The question of how much ‘bad news’ financial markets can absorb will be seen in the next few weeks. The March employment report is out this Friday (although survey period was earlier in March before strict measures in place) and then we move onto earnings season. The COVID crisis is unfolding on two fronts, the leading edge of this cycle is a healthcare crisis and behind that, the economic aftershocks follow.

With each day, there is incremental Healthcare progress and of course, the key is seeing the epicenter peak, which is NYC.

POINT #1: NYC showing steady case growth (linear not exponential), linear > exponential

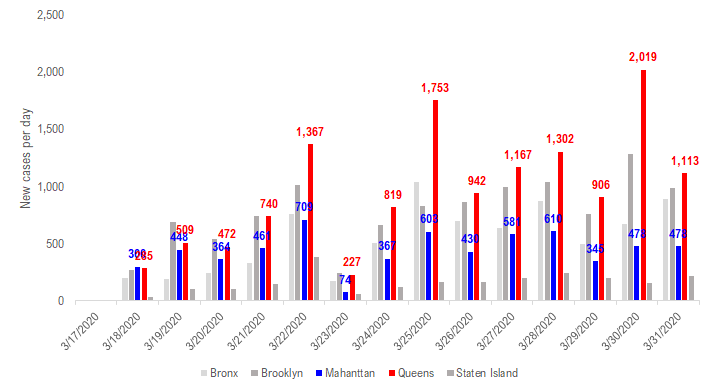

The latest update (3/31/2020) for NYC was posted this evening and the daily new cases is flattening, which is a good thing and potentially suggests the spoke on 3/30 (we wrote about yesterday) might be the anomaly. Even Queens, which saw 2,019 new cases yesterday is 50% lower and frankly, the 1,000 per day for Queens seems more like the trend.

– This is virus and virology, so it is better for us to simply observe that New York City is still seeing a high number of cases, but it does seem like it is no longer growing exponentially.

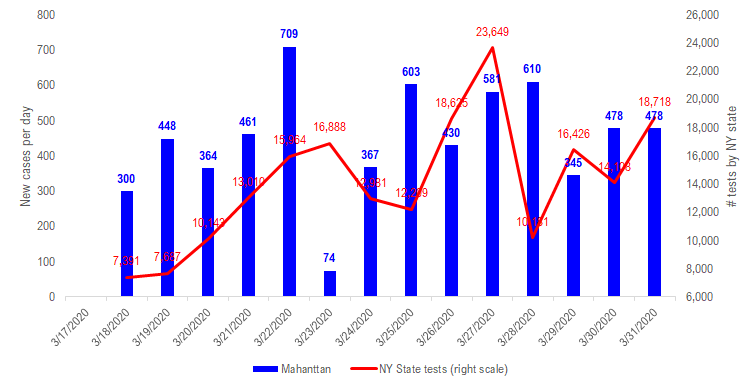

And Manhattan, has been steady for 3 days at between 350-500 cases per day (below) and this is still well below the peak of 709 daily cases seen 3/22/2020.

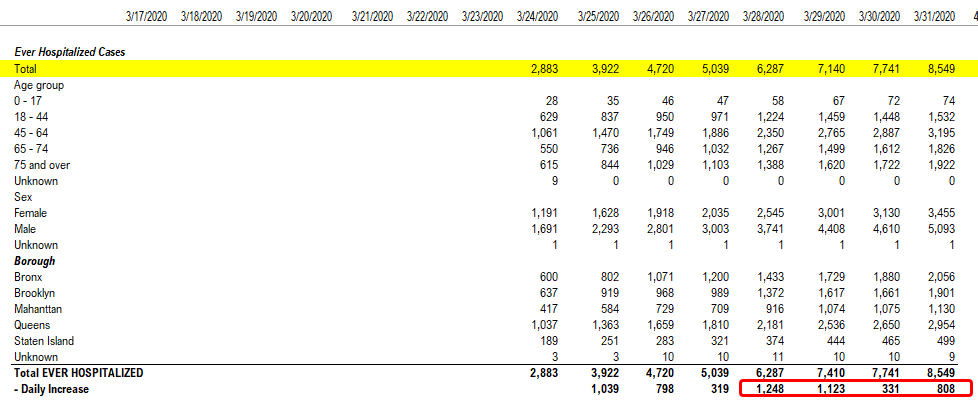

And many continue to ask for data on NYC hospital admissions. This is steady as well. With new admittances of 808 on 3/31/2020 and below the 1,248 on 3/28/2020.

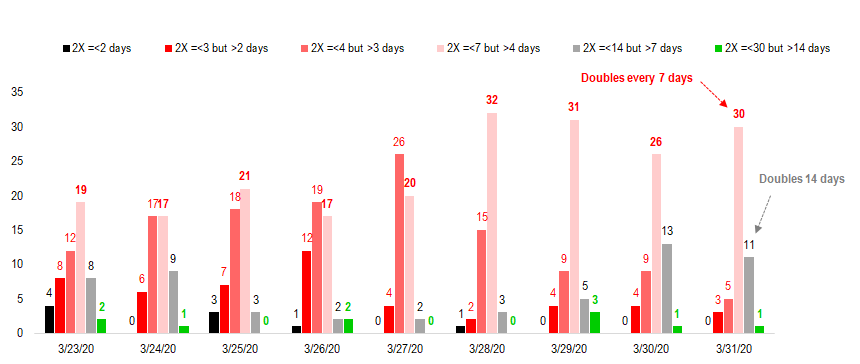

POINT #2: Statewide, daily cases rising but more states see daily case growth slowing 2X every 3 days –> 2X every 7 days

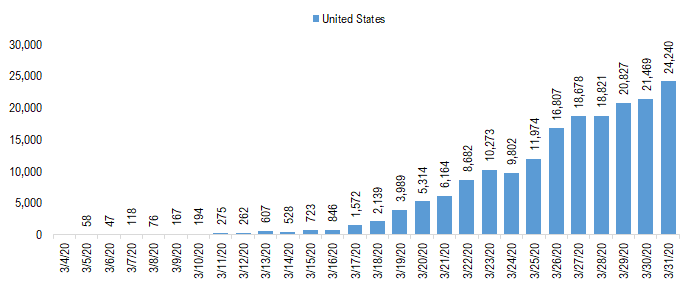

Total cases in the US rose to 24,240 (COVIDtracking project data) and reflects pretty sizable jumps in states like Louisiana (+1,212 vs +485 yesterday), Illinois (+937 vs +461) and New York State (+9,298 vs +6,984). – The outbreaks are localized, so each region has to see its own cases count slow. And hopefully, other states outperform NY.

More states seeing case growth rate slow to doubling every two weeks vs doubling every 7 days…

Looking at the distribution of growth in cases by state trends, there are more states seeing daily case growth slow.

– There are now 11 stats with a daily CAGR of 5% (doubles every two weeks or less), vs 3 on 3/28/2020.

– But the bulk of the states are still seeing rapid case growth at 10% CAGR or doubling every week. This figure is 30 states and same level it was 4 days ago.

– There are simply fewer states reporting daily CAGR >10% (doubling every 3-4 days) as that figure was 13 on 3/29/2020 and now it is down to 8 or so.

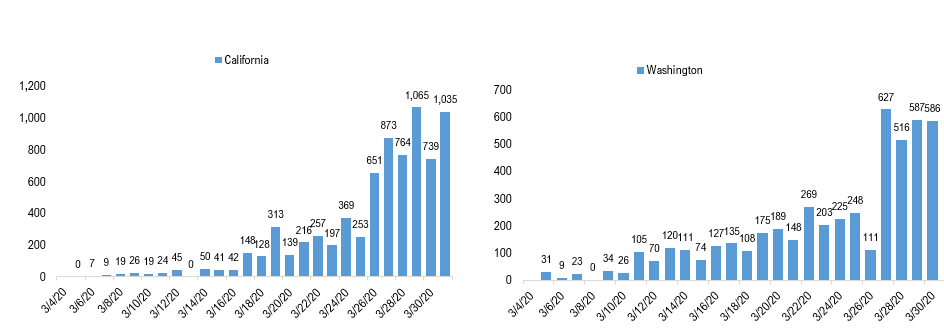

One could also see that the growth rates of cases in California and Washington state have become linear. This is a positive, particularly since the outbreak was pretty severe in King County, WA but has since become flatter in trajectory. And California continues to brace for a massive surge in cases ala NY state. But at 1,035 cases, this figure is well under the >9,000 daily reported by NY.

POINT #3: INFORMATION AND SITUATIONAL AWARENESS IMPROVING FOR COVID-19 and FEVERS DOWN ACROSS USA…

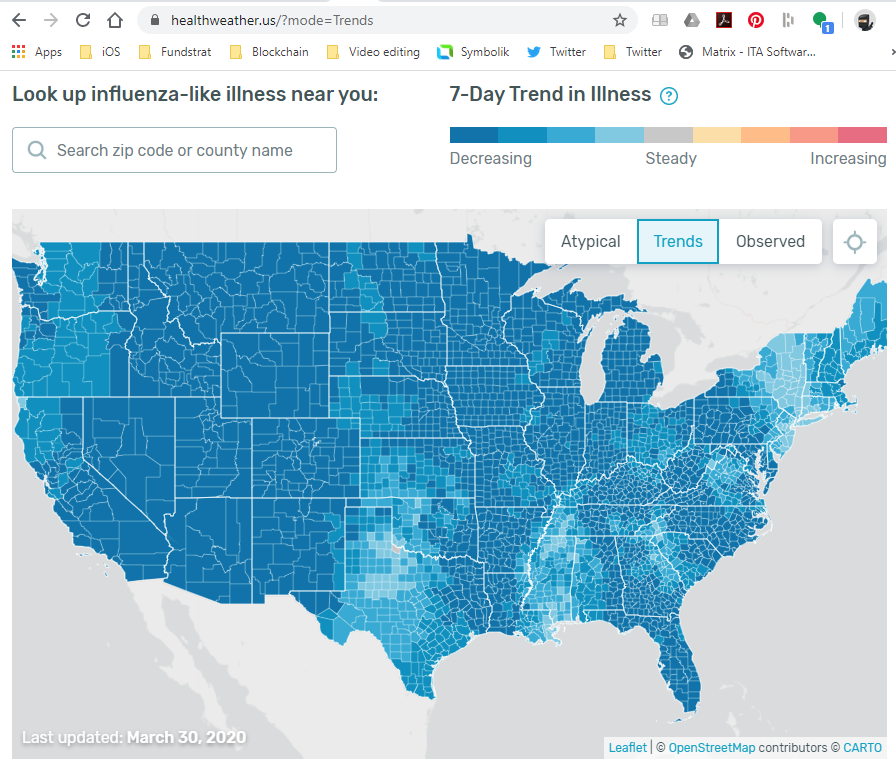

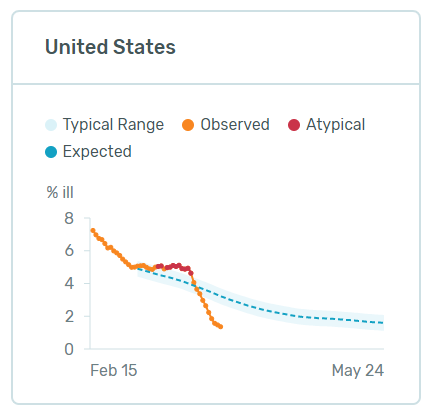

The incoming news continues to show promise on the Healthcare front. In fact, the normally dour Dr. Anthony Fauci even stated today “If you look now, we’re starting to see glimmers that that is actually having some dampening effect.” Even situational awareness is improving. Kinsa Health, which makes Smart Thermometers, collects data on 162,000 thermometers and it shows that temperatures are actually falling across the US.

In fact, perhaps staying at home is also decreasing the spread of other illnesses as well. This is also from their website and as you can see, the trend in illnesses is now falling below the typical trend.

If fewer people are getting fevers (due to social distance), does this also suggest fewer people are outright dying via avoided accidents?

This might be one of those “unanticipated” upside surprises for this “social distancing” + “work from home” and that is people simply get less ill. And potentially, fewer people die by other accidental means, because they are “social distancing”

– According to CDC, the #3 cause of death in USA (after heart disease and cancer) is “unintentional injury” and is the leading cause of death for 1-44 year olds.

– 2.8 million Americans die annually, and the #1 cause for 1-44 year olds is “accidents” which per CDC, can be reduced by

“wearing seat belts and not driving under the influence”

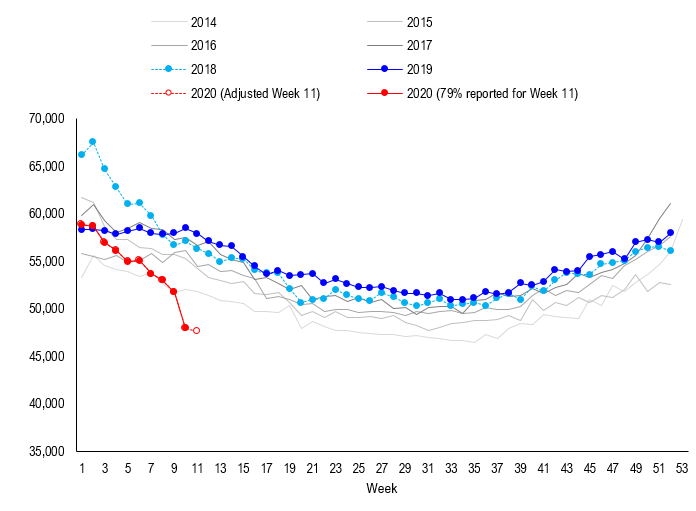

This chart below is deaths by week of the year and was originally flagged by Siddharta Sanghi, a researcher, which showed that seasonal patterns of death in the US have dropped in 2020. We reproduced using CDC data CDC data on morbidity below.

We cannot say this data is 100% accurate because of potential reporting lags and in fact, Siddharta himself tweeted he believes there are reporting lags and thus deleted his original tweet. But because the data from the thermometers show a similar pattern, we think this is worth watching.

POINT #4: EVEN IF ONE IS IN THE CAMP THAT WE EVENTUALLY GO DOWN 50% TO 1,700, NOW IS TIME TO PICK STOCKS.

To the cautious and skeptical, this means the financial markets will be roiled by a double whammy — first, the pandemic sweeps across America and second, the economic ripple effects will play out. And as such, financial markets will, therefore, be stuck in a U-shaped or L-shaped period as the economic effects play out.

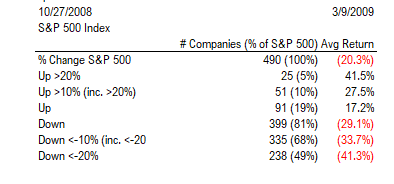

Time will tell if the crescendo seen on 3/23/2020 was ‘the bottom’ or an interim ‘bottom’ (ala October 2008). But even if it is the latter case, October 2008 was a great time for stock pickers.

– While the S&P 500 still declined 20% from October 27, 2008 to March 9, 2009, about 1 in 5 S&P 500 stocks rose.

– And in a big way. 51 stocks gained 28% or more.

Think about that, the market was already picking winners and losers from October 24, 2008. So even if one is structurally cautious, now is arguably the time to start picking winners and losers.

POINT #5: Even if EPS is down 50% in 2020, it does not mean stocks have to fall 50%…

A final point we want to make is regards to EPS and the connection to stock prices. Many have posited that since EPS is expected to fall 50% or worse in 2Q2020 and possibly 3Q2020, that stocks need to fall 50% or more.

True, earnings level determine levels of equity, but it is the “present value of EPS’ that determine stock prices, and not just the current period EPS.

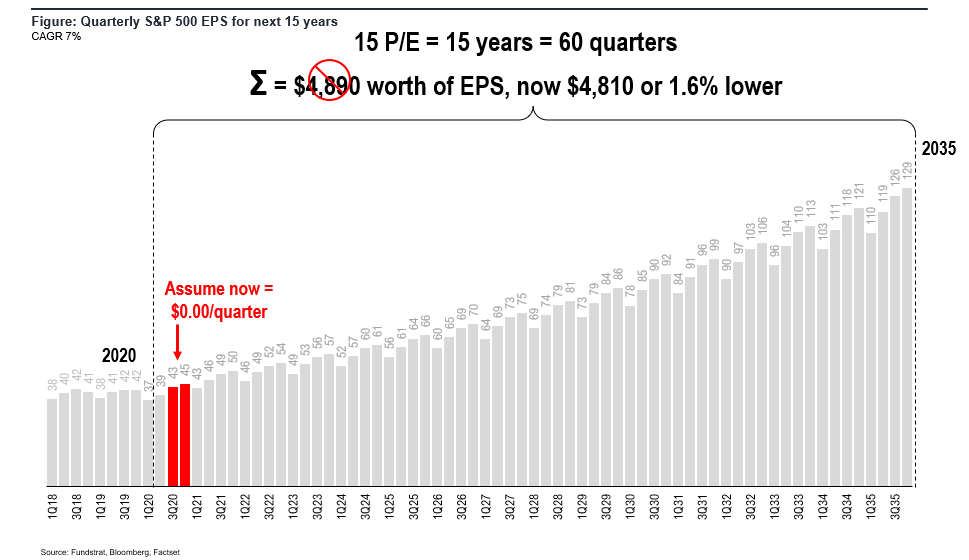

A 15X P/E means investors are buying 60 quarters of EPS (15 years) and not just 2Q2020 and 3Q2020…

The best way to lay this out is the chart below. If one is paying 15X for the S&P 500, the investor is buying 15 years of EPS, or 60 quarters.

– Since 1900, EPS has grown at 7% annually, and if EPS grows at 7% through 2035, the sum of the 60 quarters is $4,890.

– And if 2Q2020 and 3Q2020 are down 50% or even ZERO, does that mean the stream of future EPS is down by 50%?

That is the key question is whether there is a level set off 3Q2020 EPS that has permanently reduced EPS levels. We do not believe this is the case.

After all, the best US companies will be stronger after this. And the ultimate driver of GDP is population growth plus productivity.

In fact, it is possible the US population growth rate likely to surge because of a baby boom…that follows this prolonged period of stay at home…

Perhaps Hong Kong and its post-SARS 2003 experience tell us that life does recover to normal…

We are all experiencing extraordinarily unusual life conditions. Social distancing. Work from home. Invisible germs everywhere. And this prolonged quarantine risks a permanent change in our culture.

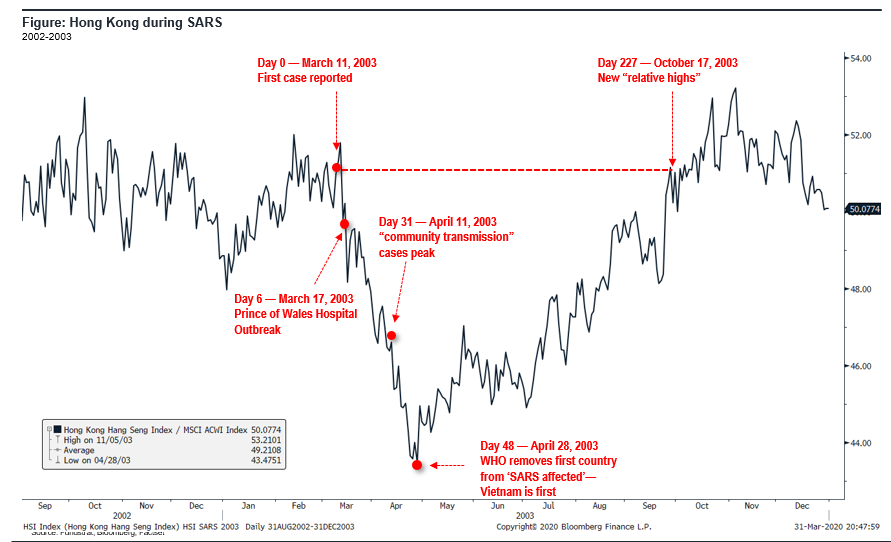

Asia has experience with pandemics, having SARS, MERS, Swine Flu, etc. and many of my friends and some clients in that region shared their 2003 SARS experience. SARS swept through Asia in 2003, hitting Hong Kong hard starting on March 11, 2003. That is when the first case was reported there and a full outbreak was confirmed by Day 6 at the Prince of Wales Hospital.

The outbreak lasted a total of 101 days, before the WHO removed HK from a SARS affected list on June 23, 2003. That is also when the last new case was reported.

101 days under HK SARS… but the HSI bottomed on Day 48 (April 17th)…

The HSI index (relative to MSCI ACWI) is shown below. And it is evident the first breakout of SARS on 3/11/2003 also marked the peak for the HSI market.

– And stocks sank steadily until April 17th.

– That was the day the WHO removed the first country from the ‘SARS affected’ list, which was Vietnam.

– HK still had another 56 days of quarantine, but the stocks had already bottomed.

– and by October 17, 2003, had recovered all the lost relative performance.

And incidentally, we were told that post-SARS, the Hong Kong residents went crazy with joy and really enjoyed themselves.

The point is that there is a post-COVID future. And while it is tempting to see the Great Depression II coming, we believe one should realize that is not the only path.

– There is a ton of progress on the Healthcare front

– Stocks look like they made a structural low, if not real low, and thus, stock picking is relevant for buying winners vs losers and buying survivors.

Heads up as well. We are planning a call on Friday to discuss some of these scenarios. On that call will be the entire team–Tom Block (policy), Brian Rauscher (Global Portfolio Strategist), Rob Sluymer (Technical Head) and myself.

Details will be forthcoming.