2019 is one of the strongest years for markets in more than 25 years and it is logical for one to think stocks will stall in 2020 (take breather) but unless P/E contracts, we think equities could do 10%-plus or better in 2020.

POINT: EPS +10% DRIVING 2020 RETURNS

2019 was all P/E.The S&P 500 is on track to gain ~30% in 2019, all gains from P/E expansion.

EPS $193 –> $178

P/E 13X –> 18X

2020 EPS +10% + PE upside: S&P 500 >3,450 and maybe 3,500-3,600

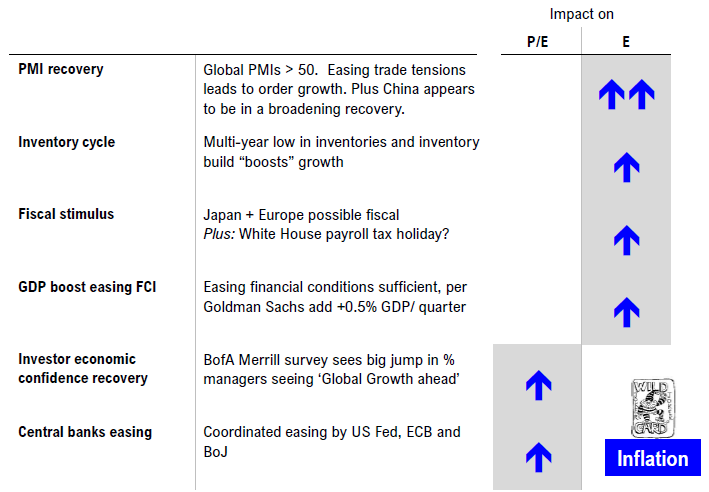

For 2020, the recovery in PMIs + Inventory build + Fiscal stimulus (Japan + possibly EU + White House) + easing financial conditions = EPS upside.

EPS >+10% in 2020

P/E flat to up (Fed ease + animal spirits)

Thus, we see stocks gaining 10% or more in 2020.

POINT: UPSIDE DRIVERS TO EPS (4) PLUS P/E EXPANSION DRIVERS (2)

We see 4 drivers to EPS upside (below) and these should allow EPS to grow >10% in 2020

P/E could also expand as “animal spirits” recover and Fed maintains dovish stance. Combined, this is >10% total return.

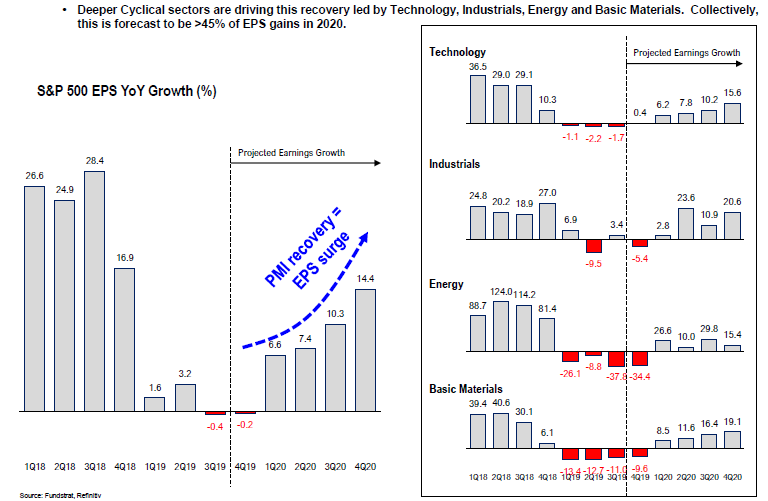

POINT: 45% OF EPS GROWTH COMING FROM 4 SECTORS — TECH, INDUSTRIALS, ENERGY & MATERIALS

About half of the cyclical recovery in EPS is coming from 4 sectors (Tech, Industrials, Energy and Materials), representing 45% of EPS growth in 2020 but only 35% of the base of earnings.

– Thus, if we are looking at flat P/E and EPS growth, these groups may be disproportionate price gainers.

The fact that Cyclicals would outperform makes sense if we are expecting rising PMIs, rising “animal spirits,” better economic visibility and also, fiscal stimulus. 2019 was a narrow market. 2020 should be broad.

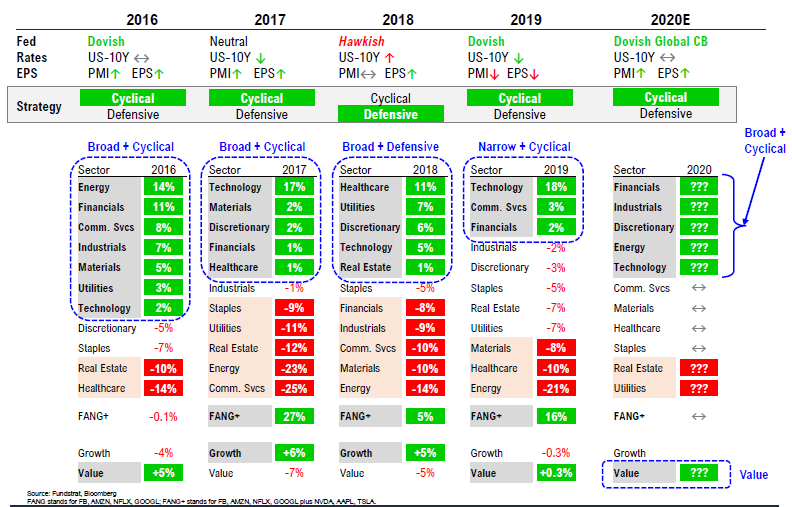

POINT: 2020 OW CYCLICALS AND EXPECT BROADER SECTOR OUTPERFORMANCE

Looking back at the last few years, a dovish Fed + flat 10-yr (maybe) + EPS and PMI recovery is supportive of cyclical stocks and Value. This is what happened in 2016 and 2017 (below).

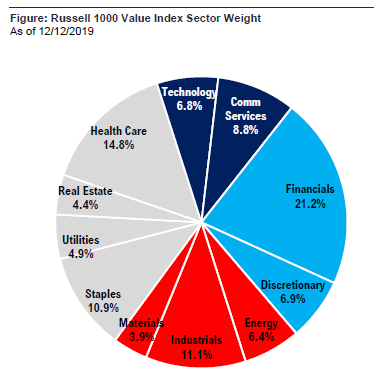

– In order of conviction, we like Financials (21% of Value index), Industrials (PMI sensitive), Discretionary (ala AMZN), Energy and Technology (best performer when PMIs recover).

– This should also make it a somewhat easier job for our active manager clients–especially because FANG is less likely to lead (it is an “even” year and FANG only works in “odd” years).

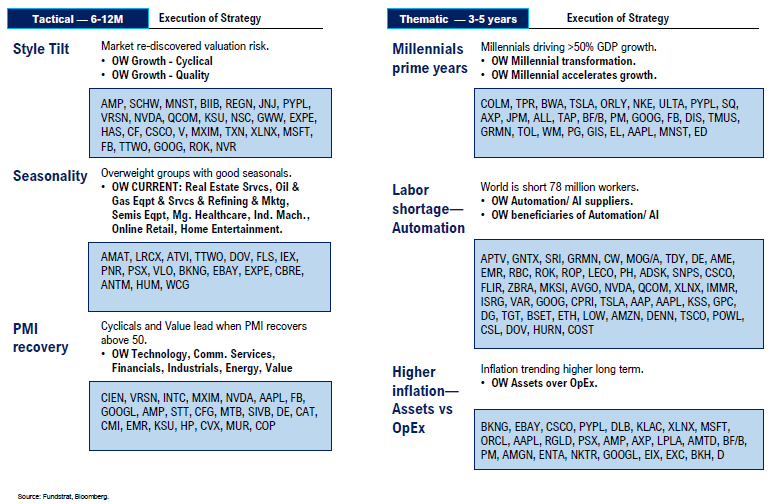

POINT: 2020 INVESTMENT THEMES –> DROPPING FANG, ADDING PMI RECOVERY BASKET

Our investment themes for 2020 are summarized on the left chart below. Basically, we think “asset light” underperforms (subscription models) partly as a result of reflationary pressure plus to an extent by-product of WeWork blowup. The theme that will likely gain more traction throughout 2020 is Millennials.

– We are adding a new “theme basket” called PMI Recovery. These are stocks which outperform consistently when US ISM moves back above 50. We expect the ISM to move above 50 before mid-2020. Already, global PMIs >50. And we are seeing a synchronized expansion in China + US. Thus, this is timely.

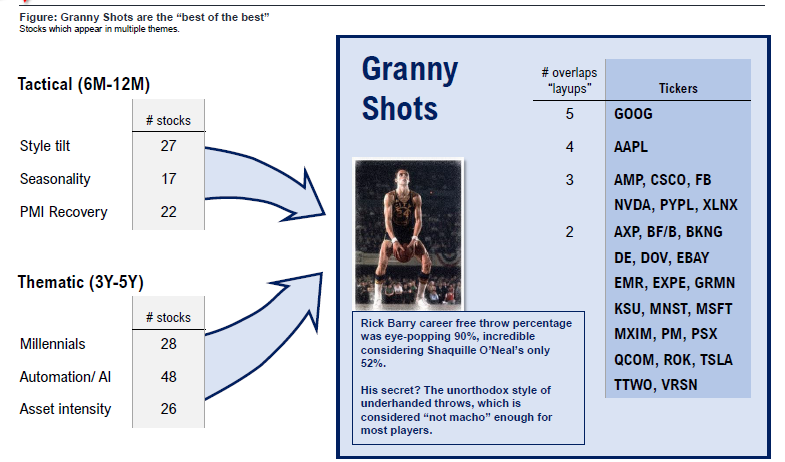

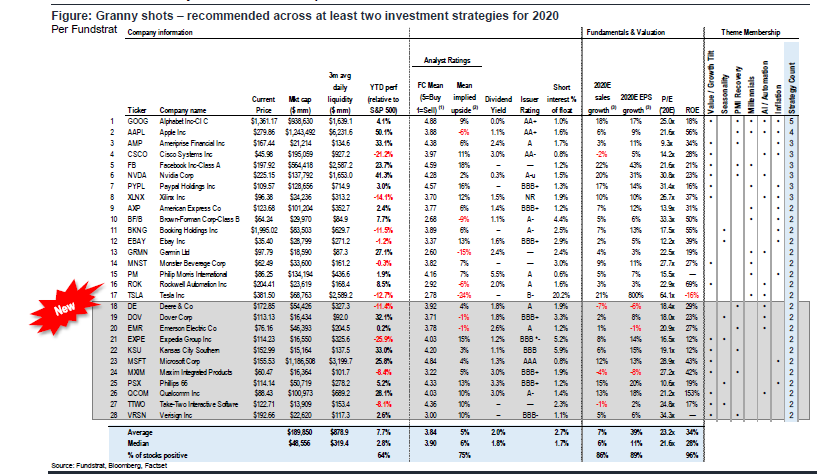

GRANNY SHOTS: 28 CORE IDEAS WHICH COMBINE OUR 6 THEMES + DQM QUINTILE 1

In tribute to Rick Barry (best free thrower, and underhand shooter), our Granny Shots are the “best risk/reward” ideas because they intersect our themes and are also DQM 1 ranked in our model.

– The rebalance results in 28 stocks. GOOG and AAPL are the top names. GOOG is in 5 of 6 themes. It is even a top performer when PMIs recover.

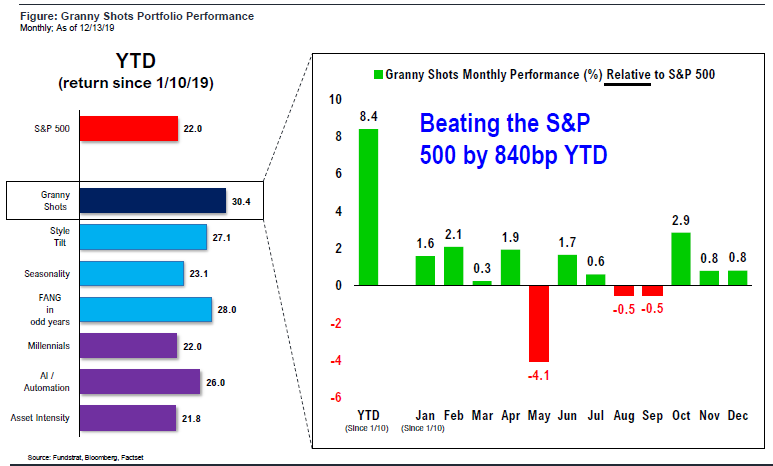

Granny shots 2019 YTD relative performance is 840bp.

Granny shots offer small monthly incremental relative performance as shown below. We are not trying to “hit home runs” but rather, provide ideas that are supported by multiple market themes and thus, have a greater chance of outperforming.