Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

Monday

Tuesday

Wednesday

SKIP THURSDAY

Friday

STRATEGY: July/August “chop” morphing into full Missouri (aka “show me state”) –> tilting us further into “risk-on” view –> multiple risk-on signs

Wednesday sell-off was capitulation…

The sell-off seen in markets Wednesday, in our view, had a capitulatory feel to it. The ostensible trigger was a combination of the soft ADP jobs report and seeming hysteria over lambda variant of COVID-19. But despite all that hysteria and broad-based selling, I was struck by a few things (anecdotes):

– dozens of inbound inquiries about lambda variant causing a new wave (see below why we think this is a nothing burger)

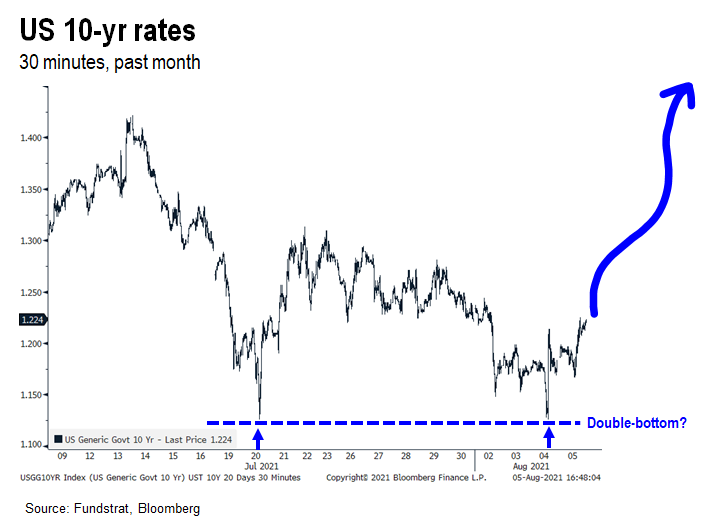

– US 10-year crashed to 1.126% but has since flipped higher (now 1.227%)

– several cited DeMark predictions of a 1929-style crash = more panic

– lots of angry investors = shouting at the market = ultimate capitulation signal, SERIOUSLY!!!

July/ August chop morphing into full Missouri

For those uninitiated, Missouri’s slogan is the “show me state” — so, in my days as a Technology analyst, when investors became so skeptical of a stock, we would call that stock a “show me” stock, or a Missouri.

The July/August “chop” is fanning investor anxiety about multiple scenarios that end in disaster:

– falling 10-year rates = double-dip/ disinflation coming

– weak ADP jobs report = fears US “peaked”

– media reports about lambda variant now sparks fears of another deadly wave behind the Delta variant

To us, this just shows how a thinner than usual market (July/August = revenge travel = buyers strike) and the resulting chop is fueling hysteria. While COVID-19 remains mysterious and the path remains uncertain, we think this set up is pretty ideal for a massive risk-on rally, assuming the right positive catalysts emerge.

– we discuss the 5 likely positive catalysts/signs that set stage for a full-risk on

– this likely lasts 5-6 weeks, or well into September

Source: Google

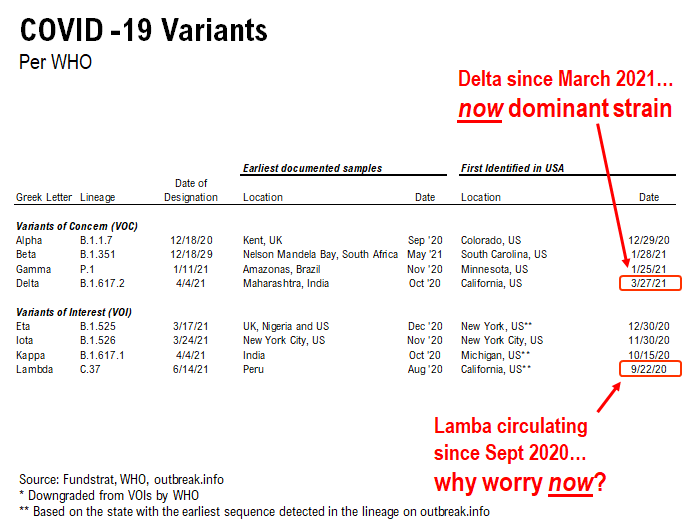

Lambda why now? Lambda variant in USA since September 2020, 6 months before Delta variant

We received multiple questions about the lambda variant, as investors are concerned this may become the next big variant sweeping across the US. We are not scientists, but we are doubtful lambda will create a new wave of infections in the US:

– Lambda was first detected in USA on 9/22/2020 in California

– Delta first detected in USA on 3/27/2021 in California

– Lambda has been circulating for 11 months, Delta for 4 months

– Why should we suddenly worry Lambda will resurge?

– Lambda was first detected in Peru and has swept through Latin America

– Investors are fearful of Lambda because it can potentially evade vaccines

…IHME forecast on Florida might be pinpoint accurate –> have FL cases peaked?

Earlier this week, we highlighted the IHME forecast that FL infections would apex on 8/4 (Wednesday this week). And this is a key pivot. FL is seasonally seeing another COVID-19 wave and this fueled by the highly transmissible Delta variant.

– the latest CDC FL case data (lower half of chart) seems to corroborate that FL peaked?

– if FL delta variant peaked, with zero mitigation = very positive outcome

We are watching this closely, but for now, it looks like FL might have peaked. Wow.

STRATEGY: REVISED VIEW –> Full “risk on” into month-end, maybe into September

We have been progressively becoming more constructive on the prospects for equity markets into August.

– For the past 6 weeks, we have warned of July/August chop.

– But the chop is leading to mounting panic by investors

– Wednesday looked like a full on capitulation day

Thus, we are revising our view. We now expect equity markets to rally into month-end, and possibly into September. Yes, we see “chop” but this chop is likely turning into a strengthening rally into the end of the month.

– WARNING: this is very counter-seasonal

– August is normally more “chop” than July

But let me explain this rationale below.

Multiple catalysts driving “full risk on” into month-end

There are multiple positive catalysts driving a full-on risky rally into month-end (possibly into the end of September):

– US 10-yr might have seen a “double bottom” on 8/4 (vs July 20) = risk-on

– FL COVID-19 cases might be soon rolling over (might have already peaked on 8/4) = risk-on

– July jobs report might confirm US economic momentum likely stronger than recent “soft data” suggests = risk-on

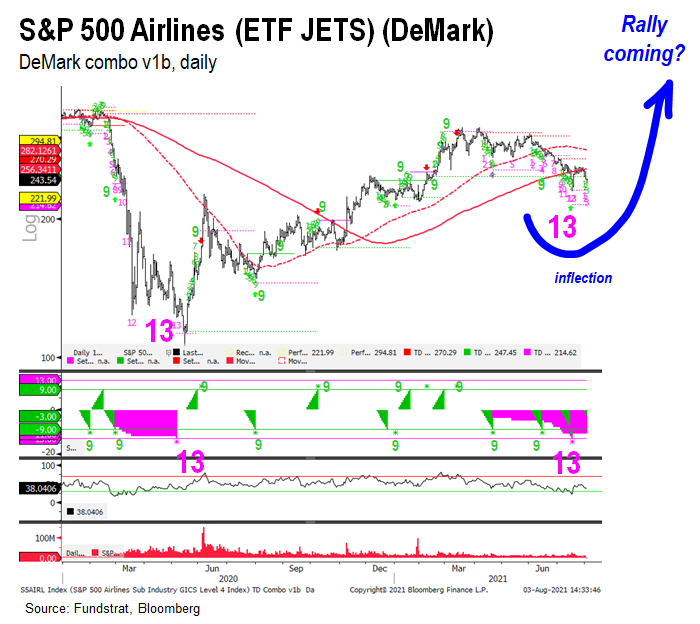

– Key groups China (ETF MCHI 0.47% ), Airlines (JETS 0.19% ) and Casinos (BETZ 1.57% ) are forming important ’13 buy setup’ bottoms = risk-on

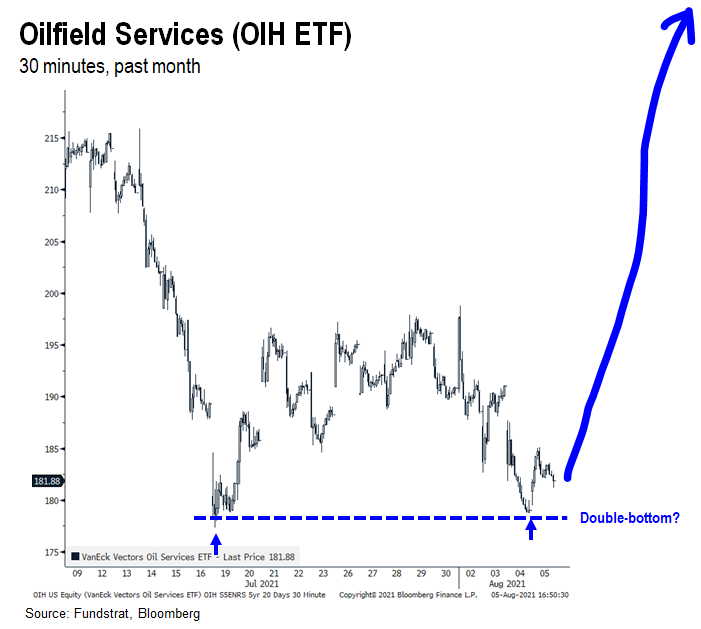

– Oilfield Services stocks (OIH 1.32% ) are finding a trifecta of key support at $179 (see below) = risk-on

EXTRA CREDIT: Multiple sell-side firms including Citi, Morgan Stanley, Stifel, among others calling for 10% correction = counter-trade

…US 10-year reversed sharply since touching 1.12% on Wed = risk-on

Earlier this week (Monday FLASH), we noted that the US 10-yr was at an important juncture on its weekly chart (touching 200-week + DeMark ’13 reversal setup’) and indeed, it looks like rates are reversing higher this week:

– possible double bottom versus July 20th

– touched 200-week moving average

– DeMark weekly combo v1b ’13 buy setup’ (meaning higher rates)

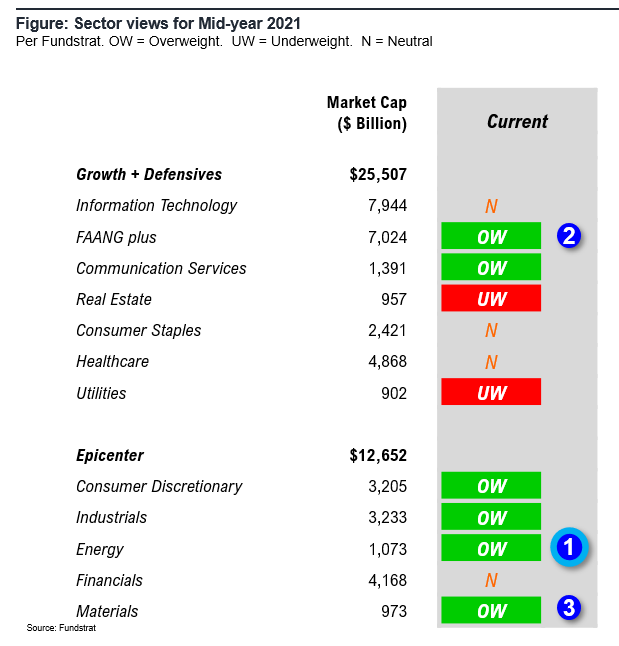

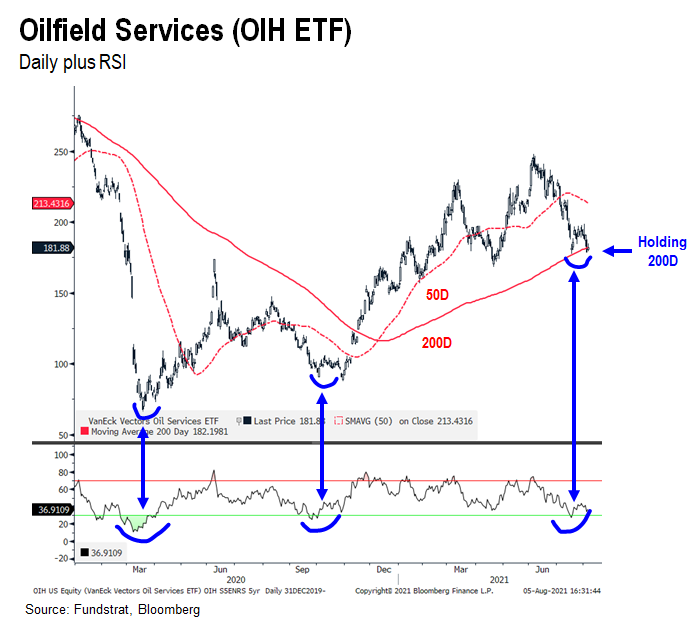

SECTORS: Oilfield Services is key to watch –> looks like a key reversal this week

If we are looking at full risk-on into month end, this is the opposite of 2020. In 2020, markets were choppy throughout the entire month and investors needed to stock with Growth/FAANG. However, in terms of sectors, our 3 favorites into month end:

– Energy

– FAANG

– Basic Materials

So a cyclical tilt.

…Oilfield Services at a trifecta of support

We continue to believe Energy will be among the best sectors into year-end. Energy stocks naturally stall when markets become worried about the global re-opening, but we view this turbulence as temporary. This is the key question, is the July/August “chop” signaling a change in the recovery?

– Or is the “chop” seasonal and investor panic = chasing these stocks later

There are 3 reasons we think Energy/ OIH 1.32% is poised to rally hard from here:

– OIH looks like it posted a double bottom (8/4 and 7/20, identical to the US 10-yr)

– OIH is holding the 200-day moving average $182

– OIH daily RSI was oversold (see chart) and has rallied hard off this RSI reading (March 2020, Sept 2020)

…Airlines JETS 0.19% are also key to watch, and look likely to lead August rally

Another group we are watching closely is Airlines (ETF JETS 0.19% ). We discussed this DeMark ’13 buy setup’ (combo v1b daily) earlier this week. And this setup seems to be playing out:

– Airlines rallied nearly 5% on Thursday

– Airlines were massacred since Delta variant fears emerged

– logically, Delta variant apexing in USA = airline rally

…Casinos BETZ 1.57% also key and look likely to lead August rally

Another group we are watching closely is Casinos (ETF BETZ 1.57% ). We discussed this DeMark ’13 buy setup’ (combo v1b daily) earlier this week. And this setup seems to be playing out:

– Casinos rallied >4.5% on Thursday

– Casinos have been particularly hard hit because of the resurgence in cases in Asia

– If casinos continue to rally, this is a leading indicator for a broader epicenter rally

__________________________

Granny Shots:

We performed our quarterly rebalance on 07/30. The full 26 Granny Shots stock ideas –> Click here

___________________________

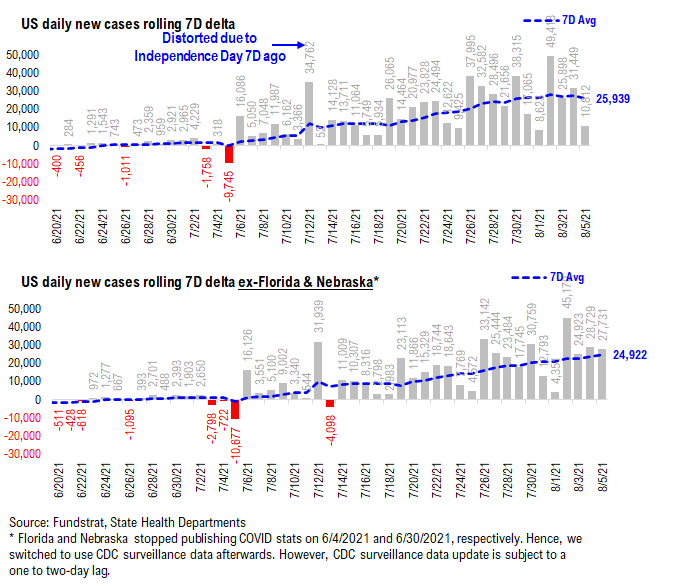

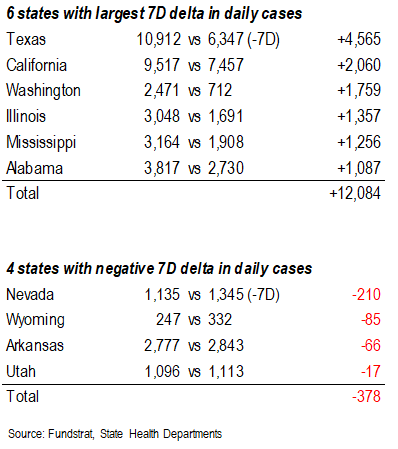

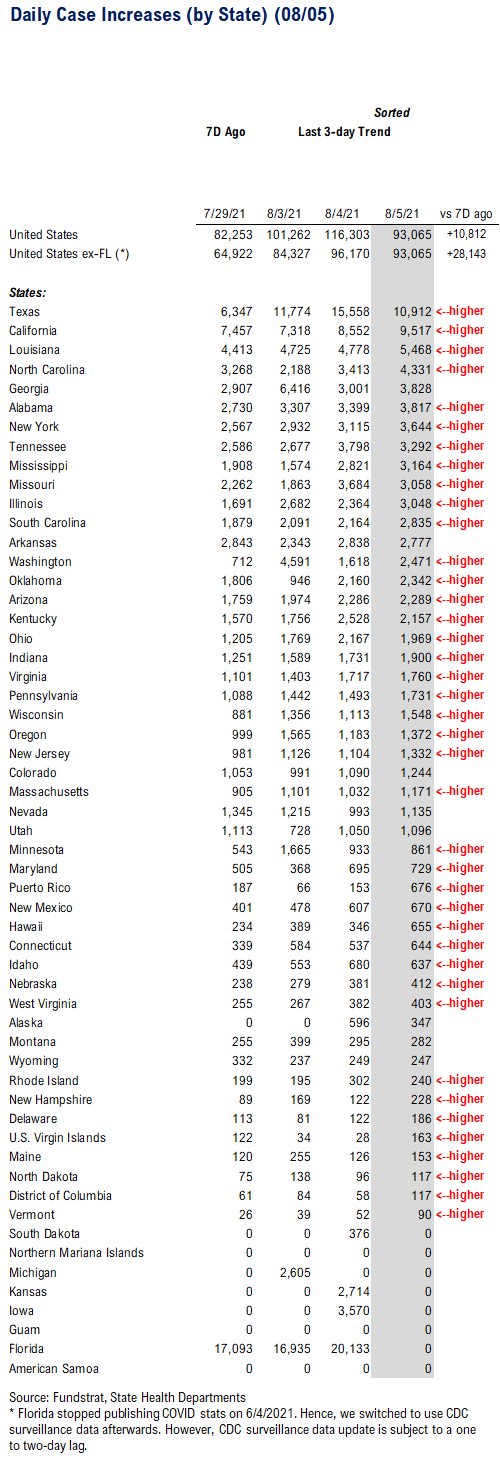

POINT 1: Daily COVID-19 cases 93,065, up +28,143 (ex-FL) vs 7D ago…

_____________________________

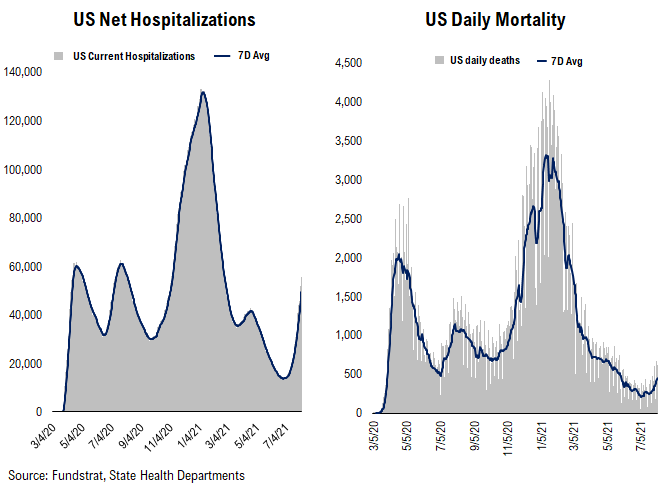

Current Trends — COVID-19 cases:

– Daily cases 93,065 vs 82,253 7D ago, up +10,812

– Daily cases ex-FL 93,065 vs 64,922 7D ago, up +28,143

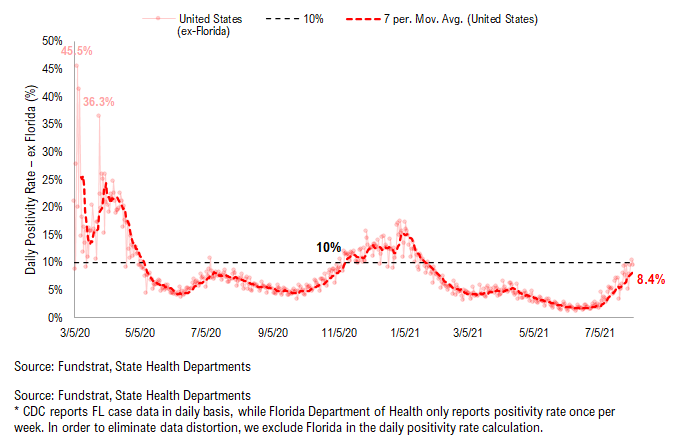

– 7D positivity rate 8.4% vs 6.4% 7D ago

– Hospitalized patients 55,686, up +32% vs 7D ago

– Daily deaths 450, up +49% vs 7D ago

_____________________________

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, since CDC surveillance data is subject to a one-to-two day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

The latest COVID daily cases came in at 93,065, up +28,143 (ex-FL) vs7D ago. The 7D delta in daily cases continue to rise higher. Currently the 7D average of the 7D delta has risen to ~25,000 (ex-FL&NE). That said, our base case remains that daily cases apex in two weeks. And if it’s going to be true, we could see the 7D delta rolling over within the next 7-10 days. Recall, the rollover in 7D delta indicates that daily cases are approaching their peak and could serve as an early signal of case rollover.

The positivity rate is also surging, currently at 8.4% and approaching the key level of 10%. Hospitalizationhas exceeded the peak level we’ve seen in April’s “mini” wave and is now near the peak of Wave 2 last summer. Most importantly, daily deaths appear to surge recently. Although we believe the surge in daily deaths might not as “dramatic” as daily cases or current hospitalization (especially with the help from vaccines), it is definitely the most important metric we are tracking closely.

7D delta in daily cases is still rising…

Previously, we noted that the 7D delta in daily cases appeared to be apexing. However, the recent data suggests that the rise in 7D delta persists. Again, we are waiting for the 7D delta to apex because that is the first sign of case rollover. However, US cases will continue to rise but will do so at a slower speed until the day that 7D delta turns to negative.

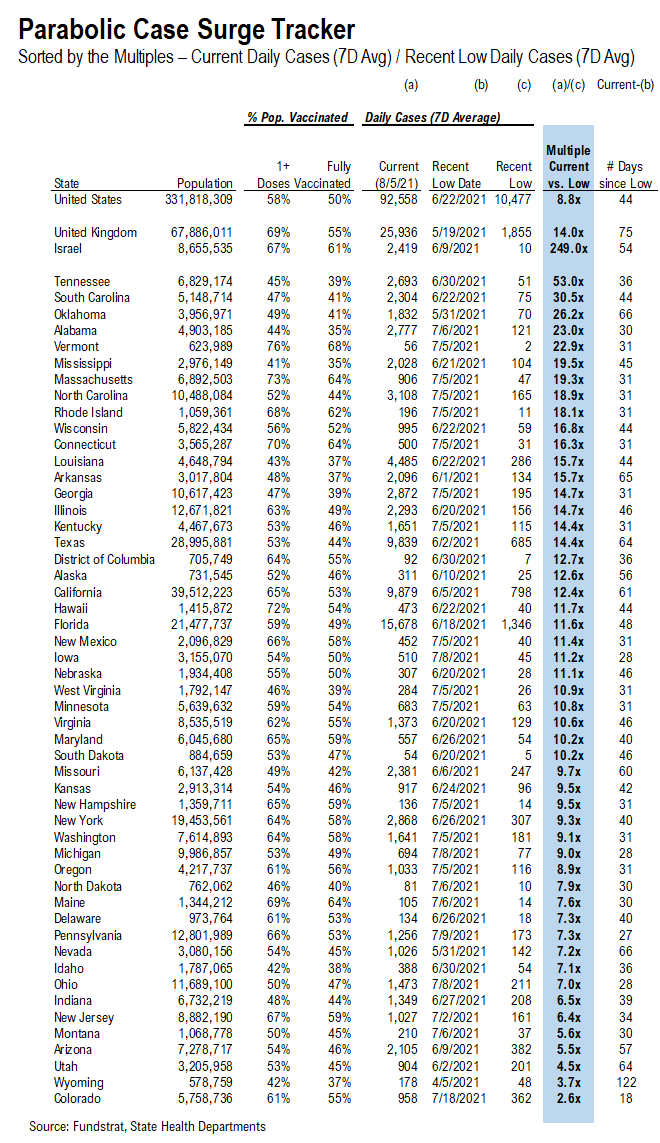

Low vaccinated states seem to have a larger increase in daily cases compared to their recent low…

Below, we added a new section called “Parabolic Case Surge Tracker” to monitor the possible parabolic surge in daily case figures. In the table, we included both the vaccine penetration and the recent case trend for 50 US states + DC. The table is sorted by the multiple of their current daily cases divided by their recent low in daily cases.

– The states with higher ranks are the states that have seen a more significant rise in daily cases

– We also calculated the number of days between now and the recent low date; a state with a high multiple but low number of days since its low means the state is facing a relatively rapid surge in daily cases

– The US as a whole, UK, and Israel are also shown at the top as a reference

Hospitalization and positivity rate continue rising… Daily deaths is also trending upwards now…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID.

As you can see, hospitalization and positivity rate have exceeded the peak level we’ve seen in April’s “mini” wave. Daily deaths have been trending upwards recently, but far less “dramatic” than the cases or hospitalization trends.

POINT 2: VACCINE: vaccination pace has been gradually rising over the past two weeks… Nearly half of Americans are fully vaccinated…

_____________________________

Current Trends — Vaccinations:

– avg 0.7 million this past week vs 0.6 million last week

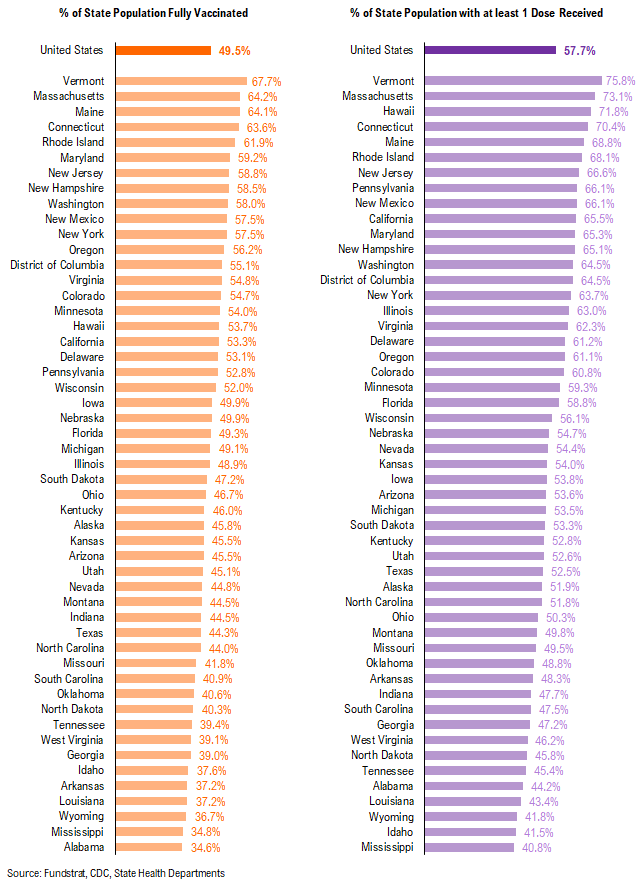

– overall, 49.5% fully vaccinated, 57.7% 1-dose+ received

_____________________________

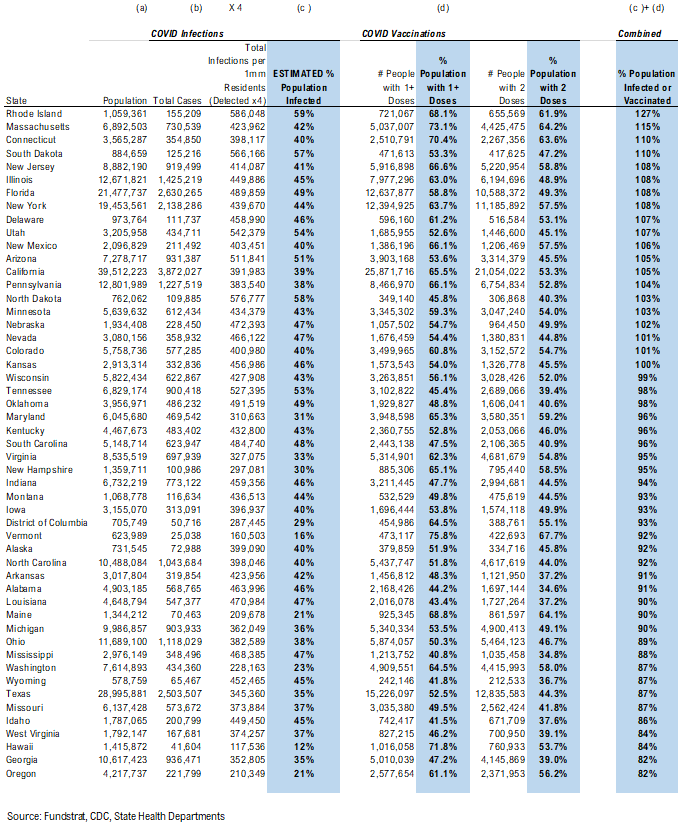

Vaccination frontier update –> all states now near or above 80% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are near or above 80% combined penetration

– RI, MA, SD, CT, NJ, IL, NY, DE, NM, UT, PA, ND, AZ, MN, CA, FL, NE are now above 100% combined penetration (vaccines + infections). Again, this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated.

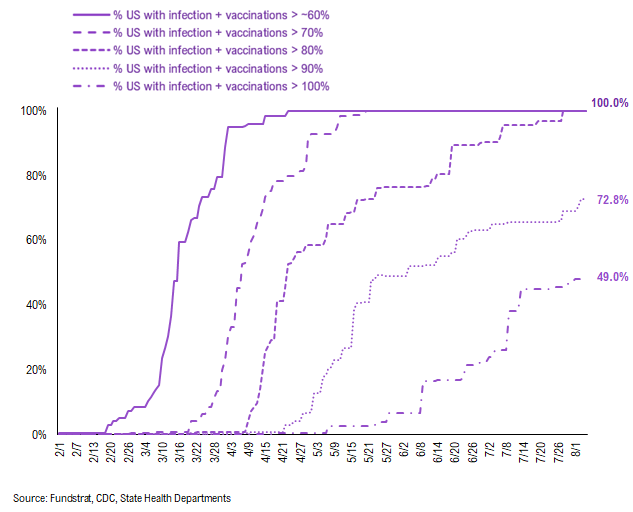

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration >60%/70%/80%/90%/100%. As you can see, all states have reached 80% combined vaccination + infection. 71.9% of US states (based on state population) have seen combined infection & vaccination >90% and 48.1% of US states have seen combined infection & vaccination >100% (Reminder: this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within the state is either infected or vaccinated).

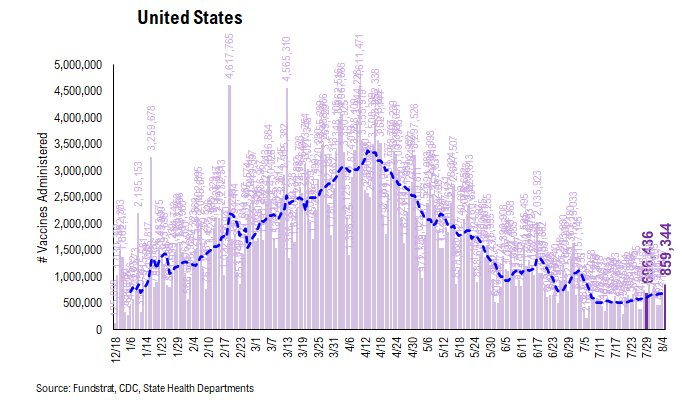

There were a total of 859,344 doses administered reported on Thursday, up 23% from 7D ago. The vaccination pace apparently has improved over the past two week (although slowly). As we noted earlier this week, it seems that people are becoming more inclined to get vaccinated over growing Delta variant concerns. Especially, the states with lower vaccine penetration appear to have a greater improvement. This is a great sign.

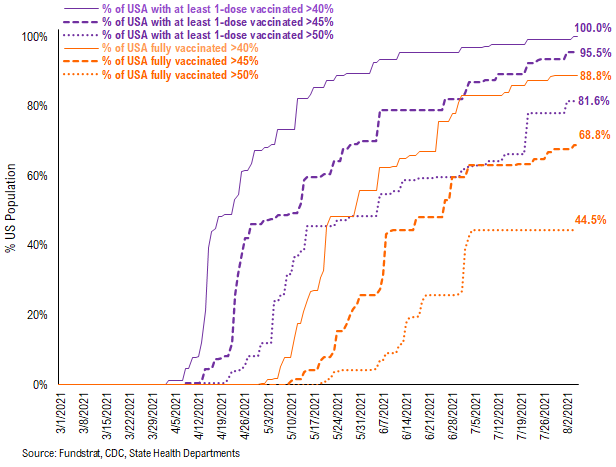

81.6% of the US has seen 1-dose penetration >50%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 45%/45%/50% of its residents fully vaccinated, displayed as the orange line on the chart. Currently, 88.8% of US states have seen 40% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 45% of its residents fully vaccinated, this figure is 68.8%. And only 44.5% of US (by state population) have seen 50% of its residents fully vaccinated.

– While all US states have seen vaccine penetration >40%, 95.5% of them have seen 1 dose penetration >45% and 81.6% of them have seen 1 dose penetration > 50%.

– 88.8% of the US has at least 40% of its residents fully vaccinated, However, only 68.8% of US has fully vaccinated >45% and 44.5% of US has fully vaccinated >50%.

This is the state by state data below, showing information for individuals with one dose and two doses.

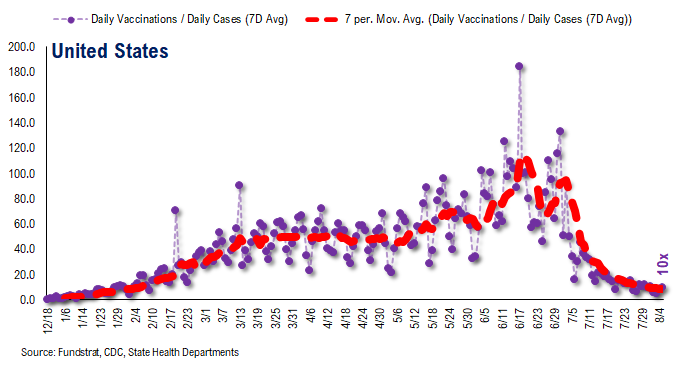

The ratio of vaccinations/ daily confirmed cases has been falling significantly (red line is 7D moving avg). Both the surge in daily cases and decrease in daily vaccines administered contributed to this.

– the 7D moving average is about ~10 for the past few days

– this means 10 vaccines dosed for every 1 confirmed case

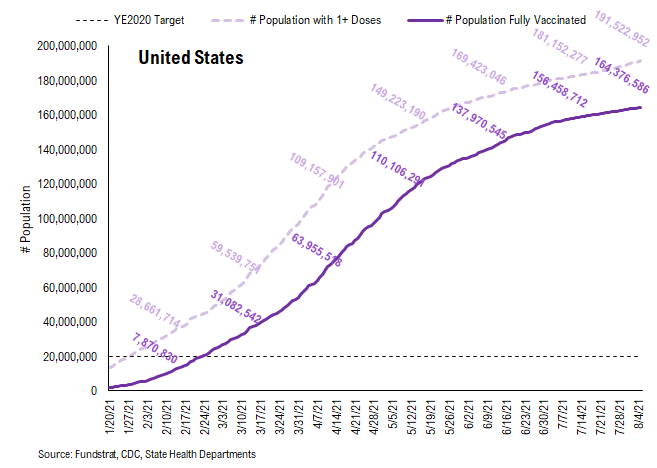

In total, 347 million vaccine doses have been administered across the country. Specifically, 192 million Americans (58% of US population) have received at least 1 dose of the vaccine. And 164 million Americans (50% of US population) are fully vaccinated.

POINT 3: Tracking the seasonality of COVID-19

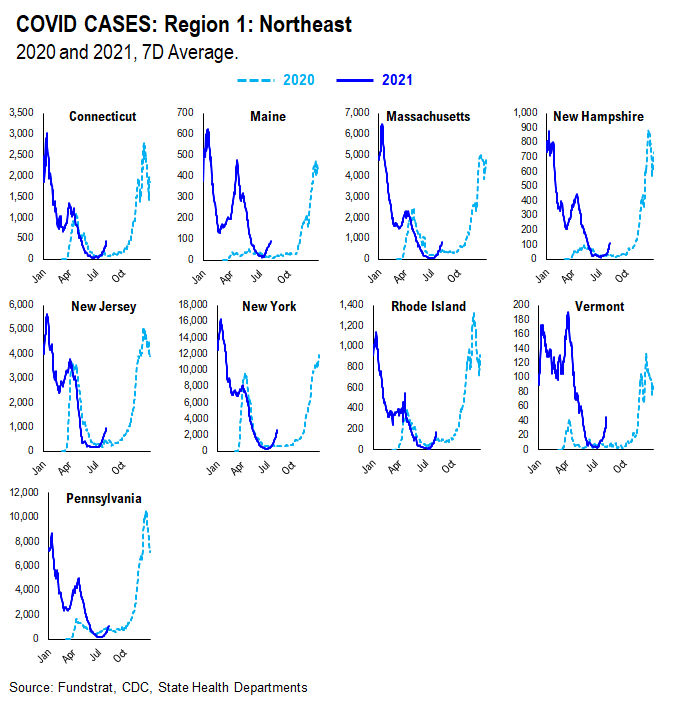

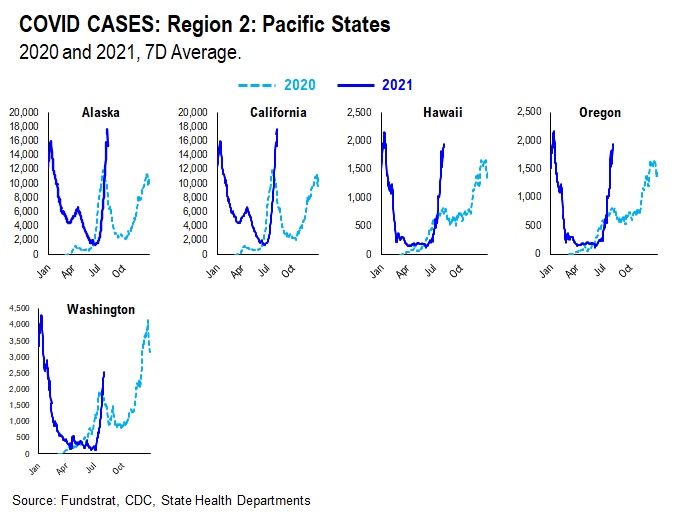

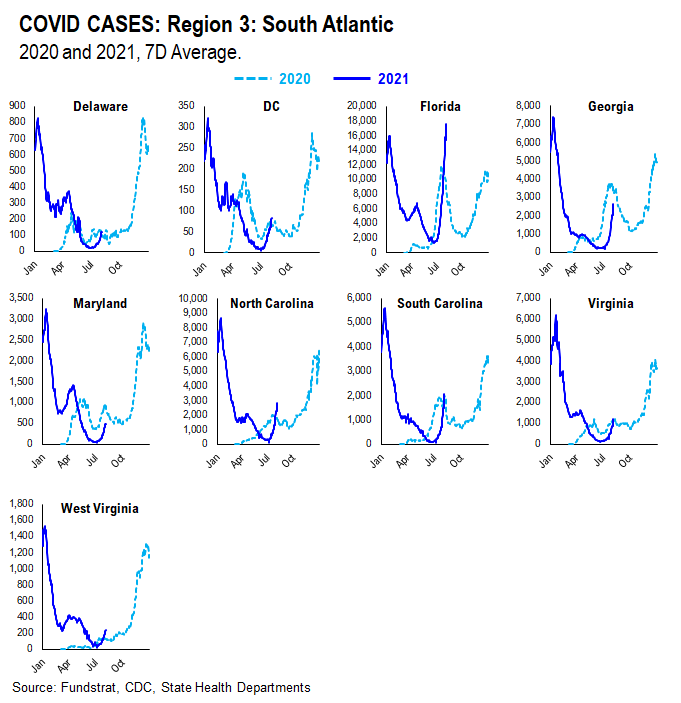

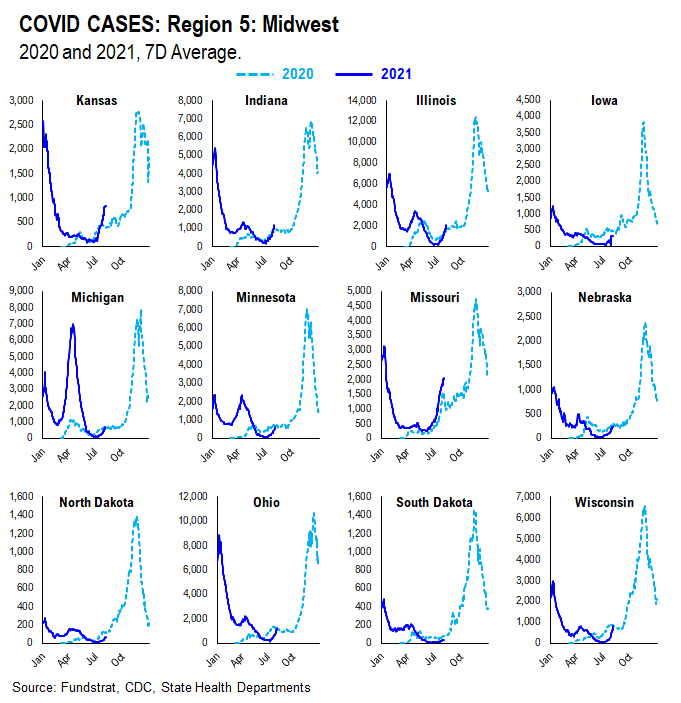

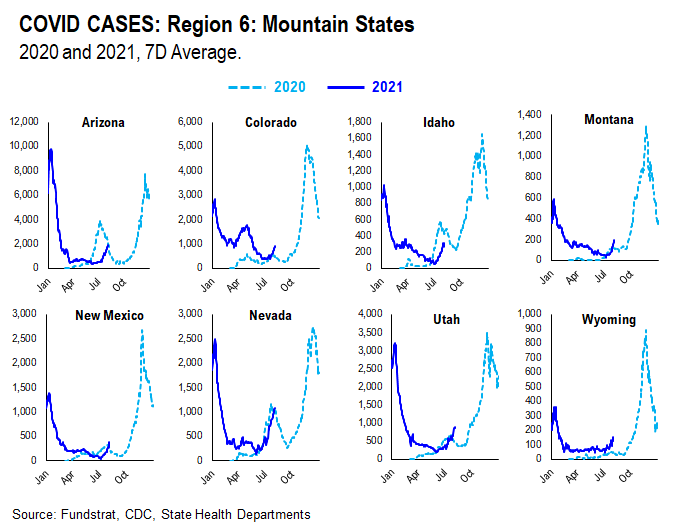

In July, we noted that many states experienced similar case surges in 2021 to the ones they experienced in 2020. As such, along with the introduction of the more transmissible Delta variant, seasonality also appears to play an important role in the recent surge in daily cases and hospitalization. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.

The possible explanations for the seasonality we observed are:

– Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer

– “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors

If this holds true, seasonal analysis suggests that the Delta spike could roll over by following a similar pattern to 2020.

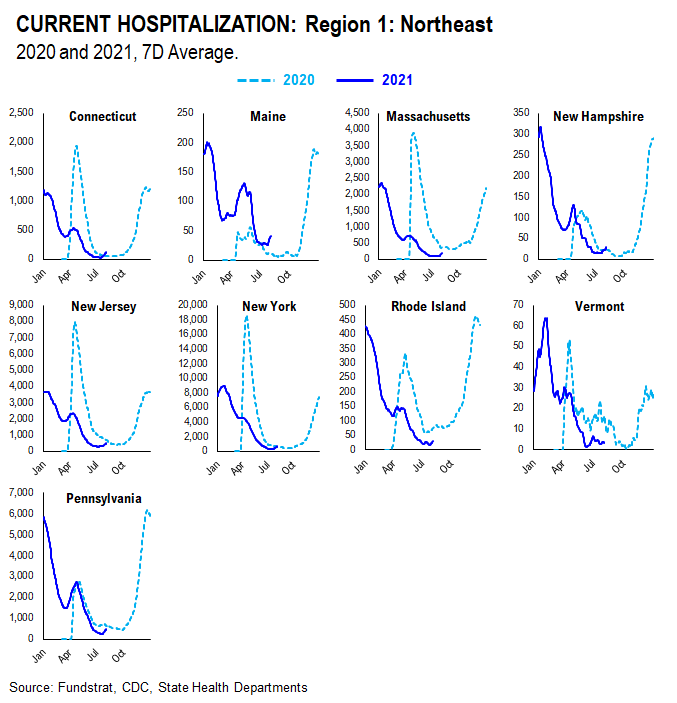

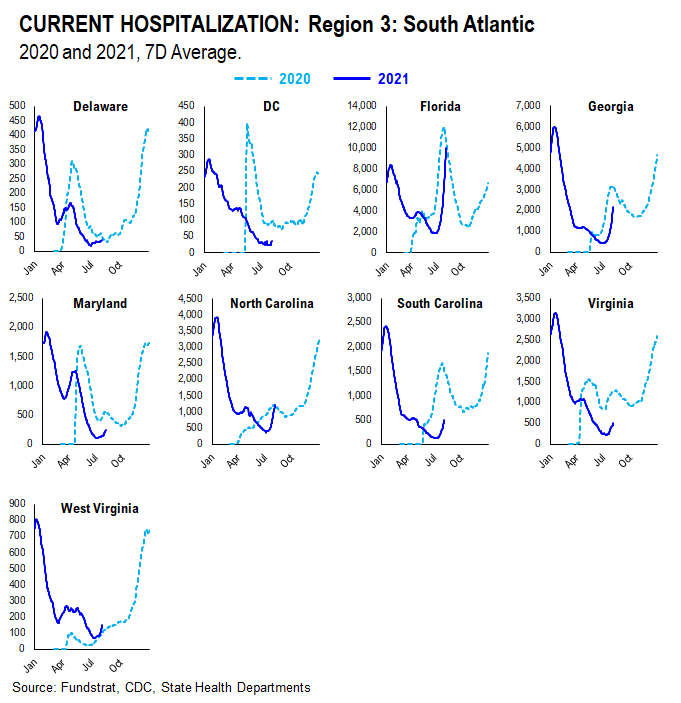

We created this new section within our COVID update which tracks and compare the case and hospitalization trends in both 2020 and 2021 at the state level. We grouped states geographically as they tend to trend similarly.

CASES

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

HOSPITALIZATION

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus.