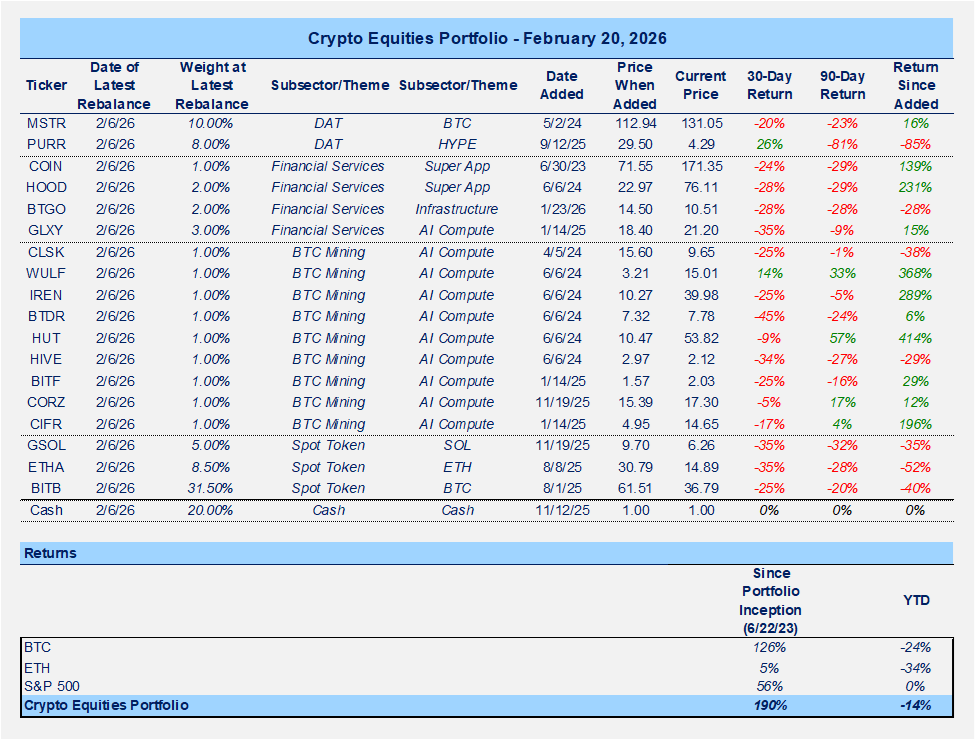

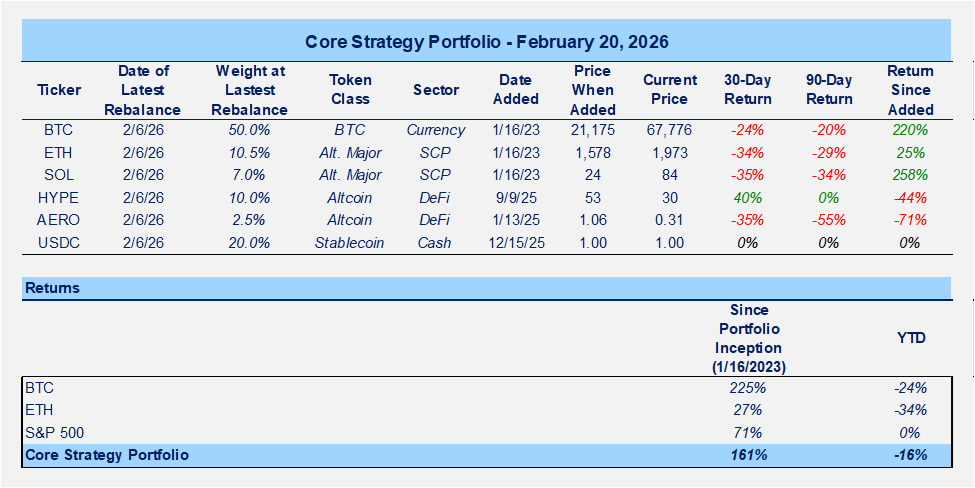

Portfolios

Supreme Court Ruling’s Impact on Crypto: Marginally Positive, Not a Gamechanger

What Happened

- The Supreme Court struck down the administration’s emergency tariffs, ruling that IEEPA does not authorize the President to impose duties. The decision reaffirms that tariff authority rests with Congress under Article I and underscores that economically significant executive actions require clear congressional authorization.

- The Court did not address whether previously collected tariffs must be refunded, leaving that question to further litigation or administrative process.

- President Trump framed the ruling as a narrow rejection of using IEEPA to impose tariffs while emphasizing that other statutory authorities remain available.

- He signaled continuity in trade policy, noting that existing Section 232 and Section 301 tariffs remain in effect, announcing an intent to implement a 10% global tariff under Section 122 on an expedited timeline, and indicating that additional Section 301 investigations are forthcoming.

Initial Take

- Absent the implementation of replacement sectoral tariffs, the immediate effect of the ruling is lower tariff revenue and a reduced effective tax burden on imported goods.

- Lower import costs are incrementally supportive of growth as consumer and business input pressures ease.

- At the same time, reduced tariff revenue widens the deficit at the margin, increasing financing needs.

- The direct price effect is disinflationary for goods, while the deficit impulse is mildly inflationary over time, effectively the inverse of a tariff shock that raises prices and dampens demand.

- On balance, the mix is incrementally supportive of debasement dynamics.

- Reduced tariff uncertainty lowers downside growth risk and may slightly reduce the urgency for near-term easing.

- However, as noted above, the administration has already outlined alternative statutory pathways, including Sections 232, 201, 301, 122, and potentially 338.

- Assuming these measures are narrower than the invalidated IEEPA tariffs, they would partially offset the pro-growth impulse while introducing greater structural predictability (good for business planning).

- The net effect is somewhat less flexibility but greater policy clarity, a tradeoff markets generally prefer.

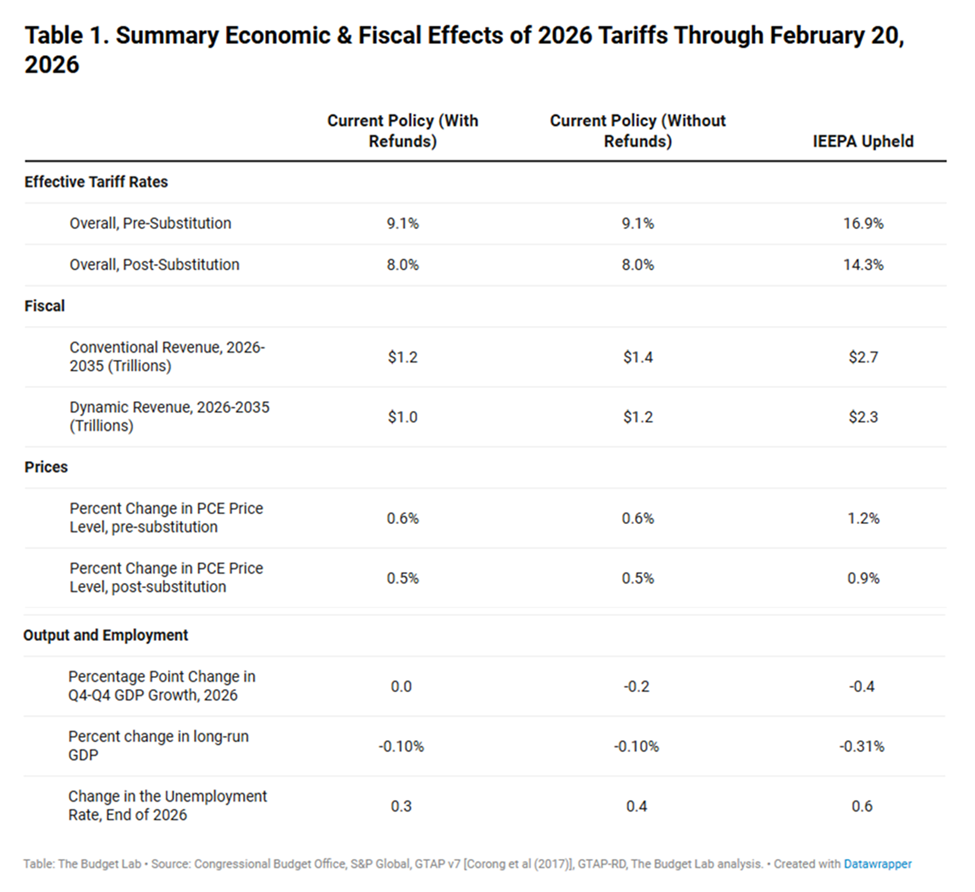

One study released today by Yale’s Budget Lab, confirms these intuitions. They project:

- The effective tariff rate falling from 16.9% to 9.1% (lower but still significant tariff levels)

- Fiscal receipts to fall from $2.7T over the next 10 years to $1.4T (expansion of deficit)

- The % change in PCE to decrease from 1.2% to 0.6% (disinflationary)

- The percentage-point change in Q4 GDP growth to move from -0.4 to -0.2 (growth-positive)

- The change in unemployment to decrease from 0.6 to 0.4 (stronger labor market)

Other Consideration: Refunds

- The Court did not rule on whether previously collected tariffs must be refunded.

- If refunds are mandated, that would constitute a direct fiscal injection, materially widening the deficit and increasing Treasury issuance. In other words, it would exacerbate the pro-growth, pro-deficit effects outlined above.

- While this could pressure long-end yields, I think it would likely be incrementally supportive for crypto via deficit expansion dynamics.

Bottom Line on the Ruling

- The ruling is modestly positive for crypto.

- A favorable outcome and partial tariff replacement were largely anticipated, as reflected in prediction market odds and the muted price response.

- The next key variable is whether refunds are mandated and the timing of any such payments. I would view refunds as constructive for crypto.

Price Action

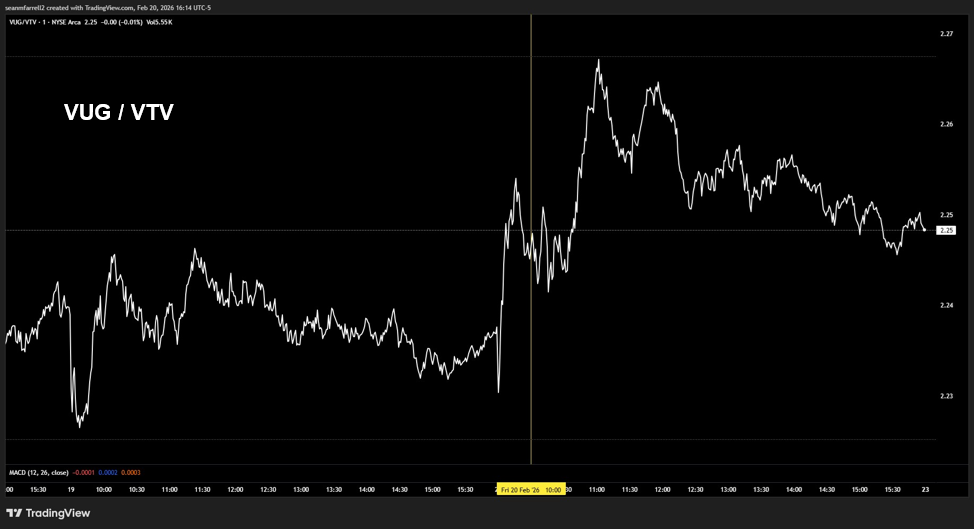

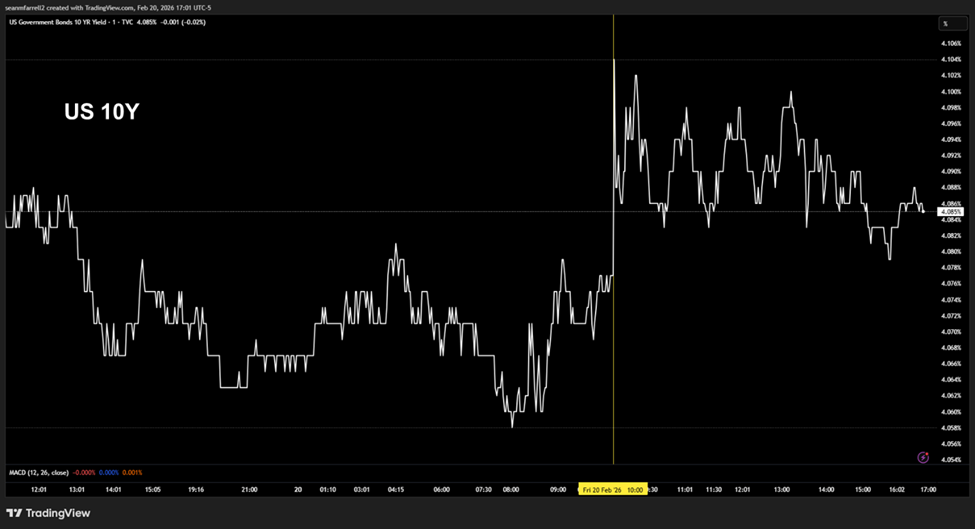

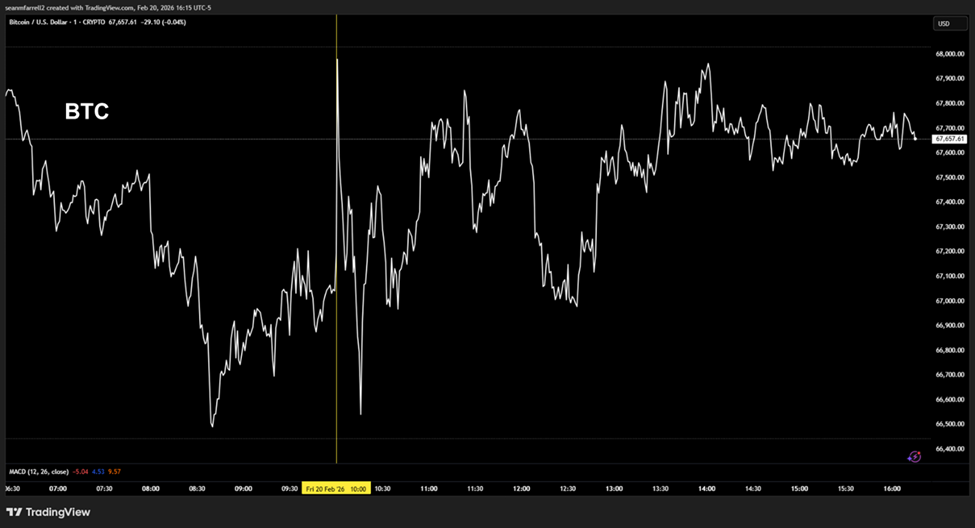

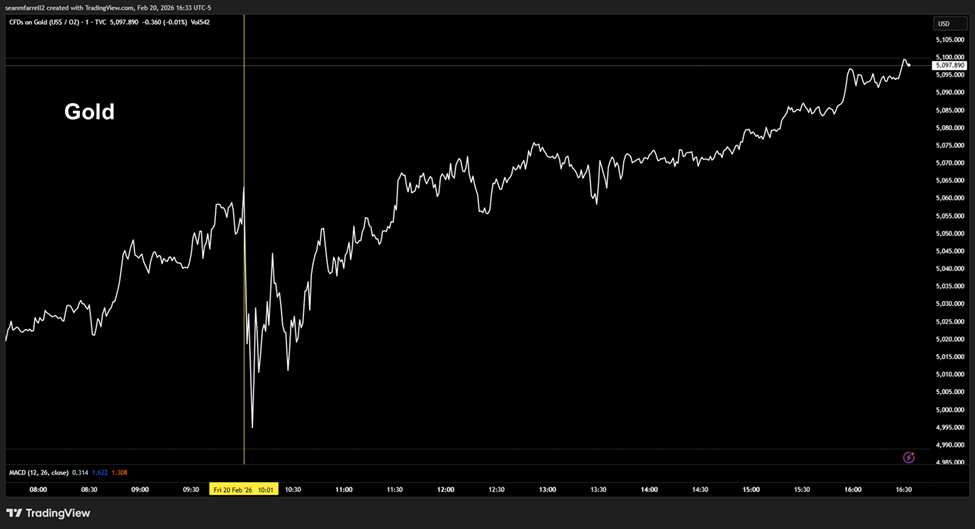

Friday’s price action reinforced our initial interpretation of the Supreme Court ruling.

- Growth outperformed value, consistent with a marginal pro-growth impulse.

- Treasury yields edged higher, reflecting firmer growth expectations and the potential for slightly wider deficits.

- Crypto participated to the upside, consistent with both the pro-growth tilt and the incremental liquidity implications of deficit expansion.

- Importantly, precious metals, particularly gold, also advanced. This suggests markets view the ruling as a marginal shift rather than a structural regime change (tariffs are still significant and will remain in place).

Macro Crosscurrents: Near-Term Risks to Crypto

Crypto has shown relative resilience in recent sessions, and for this reason I remain optimistic about a near-term rally in prices, but several macro crosscurrents warrant close attention. Below I outline the primary risks that could pose a threat to crypto prices in the near term.

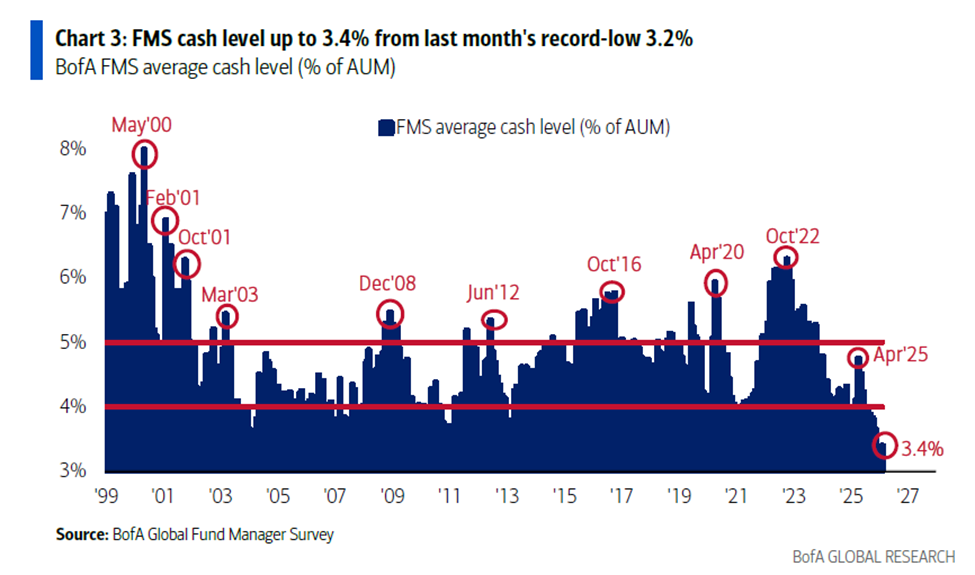

Extended Positioning

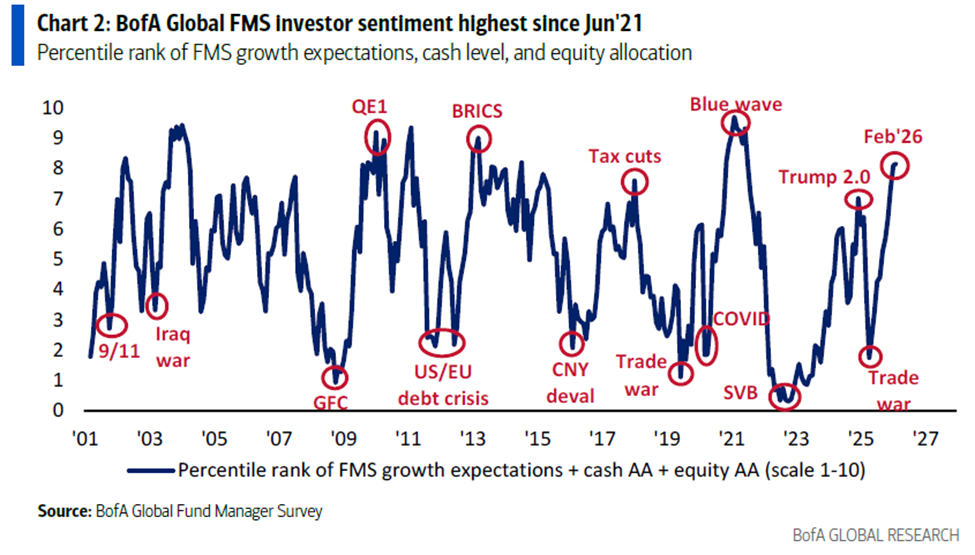

The most recent BofA fund manager survey indicates:

- Cash allocations remain near historical lows

- Investor sentiment is elevated

This combination implies limited incremental buying power and raises vulnerability to a broader de-risking event. While crypto often clears speculative excess before traditional assets and has historically bottomed ahead of equities, a generalized cross-asset degrossing would likely pressure crypto alongside other risk exposures.

Credit Market Sensitivity

The decision by Blue Owl Capital to continue gating withdrawals in a retail-focused private credit vehicle has refocused attention on liquidity conditions within private credit markets.

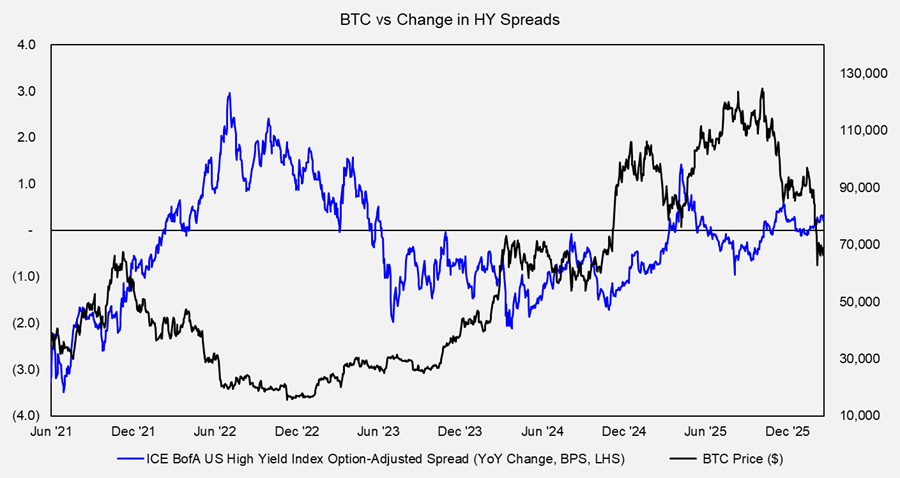

While this does not currently represent a systemic event, the opacity of the asset class makes contagion risk difficult to quantify. The key transmission channel to monitor is high-yield spreads.

Historically, crypto exhibits a strong inverse relationship to high-yield spreads, for obvious reasons. A sustained widening in junk bond spreads would likely tighten financial conditions and weigh on digital assets.

Firming Rate Expectations

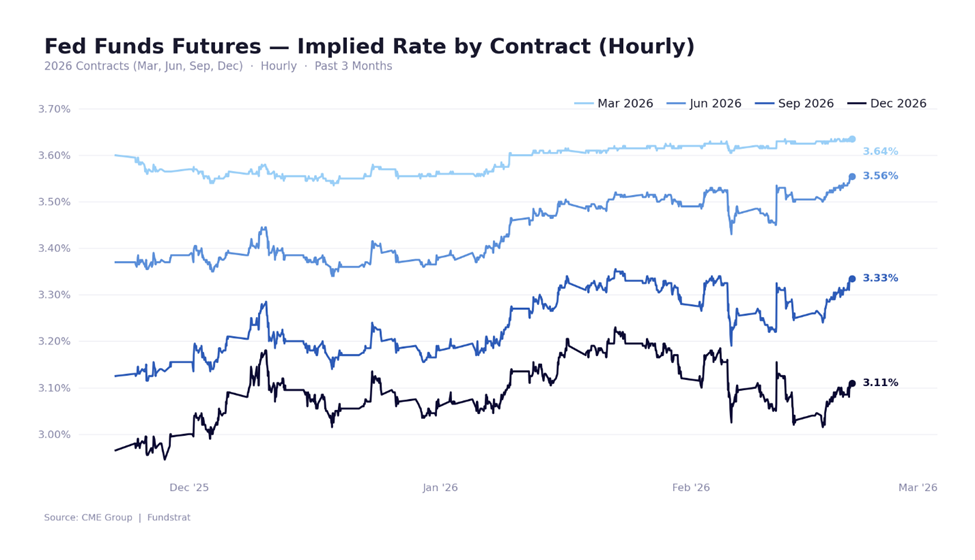

Rate expectations have firmed at the margin, reflecting stronger-than-expected labor data and incremental hawkish commentary from policymakers.

Even dovish voices have acknowledged that incoming data may justify less aggressive easing relative to prior projections. While inflation expectations remain anchored, and expectations for additional rate cuts this year remain intact, the path toward easier policy is not accelerating.

For crypto, which remains sensitive to liquidity expectations, any repricing toward a “higher for longer” framework could act as a headwind.

Geopolitical Escalation and Oil Risk

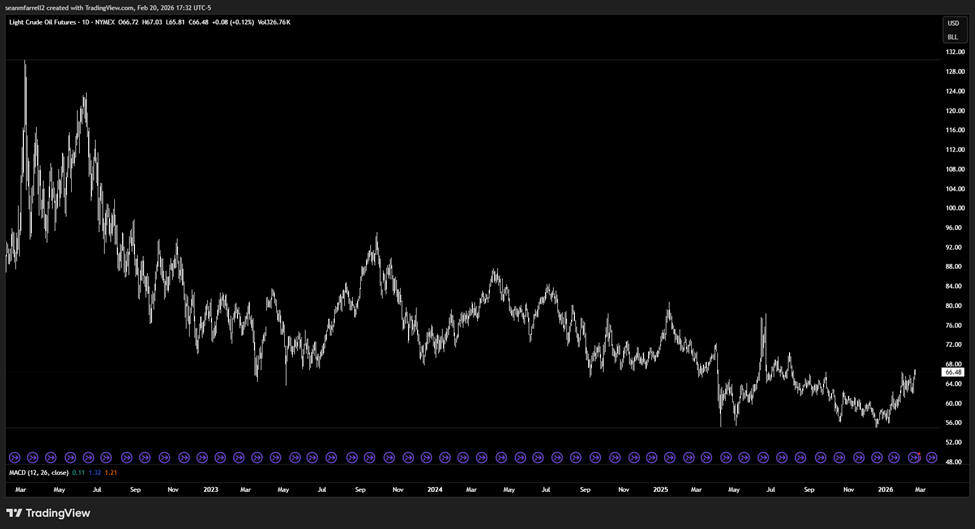

Rising tensions with Iran introduce event risk into an already fragile macro backdrop.

Historically, military flare-ups have triggered short-lived volatility in risk assets (more often than not, you want to buy drawdowns due to military flare-ups). The key variable is whether escalation produces a sustained oil price shock. Crude has lifted modestly but remains below levels typically associated with inflationary concern.

Should oil move materially higher, the resulting pressure on inflation expectations and yields could tighten financial conditions and challenge crypto’s recent resilience.

Clarity Act Progress: A Good Sign

In contrast to the macro tightening risks above, regulatory clarity has reemerged as a potential positive idiosyncratic tailwind for crypto:

Why Clarity matters

- The Clarity Act represents one of the most significant regulatory efforts to define regulatory frameworks for crypto.

- Legislative progress has material implications for institutional confidence, capital deployment, and market structure.

Current State of Play

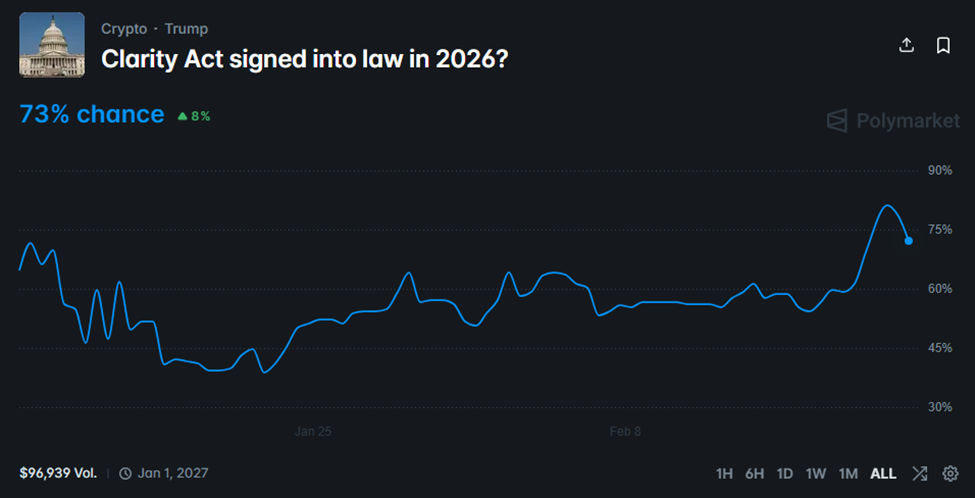

- Polymarket shows rising odds of the Clarity Act being signed into law in 2026 (low volume but still a valid data point).

- Reporting signals continued executive-branch and congressional engagement on stablecoin yield language.

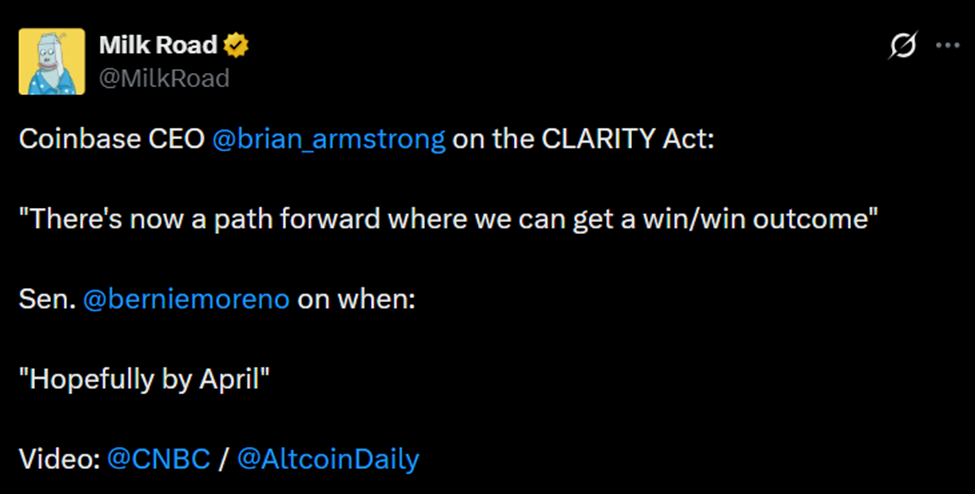

- Recent public comments from Brian Armstrong suggest there may be a path to compromise after earlier opposition to the bill’s stablecoin provisions.

Rising Optimism:

Continued Engagement:

Armstrong’s Pivot:

Historical context

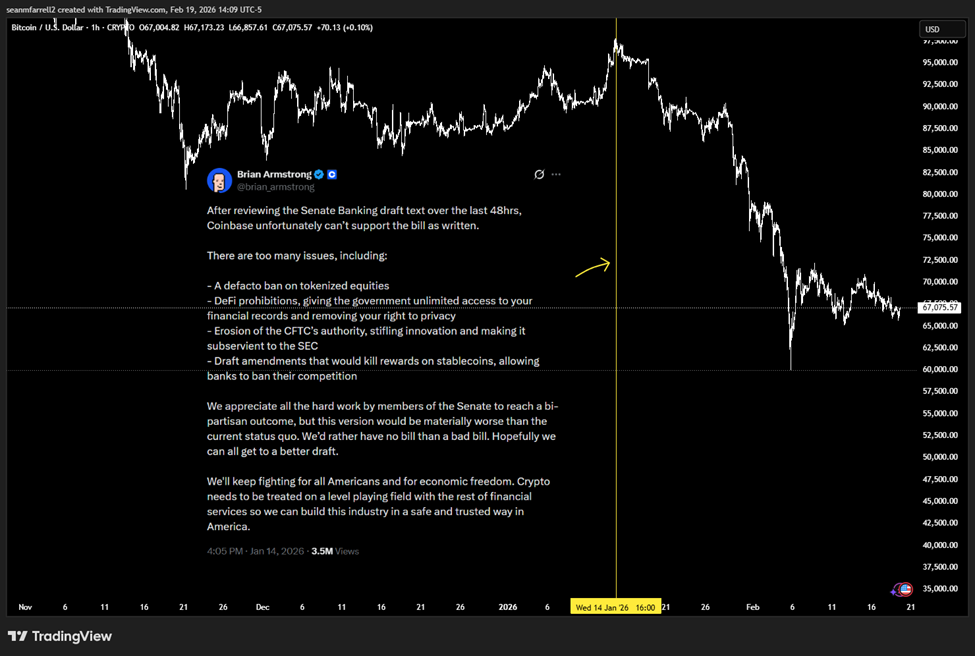

To verify the positive impact that Clarity might have on crypto prices, it is worth revisiting price action from earlier this year, when doubt about the bill’s prospects were rising. The most recent drawdown, which began on January 14th, coincided directly with a tweet from Brian Armstrong opposing the Clarity Act’s stablecoin language. While other macro forces were present (Greenland, JGBs, tightening rate expectations, among other factors), the timing suggests real sensitivity to crypto-specific policy risk.

Thus, Clarity progress is one of the few macro-adjacent positive catalysts at a time when broader macro risks are accumulating. It is encouraging to see optimism surrounding Clarity, and any visible progress would be, all else equal, a positive for crypto prices.

Final Assessment

We remain in a consolidation phase following the February 5th capitulation. Follow-through has been muted, but recent resilience amid tightening financial conditions is constructive.

Macro risks remain elevated, especially given current investor positioning and sentiment. As such, I am hesitant to declare the February 5th low as definitive.

That said, crypto has already worked through significant speculative excess. Incremental regulatory progress and continued resilience against macro headwinds leave us tactically constructive, while remaining attentive to cross-asset risk signals.