Given the steep sell-off of equities on Friday, it was clear investors were bracing for another weekend of bad news and a Sunday night futures massacre (which has been the story for the past few weeks). But the developments over the weekend were marginally positive, in our view. We thought it was wise for the President and White House to extend the “stay at home” through April 30th.

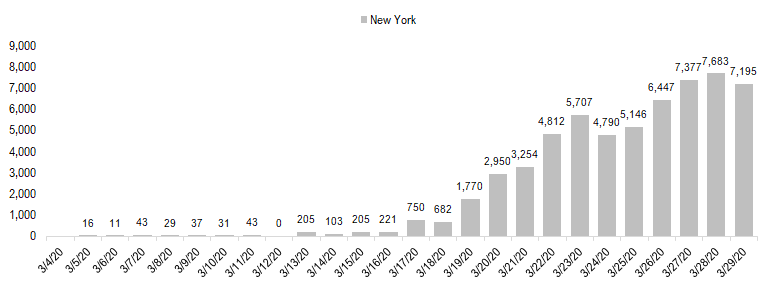

POINT #1: New York City daily new cases likely peaked on 3/25/2020…

Among the incrementally positive data, it does indeed appear that New York City COVID-19 daily new cases have peaked. This is something we flagged last week, and wondered aloud. Given some of the changes of testing methodology, etc., there is bound to be some inconsistency, but the overall trend seems to be improving.

– Notice, the daily new cases reported for 3/29/2020 is 2,710 which is similar to the number of cases reported on 3/24/2020 (5 days earlier) and with 50% estimated greater tests conducted (the test data is NY statewide, not city).

Even data by borough shows a similar trend. That daily new cases across all boroughs seems to be coming down. Queens remains the borough with greatest new cases but the recent figure of 906 is down 50% from where it was on 3/25/2020.

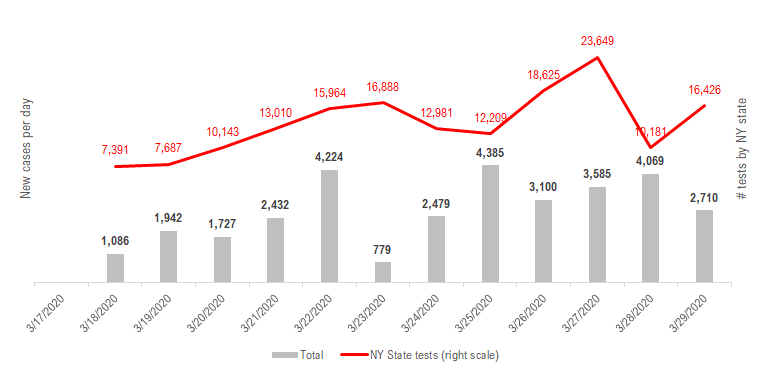

POINT #2: The last few days does suggest New York State could also be seeing a “peaking” of cases soon…

The epidemic exploded in New York City and almost half of all COVID-19 cases in the US are in the state of New York. The daily new confirmed cases is shown below and as seen, it does seem like the exponential growth rate of new cases is slowing in NY state.

– This is arguably too early to draw conclusion, but the daily new cases reported 3/29/2020 was actually ~500 less than the day prior.

– Tests administered on 3/29/2020 were 16,426 vs 10,151 the day prior.

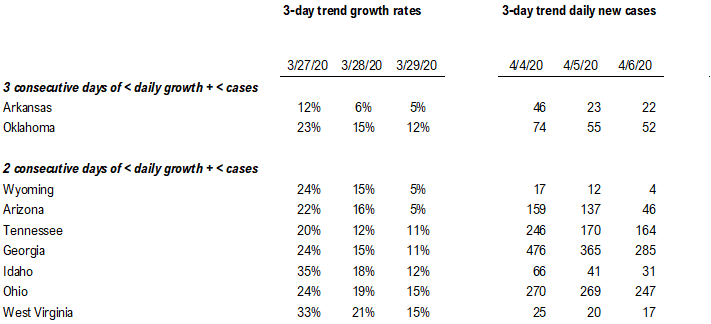

POINT #3: Several states are showing consistent and consecutive improvements in case count…

The epicenter of the US COVID-19 outbreak has been the state of New York and we are seeing new spread as New Yorkers flee to other states. And while the majority of cases are New York, we highlight 9 states which have shown consistent improvements in case count.

– Only 2 states have seen 3 consecutive days where the daily growth rate and the number of new cases has been falling. Arkansas and Oklahoma.

– Another 7 states have seen 2 consecutive days of both daily growth rates and daily new cases. Wyoming, Arizona, Tennessee, Georgia, Idaho, Ohio and West Virginia.

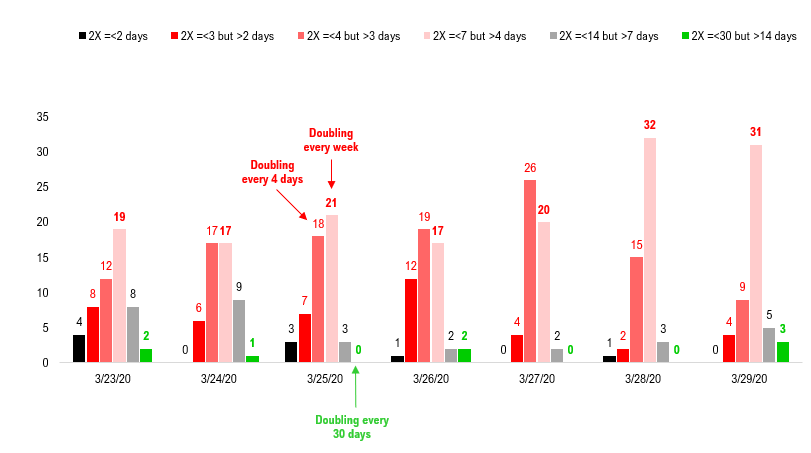

So each region/city will experience its own wave. We have grouped states by the daily growth rate of COVID-19 (see 5 categories below):

– The plurality of states (31 states) have a daily growth rates between 10%-19%, which is a doubling sometime between 4-7 days.

– Notably, 8 states (and territories) have seen the growth rates slow to between 2%-9% daily growth (which is a doubling between 14 to 30 days).

BOTTOM LINE: New York City and New York state seeing linear, not exponential growth is positive, as it provides a template for other governors/states to prepare.

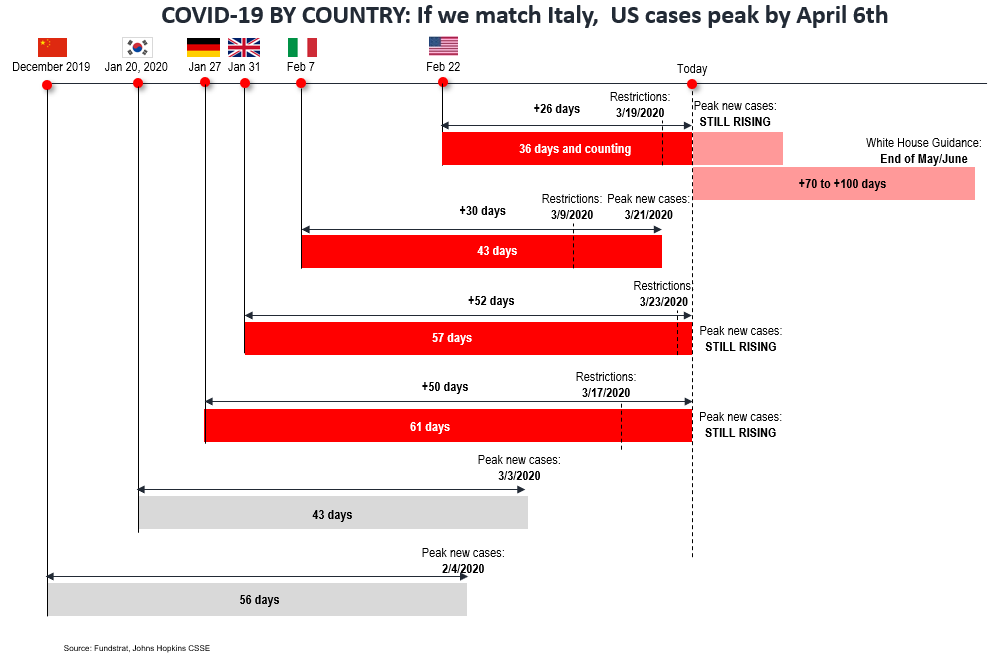

We are stating the obvious when we observe a reduction of fear (both by population and by markets) around COVID-19 will be achieved by a combination of seeing regions contain local outbreaks (Italy seems like it is peaking and eyes are on NY and NYC) and by measurable improvements in treatment options.

On the margin, it does appear that New York City’s social distance measures are achieving the flattening of the case curve. Of course, there are still ~2,500 new cases daily in New York City, but that is almost half of what it was on 3/25/2020. Second waves of cases can take place, so we could not conclude that cases have peaked. But it is fair to observe that case count appears linear not exponential.

The weekend was not a tsunami of bad news, but rather, more of the same with some improvements…

As for markets, the cadence of news is less terrifying compared to the last few weeks. And last week, it was notable to see Tom DeMark observe that the bulk of the sell-off is done (but 2,097 is lingering out there for the S&P 500) and Lowry’s registered a conventional buy signal given the cluster of 80% and 90% up days.

– We had many conversations with our clients last week. And we see a broad buyer’s strike. Nobody wants to buy stocks given the poor visibility. This is understandable.

– But realize that the sellers are no longer necessarily liquidating at the pace they did the past few weeks. And if Lowry’s data is right, the market is shifting in favor of buyers.

Last comment, Brian Rauscher, our global portfolio strategist also listed a new of 2H2020 surprises. He is generally constructive medium to long-term and noted the possibility of new all-time highs later in 2020 (link –> Rauscher report). This makes perfect sense to us, if the scenario of a 1-quarter but not 2-quarter disruption unfolds. A 1-quarter scenario is more probable if New York State is indeed seeing an apex of cases.