Countertrade consensus into and after Jackson Hole

We think Fed Powell’s speech at Jackson Hole at 10am ET (8/26) is a buyable event. That is, under any of the following 3 scenarios, we are buyers of equities:

- Powell hawkish –> speaks of need to stay tough on inflation and markets might weaken. But we buy equities as leading indicators show inflation is set to weaken = future P/E expansion

- Powell vague –> markets fear Powell sounds data dependent. We buy any weakness as the above still holds true

- Powell possibly dovish sounding –> economic weakness is garnering momentum, plus labor market set to soften which means inflation set to fall. Future P/E expansion

So, ok, we sound repetitive, but the main point is that we are counter-trading consensus.

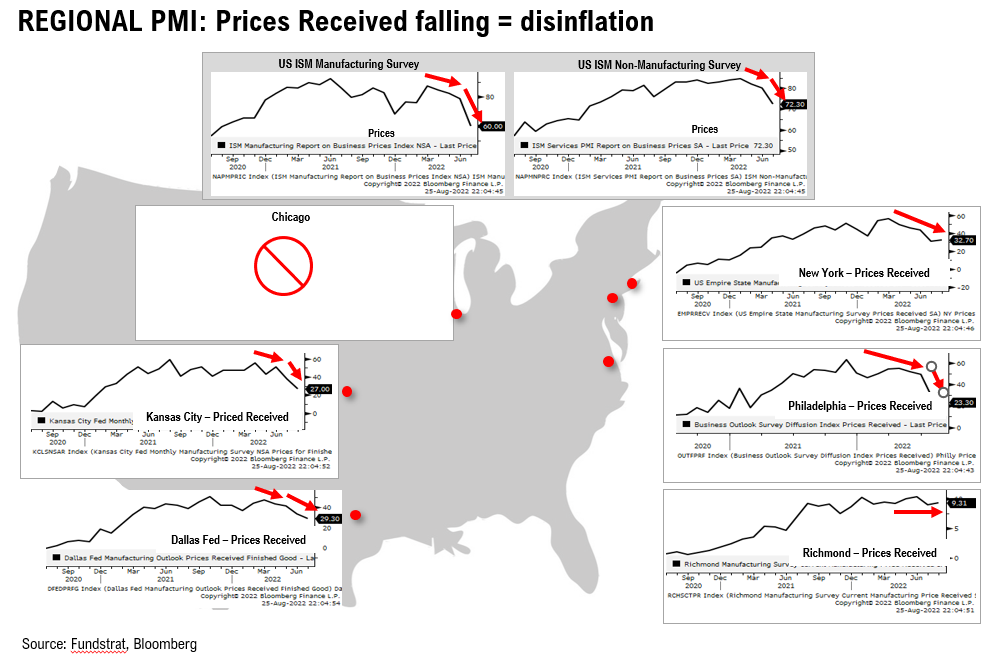

Consensus thinks Fed will bring on the “hammer” to quash inflation

Based upon my conversations with investors, most share the viewpoint of the Bloomberg article below:

- investors are too optimistic

- inflation will be a problem for years

- Fed will “reset” expectations

- prepare for earnings apocalypse

But this takes me back to a basic question. Today, does the Fed really need equity markets to fall?

- this made sense earlier in 2022 to “cool demand” broadly

- now that there is growing signs of slowing economic growth

- further equity weakness could lead to far more tightening in credit markets

- this could spiral the economy into a deeper recession

- this could lead to a far worse outcome

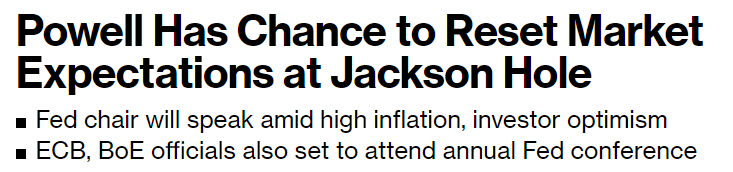

Consensus positioning seems to assure a rally…Investor too bearish?

Take a look at the comments from Mark Newton, Head of Technical Strategy, at Fundstrat. As he noted, investor positioning is quite bearish:

- leveraged funds net exposure on equity futures is unusually negative

- the lowest since 2015, which was the structural low of the “industrial recession of 2016”

- read this as very bullish since positioning is already negative

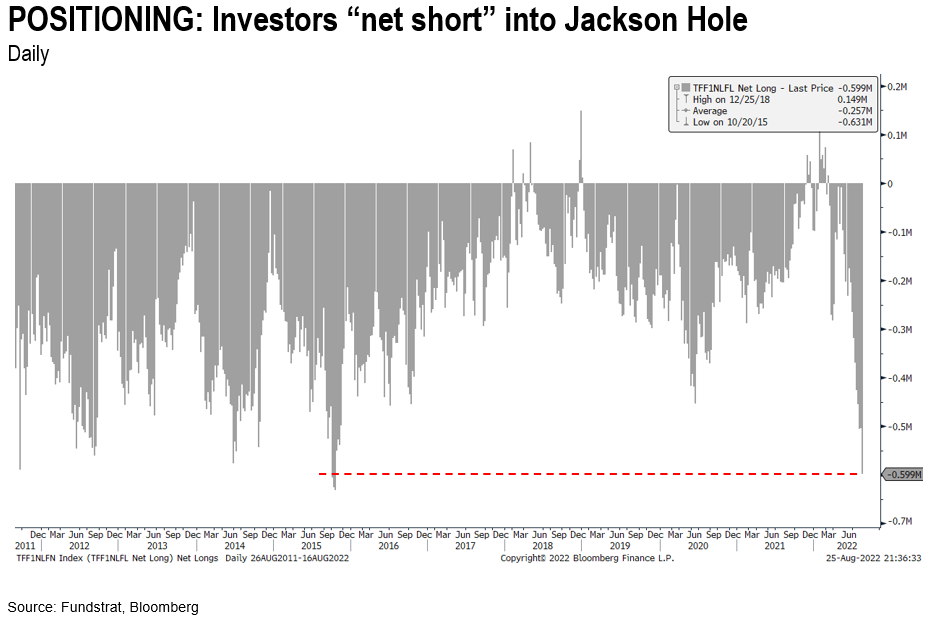

FED: Fed Funds set to be +90bp above market inflation by YE… very “tight”

We think too many investors focus on YoY CPI as the metric that the Fed needs to track and set policy rates against. However, as we have highlighted in multiple reports, the CPI report itself reports inflation with a severe lag:

- sequential changes take up to 12 months to show up

- Fed won’t be only “chasing” 12-month change but have to look at contemperaneous conditions

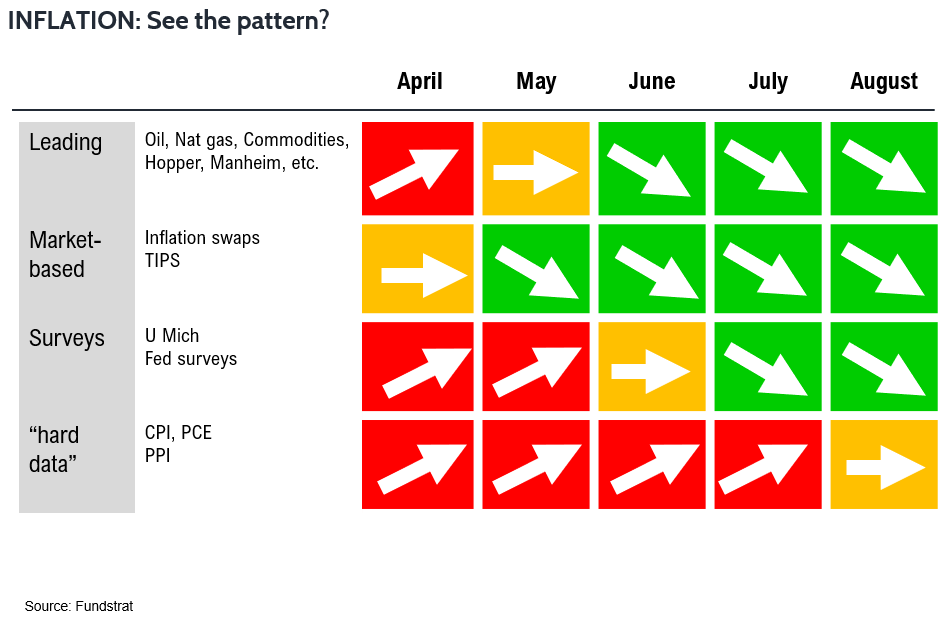

- leading indicators such as energy, commodities, high-frequency data and ISMs all show a sharp slowing

- the above factors impact “market” inflation metrics such as the swaps shown below

- Fed funds is +90bp above market inflation

- meaning Fed Funds is already quite restrictive

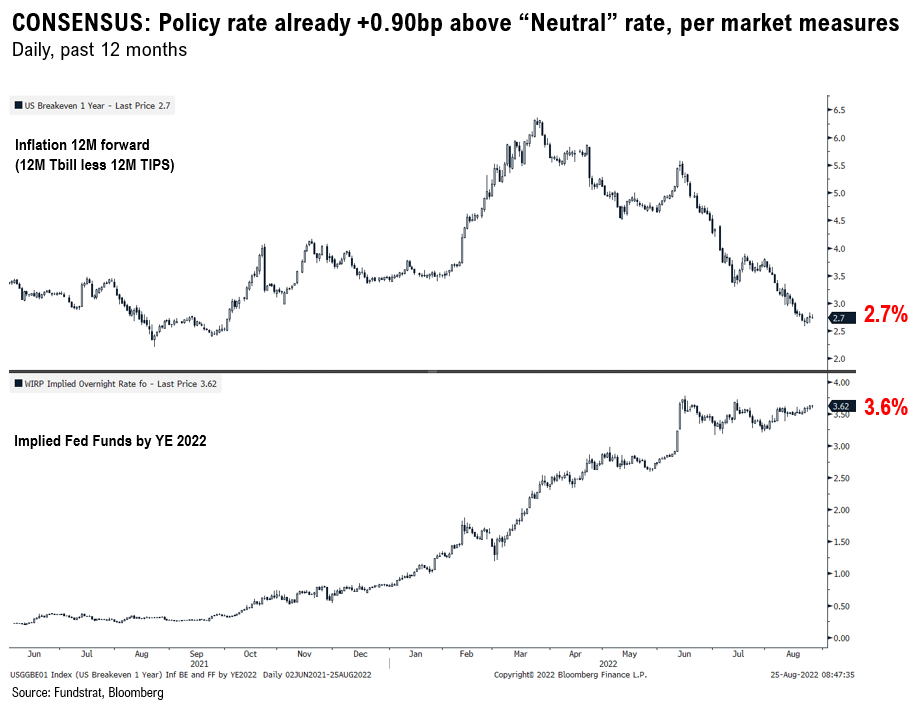

REGIONAL PMI: Prices tanking big time

Regional PMIs reported the past few weeks show that prices received by manufacturers are falling rapidly.

- the “inflation” pressures of 2021

- are quickly becoming disinflation

- and for many durables, outright deflation

- this argues against the Fed having to be “super hawkish”

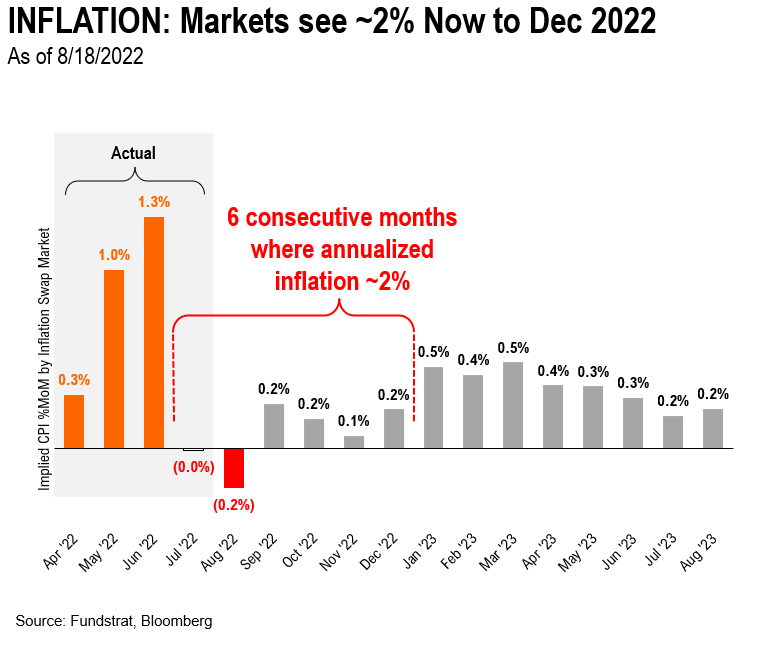

INFLATION: Swaps markets show inflation annualizing ~2% until December 2022

We refer to the below chart frequently, but this continues to make the key point. Inflation is set to slow sharply in the next 6 months. In coming reports, we will look at the “downside” drivers of inflation:

- we think there is growing probabilities inflation weakens faster than consensus expects

See the pattern? We are seeing growing signs of disinflation and maybe deflation in products

And as shown below, there are growing signs of promising inflation trends.

And this improvement is prompting Street economists to lower their inflation forecasts. See the comments from JPMorgan Economists below, as highlighted by @carlquintanilla.

STRATEGY: 2H rally view intact

Bottom line. We see 2H rally thesis intact.

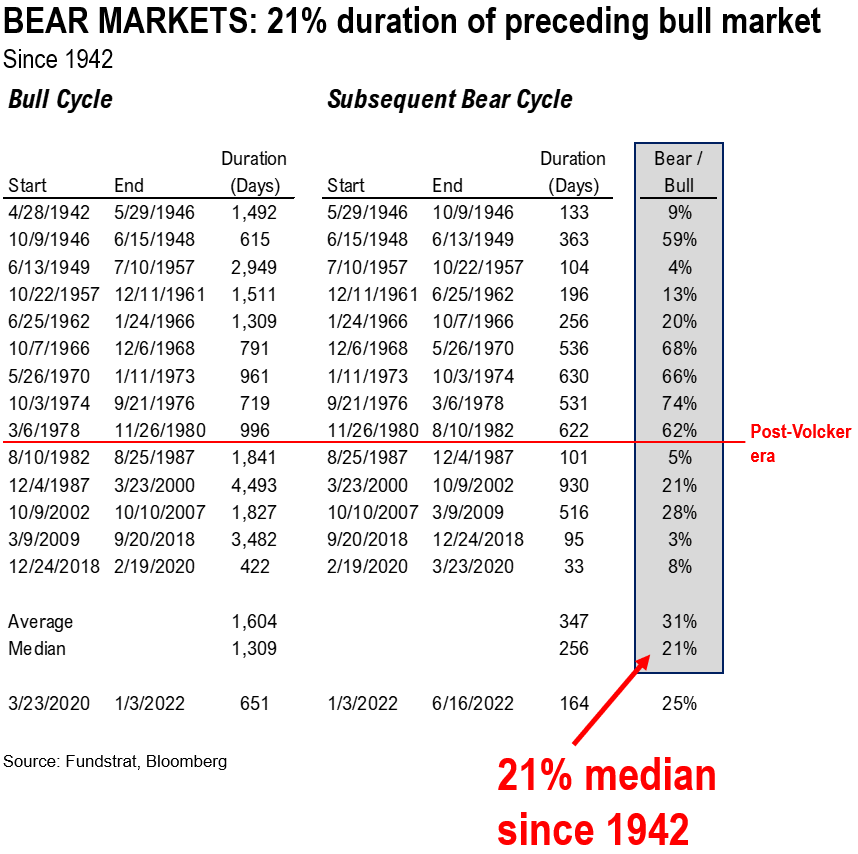

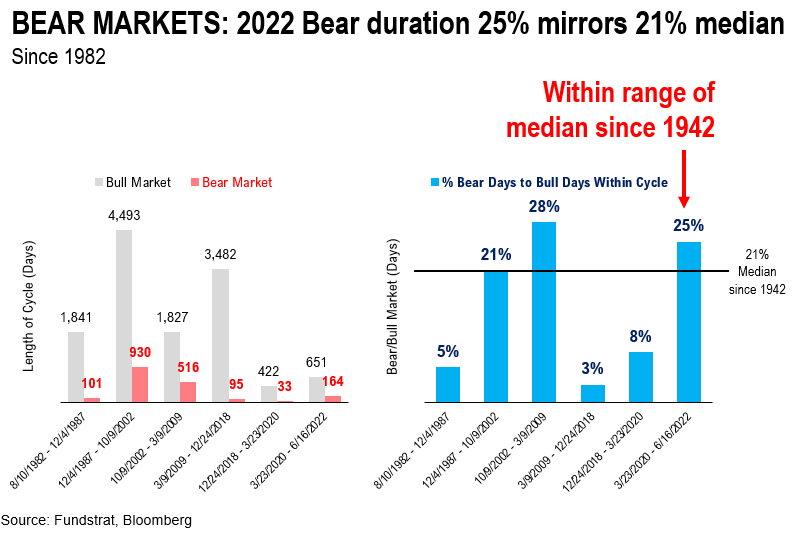

STRATEGY: 2022 Bear market was 164 days, or 25% duration of prior bull

Our data science team put together the comparative duration of bull markets and bear markets, and the corresponding ratio:

- since 1942, there have been 14 such cycles

- median ratio of bear vs bull is 31%, meaning a bear market is roughly 1/3 duration

- since 1982, this ratio is only 15%

- in 2022, the preceding bull market was 651 days

- the current bear market was 164 (using 6/16)

- or 25% ratio

As seen below, this ratio is solidly within the ranges seen since 1982.

- many investors think “more time” is needed for this bear market

- but given the shortness of the preceding bull market 651 days versus 1,309 median

- the corresponding bear market should also be shorter

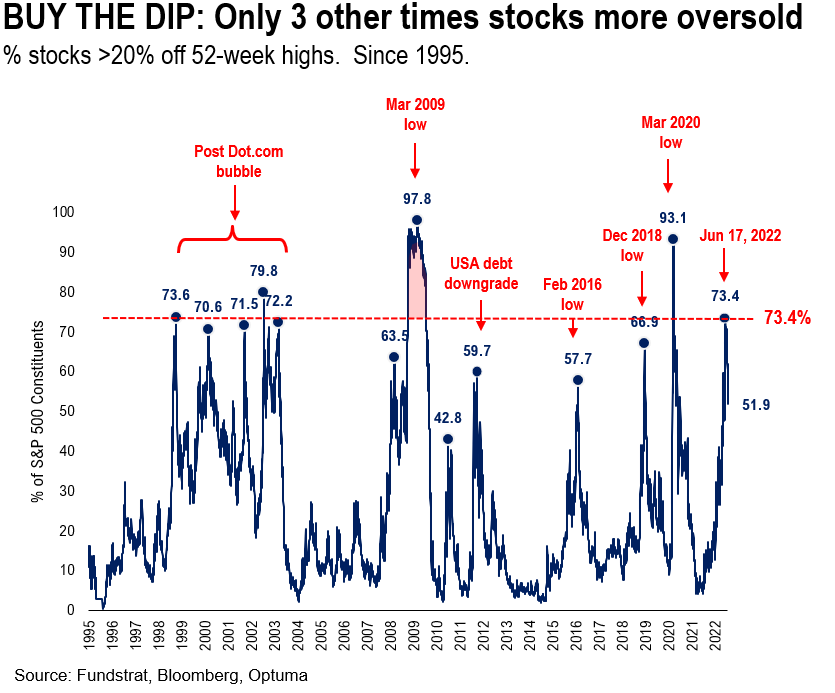

BUY THE DIP REGIME: Stocks already saw fundamental capitulation

And we want to revisit the chart below, which looks at the internals of the S&P 500 — the % stocks >20% off their highs, aka % stocks in a bear market.

- this figure surged to 73% on 6/17

- this was only exceeded 3 times in the past 30 years

- each of the 3 prior instances was the market bottom

- we think this is the 4th instance

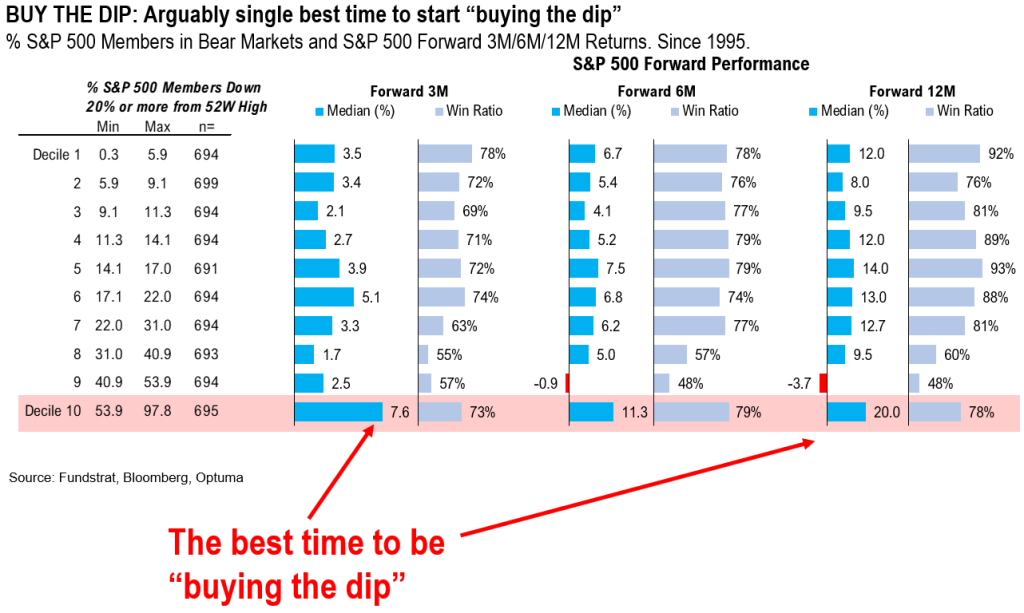

BUY THE DIP: forward returns strong

And stocks have the best forward returns when this figure exceeds 54% as shown below:

- in 3M, 6M and 12M

- the best decile for returns

- is when this figure is oversold >54%

- hence, buy the dip regime is in force

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

33 Granny Shot Ideas: We performed our quarterly rebalance on 7/12. Full stock list here –> Click here

______________________________