer is as follows:

– If January positive:

– Median FY +19%, 89% win-ratio

– If January negative:

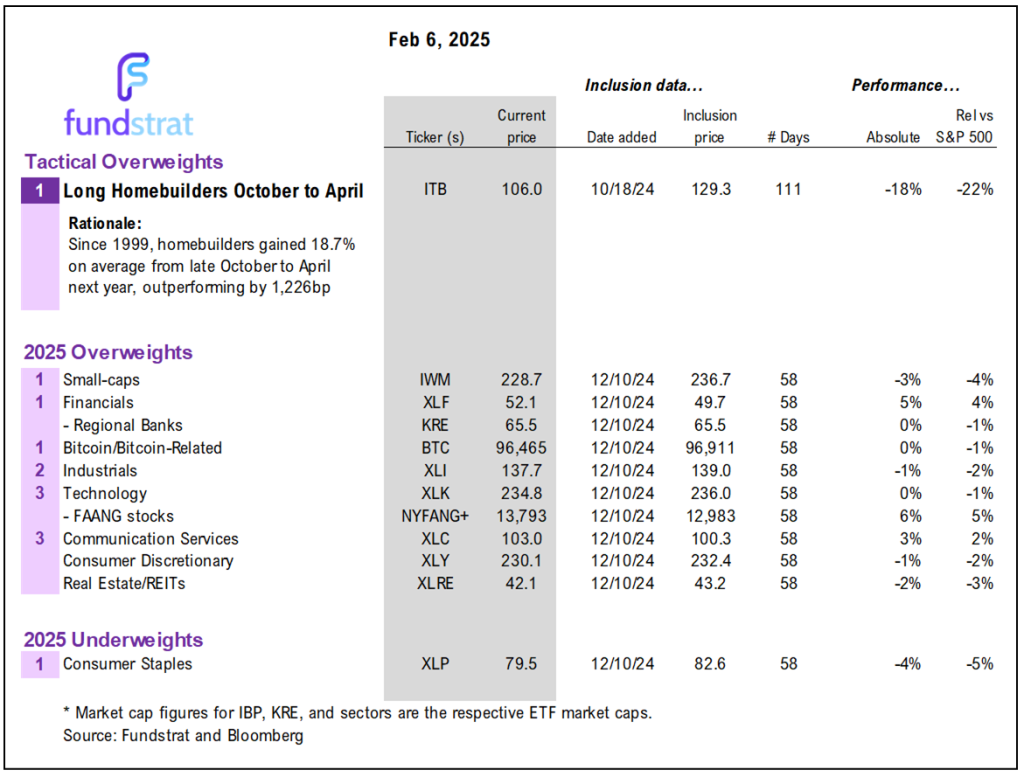

– Median FY +0%, 50% win-ratio - The top sector ideas remain:

- Bitcoin

- Small-caps

- Financials

- Industrials

- Technology

_____________________________

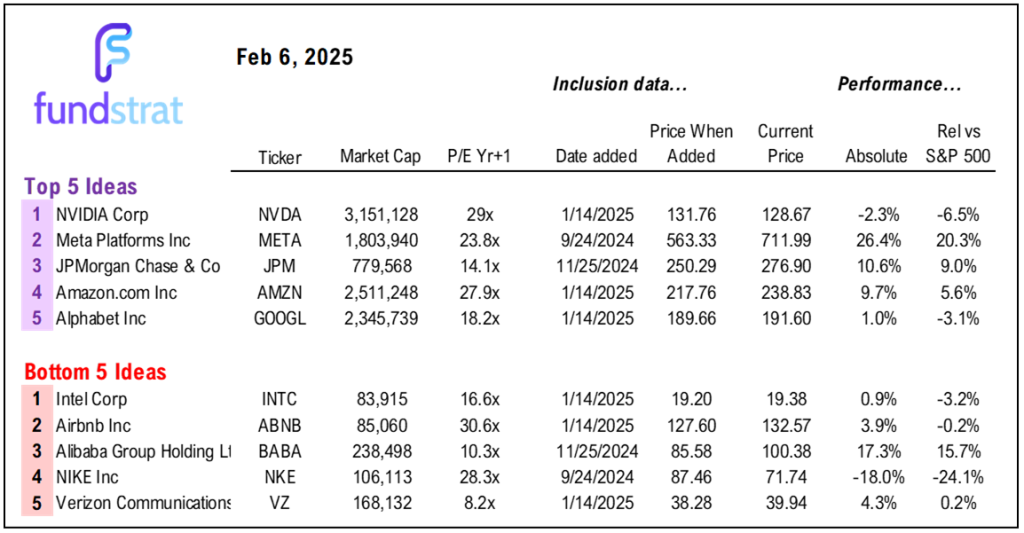

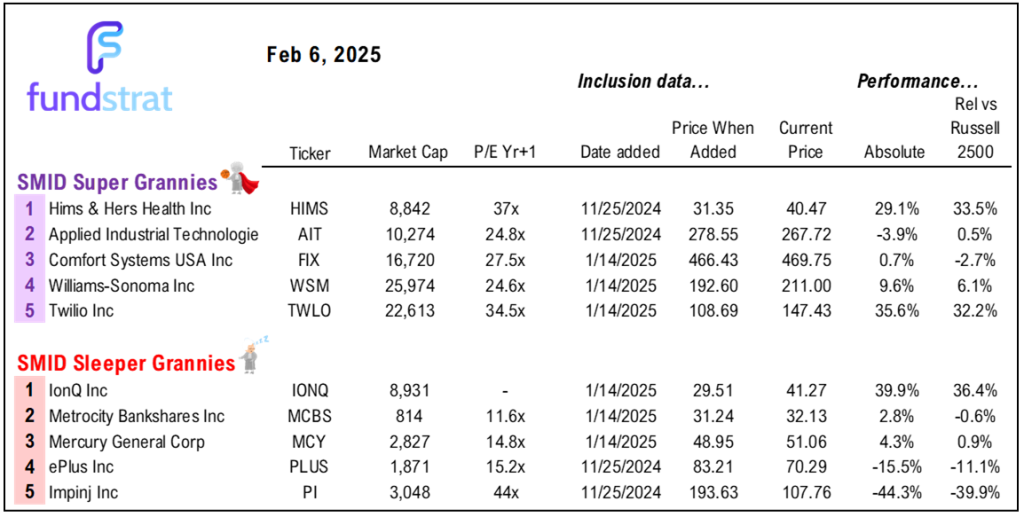

44 SMID Granny Shot Ideas: We performed our quarterly rebalance on 11/25. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

___________________________

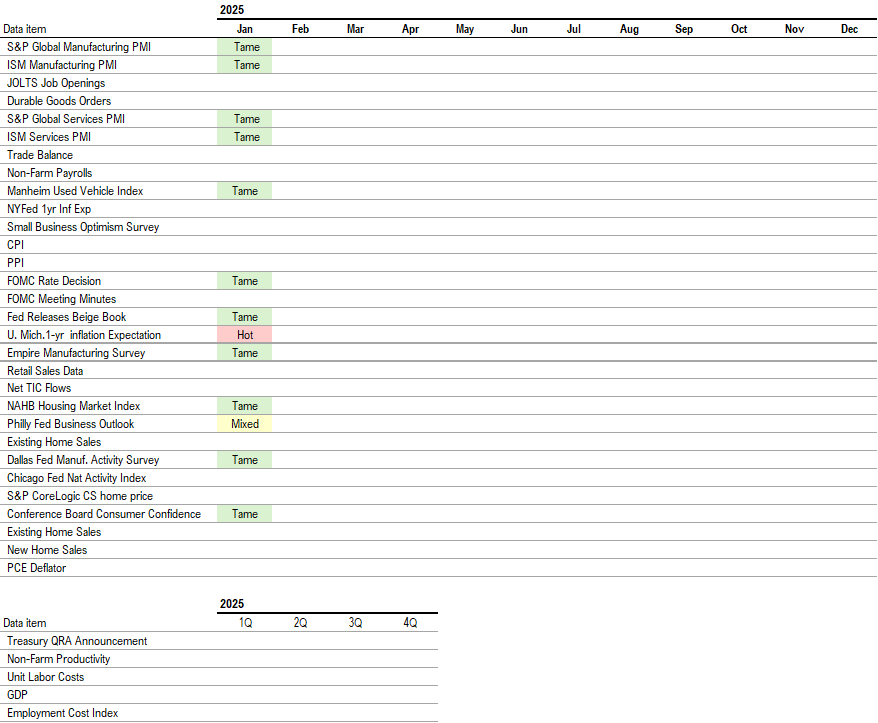

Key incoming data February:

2/3 9:45 AM ET: Jan F S&P Global Manufacturing PMITame2/3 10:00 AM ET: Jan ISM Manufacturing PMITame2/4 10:00 AM ET: Dec JOLTS Job OpeningsTame2/4 10:00 AM ET: Dec F Durable Goods OrdersTame2/5 8:30 AM ET: Dec Trade BalanceTame2/5 9:45 AM ET: Jan F S&P Global Services PMITame2/5 10:00 AM ET: Jan ISM Services PMITame2/6 8:30 AM ET: 4Q P Non-Farm ProductivityTame2/6 8:30 AM ET: 4Q P Unit Labor CostsTame- 2/7 8:30 AM ET: Jan Non-Farm Payrolls

- 2/7 9:00 AM ET: Dec F Manheim Used Vehicle index

- 2/7 10:00 AM ET: Feb P U. Mich. Sentiment and Inflation Expectation

- 2/10 11:00 AM ET: Jan NY Fed 1yr Inf Exp

- 2/11 6:00 AM ET: Jan Small Business Optimism Survey

- 2/12 8:30 AM ET: Jan CPI

- 2/13 8:30 AM ET: Jan PPI

- 2/14 8:30 AM ET: Jan Retail Sales Data

- 2/18 8:30 AM ET: Feb Empire Manufacturing Survey

- 2/18 10:00 AM ET: Feb NAHB Housing Market Index

- 2/18 4:00 PM ET: Dec Net TIC Flows

- 2/19 9:00 AM ET: Jan M Manheim Used Vehicle index

- 2/19 2:00 PM ET: Jan FOMC Meeting Minutes

- 2/20 8:30 AM ET: Feb Philly Fed Business Outlook

- 2/21 9:45 AM ET: Feb P S&P Global Manufacturing PMI

- 2/21 9:45 AM ET: Feb P S&P Global Services PMI

- 2/21 10:00 AM ET: Feb F U. Mich. Sentiment and Inflation Expectation

- 2/21 10:00 AM ET: Jan Existing Home Sales

- 2/24 8:30 AM ET: Jan Chicago Fed Nat Activity Index

- 2/24 10:30 AM ET: Feb Dallas Fed Manuf. Activity Survey

- 2/25 9:00 AM ET: Dec S&P CoreLogic CS home price

- 2/25 10:00 AM ET: Feb Conference Board Consumer Confidence

- 2/26 10:00 AM ET: Jan New Home Sales

- 2/27 8:30 AM ET: 4Q S GDP

- 2/27 10:00 AM ET: Jan P Durable Goods Orders

- 2/28 8:30 AM ET: Jan PCE Deflator

Economic Data Performance Tracker 2025:

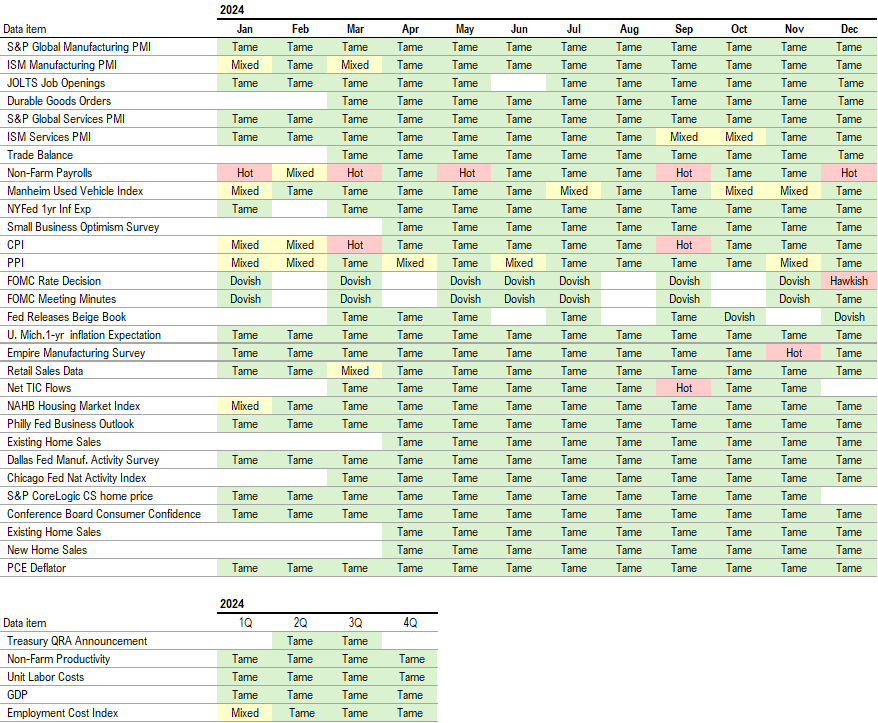

Economic Data Performance Tracker 2024:

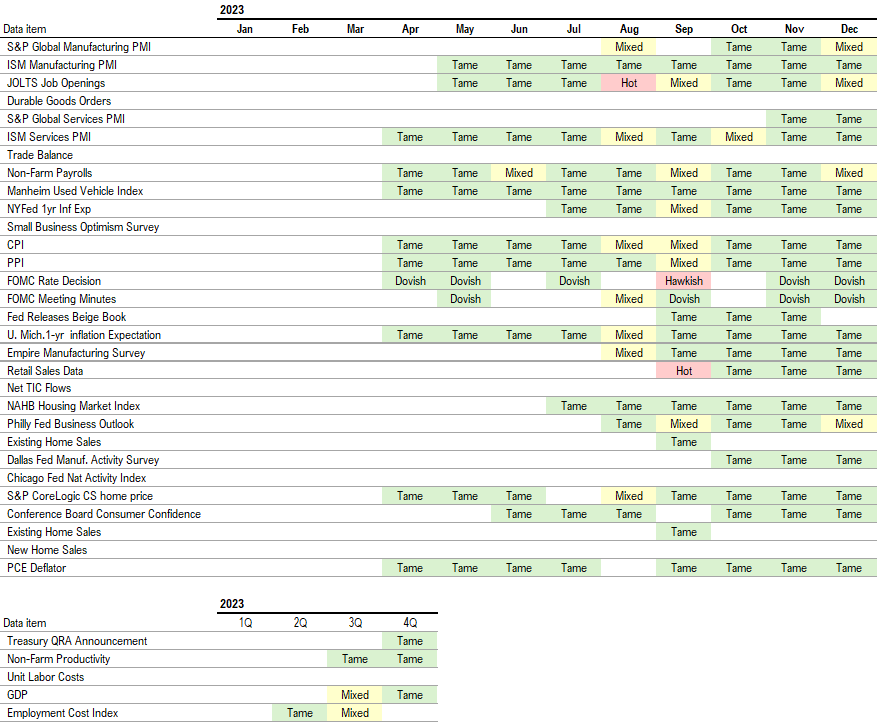

Economic Data Performance Tracker 2023: