Thank you to everyone who joined my annual outlook call today. Below are several high-level takeaways, along with the latest Core Strategy and Crypto Equity portfolios.

Click here to download the presentation deck.

The Headwinds

- Near-Term Risks Mounting: Q1 risks to crypto include a potential government shutdown, renewed trade policy volatility, waning confidence in AI capex returns, and uncertainty around the Fed Chair transition, all of which could pressure markets currently characterized by tight HY spreads and low cross-asset volatility.

- Mixed Near-Term Flows: BTC sits in valuation no-man’s land. While long-term ETF flows should improve as wirehouses onboard, near-term pressures persist from miner selling, a likely MSCI MSTR delisting, and fund redemptions.

The Tailwinds

- Liquidity Trends Turning Positive: Liquidity should improve in 2026 as fiscal deficits widen from tax cuts, monetary easing continues amid labor slack and anchored inflation expectations, and the Fed begins reserve-management balance-sheet expansion. Dollar weakness should persist on rate differentials and trade dynamics.

- Shift Toward a “Run-It-Hot” Regime: Once uncertainty clears, a coordinated mix of lower rates, bank deregulation, and trade clarity could drive a durable business-cycle expansion. BTC should benefit from improved liquidity and lower real rates, but better risk-adjusted upside likely lies in structurally bid alts (ETH, SOL, HYPE) and crypto-linked equities. The Clarity Act is another key 2026 catalyst to monitor.

- Secular Tailwinds Intact: Regulatory progress and continued TradFi adoption remain supportive. Growth in stablecoins and tokenization is improving the operating efficiency of companies adopting these primitives while enhancing the quality of on-chain assets.

Strategy

- Despite my view that BTC and crypto face powerful long-term tailwinds, and that liquidity-driven support should emerge in 2026, there are several risks we likely need to clear in Q1/Q2 that could create more attractive entry points.

- My base case is a meaningful drawdown in 1H 2026, with BTC falling to $60k-$65k, ETH to $1,800-$2,000, and SOL to $50-$75. These levels would present attractive opportunities into year-end. If this view proves incorrect, I still prefer to play defense and wait for confirmation of strength.

- This framework implies relative strength in ETH, which I think is reasonable given its more favorable structural flow dynamics, including the absence of miner selling, no MSTR-related overhang, and lower perceived quantum risk.

- I suspect that sometime in Q1–Q3 we find a durable low and rally into year-end, effectively ending the “four-year cycle” with a shorter and shallower bear market than in prior cycles.

- Factors to look for when diagnosing a “turn” include relative outperformance vs equities, robust performance on bad news, signs of capitulation, flow trends turning in a constructive direction, and/or a key unforeseen catalyst hits the tape.

- Any reset in prices should create compelling opportunities across L1s, DeFi, and crypto-linked equities as multiples compress while forward “earnings” continue to improve.

- BTC Mid-Year PT: $60k; Year-End PT: $115k; ETH Mid-Year PT: $1,800; Year-End PT: $4,500

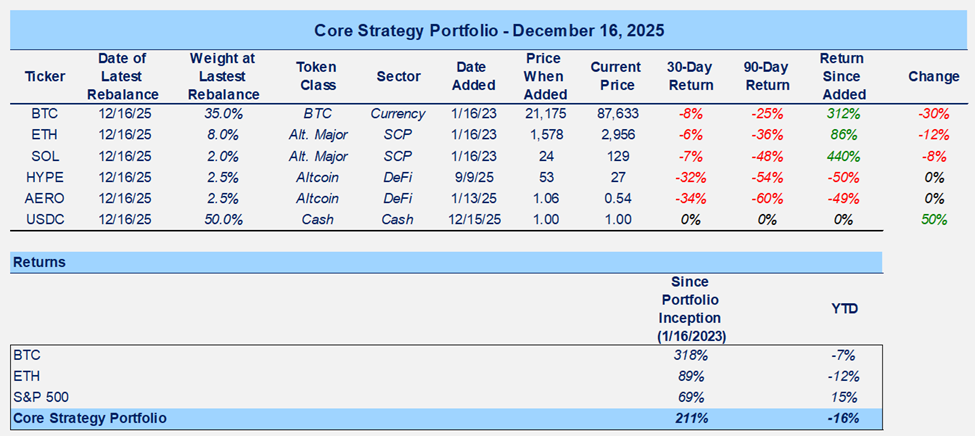

Core Strategy