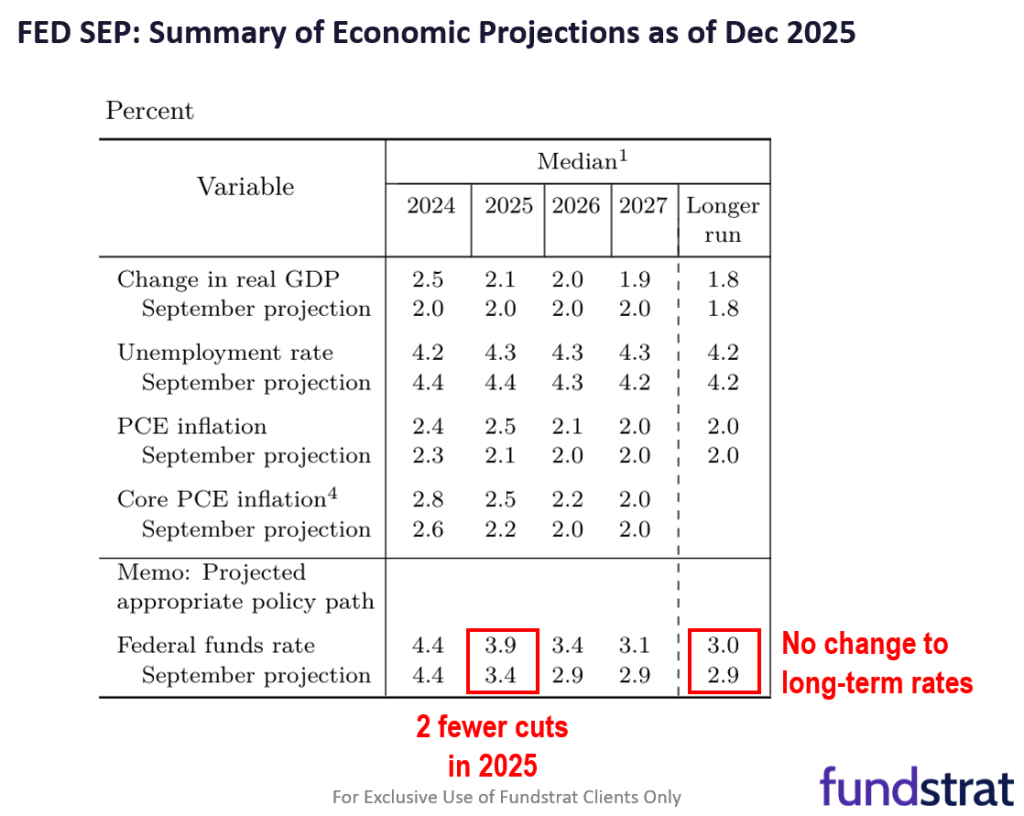

Equity markets fell sharply post-Dec FOMC rate decision, with losses of 3% to 5% across all major indices. The Fed is forecasting fewer cuts in 2025 (based upon their SEP, aka Summary Economic Projections) to 2 cuts compared to 3 cuts expected by markets (Fed Funds futures).

- There was an across the board negative and panicked reaction to the Fed press conference:

– US 10-yr yields rose 10bp to 4.512%

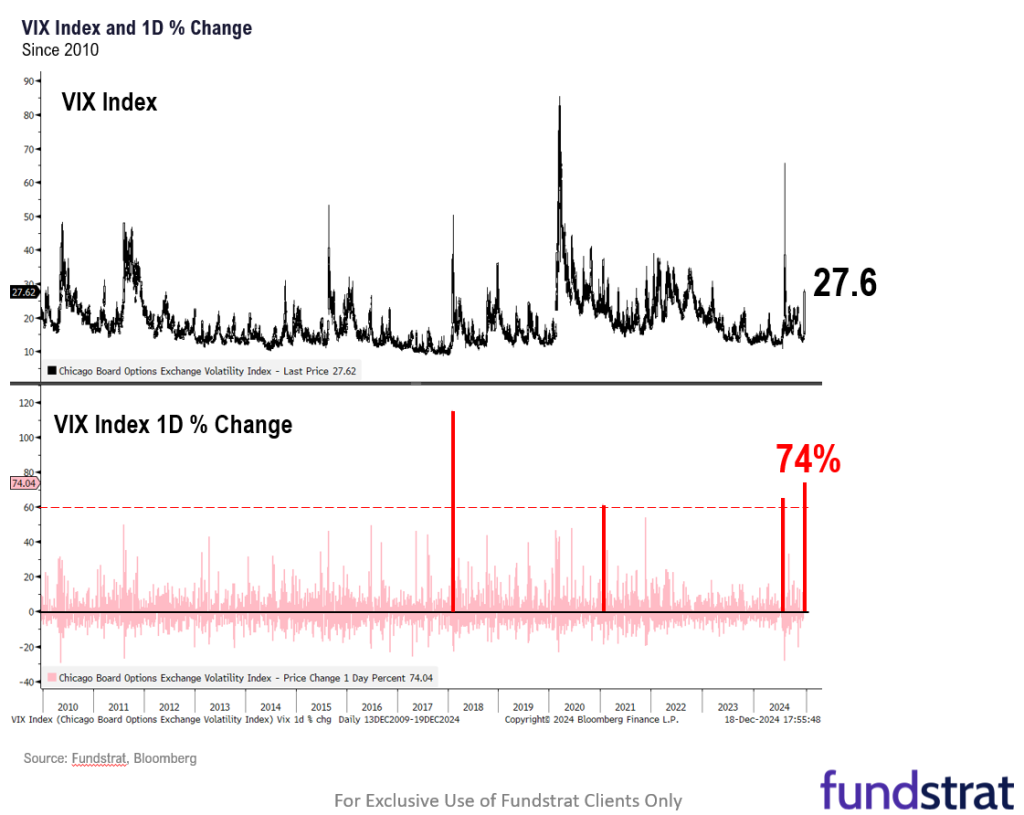

– VIX surged 74% to 28

– S&P 500 fell -3%, Russell 2000 -5%

– NYSE tick worst ever intraday reading -2,170 (panic) - Fed Chair Powell made two statements that caused markets to de-risk:

– first, “The slower pace of cuts for next year really reflects both the higher inflation readings we’ve had this year and the expectation inflation will be higher.”

– second: “Some people did take a very preliminary step and start to incorporate highly conditional estimates of economic effects of policies into their forecast at this meeting and said so in the meeting. Some people said they didn’t do so, and some people didn’t say whether did or not” - Basically, Powell says FOMC sees higher inflation in 2025 (we would bet actual inflation undershoots Fed) and that some Fed officials might be reflecting the inflation impact of a Trump White House. In any event, he considers these uncertainties and thus, warrants a slowing of the pace of cuts.

- Equities and risk-assets de-risked sharply, in our view, because investors are not fan of “second derivative” change. That is, if the Fed dot plot shows 2 fewer cuts expected, compared to Sept 2024, then this is a “hawkish” turn by the Fed. And this caught investors by surprise.

- But to us, this panicked reaction will be short lived. There are 4 reasons for this:

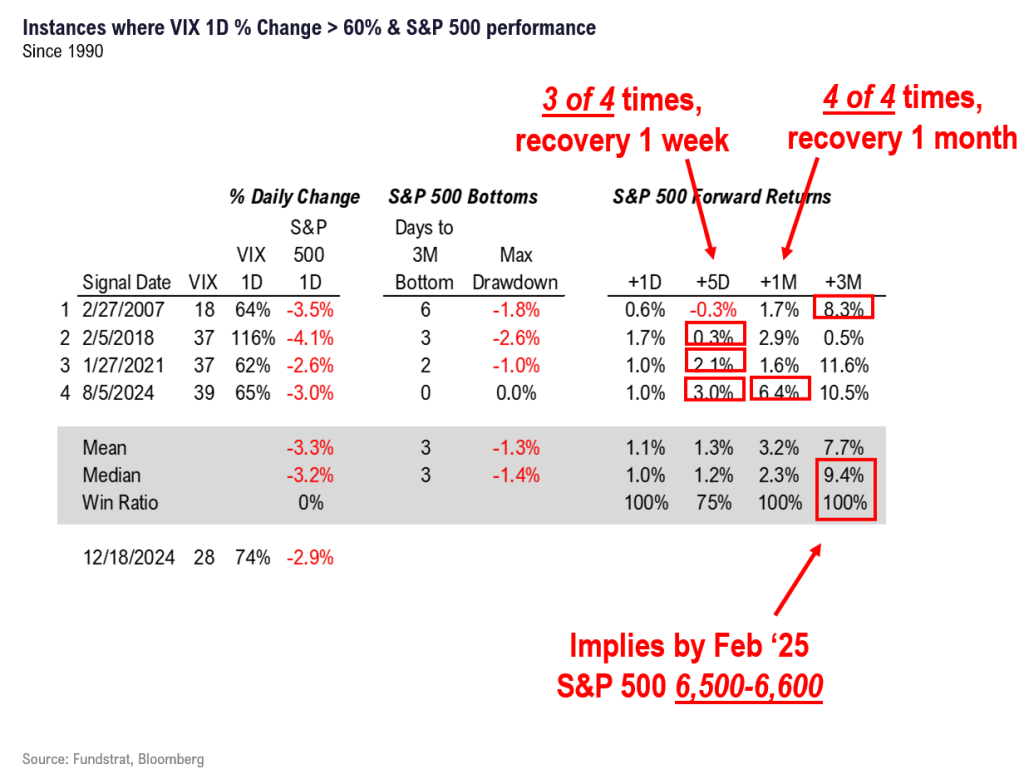

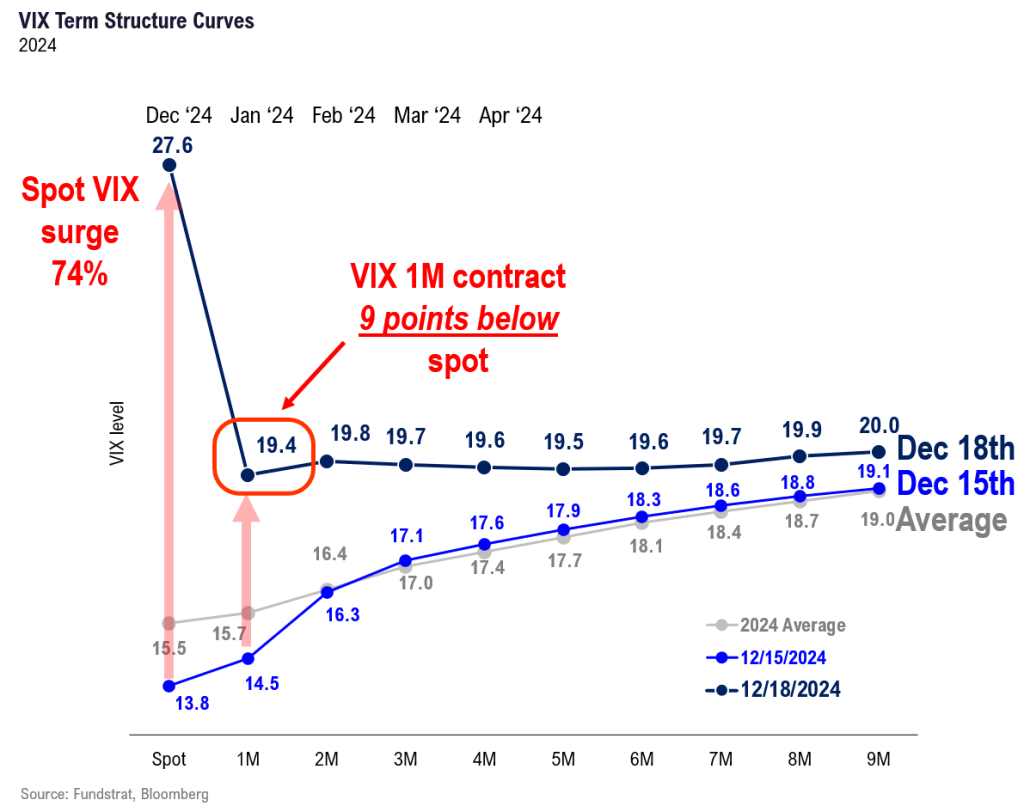

– first, the spot VIX spiked +74%, 2nd highest ever spike and 4 worst spikes saw full recovery of stocks within a month 4 of 4 times

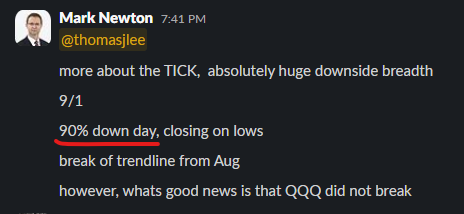

– second, signs of capitulation as today was 90% down day, and NYSE TRIN reading reaching lowest ever negative intraday -2,170

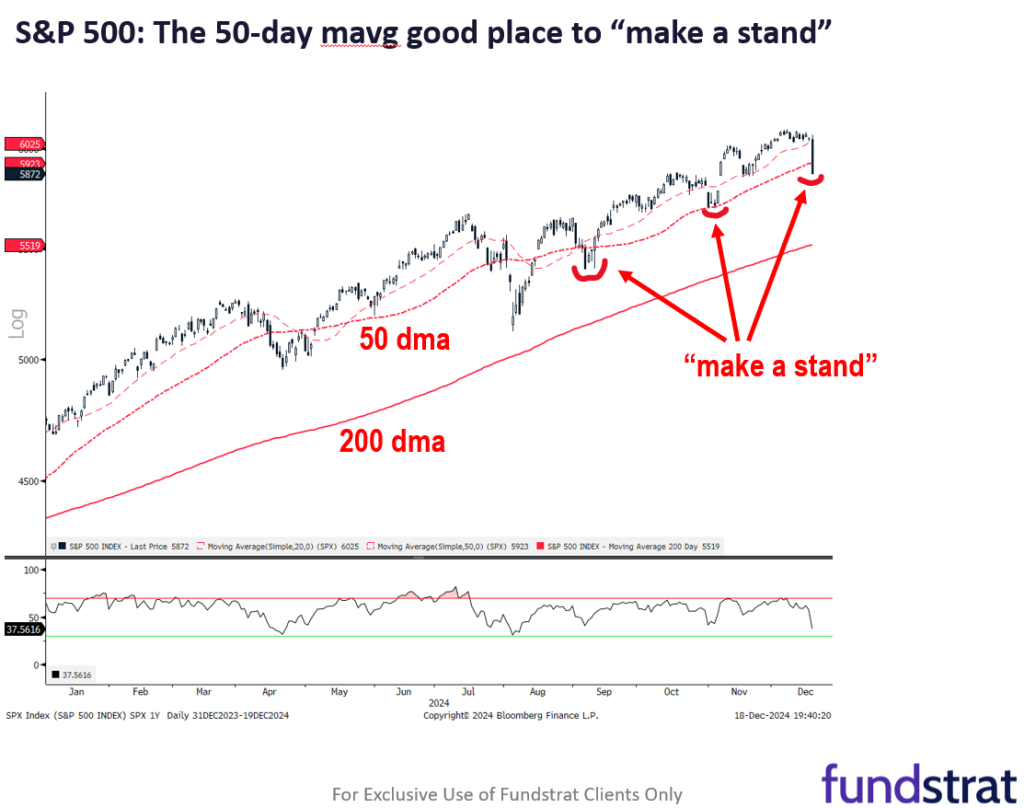

– third, S&P 500 basically testing 50D moving avg (5,923), where it rallied in 2024

– fourth, investors ultimately conclude Fed still dovish, but has less “visibility” into 2025 - The VIX spike is really notable. This 74% spike is the second highest single day surge ever:

– Date VIX %1D

– 2/5/2018 37 116%

– 12/18/2024 28 74%

– 8/5/2024 39 65%

– 2/27/2007 18 64%

– 1/27/2021 37 62% - What is notable is how quickly markets recover from these sell-offs:

– 3 of 4 times, the S&P 500 fully recover within a week

– Jan 2021, Feb 2018, Aug 2024.

– 4 of 4 times, fully recovered within a month - See the point, this massive surge in VIX is showing a full-on “buy the dip” moment

- In other words, the Fed remains supportive of markets. The Fed still sees Fed Funds in the “long term” getting to 3.0%, which is essentially the same as the 2.9% it showed in Sept 2024. Thus, there is still 150bp of cuts in the future.

- But he repeated several times that the labor market is not a source of inflation. This is key. After all, there really is no other structural argument for why inflation should remain high, unless wage pressures warrant a higher level of inflation. So, we see this more as the Fed wanting to “take it slower.”

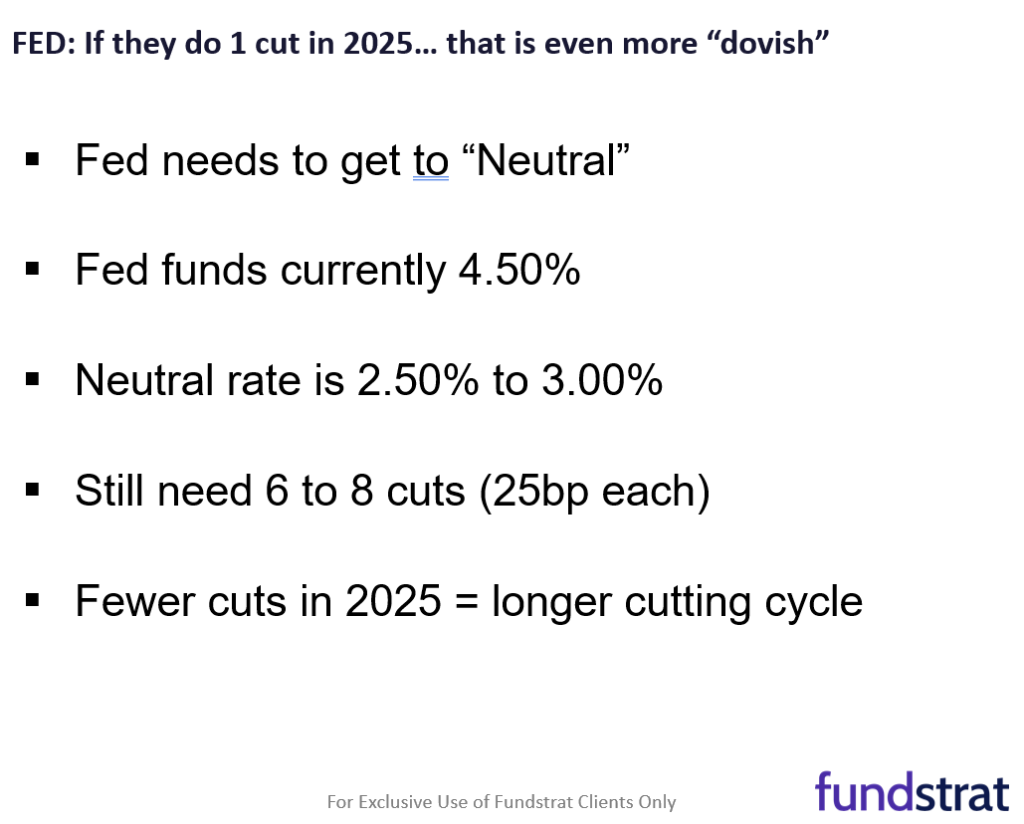

- Currently, Fed Funds futures sees 1 additional cut in 2025. This is down from 2-3 priced into markets prior to the Dec FOMC rate decision. We believe that it would actually better for the Fed to make fewer cuts in 2025. We have discussed this previously, but the factors are:

– Fed needs to get to “Neutral”

– Fed funds currently 4.50%

– Neutral rate is 2.50% to 3.00%

– Still need 6 to 8 cuts (25bp each)

– Fewer cuts in 2025 = longer cutting cycle

Bottom line: This is a “buy the dip” moment

This was a painful day, but the fundamentals did not change. This is why we see this as a buy the dip moment.

_____________________________

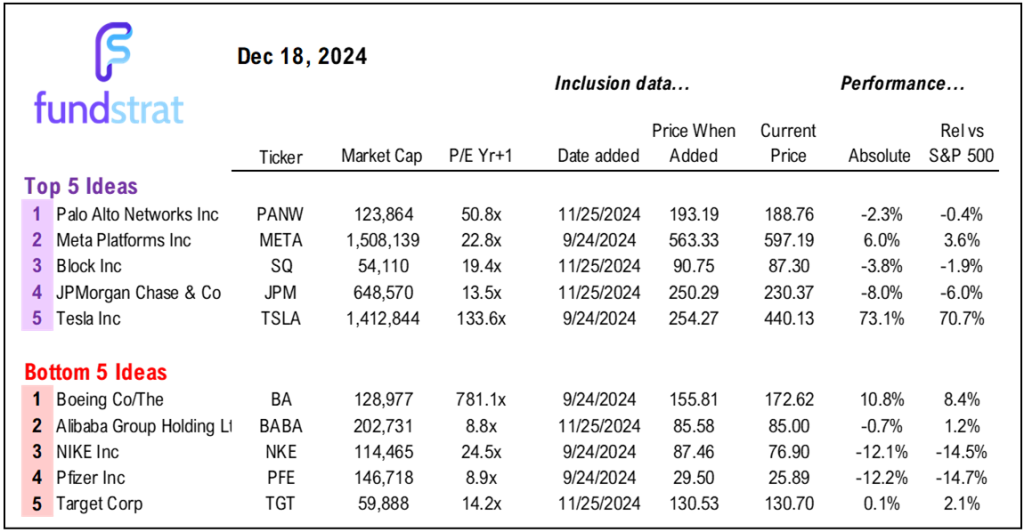

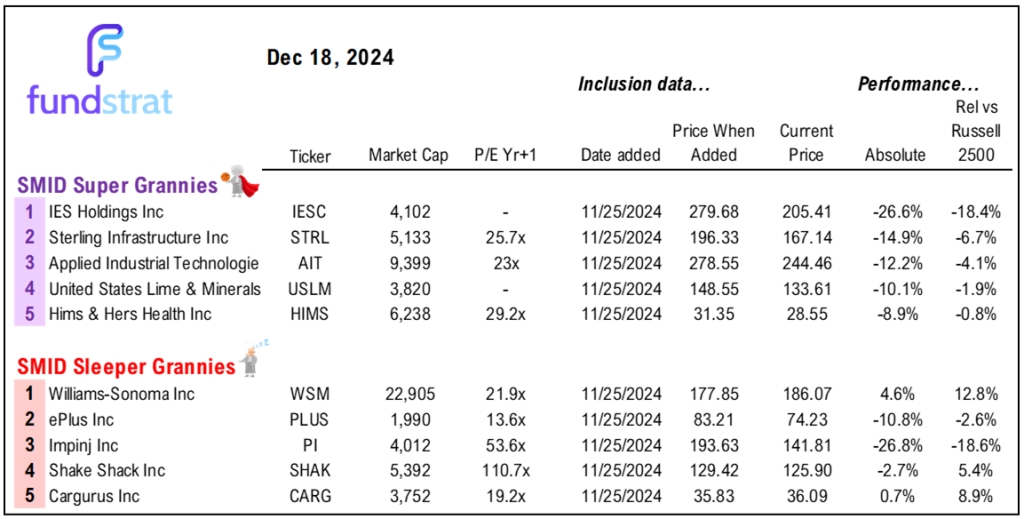

44 SMID Granny Shot Ideas: We performed our quarterly rebalance on 11/25. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

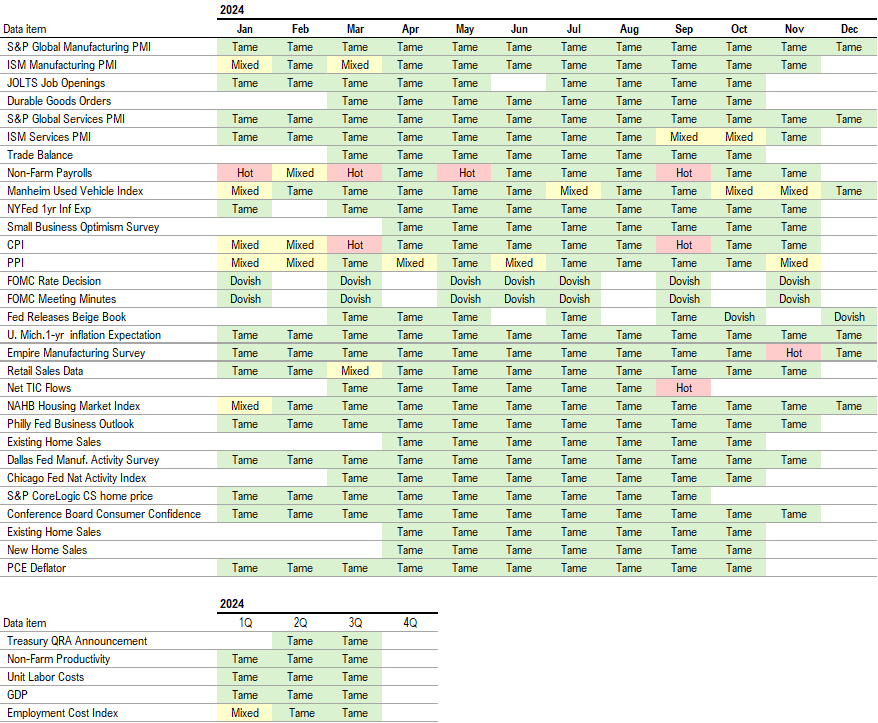

Key incoming data December:

12/2 9:45 AM ET: Nov F S&P Global Manufacturing PMITame12/2 10:00 AM ET: Nov ISM Manufacturing PMITame12/3 10:00 AM ET: Oct JOLTS Job OpeningsTame12/4 9:45 AM ET: Nov F S&P Global Services PMITame12/4 10:00 AM ET: Nov ISM Services PMITame12/4 10:00 AM ET: Oct F Durable Goods OrdersTame12/4 2:00 PM ET: Fed Releases Beige BookDovish12/5 8:30 AM ET: Oct Trade BalanceTame12/6 8:30 AM ET: Nov Non-Farm PayrollsTame12/6 9:00 AM ET: Nov F Manheim Used vehicle indexMixed12/6 10:00 AM ET: Dec P U. Mich. Sentiment and Inflation ExpectationTame12/9 11:00 AM ET: Nov NY Fed 1yr Inf ExpTame12/10 6:00 AM ET: Nov Small Business Optimism SurveyTame12/10 8:30 AM ET: 3Q F Non-Farm ProductivityTame12/10 8:30 AM ET: 3Q F Unit Labor CostsTame12/11 8:30 AM ET: Nov CPITame12/12 8:30 AM ET: Nov PPIMixed12/16 8:30 AM ET: Dec Empire Manufacturing SurveyTame12/16 9:45 AM ET: Dec P S&P Global Manufacturing PMITame12/16 9:45 AM ET: Dec p S&P Global Services PMITame12/17 8:30 AM ET: Nov Retail Sales DataTame12/17 9:00 AM ET: Dec P Manheim Used vehicle indexTame12/17 10:00 AM ET: Dec NAHB Housing Market IndexTame12/18 2:00 PM ET: Dec FOMC DecisionHawkish- 12/19 8:30 AM ET: 3Q T 2024 GDP

- 12/19 8:30 AM ET: Dec Philly Fed Business Outlook

- 12/19 10:00 AM ET: Nov Existing Home Sales

- 12/19 4:00 PM ET: Oct Net TIC Flows

- 12/20 8:30 AM ET: Nov PCE Deflator

- 12/20 10:00 AM ET: Dec F U. Mich. Sentiment and Inflation Expectation

- 12/23 8:30 AM ET: Nov Chicago Fed Nat Activity Index

- 12/23 10:00 AM ET: Dec Conference Board Consumer Confidence

- 12/24 10:00 AM ET: Nov New Home Sales

- 12/24 10:00 AM ET: Nov P Durable Goods Orders

- 12/30 10:30 AM ET: Dec Dallas Fed Manuf. Activity Survey

- 12/31 9:00 AM ET: Oct S&P CoreLogic CS home price

Economic Data Performance Tracker 2024:

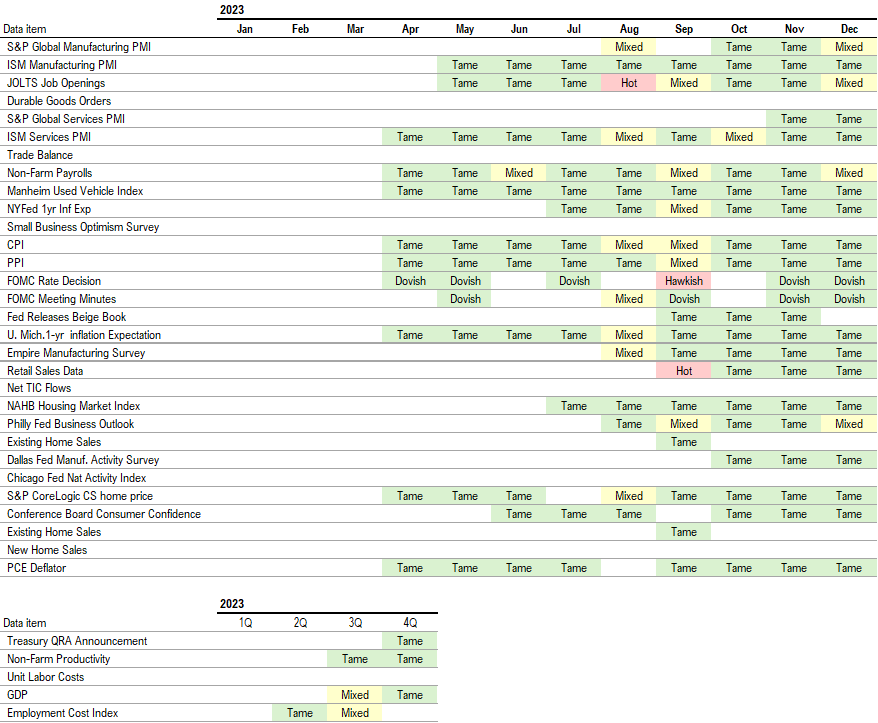

Economic Data Performance Tracker 2023: