THIS MESSAGE IS SENT SOLELY TO CLIENTS OF FUNDSTRAT GLOBAL ADVISORS

Apple, in a press release yesterday, noted March guidance would change as (i) the supply of iPhone would be disrupted by manufacturing issues; (ii) demand in China hurt by retail store closures (owned and partner). These issues will affect a broad swathe of S&P 500 companies and with this news, we can make a first 'stab' at EPS impact on S&P 500 1Q2020 profits.

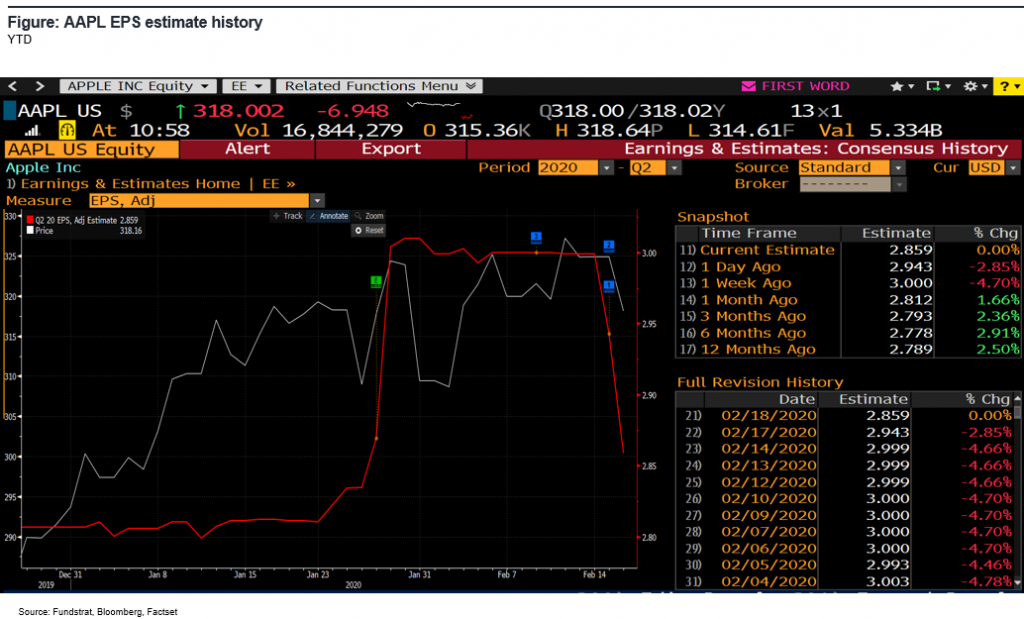

- Sell-side analysts cut AAPL EPS by ~$0.15 this am (their best guess), which is ~$650 million on a $12.5 billion quarterly net income. Or 5%.

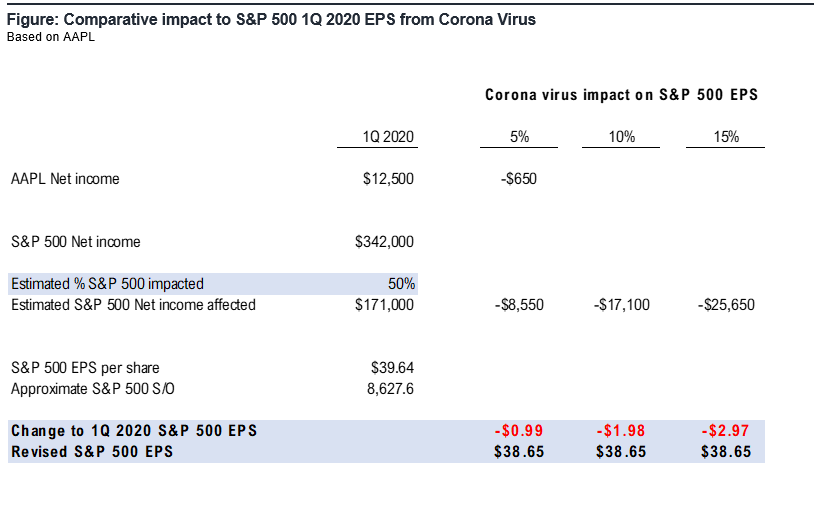

- We estimate that 50% of S&P 500 companies will face one or both of the issues cited by AAPL.

- Assuming a 5%, 10% or 15% impact on 1Q2020 EPS for those exposed (50%), this implies $1.00 to $3.00 of S&P 500 EPS impact. S&P 500 quarterly net income is about $342 billion.

- We do not see this hit to 1Q 2020 perpetuating into the full-year EPS. We estimate there will be a snap back of activity post-Corona, and hence, that $1.00 to $3.00 is added back to 2H2020 EPS.

- The fact that $8 billion to $25 billion is the potential 1Q2020 impact to S&P 500 profits in 1Q2020 also means fiscal stimulus odds are on the rise, from US, China and Europe.

- The hit to European and Asian companies should be far larger as % net income.

Bottom line: AAPL is giving us the first hints of what we can expect for 1Q2020 and it should be sloppy. This is not a thesis killer for our 2020 equity outlook as we do not see the competitive position of AAPL or US-tech companies weakening. These are issues facing all global companies.

But in the short-term myopia of market consensus thinking, this downward cycle of 1Q2020 EPS estimates will be a short-term headwind. In other words, expect a lot of negative chatter in the next few weeks.

POINT 1: AAPL SELL-SIDE ANALYSTS CUTTING MARCH QUARTER EPS BY 5% OR $0.15

AAPL’s filing did not disclose numerical impacts, so this is the sell-side analysts attempt to calibrate this impact. AAPL is still expected to earn $12.5 billion for 1Q2020.

- So while the $650 million looks meaningful, it is small relative to the base of earnings.

POINT 2: FIRST GUESSTIMATE IS $1.00 TO $3.00 FOR S&P 500 1Q2020 EPS FROM CORONA

The AAPL hit of $650 million is directly $0.08 hit to S&P 500 EPS (~8.7 billion S/O implied by divisor) but of course, many of the 500 constituents face similar impacts that Apple is seeing --> manufacturing interruptions + retail store impacts.

- We made a sensitivity table below, based on assuming 50% of 500 cos impacted (250) and a range of EPS hit for those of 5% to 15% (see below).

- This implies a 5% hit is $1.00 of EPS and $3.00 at 15%.

- As noted above, this is not a full-year impact as we expect a snapback in 2H2020 from this hit. Thus, we expect full-year S&P 500 EPS estimates to remain stable.

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.