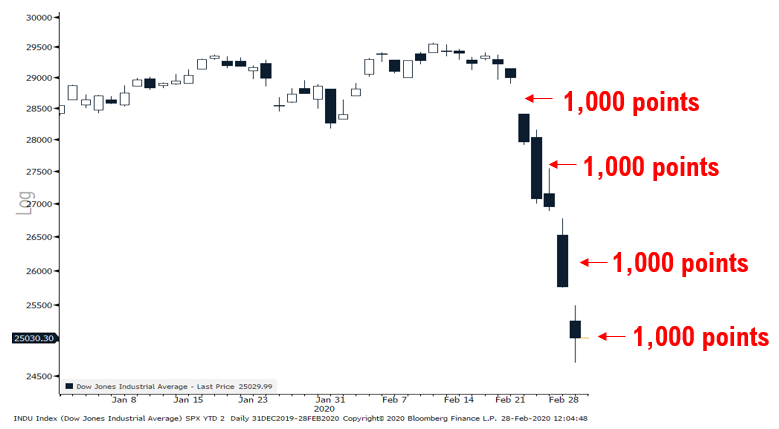

The Dow has posted 4 1,000 point drops this week.

This is not normal and the market is clearly indicating to us a change, and it could mean one of the following:

- Significant change in fundamentals

- Significant increase in 'risk' to fundamentals

- Financial plumbing is breaking down

- Meteor or alien invasion to end global existence has been spotted and arriving is unknown (or virus pandemic)

Of these factors, perhaps many will cite the 'risk' of economic calamity from COVID-19 and the lack of US preparedness for its eventual arrival. To an extent, this makes sense to us. And the natural question, therefore, is when is this priced in. Because of the idiosyncratric nature of a potential pandemic, this is really difficult to know when it is priced in.

But here are some perspectives and why we think we end up with a V-bounce:

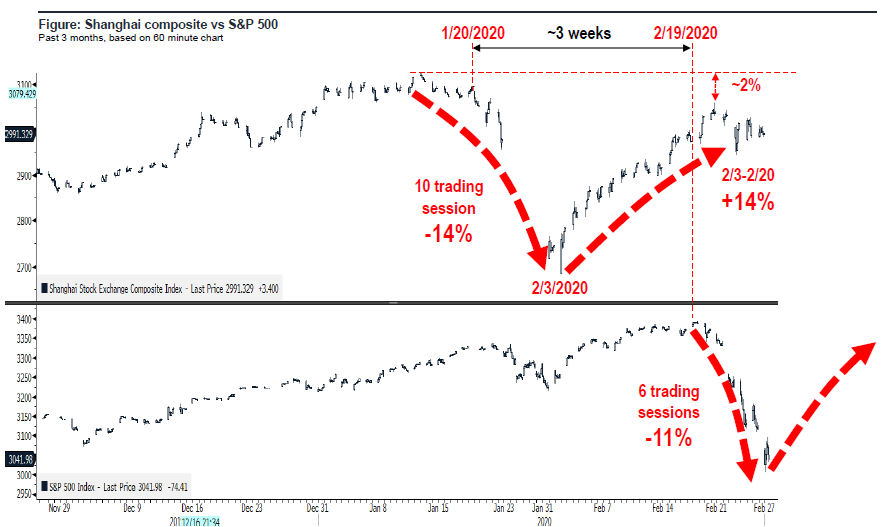

1. China stock market tanked 3 weeks before the S&P 500 peaked and has bottomed and rallied 14%. Even as the economy has not fully recovered or restarted.

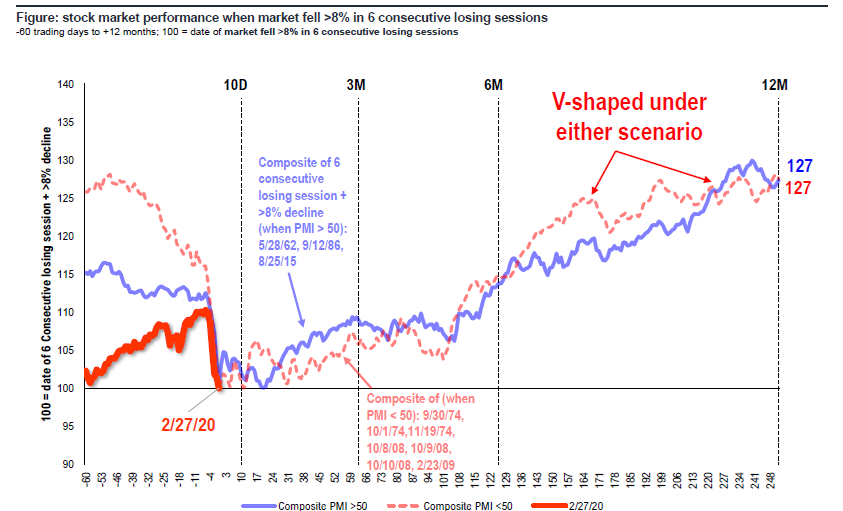

2. S&P 500 has fallen 6 consecutive days with >8% fall. This happened 10 times since 1948. 10 of 10 times stocks higher 12M later (27% avg, median 28.5%). When PMI>50, 100% win-ratio 10D, 3M, 6M and 12M later.

3. VIX surge to 48. This is peak fear and seen only in 2010, 2011, 2015 and 2018 within days of the low.

4. The spread between Div yield vs corporate bond yield is narrowest in 40 years. Think about that. Since the plunge started, Investment grade bond yields have plunged to 2.54% (2.97% start of year) while dividend yields surged. This did not happen in 2008 and is arguing strongly for stocks having valuation support.

5. Internals bottoming -- Lowry's data shows we have now seen 4 90% down days (including today) (90% of volume down + 90% stocks down). This is evidence of exhaustion of selling and when stocks see a 90% up day (next week?), would confirm a major bottom in place. There is not a need to necessarily see another "whoosh" down.

6. Internals bottoming -- the % stocks trading above their 200D is now a mere 27% (yesterday) and below 20% marks major lows. We will likely be there on today's close.

7. Today is the last day of the quarter, so there is window dressing. Monday is start of a new month and thus, there are inflows. Bonds are OW now, because they rose, so rebalance favors inflows to stocks.

8. COVID-19 is becoming political and shifting into an attempt to weaken the White House for 2020. Thus, there is some interested parties who would benefit from making this a greater fear to the financial markets. Down markets hurt Trump. Bad press hurts Trump.

On this latter point, our sense is that CEO confidence is considerably stronger, actually, and companies can and have responded to conditions--ala airlines making cuts, etc. This is good. Because businesses are not blind to the risks.

Bottom line: We think the odds still favor heavily that markets are bottoming this week. Even as the bad news continues and the risk of an eventual US outbreak is high. The oversold nature of markets is what is setting stage for a V-bounce.

WHAT COULD GO WRONG/ HAPPEN NEXT FEW DAYS

There will be anxiety heading into this weekend. No doubt, more countries will see infections. And the risk of more US cases is a given. And this would sow more panic.

However keep in mind, US and other governments can stage a policy response:

- US could announce Healthcare action plan

- US Treasury department could announce support for financial support

- US could announce fiscal stimulus package

- Fed could do an emergency cut

- Fed could announce a special facility to support stocks -- yes, I realize they don't have legal authority at the moment, but has anyone heard of "Presidential Executive Order"?

These, of course, are emergency measures. But it is an election year and the White House is incented to get equity markets to rise and to stem the fear.

POINT 1: CHINA MARKET BOTTOMED 3 WEEKS AGO...

China essentially shut down its entire economy and has not yet seen a peak in its infections. Yet, the Shanghai Composite bottomed 3 weeks ago, after a 14% plunge and V-rallied 14% to within 2% of this high.

- The US can bounce similarly (not a guarantee)

POINT 2: S&P 500 V-BOUNCES AFTER 6 CONSECUTIVE DAYS OF DECLINE >8% CUMULATIVE

Since 1948, there are 10 times S&P 500 posted 6 consecutive daily declines totaling >8% losses. The price recovery path is shown below. The blue is PMI>50 (3 times) and PMI<50 (red, 7 times).

- Notably, the recovery path looks the same and the 12M gets to the exact same endpoint. A 27% in 12 months --100% times positive.

It is just 100% win-rate 10D, 3M and 6M when PMIs are positive (see table below). The Chicago PMI came out today and confirms US still in expansionary trend.

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.