VIDEO: While the S&P 500 is down slightly for the week, we believe this is a successful positive test of “resolve of bulls” given there are multiple excuses for a large sell-off including DeepSeek and tariff wars and AAPL miss

Please click below to view our Macro Minute (duration: 5:01).

The S&P 500 is down modestly this past week (-0.77%) which is a pretty solid outcome given the panic selling seen Monday post-DeepSeek R1 release. We view this week’s turbulence as a further test of the “resolve of bulls” and one that shows equity markets remain fairly resilient.

- Why was this week a test? Consider this:

– Week of 1/27/25: successful test “resolve of bulls”

– DeepSeek R1 sinks AI-related stocks

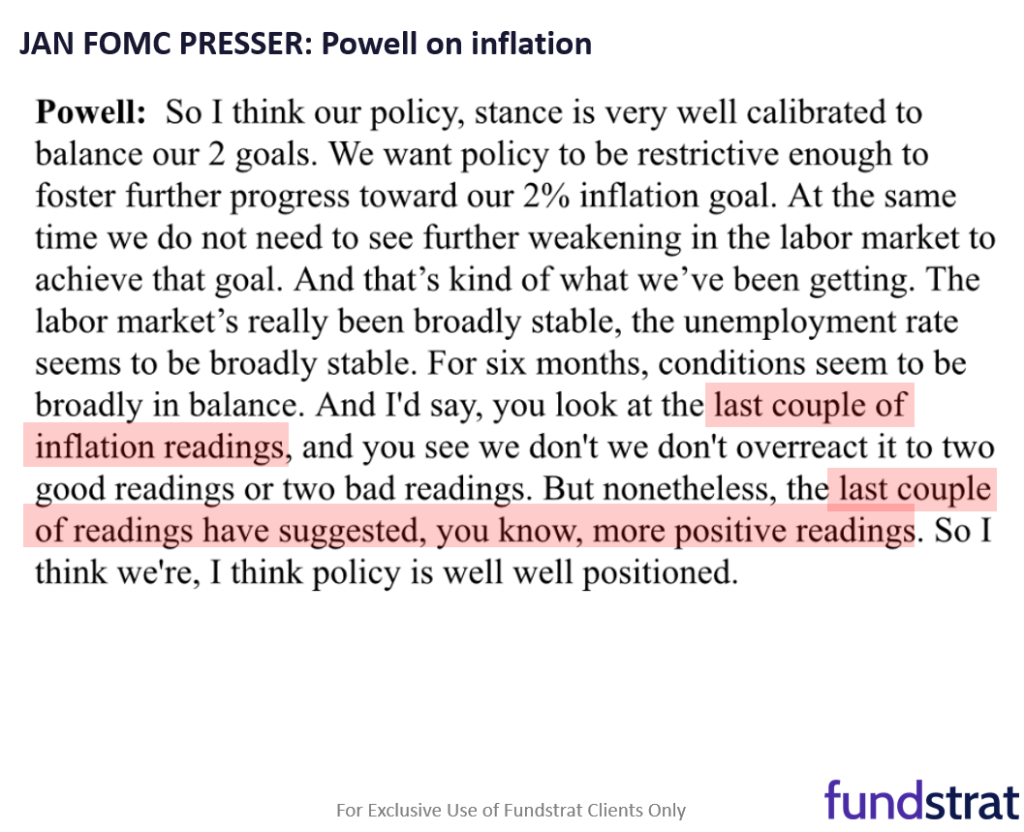

– Jan FOMC shows Fed “dovish” vs Dec FOMC

– 4Q24 Earnings strong: META TSLA = Good, MSFT = eh

– This Friday Dec Core PCE likely to show inflation tracking towards 2%, we believe - Overall, there were several opportunities for stocks to see extended weakness, but instead, equities managed to climb higher after that fierce sell-off Monday. In fact, near the close Thursday, headlines crossed that President Trump would follow through on tariffs for Mexico and Canada on February 1.

- While equities finished a bit softer after those headlines, the VIX and yields both moved lower. And this is showing markets are more measured in their reaction to the tariff news. Thus, while there is some technical damage that needs to be repaired (per Mark Newton), particularly with large-cap technology, we see this week’s price recovery as constructive for stocks.

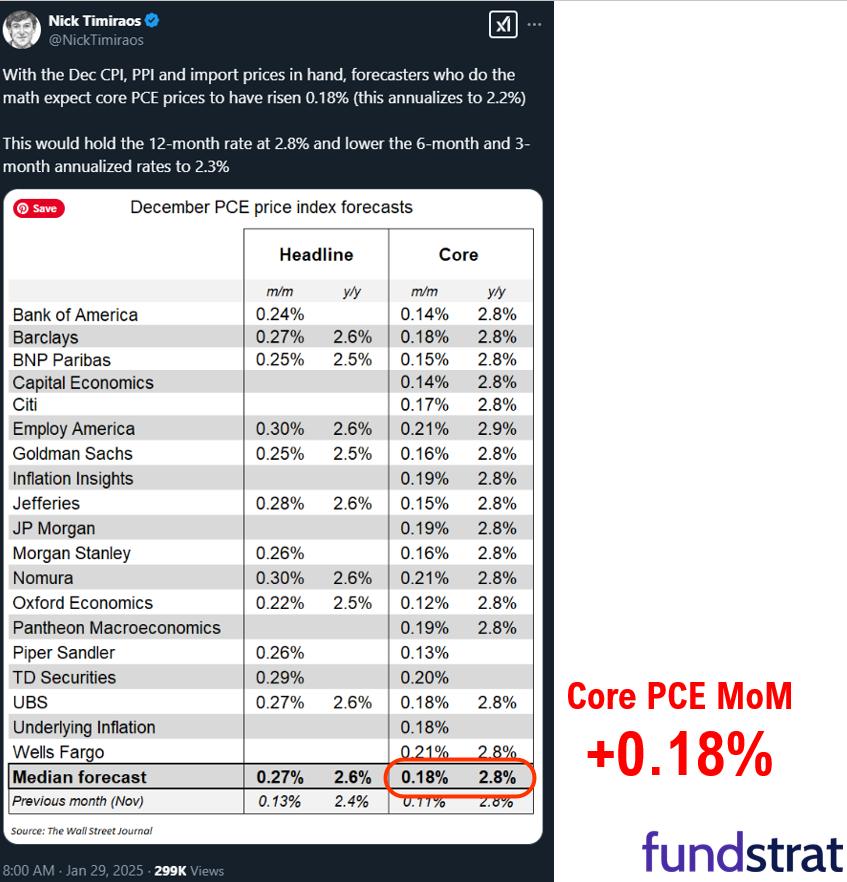

- On Friday, the BEA will release December Core PCE (personal consumption expenditures) which is the Fed’s preferred measure of inflation.

– Street consensus for Core is +0.18%

– this would be continuing a string of tame inflation measures

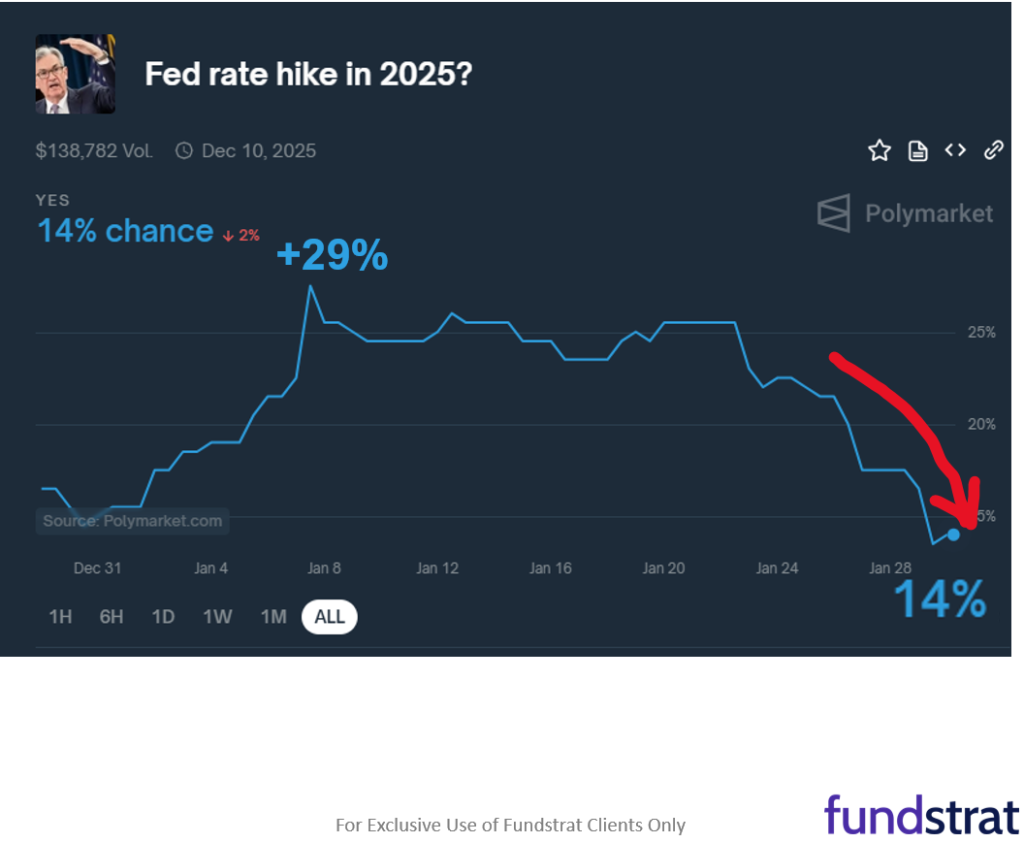

– similar to the comments made by Fed Chair Powell at the Jan FOMC - This would reinforce the relatively dovish message from the Fed seen on the Wed press conference post-FOMC. Perhaps the best evidence for this is the drop in market probabilities of a rate hike in 2025:

– per Polymarket

– pre-FOMC, odds of a rate hike in 2025 as high as 29%

– post-FOMC press conference, odds dropped to 14% - To us, those odds are still too high. We think the probability of a hike is 0% in 2025. But the 14% reflects the “hawkish” tilt of financial markets — that many still expect inflation to make a resurgence. This is in contrast to our view that inflation is set to “fall like a rock” (see prior notes on this).

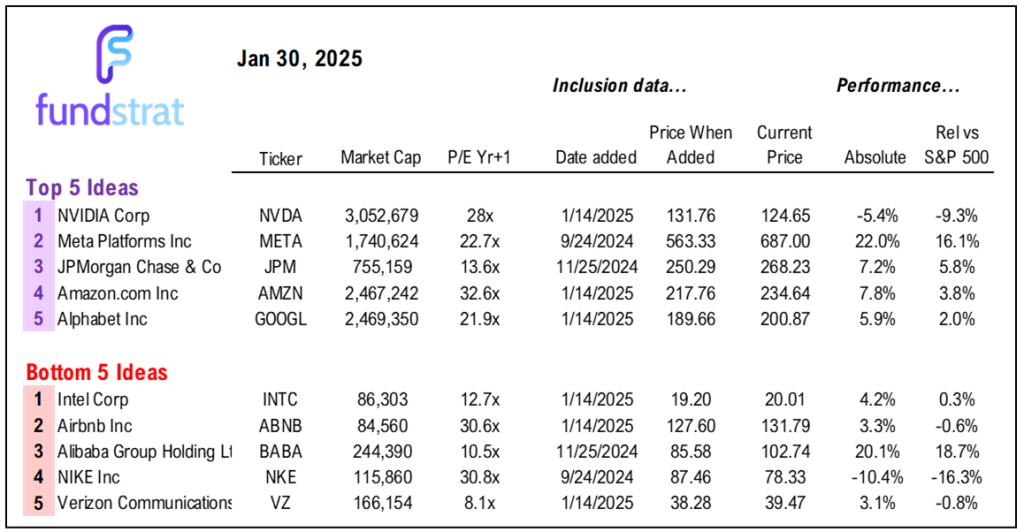

- As for 4Q24 EPS from MAG7 (FAANG), 3 of 5 had good results:

Regarding earnings, two things are our focus:

– AI Update from Mag7/FAANG

– Wed (close) - Regarding earnings, the following companies are our focus:

– TSLA –> good

– META –> good

– MSFT –> eh

– Thu (close)

– AAPL –> good

– overall, good enough in our view

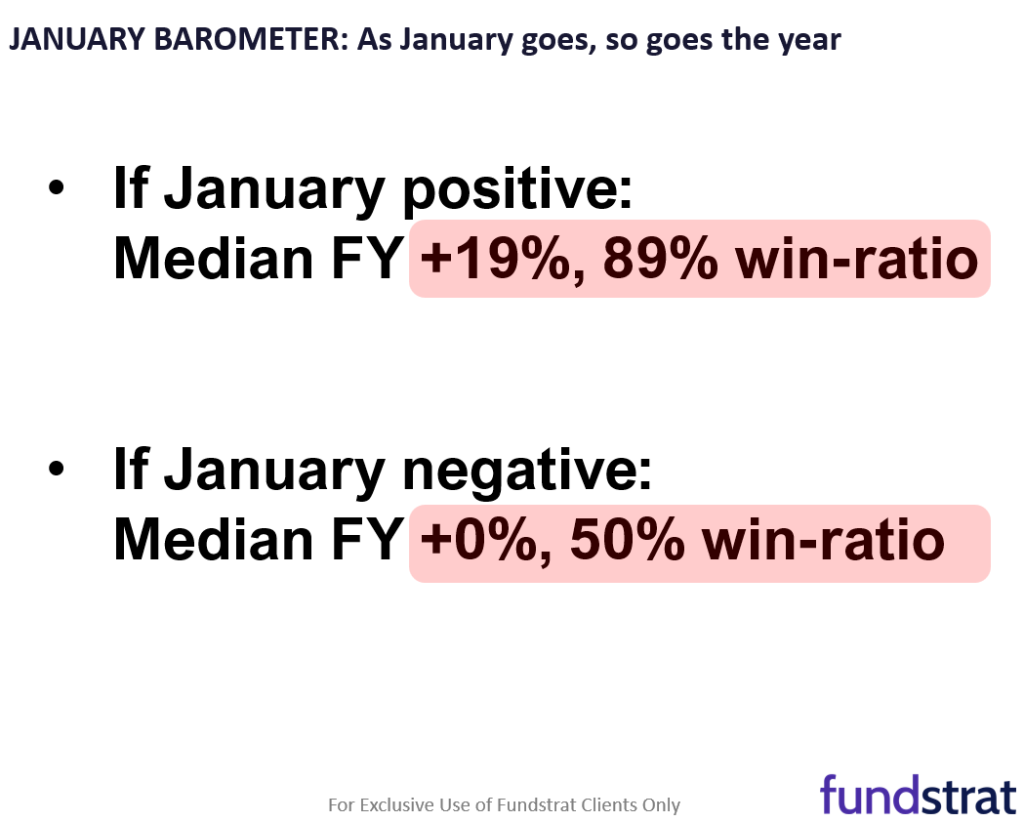

- Finally, we are watching the January 31 close for S&P 500 (Friday) and the key is a positive close for the month. This is the January barometer “as January goes, so goes the year”:

– and The January barometer is as follows:

– If January positive:

– Median FY +19%, 89% win-ratio

– If January negative:

– Median FY +0%, 50% win-ratio - The Dec 31 closing level was 5,881.31, so closing above that is key. The S&P 500 closed at 6,071.17 on Thursday. So there is 200 points of cushion, for now.

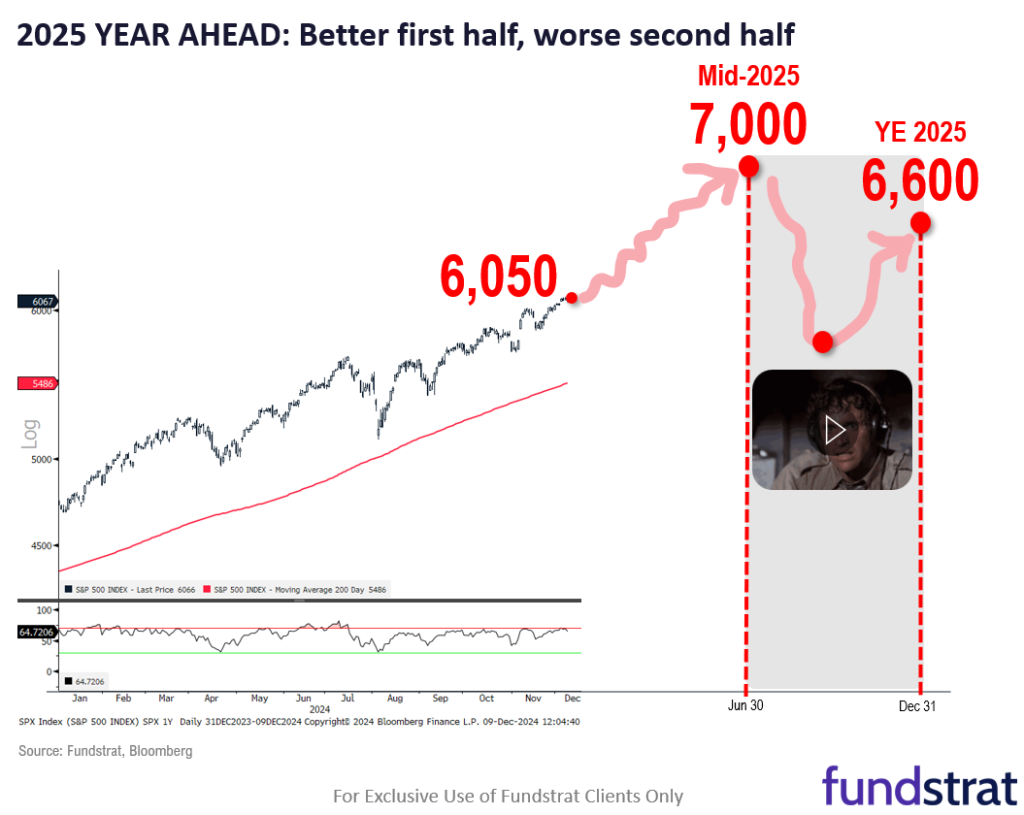

- If we get that positive close, this is a 6th reason 2025 tracking better than expected.

- There are six reasons (if Jan 31 close positive) that show 2025 tracking better than our base case:

– Barometer “first 5 days” positive = 82% win-ratio

– Sentiment capitulation on Dec to Jan chop = good

– Inflation tracking “softer” than consensus view

– Fears of “day 1 tariffs” overblown = USD weaker

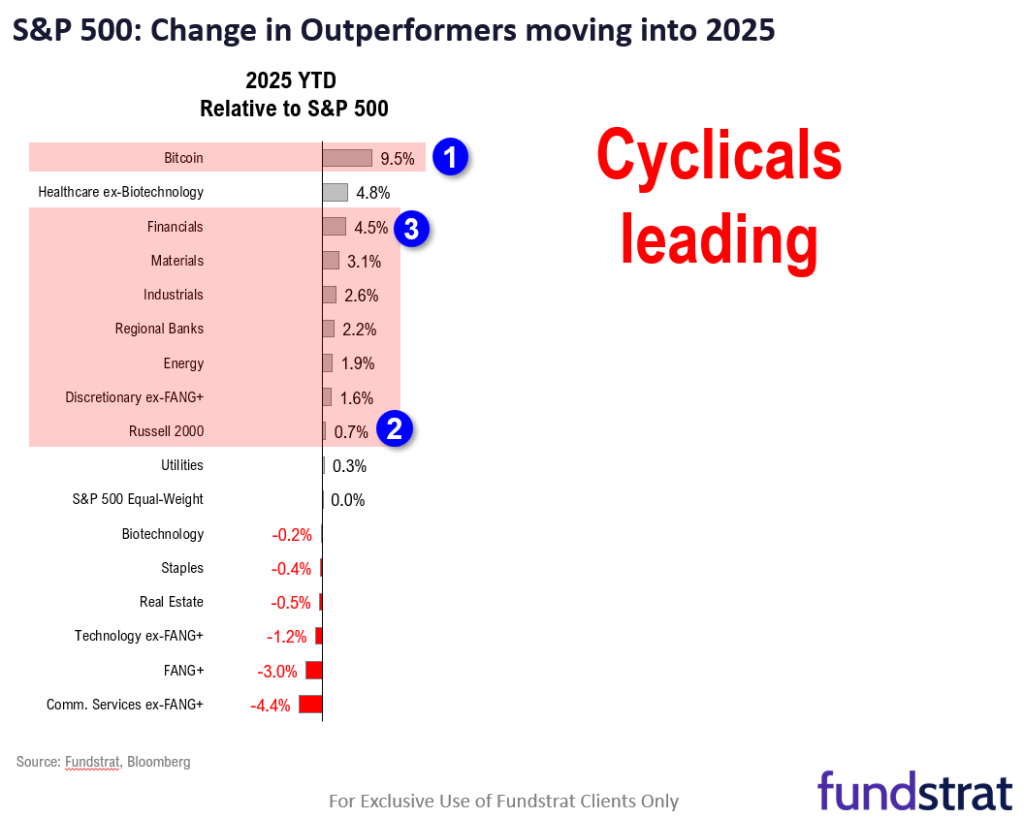

– Cyclicals leading YTD = risk-on signal

– January barometer “positive” = 89% win-ratio

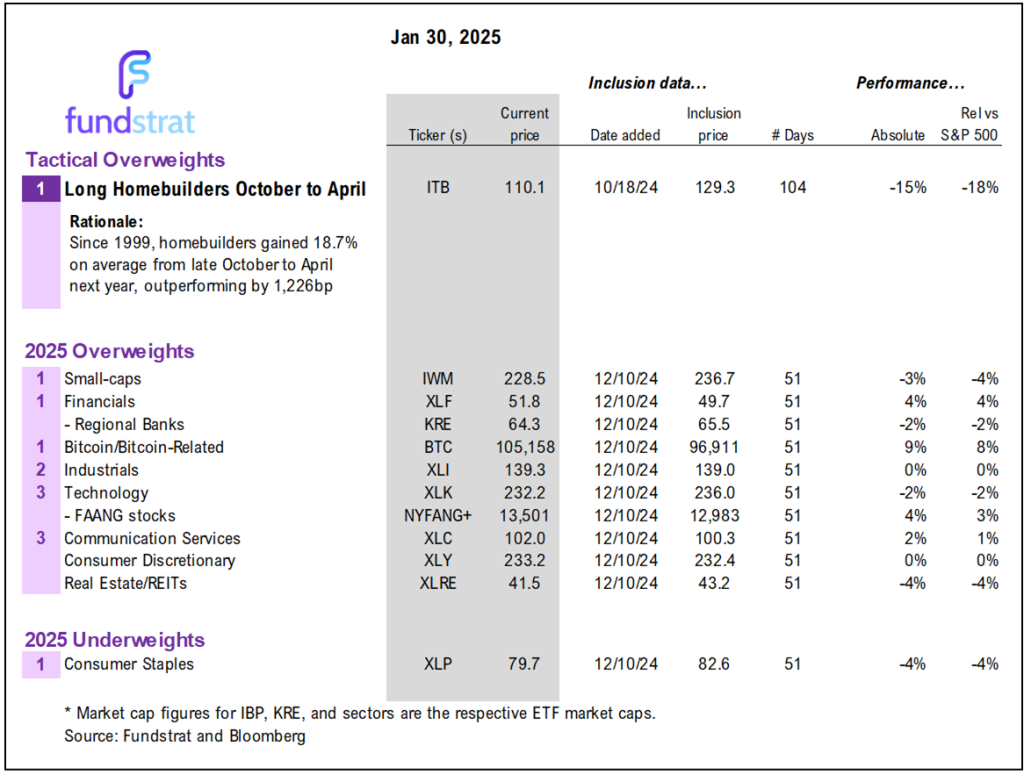

Bottom line, 2025 is tracking better than our base case. We remain constructive and now see 2025 as less turbulent than we expected. The top sector ideas remain:

- Bitcoin

- Small-caps

- Financials

- Industrials

- Technology

_____________________________

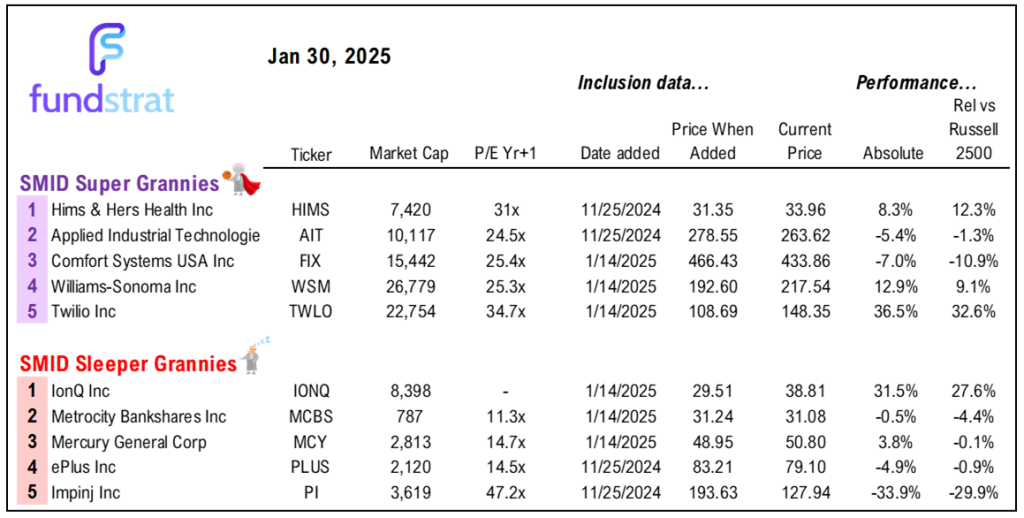

44 SMID Granny Shot Ideas: We performed our quarterly rebalance on 11/25. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

___________________________

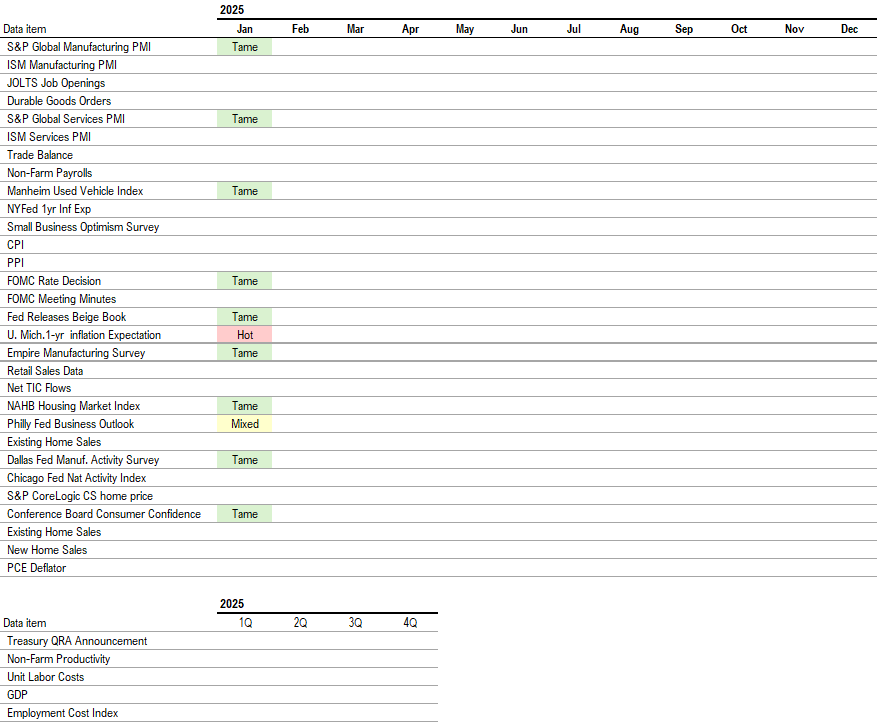

Key incoming data February:

- 2/3 9:45 AM ET: Jan F S&P Global Manufacturing PMI

- 2/3 10:00 AM ET: Jan ISM Manufacturing PMI

- 2/4 10:00 AM ET: Dec JOLTS Job Openings

- 2/4 10:00 AM ET: Dec F Durable Goods Orders

- 2/5 8:30 AM ET: Dec Trade Balance

- 2/5 9:45 AM ET: Jan F S&P Global Services PMI

- 2/5 10:00 AM ET: Jan ISM Services PMI

- 2/6 8:30 AM ET: 4Q P Non-Farm Productivity

- 2/6 8:30 AM ET: 4Q P Unit Labor Costs

- 2/7 8:30 AM ET: Jan Non-Farm Payrolls

- 2/7 9:00 AM ET: Dec F Manheim Used Vehicle index

- 2/7 10:00 AM ET: Feb P U. Mich. Sentiment and Inflation Expectation

- 2/10 11:00 AM ET: Jan NY Fed 1yr Inf Exp

- 2/11 6:00 AM ET: Jan Small Business Optimism Survey

- 2/12 8:30 AM ET: Jan CPI

- 2/13 8:30 AM ET: Jan PPI

- 2/14 8:30 AM ET: Jan Retail Sales Data

- 2/18 8:30 AM ET: Feb Empire Manufacturing Survey

- 2/18 10:00 AM ET: Feb NAHB Housing Market Index

- 2/18 4:00 PM ET: Dec Net TIC Flows

- 2/19 9:00 AM ET: Jan M Manheim Used Vehicle index

- 2/19 2:00 PM ET: Jan FOMC Meeting Minutes

- 2/20 8:30 AM ET: Feb Philly Fed Business Outlook

- 2/21 9:45 AM ET: Feb P S&P Global Manufacturing PMI

- 2/21 9:45 AM ET: Feb P S&P Global Services PMI

- 2/21 10:00 AM ET: Feb F U. Mich. Sentiment and Inflation Expectation

- 2/21 10:00 AM ET: Jan Existing Home Sales

- 2/24 8:30 AM ET: Jan Chicago Fed Nat Activity Index

- 2/24 10:30 AM ET: Feb Dallas Fed Manuf. Activity Survey

- 2/25 9:00 AM ET: Dec S&P CoreLogic CS home price

- 2/25 10:00 AM ET: Feb Conference Board Consumer Confidence

- 2/26 10:00 AM ET: Jan New Home Sales

- 2/27 8:30 AM ET: 4Q S GDP

- 2/27 10:00 AM ET: Jan P Durable Goods Orders

- 2/28 8:30 AM ET: Jan PCE Deflator

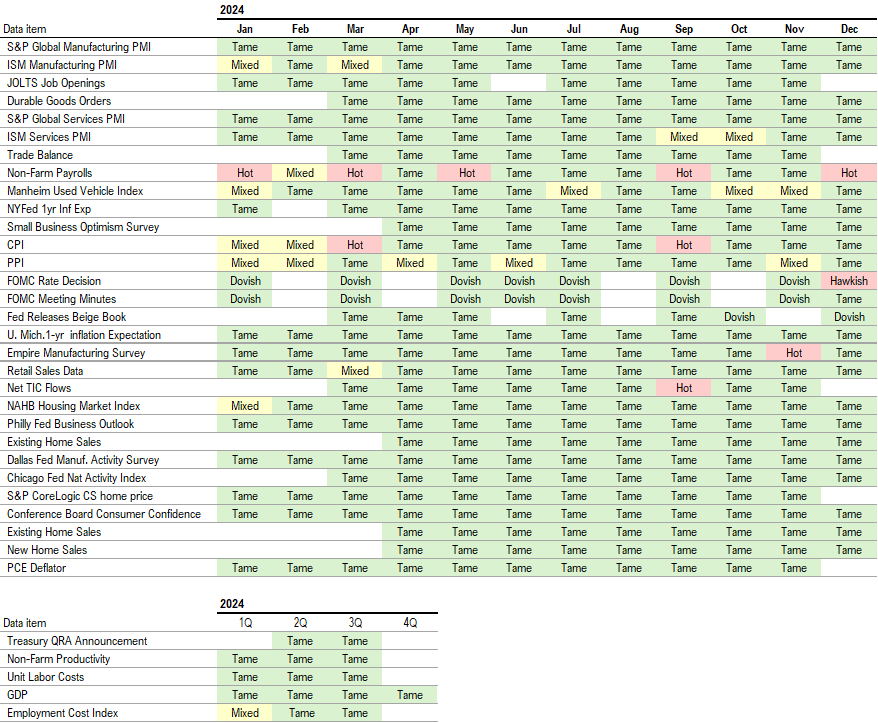

Key incoming data January:

1/2 9:45 AM ET: Dec F S&P Global Manufacturing PMITame1/3 10:00 AM ET: Dec ISM Manufacturing PMITame1/6 9:45 AM ET: Dec F S&P Global Services PMITame1/6 10:00 AM ET: Nov F Durable Goods OrdersTame1/7 8:30 AM ET: Nov Trade BalanceTame1/7 10:00 AM ET: Dec ISM Services PMITame1/7 10:00 AM ET: Nov JOLTS Job OpeningsTame1/8 9:00 AM ET: Dec F Manheim Used vehicle indexTame1/8 2:00 PM ET: Dec FOMC Meeting MinutesTame1/10 8:30 AM ET: Dec Non-Farm PayrollsHot1/10 10:00 AM ET: Jan P U. Mich. Sentiment and Inflation ExpectationHot1/13 11:00 AM ET: Dec NY Fed 1yr Inf ExpTame1/14 6:00 AM ET: Dec Small Business Optimism SurveyTame1/14 8:30 AM ET: Dec PPITame1/15 8:30 AM ET: Dec CPITame1/15 8:30 AM ET: Jan Empire Manufacturing SurveyTame1/15 2:00 PM ET: Jan Fed Releases Beige BookTame1/16 8:30 AM ET: Dec Retail Sales DataTame1/16 8:30 AM ET: Jan Philly Fed Business OutlookMixed1/16 10:00 AM ET: Jan NAHB Housing Market IndexTame1/17 9:00 AM ET: Jan M Manheim Used vehicle indexTame1/17 4:00 PM ET: Nov Net TIC FlowsTame1/24 9:45 AM ET: Jan P S&P Global Manufacturing PMITame1/24 9:45 AM ET: Jan P S&P Global Services PMITame1/24 10:00 AM ET: Jan F U. Mich. Sentiment and Inflation ExpectationHot1/24 10:00 AM ET: Dec Existing Home SalesTame1/27 8:30 AM ET: Dec Chicago Fed Nat Activity IndexTame1/27 10:00 AM ET: Dec New Home SalesTame1/27 10:30 AM ET: Jan Dallas Fed Manuf. Activity SurveyTame1/28 9:00 AM ET: Nov S&P CoreLogic CS home priceTame1/28 10:00 AM ET: Jan Conference Board Consumer ConfidenceTame1/28 10:00 AM ET: Dec P Durable Goods OrdersTame1/29 2:00 PM ET: Jan FOMC DecisionTame1/30 8:30 AM ET: 4Q A 2024 GDPTame- 1/31 8:30 AM ET: Dec PCE Deflator

- 1/31 8:30 AM ET: 4Q Employment Cost Index

Economic Data Performance Tracker 2025:

Economic Data Performance Tracker 2024:

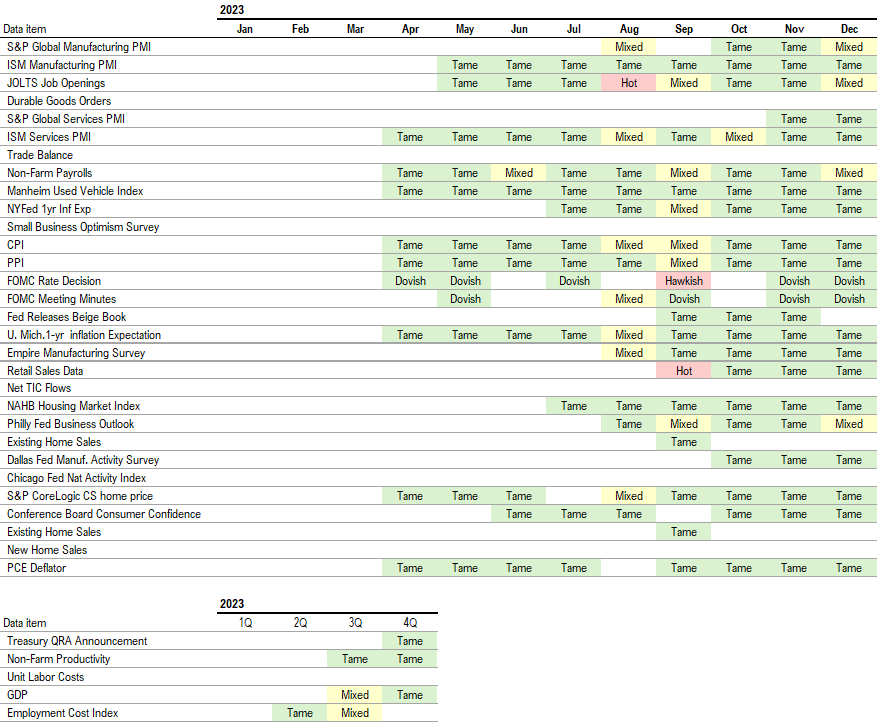

Economic Data Performance Tracker 2023: