______________________________________________________________

We discuss: why markets could react positively post-FOMC meeting this Wed. This reflects both a potential change in Fed view on inflation but also because equities are oversold.

Please click below to view our Macro Minute (Duration: 6:29).

______________________________________________________________

The FOMC will announce its rate decision on Wed (9/20) at 2pm ET. The Sept rate decision is a fait accompli, in the sense that no hike is expected, but that is not what will matter for markets. What will matter is the Fed’s views around the path of future hikes, future neutral rate and generally assessment on inflation. The S&P 500 has struggled this month, down -1.4% month to date, on top of a weak August. Investors are naturally apprehensive that Wednesday FOMC press conference could unleash a push higher in interest rates, and a commensurate sell-off in stocks. But we think the risk/reward is actually somewhat positive into this meeting:

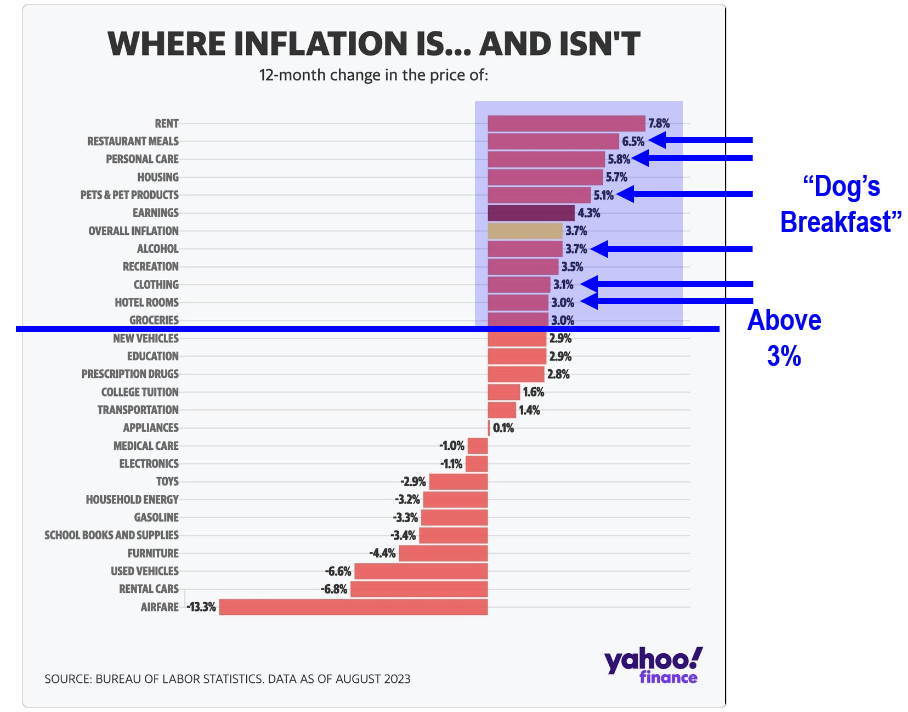

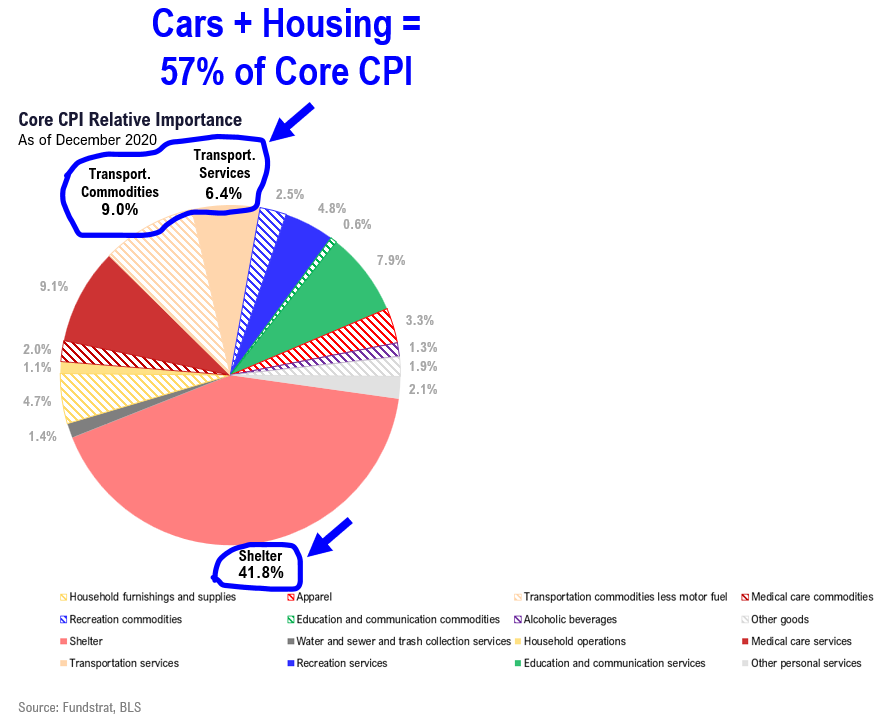

- The progress on inflation since July is meaningful, as core inflation YoY has dropped from 4.8% to 4.3% and the underlying trends in labor markets has improved on supply (jobs growth) and the pace of worker growth. So the Fed is in a position to not only pause, but also to become far more surgical on the need for future tightening. We also think the Fed may shift away from its data dependent view towards one that looks at future indicators.

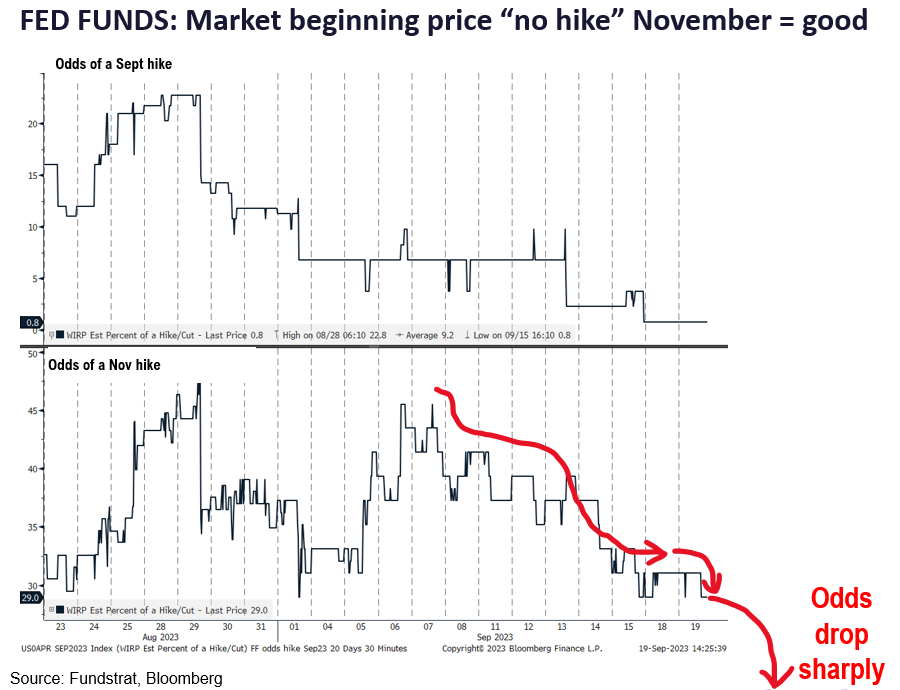

- We think post-FOMC, the odds of a number hike should fall from the current 29% (down from 48% a few weeks ago) towards zero. The odds dropped 2pp today from 31% to 29%. If Powell speaks of a shift towards looking at forward indicators, this would likely be a positive surprise for markets.

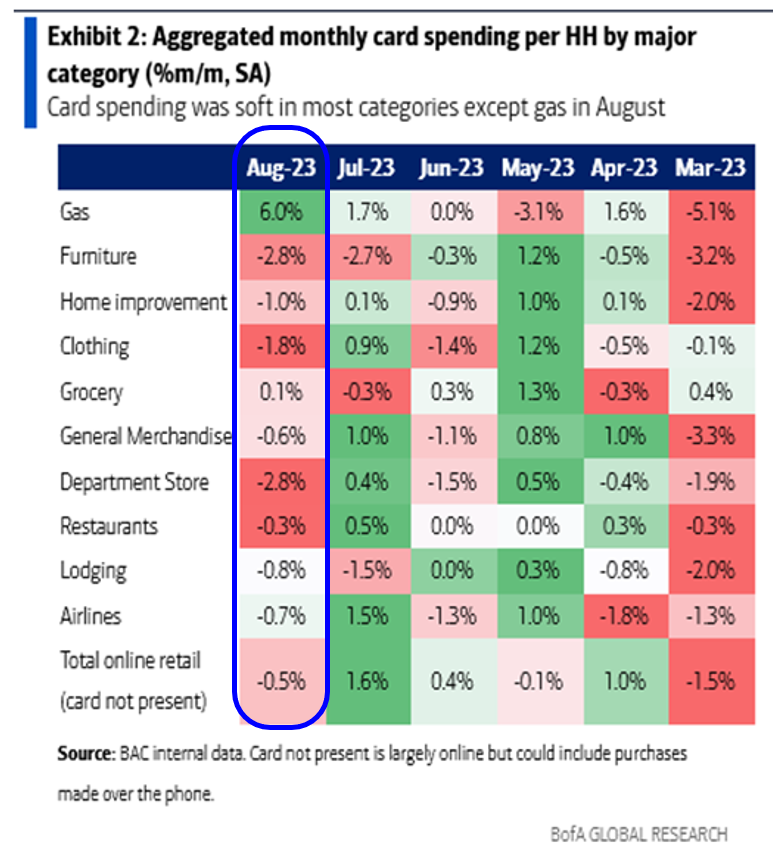

- Oil prices are up sharply in the past few months and this will elevate headline inflation. The concern is this might trigger a renewed effort by the Fed to lower inflation. This rise in oil is triggered by a supply shock (versus demand) and a Fed reacting to this with further tightening might seem less effective than if this was a demand surge. Moreover, as ZD of NY notes, the BofA credit card data shows a sharp slowing of consumer spending in August.

- Thus, the oil shock is actually disinflationary to services, arguably, because it has reduced consumer spending around services. This is an argument further favoring a pause.

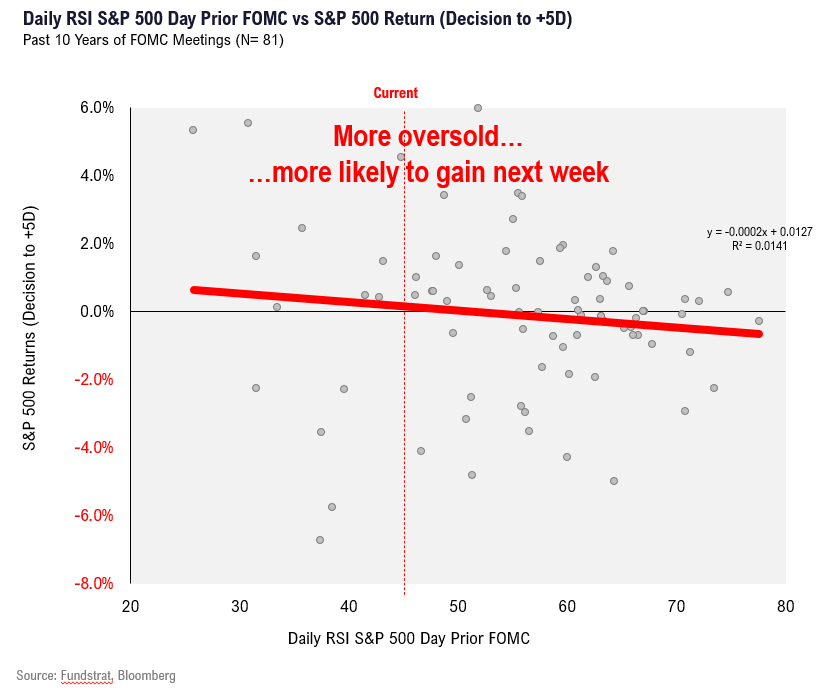

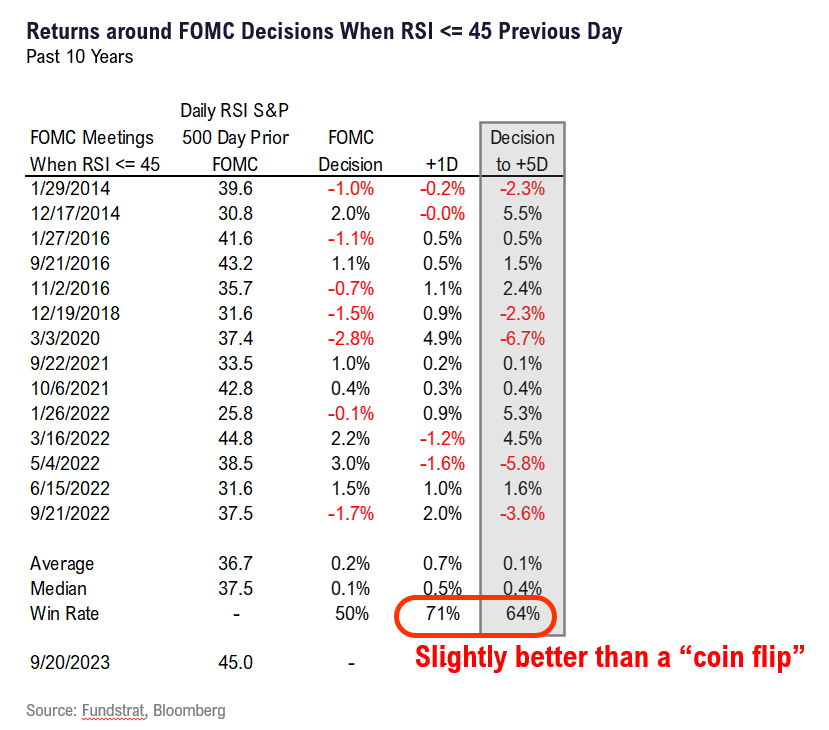

- Another reason to expect markets to react positively is the S&P 500 is oversold heading into this rate decision. There are many ways to measure this, especially looking at hourly charts. And below we show the daily RSI (14 period) and we are at the lower end of the range and at 44 is one of the lowest levels in recent history into an FOMC meeting.

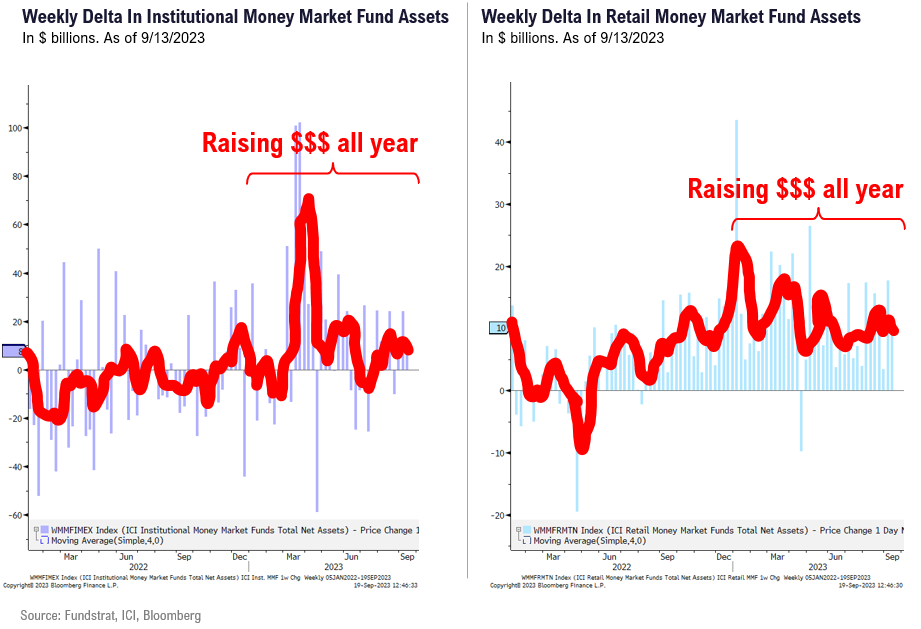

- Investors continue to pile into money market funds. In just the past 3 weeks, $74 billion has flowed into money market funds, while equities continue to be starved of inflows. Investors are sitting on a mountain of $5.6 trillion of money market cash and this will not be reinvested into money market funds foreover. Thus, we know this dry powder will be a fuel for stocks down the road.

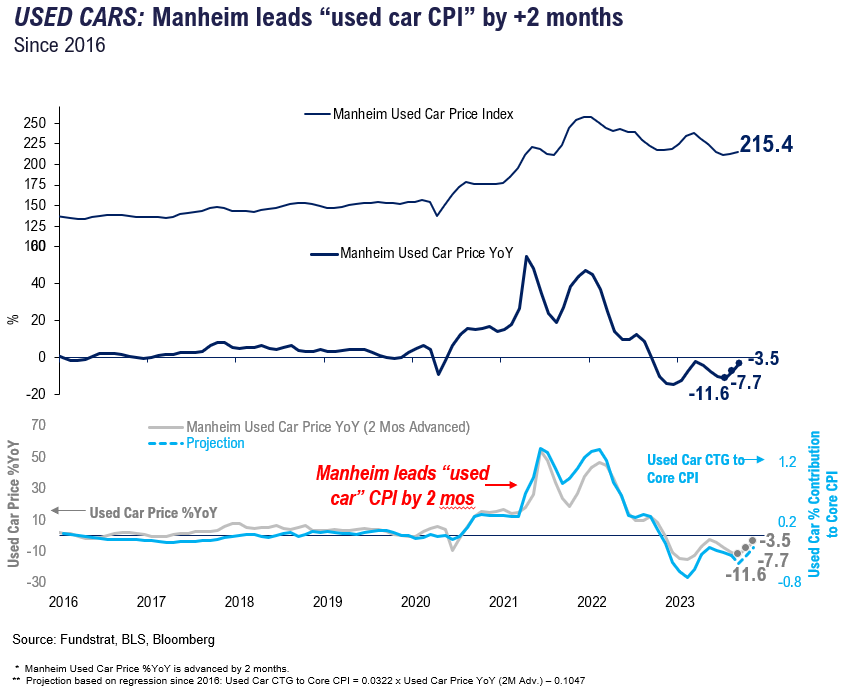

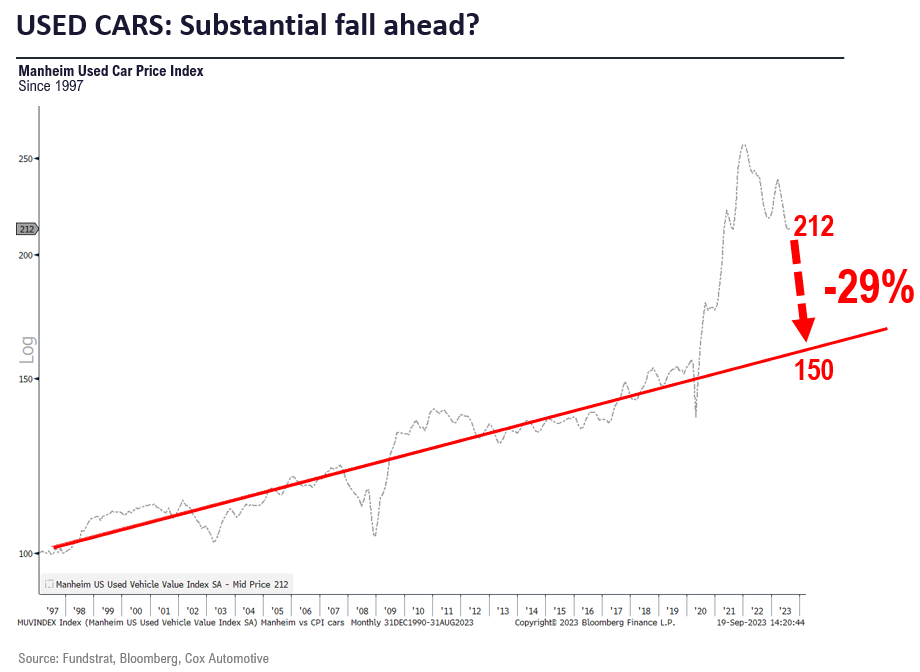

- There might be some concerned that Manheim Used Vehicle index showed a rise for mid-Sept (vs end of August) of which was up +1.5%. But the used car market doesn’t seem to be gaining momentum and in fact, multiple banks have exited auto loan financing recently, including BMO most recently, impacting 3,000 dealerships. The UAW strike might create a short-term shortage of vehicles. And this might push up prices, but the broader impact of this strike is a loss of income for workers. And this results in disinflation pressures on services.

Bottom line: We still see a favorable setup into Wed FOMC rate decision, but aware that markets are nervous.

September is proving to be another bad month for stocks. Mark Newton, our Head of Technical Strategy, has warned of internal deteriorations, and this is the backdrop. The bar is set high for stocks to manage to strengthen between now and the end of the month.

- one of the key events is the Wed FOMC rate decision

- we expect stocks to strengthen post this event

- Looking at market behavior post-FOMC, we see that 71% of the time, when daily RSI is <45, the one-day reaction is positive. And positive follow through over next 5 days is 64% (see below).

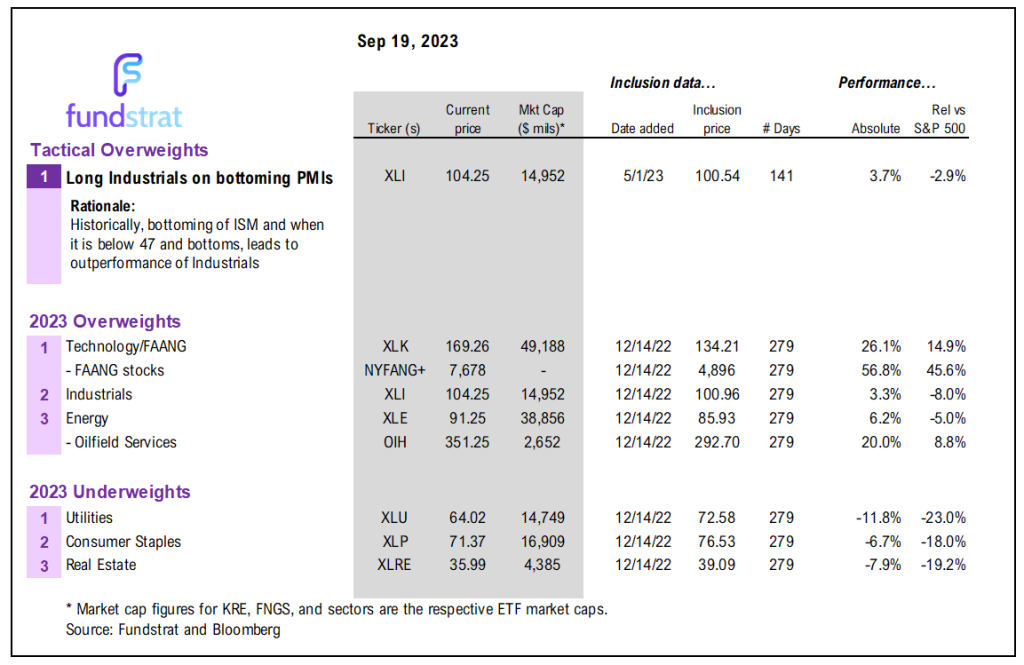

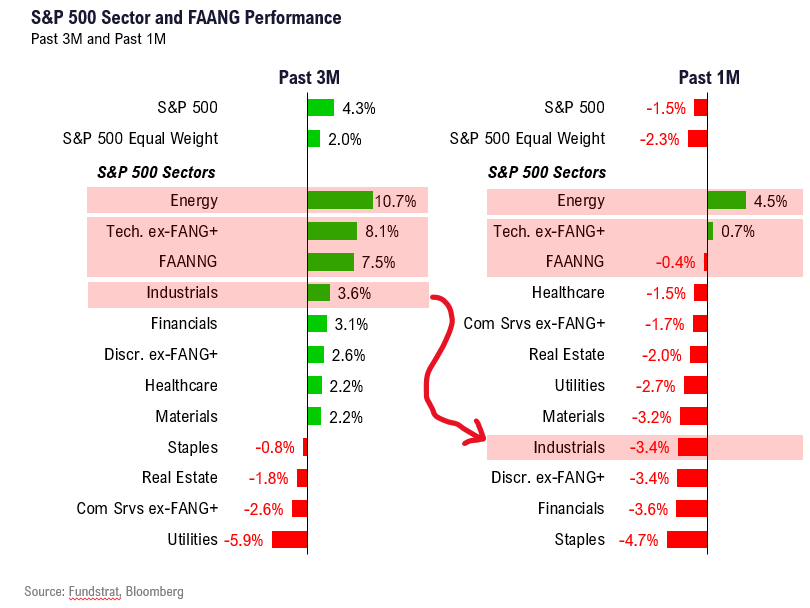

- Over the past month, two sectors posted positive returns, Energy and Technology has positive absolute return. Energy +4.5% and Technology is +0.7% while the S&P 500 is down 1.5% in that timeframe. While many wonder why we see both outperforming in 2023, the last month shows this is the case. Energy is a supply constrained industry. And we still like Technology into year-end.

- Among our favorite sectors, Industrials have performed poorly in the past month, down -3.4%. Financial conditions have tightened and this hurts Industrials, as does a stronger dollar. And the UAW strike will have ripple effects among cyclical stocks. But the UAW impacts are ultimately short-term noise.

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame - 9/15 8:30am ET September Empire Manufacturing Survey Tame

- 9/15 10am ET U. Mich. September prelim 1-yr inflation Tame

-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed- 9/20 2pm ET September FOMC rates decision

- 9/21 8:30am ET September Philly Fed Business Outlook Survey

- 9/22 9:45am ET S&P Global PMI September Prelim

- 9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey

- 9/26 9am ET July S&P CoreLogic CS home price

- 9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame- 9/1 8:30am ET August NFP jobs report

- 9/1 10am ET August ISM Manufacturing

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday